Summary:

- I’ve owned Tesla’s stock for a long time.

- Tesla’s recent revenue missed due to well-telegraphed price cuts that should be transitory.

- Tesla remains the dominant force in the EV segment, delivering robust profitability in Q1.

- Moreover, Tesla’s secondary businesses are gaining significant momentum.

- Tesla’s stock is approaching the buy zone again, and its shares should continue appreciating considerably long term.

jetcityimage

I’ve been long Tesla (NASDAQ:TSLA) stock for a long time (10 years this October), and I will add more as the company’s shares cascade in pre-market after a solid earnings announcement. Tesla’s recently lower-than-anticipated revenues occurred because it introduced price cuts, enabling it to capture market share from its less profitable competitors. Tesla remains the dominant force in the EV segment, delivering a staggering $2.5 billion in GAAP net income ($2.9B non-GAAP) in Q1. Moreover, Tesla’s secondary businesses are gaining significant momentum, with its energy generation and storage segment’s revenues surging by nearly 150% YoY. Tesla’s stock is approaching the buy zone again, and its shares should continue appreciating considerably long term.

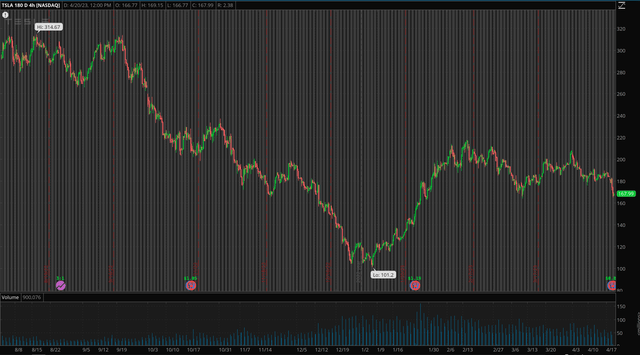

The Technical Image – Tesla $150 Buy-In Target

TSLA 6-Month Chart – 4-hour candles

Tesla’s stock has been on a wild rollercoaster ride in recent years. However, Tesla hit a significant long-term low of around $100 during the panic selling late last year and early this year. That was the ideal buy-in point, and we discussed this in our Financial Prophet reports during this critical time.

So, where will the stock go from here?

Tesla’s stock is around $167 here, and if we don’t get a bullish reversal after the opening bell today, Tesla could continue to the $160 support level. If $160 support breaks down, Tesla will likely fill the gap (day chart) around the $150 level, implying that the stock could head towards that level soon, making the level an attractive entry or dollar cost average point. Nevertheless, despite prospects for near-term volatility, long term, Tesla’s shares should go much higher.

Tesla’s Revenue Miss – Not A Big Deal Here

Talk about an overreaction: Tesla’s stock is down by 10% in pre-market, primarily due to a revenue miss of $60 million in Q1. The company still delivered $23.3 billion in revenues, a significant 24% YoY gain. Moreover, Tesla topped delivery expectations with 422,875 vehicles sold in Q1—Tesla’s non-GAAP income of $0.85 came in line with analysts’ estimates. Also, we know that the revenue miss occurred because of a strategic decision to lower prices to spur demand in the current challenging economic environment. This dynamic enabled Tesla to continue growing its customer base while taking market share from its less profitable EV-producing competitors.

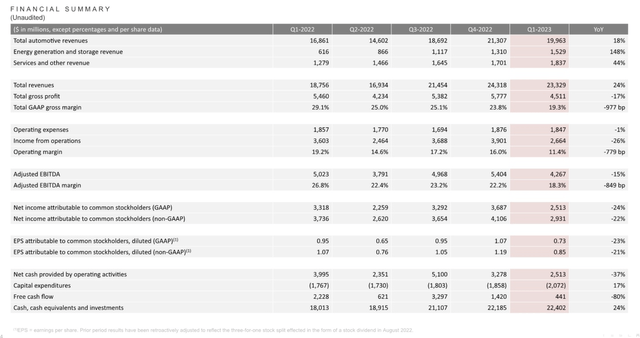

Tesla’s Q1 Financial Summary

Financial summary (ir.tesla.com)

The first thing we see is lower-than-expected automotive revenues. However, we know this price lowering occurred due to Tesla’s decision to implement temporary price cuts due to the global economy’s transitory macroeconomic challenges. Therefore, I am not surprised to see automotive sales lower than expected for now, and I am not concerned that it will negatively affect Tesla’s bottom line in the long term.

On the contrary, Tesla’s strategy effectively gains sales from customers who may otherwise go to Lucid (LCID), Rivian (RIVN), NIO (NIO), or any other company selling EVs. Also, the next element I want to highlight is Tesla’s energy generation and storage “EG&S” segment’s skyrocketing revenues of 148% YoY ($1.53B). In addition to the remarkable growth in Tesla’s energy segment, services & other segment revenues surged by 44% YoY to about $1.84B.

Therefore, we see Tesla firing on all cylinders. Moreover, as the transitory slowdown subsides, growth should improve, and Tesla’s prices will probably rise as we advance. Furthermore, the company’s operational summary looks excellent.

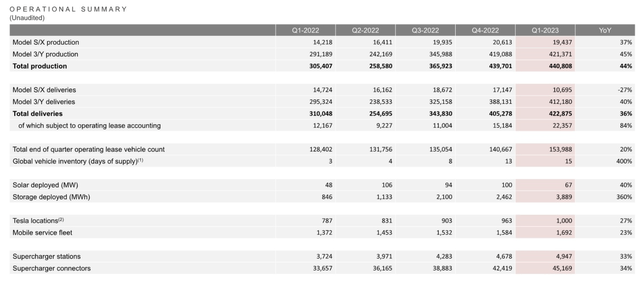

Operational Summary

Operational summary (ir.tesla.com)

YoY production, deliveries, and other metrics illustrate significant YoY growth, resilience, and strength. Remarkably, Tesla increased total production by a staggering 44% YoY. Total lease vehicles increased by 84% YoY, illustrating a healthy trend toward leasing Tesla vehicles, a dynamic that should continue benefitting Tesla long-term.

Tesla’s Enormous Production Capacity

Vehicle capacity (ir.tesla.com)

Tesla currently can produce approximately two million vehicles annually. However, as the company continues innovating, optimizing, and expanding, production capacity should continue rising in the coming years. Tesla produced 440,000 cars in Q1. Thus, the company should make around two million vehicles this year. Moreover, Tesla’s market share continues to climb here as the company approaches 4% of total U.S. vehicles and surpasses the 2% mark in Europe and China. This trend of market share gains should continue for Tesla and will probably reflect very favorably on the company’s stock price in the long term.

Tesla – Not Expensive Anymore

It’s challenging to call Tesla a cheap stock, but it certainly looks reasonable here, especially considering longer-term prospects.

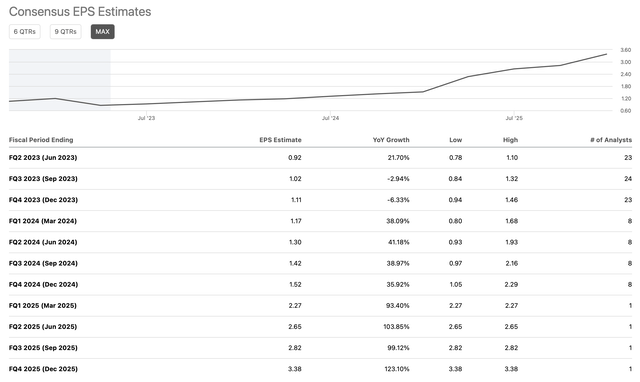

EPS Estimates – Moving Higher and Higher

EPS estimates (Seekingalpha.com )

We know that Tesla faces a temporary earnings decline due to the challenging macroeconomic environment, temporary price cuts, and other transitory factors. Therefore, we could see a quarterly EPS trend around $1-$2 in 2023-2024. However, Tesla’s EPS growth should continue, and the company could earn around $3-$4 per quarter in 2025. If we use a mid-range estimate of $3.50, splitting it over four quarters would provide Tesla with an annual EPS of about $14 in 2025. Even if the company earns $13, the lower range of my estimates, it’s trading below 13 times 2025 estimates now.

Tesla is trading around $167 in pre-market now, and putting a $14 EPS target for 2025 is reasonable here. Therefore, Tesla could be trading at only about 12 times 2025 earnings estimates. Given Tesla’s incredible growth rate, apparent market leadership, and excellent profitability prospects, its stock should appreciate considerably in the coming years. Thus, I’m looking for an opportunity to double down on my Tesla position in future sessions.

Here’s what Tesla’s financials could look like in future years:

| The year | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $110 | $160 | $215 | $300 | $400 | $510 | $640 | $780 |

| Revenue growth | 35% | 45% | 34% | 40% | 33% | 27% | 25% | 22% |

| EPS | $5 | $9 | $13 | $18 | $23 | $30 | $35 | $40 |

| EPS growth | 25% | 80% | 44% | 38% | 32% | 28% | 19% | 18% |

| Forward P/E | 18.6 | 23 | 25 | 27 | 25 | 24 | 23 | 22 |

| Stock price | $167 | $299 | $450 | $621 | $750 | $840 | $920 | $1,000 |

Source: The Financial Prophet

Risks to Tesla

A slowdown in demand, increased competition, supply issues, decreased growth, issues with regulators and foreign governments, and other variables are all risks we should consider before betting on Tesla to move higher. Serious concerns could cause Tesla’s valuation to lose altitude, and the company’s share price could even head in reverse if any serious issues should arise. Therefore, one should consider these and other risks before committing any capital to a Tesla investment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- Our Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement our Covered Call Dividend Plan and earn an extra 40-60% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Own Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now, and start beating the market for less than $1 a day!