Summary:

- PayPal is one of the largest online payments processing companies in the world.

- Their unique platform that offers both merchants and consumers a compelling service enhances moatiness for the company.

- Strong growth in a difficult 2022 macro environment suggests PayPal is on the track to continued margin expansion.

- Significant undervaluation means the company trades almost 50% below its intrinsic value.

- Strong Buy warranted given their high-quality business model and focus on innovation and profitability.

Justin Sullivan

Investment Thesis

PayPal (NASDAQ:PYPL) is one of the main players in the online secure payments processing industry.

Their established presence pre-COVID19 meant that the company benefitted greatly from increased online spending during the pandemic. Since 2021, management has been working hard to maintain the momentum both in terms of growth and profitability to ensure the future looks better for PayPal than the past.

An innovation centered business strategy with customer satisfaction, ease of use and strategic partnerships at the core means PayPal is well positioned for a strong 2023, despite unrelenting macro headwinds.

Significant undervaluation due to an excessive market correction in pricing since the pandemic means shares now trade at a 44% discount to their intrinsic value.

Company Background

PayPal is an American multinational fintech company who focus on the operation of an online payments system. The company focuses on supporting money transfers, payments and transaction processing with a unique blend of consumer- and merchant-side services on offer.

The company benefitted greatly from the accelerated transition to e-commerce that was largely jumpstarted by the COVID-19 pandemic. Since then, PayPal has been hard at work developing new features for their payments platform to ensure they remain ahead of the competition.

A focus on diversifying their market outreach through strategic partnerships combined with a reliable and safe reputation means PayPal has become a household name in the online payments marketplace. Millions of websites offer quicker payment options utilizing PayPal which has made the company incredibly popular and highly valued.

Nonetheless, a difficult macroeconomic environment combined with multiple influential industry factors including increased competition and a shift in how people pay could leave PayPal in a difficult situation.

Therefore, a fundamental company analysis and intrinsic value calculation must be completed to fully understand what sort of investment opportunity may exist in PayPal from a value perspective.

Economic Moat – In Depth Analysis

PayPal has a relatively narrow economic moat due to the high levels of competition within the industry. Their primary moat drivers include their unique two-sided platform, their established reputation as well as the increased levels of security offered to customers paying online with PayPal.

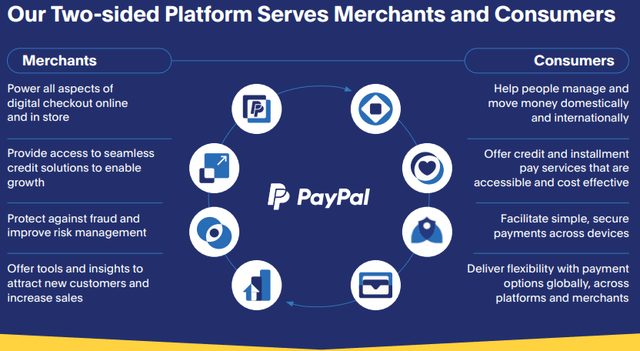

The company’s high quality payments platform is perhaps their greatest source of moatiness. By offering both merchants and online consumers with a safe and secure payment processing platform, PayPal is able to capture a significantly increased number of users and partners which further helps to diversify their revenue streams.

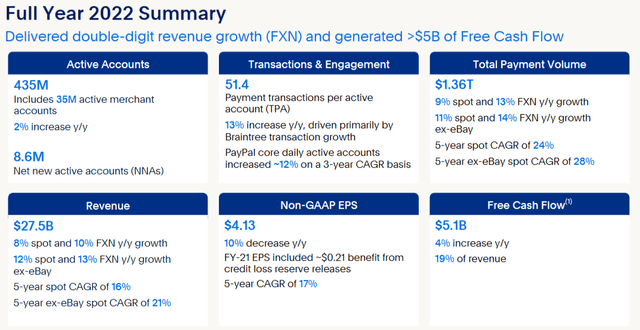

PayPal Q4 FY22 Investor Update

For merchants, PayPal offers all the aspects of a digital checkout flow for online stores, access to credit solutions to enable faster growth, fraud protection and customer insights tools and data. These factors make PayPal attractive to many small and large-scale businesses who want to simplify the payment process from their ends.

For consumers, PayPal is focused on helped move money domestically and internationally, offering credit and installment pay services, increasing the security of online transactions and connect customers with online retailers in a smoother and more seamless fashion.

As an aggregate, this holistic approach to managing both the seller and buyer side services in online transactions acts to create a positive feedback loop for the company. The more businesses adopt PayPal, the more customers will use it to increase the ease of paying online.

This creates a powerful network effect for the company that compounds the number of users paying on their platform.

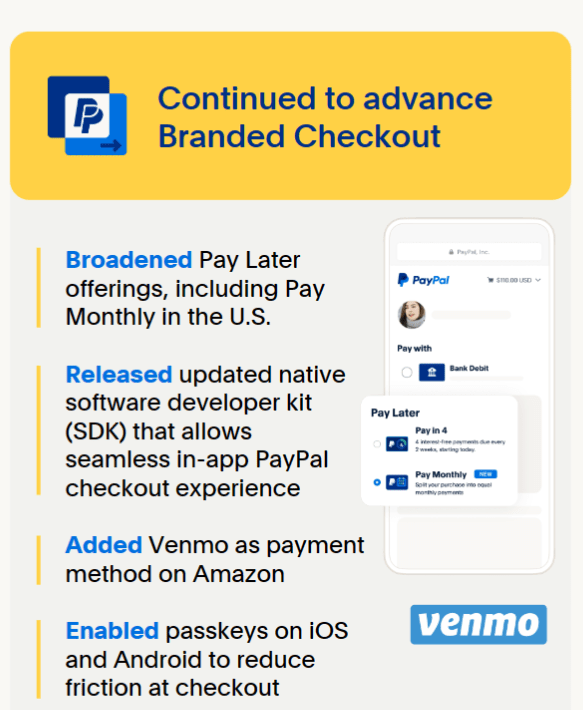

PayPal Q4 FY22 Investor Update

PayPal has acquired multiple different checkout solutions and currently operates PayPal, Venmo, Pay Later, PayPal Credit and Paidy.

While the company has diversified the number of checkout solutions on offer to harness different segments of the market, they have maintained their core processing solutions to just PayPal and PayPal Braintree. This allows PayPal to operate a streamlined and efficient processing system which maximizes transactions quantity while minimizing costs.

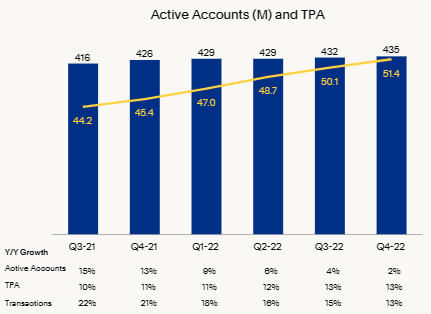

Cumulatively, PayPal handled 22.3B global transactions in 2022 with over 435M active accounts using their platform. This 435M accounts is spilt between 400M consumer accounts and 35M merchant accounts.

The flexibility and security offered by PayPal and their auxiliary services has proven popular with consumers thanks to the safer environment it creates for online transactions. This has garnered PayPal an incredibly reliable and strong reputation within the industry with many consumers choosing to use the service thanks to the peace of mind it guarantees when shopping online.

Such a reputation would take years for an emerging competitor to accumulate if they could do so at all. As long as PayPal remains innovative and offers customers with a competitive service, their reputation will help to shore-up revenues and user numbers.

To create revenue from this operation, PayPal charges fees for competing payment transactions for customers as well as for other payment-related services. These fees are typically based on the volume of activity processed on their payment’s platform.

The company also extracts revenue from currency conversion fees as well as from the provision of value-added services. These VAS’ are primarily comprised of partnerships, interest payments and fees from merchant and consumer credit products.

PayPal’s dedication to risk and compliance management – that is, the reduction and mitigation of risk and threats present in the online payment environment has proven a particularly strong strategy for the firm.

By ensuring their network is highly protected against any cybersecurity issues, PayPal not only creates another competitive advantage over some of their less secure competitors, but also shields their operations from unwanted threats and scandals.

Overall, I believe PayPal has carved out a robust but narrow economic moat particularly in the online payments marketplace. Their unique two-sided platform combined with the provision of an ease-of-use and security-oriented set of payments products allows the company to meaningfully differentiate themselves from the competition.

However, due to the difficultly to innovate within the sector thanks to stringent regulations and the generally high competitive atmosphere present within the industry, it is difficult to argue that PayPal offers a truly unreplaceable service.

Financial Situation

PayPal has had a very profitable history for much of its recent existence. Their 5Y average ROIC and impressive 16.66% ROE have been maintained even through periods of rapid user growth illustrating the scalable nature of their payment’s platform.

When combined with an impressive 5Y operating margin of 16.13% and net margins averaging around 15% for the same period, it is clear to see that PayPal has a profitable and robust business on their hands.

While PayPal saw incredibly profitable years of operation in both 2020 and 2021 due to the coronavirus pandemic increasing the number of sales occurring online, FY22 has still been a truly remarkable year for the firm.

The company earned over $27.5B in revenue in 2022 which represents an 8% increase compared to the already impressive 2021. Furthermore, on a constant currency basis this turns into 10% revenue growth which, given the vast number of currencies PayPal handles, is truly outstanding.

Similar patterns of healthy growth can be seen in their total payment volumes which increased to a whopping $1.36T in FY22, up 9% (13% on a constant currency basis) from FY21. FCF also grew a healthy 4% to over $5B in FY22.

PayPal Q4 FY22 Presentation

PayPal attributes much of this growth to the success of their innovation-oriented business strategy which is focused around delivering customers with new payment experiences. The launch of PayPal branded checkouts, Pay Later schemes and PayPal rewards has helped spur organic user growth through the targeting of new demographics both geographically and socially.

Their Buy Now Pay Later products have shown particularly strong momentum with over 25M customers (a 105% YoY growth) yielding over 20.3B in transactions volumes throughout FY22.

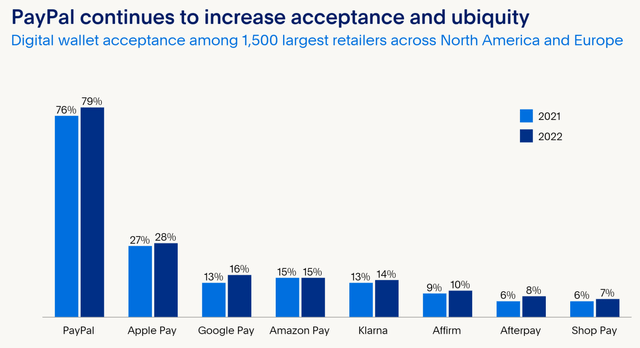

Their focus on continuing to lead the charge in digital wallet acceptance also seems to be paying off as PayPal is now accepted by 79% of the 1500 largest North American and European retailers. When compared to the acceptance of competing product offerings such as Apple (AAPL) Pay or Google (GOOG) (GOOGL) Pay, the advantage PayPal has is clear and decisive.

A key strategy in this increased acceptance is through the creation of partnerships with merchants to provide rewards and other payment solutions through PayPal’s various checkout product offerings. A partnership with Starbucks (SBUX) to offer Starbucks Rewards members with the option to pay using Venmo significantly increases the fluidity of ordering and paying for products at participating locations.

PayPal Q4 FY22 Presentation

When combined with the number of core PayPal daily active accounts increasing 10% on a 3Y CAGR basis by the end of Q4 FY22, it is clear that PayPal has managed to not only maintain pandemic-era levels of engagement, but continue to meaningfully grow it post-COVID19.

These product offering improvements culminated in PayPal increasing the number of transactions per active account (TPA) from just 45.5 at the end of FY21, to over 51.4 in FY22. This important metric highlights how PayPal is extracting more revenue from their existing customers suggesting that their new product offerings are accurately fulfilling customer needs and desires.

PayPal Q4 FY22 Presentation

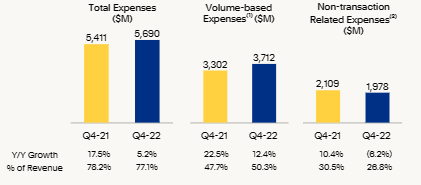

Management also suggests that PayPal has defeated the relatively high non-transaction related expenses that bogged mid-FY22 operating margins by streamlining their business structure. A welcomed objective to control costs across their customer support, administrative, marketing and R&D departments illustrates a conservative and responsible approach to business.

Given the huge waste and inefficiency present at many U.S. tech and fintech companies, PayPal’s proactive cost management is undoubtedly good to see, especially from the perspective of investors.

These operational efficiency focused objectives should see PayPal continue to increase their operating margins moving into Q1 of FY23 which, in a hugely inflationary period of contractionary monetary policy, is a true rarity.

This expansion of margins has been accompanied by an increase in their quarterly EPS from just $1.11 in Q4 FY21 to $1.21 in Q4 FY22. FY23 estimates forecast a four-quarter total EPS of around $4.89.

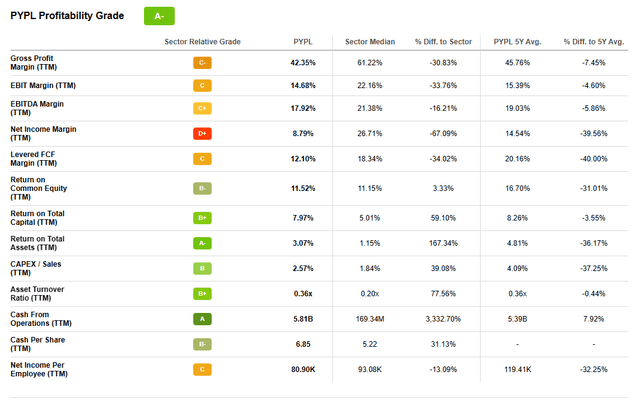

Seeking Alpha | PYPL | Profitability

Seeking Alpha’s quant assigns PayPal with an “A-“ profitability rating. I believe that while representative, this is a slightly pessimistic evaluation of their profitability given the efficiency-oriented improvements and growth the company achieved in FY22.

PayPal’s balance sheet looks to be in healthy shape. The company currently has $57.7B in Total Current Assets while Current Liabilities only total $45.1B.

The company has a debt/equity ratio of just 0.51 which is fantastic to see from an investor perspective. Their quick ratio (current assets minus inventory divided by current liabilities) is 1.23.

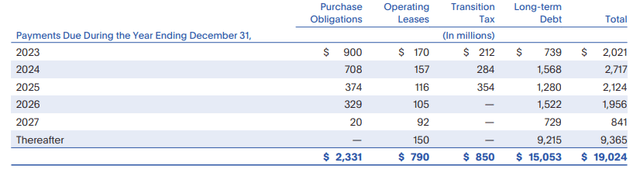

PayPal has around $15B in long-term debts with a majority of senior notes maturing after 2027. This illustrates a once more restrained and conservative form of financial planning which limits their exposure to the high-interest rate environment currently affecting economies across the globe.

PayPal operates with a financial leverage of just 3.88 which is fantastic to see, especially given the overleveraged nature of many tech and fintech companies.

Overall, it is clear that the management at PayPal has been working hard to not only retain pandemic-era levels of revenue and margins, but to continue growing into the future. Their huge focus on consumer-oriented innovation to produce new and exciting products that increase the firm’s moatiness and profitability means financially, I believe PayPal is headed in the right direction.

Valuation

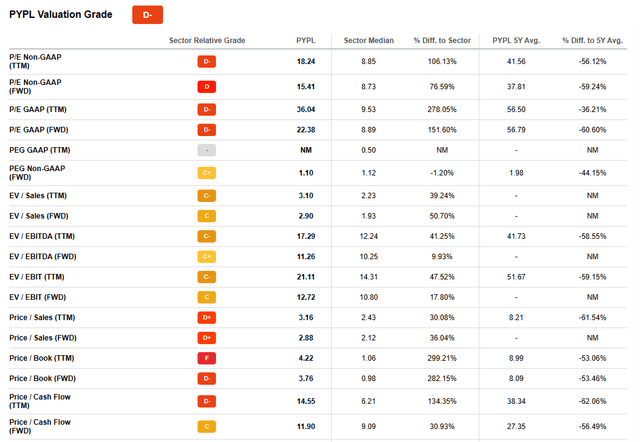

Seeking Alpha | PYPL | Valuation

Seeking Alpha’s Quant has assigned PayPal with a “D-“ Valuation rating. I find this valuation relatively incorrect as it suggests either an over or approximately fairly valued entity at present time. I believe PayPal is undervalued. Significantly.

The firm is currently trading at P/E GAAP FWD ratio of 22.38 and a P/CF TTM ratio of 14.55. Their FWD EV/EBITDA of 11.26 is not excessive, nor is their EV/Sales FWD of 2.90. While these figures are generally above the sector median, I believe given their growth expectations and margin improvements, these figure are not at all excessive and thus do not indicate an overvaluation.

Seeking Alpha | PYPL | Summary

From an absolute perspective, PayPal shares have fallen 21.25% YoY with the company leaving investors for the past five years with nothing but essentially dead money.

However, I believe the tides are changing and that the market correction since the COVID-19 pandemic has left share trading at intrinsically below the firm’s 2023 value.

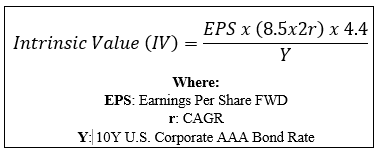

By accomplishing a simple financial valuation based on the calculation below and using the estimated 2023 EPS of $4.89 a realistic r value of 0.10 (10%) and the current Moody’s Seasoned AAA Corporate Bond Yield, we can derive a base-case IV for PayPal of $133.3

The Value Corner

When using this reasonably realistic CAGR value for r, PayPal appears to be undervalued by a whopping 43.9%. Even when using an incredibly conservative CAGR value of 0.06 (6%), shares are valued at around the $95.9 mark, still representing a 22% undervaluation at present time.

Therefore, I believe PayPal as a company is currently sitting somewhere between undervalued and deep-value territory due to a fundamentally pessimistic attitude leading to an incorrect pricing by the market.

Both an absolute comparison to historic share prices combined with an intrinsic value calculation suggest the company’s shares are trading at a tangible discount to their fair value.

In the short term (3-10 months) it is difficult to say exactly what the stock will do. Much depends on the prevailing macroeconomic conditions and the ability of global economies to skirt a recession in 2023. Given that most fundamental market metrics are forecasting a recession, the potential for reduce consumer spending (and thus PayPal usage) is a real possibility moving through 2023.

In the long term (2-4 years) I expect their position as the leader in secure online payments processing to become even stronger. Their reliable brand reputation, great selection of products to choose from combined with significant market presence means any arising threat from a competitor should be relatively predictable.

I believe current share prices create a persuading argument for value oriented investors to potentially begin building a long-horizon position in PayPal.

Risks Facing PayPal

PayPal must continue to manage a few critical threats that could cause serious problems for the company without effective mitigation strategies. These threats include the highly competitive environment within which the company operates combined with their ultimate exposure to the sentiment present on the global economic marketplace.

Increased competition from the likes of Apple with their rapid expansion into the fintech industry (which you can read all about in my recent Apple update article here) along with the possibility for entirely new entrants to enter the market is a real issue for PayPal.

Given the huge potential userbase Apple has to capture with their Apple Pay service, PayPal could find themselves outpaced by the Cupertino based tech giant when it comes to future growth.

Any decrease in PayPal’s commanding market share could lead to a reduction in operational efficiency, contracting margins and ultimately, a reduction in innovation from the company.

While this would most likely take time to occur, PayPal must continue establishing meaningful and robust relationships with merchants across the globe to ensure PayPal remains the payment platform of choice.

The company’s exposure to macroeconomic factors means any economic slowdown could lead to decreasing total transaction volumes thus leading to a reduction in the lucrative fees and charges PayPal relies on. Given the forecast of a 2023 recession, this could mean short-term pains may still affect the company over the next few months.

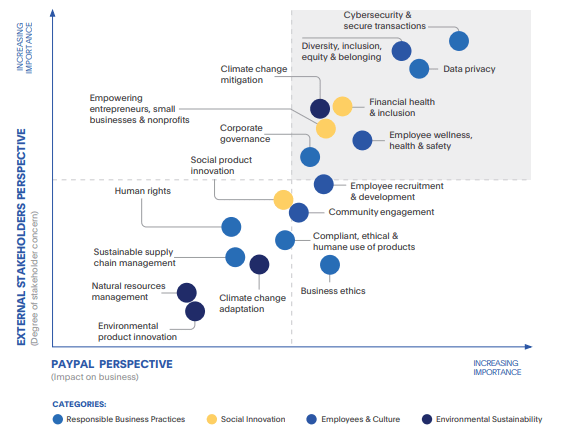

PayPal FY22 10-K

From an ESG perspective, PayPal faces little threat. Their commitment to sustainable business operations along with a dedication to practice and actionable ESG objectives has earned the company a fantastic reputation among more ESG conscious investors.

PayPal boasts one of the most comprehensive ESG risk assessment program which focuses around mitigation strategies is refreshing to see.

A specific focus on ensuring social equity with PayPal’s business operations illustrates how a profitable and successful company can also be ethical and champion key ESG improvements that beneficially affect entire financial markets

Summary

FY22 was evidence that PayPal has managed to regain the momentum they captured during the coronavirus pandemic by posting strong organic growth figures and net margins despite difficult macroeconomic conditions.

Their strong emphasis on consumer-oriented products that continue to serve both merchants and end-customers increases the network effect of their business model. An innovation driven business strategy has created multiple products which are effectively targeting the needs and wants of many consumers.

While 2023 looks uncertain from a macroeconomic perspective, PayPal’s robust set of revenue streams and merchant partnerships should help the company to weather any potential fiscal storm that lies on the horizon.

Given the current undervaluation in shares along with expectations for continued margin expansion, I believe a 20-50% upside potential lies in PayPal shares.

Therefore, I rate PayPal a Strong Buy given the significant undervaluation and strong business fundamentals present at the company at this time. Any further price decrease would only strengthen my investment thesis into the company.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and are not soliciting any content or security. Opinions expressed in my articles are purely my own. Please conduct your own research and analysis before purchasing a security or making investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.