Summary:

- Nvidia has excellent long-term growth, high margins, and very low debt.

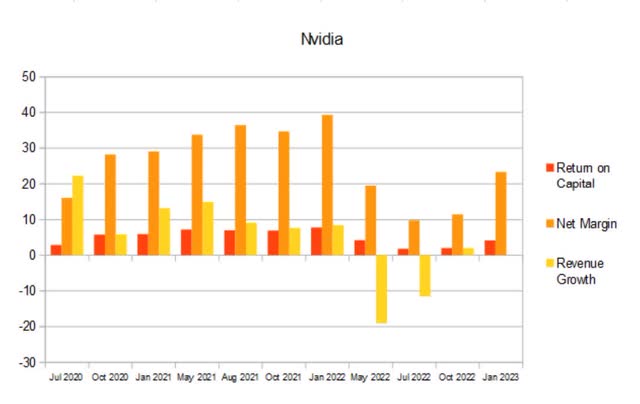

- Since 2015, the company has achieved return on capital values at or above 10%, and even experienced two years above 30%.

- They are expected to see significant tailwinds over the coming years.

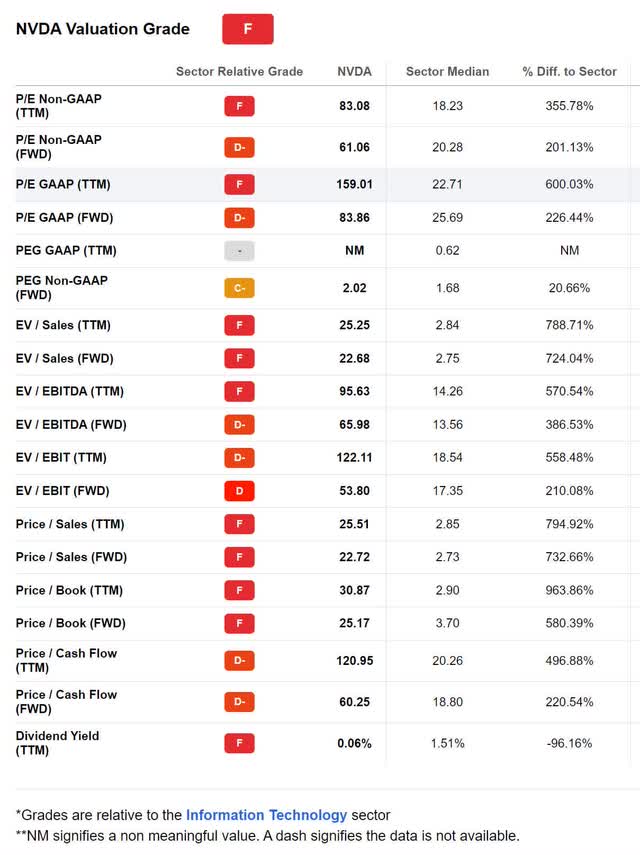

- The company currently appears overvalued with a P/E of 83.86 and a Price/Cash Flow of 60.25.

- Nvidia stock is a Hold.

Sundry Photography

Thesis

The chip shortage that broke out in 2020 provided Nvidia (NASDAQ:NVDA) with significant tailwinds. The company has also been swept up into the recent wave of enthusiasm for artificial intelligence. The euphoria that is presently gripping the industry has pushed its valuation far enough above the norm that many are calling it overvalued.

After looking over its financials and valuation, I agree that Nvidia is presently overvalued. However, the company has strong fundamentals and faces significant tailwinds, so the present A.I.-fueled rally may continue to drive price higher. Since it’s not safe to short into the middle of a euphoria-driven rally, I will cover a low risk options trade in my conclusions. Nvidia is a Hold.

Company Background

Nvidia was founded in 1993 by Jensen Huang, Chris A. Malachowsky, and Curtis Priem. The company made a name for itself in graphics based computing after they launched both the RIVA TNT and later the GeForce line of video cards. The company makes products for gaming, automotive electronics, and mobile devices.

I was first exposed to Nvidia in the 1990’s when their products began showing up at LAN parties. Smoother motion and higher frame rates were always in high demand when playing first person shooters. For several years Nvidia and their main competitor, 3dfx made the best products.

Nvidia would later buy all of 3dfx’s intellectual assets in 2000. In the following 6 years the company would also go on to buy Exluna, MediaQ, iReady, Uli Electronics, and Hybrid Graphics. Nvidia would become dominant enough in the industry that they, along with AMD (AMD), were the targets of an antitrust investigation in 2006.

Nvidia GPUs are used in deep learning. The company produced the DGX-1 which combine GPU’s with deep learning software. They also developed the Tesla K80 and P100 GPU-based virtual machines.

Long-Term Trends

Nvidia faces significant tailwinds over the coming years. The Global GPU market is projected to have a CAGR of 21.2% until 2029. The global market for deep learning is projected to have a CAGR of 33.5% through 2030. The global artificial intelligence market is expected to have a CAGR of 38.1% until 2030. I would not be surprised if the projected CAGRs for the 2030’s and beyond end up even higher.

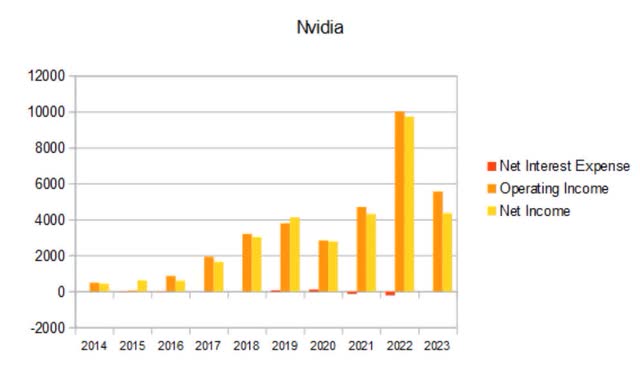

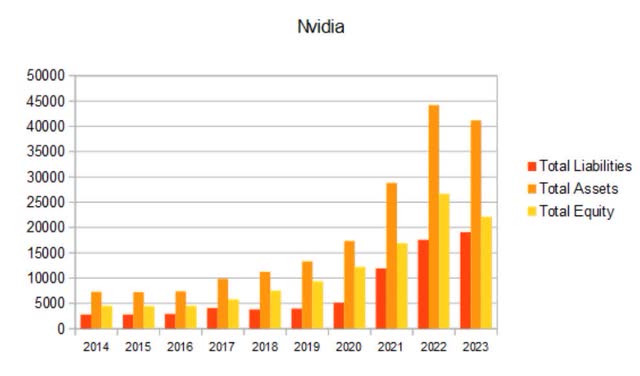

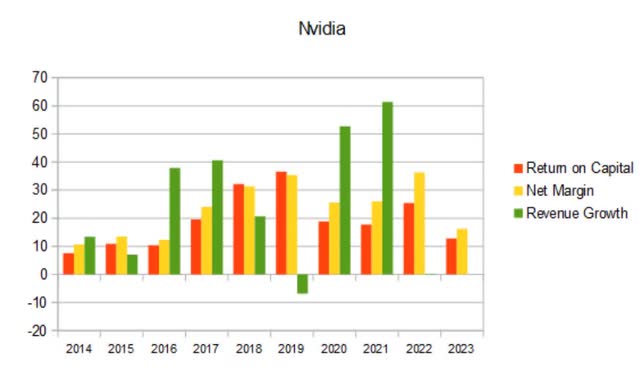

Financials

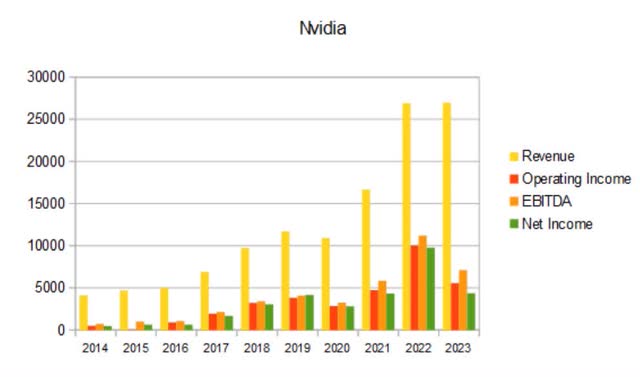

Before we dive into the charts I should inform you that Nvidia’s annual statements are from January to January. This means the global pandemic and chip shortage that both happened in 2020, shows up on the following charts as affecting their 2021 numbers. This also explains why 2023 shows up on these charts, it covers Jan 2022 to Jan 2023.

Nvidia has experienced rising revenue for most of the last decade. We can see they experienced a drop in revenue that came the year before the pandemic and chip shortage. The beginning of the chip shortage in 2020 provided Nvidia with significant tailwinds and went on to boost their 2021 and 2022 annual revenue numbers.

NVDA Annual Revenue (By Author)

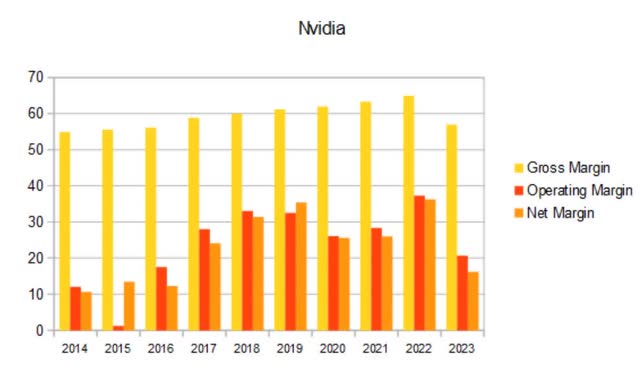

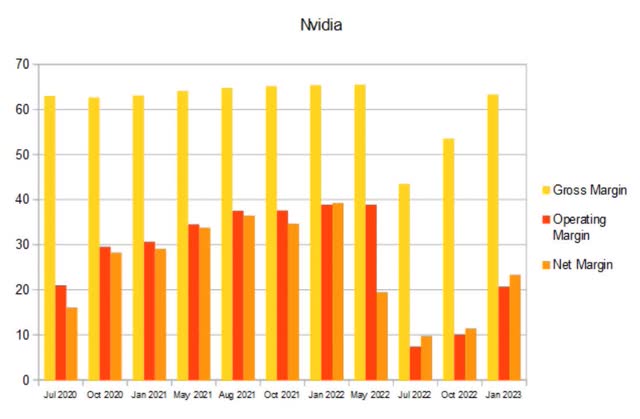

Here we can see their net margins were improving until 2019. The lows in 2023 are making 2022 look more like an outlier. Operating and net margins have been contracting for most of the last 5 years.

NVDA Annual Margins (By Author)

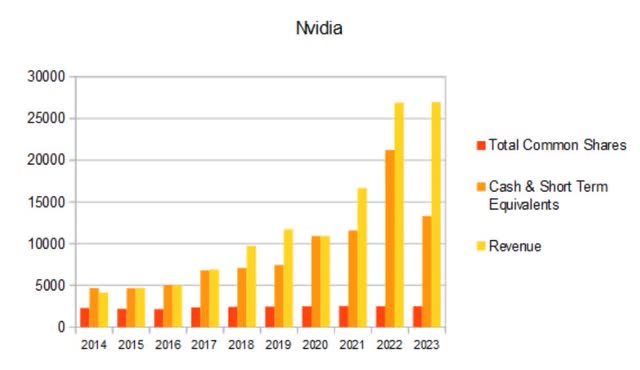

I also like to look at the relationship between share count, cash, and revenue. With young companies I look to see how well they translate dilution into revenue growth. With mature companies I look for a history of buybacks. Nvidia has experienced significant enough revenue increases that they are making changes in share count hard to see. Anytime revenue growth like this happens without significant dilution, it’s typically a good sign.

NVDA Annual Share Count vs Cash vs Revenue (By Author)

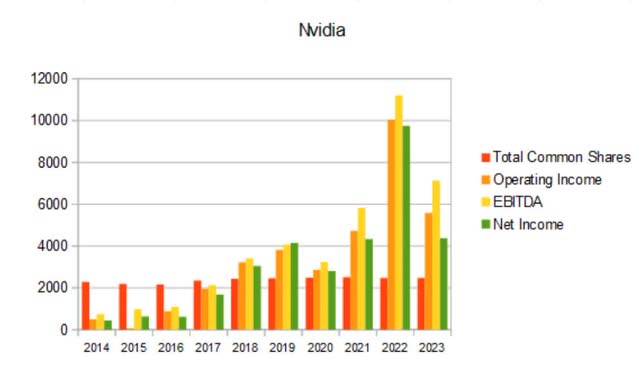

Here we can more clearly see their share count slowly rising. In 2014 total common shares outstanding were 2.272B, by 2023 that had grown to 2.466B, which is a 8.54% rise in share count. While I would rather see the share count decreasing, this level of dilution is far from alarming. The company has effectively converted it into rises in revenue and income, so this dilution is accretive and not toxic.

NVDA Annual Share Count vs Incomes (By Author)

Taking a look over their debt obligations. Nvidia has debt, but balances out its regular debt payments with its own interest and investment income. This does not perfectly cancel out their debt obligation every year, but it comes close. While Nvidia does carry some debt, it is well within the limits of being a healthy amount.

NVDA Annual Net Interest Expense (By Author)

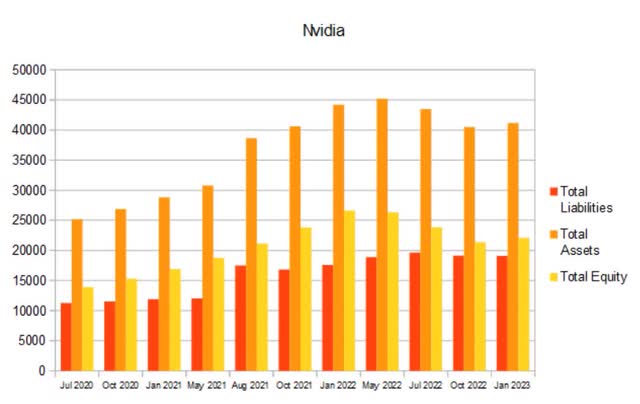

While their equity curve was already slowly rising, it inflected upwards in 2016. It is not unreasonable to assume 2022’s high was caused by the chip shortage and represents an outlier year. If 2022 is ignored, equity has been steadily rising since 2016.

NVDA Annual Total Equity (By Author)

Typically, value investors want to see return on capital numbers stay consistently above 10%. Nvidia has stayed above 10% since 2015, and has even managed to achieve ROC above 30% in 2018 and 2019. Overall this looks really strong.

I should note that the revenue growths shown on the below chart is in comparison to the following year, so 2022 to 2023 barely shows up because revenue growth was almost flat. Also, 2023 doesn’t have a value because we don’t have next year’s revenue number yet.

NVDA Annual Return On Capital (By Author)

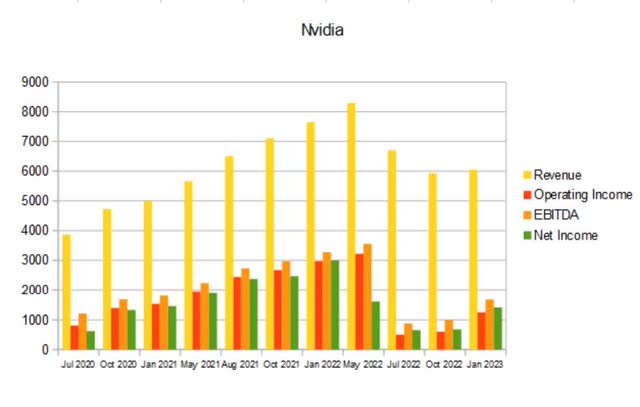

Their quarterly financials clearly shows the amazing growth the company was experiencing pivoted in mid-2022. Nvidia took a significant hit to its financials but has been recovering for the last three quarters.

NVDA Quarterly Revenue (By Author)

The significant drop that showed up on the above chart also affected their margins. This indicates the company didn’t merely experience a drop in revenue, but something fundamental changed about how the business functioned that caused a significant contraction. Gross, operating, and net margins have all been recovering for the last three quarters.

NVDA Quarterly Margins (By Author)

The same peak which showed up on their annual equity curve can be seen in more detail here on their quarterly equity chart.

NVDA Quarterly Total Equity (By Author)

Their quarterly return on capital chart shows the mid 2022 revenue drop and margin contraction actually began the preceding quarter.

NVDA Quarterly Return On Capital (By Author)

Valuation

As of April 19th, 2023, Nvidia had a market capitalization of $682.27B and traded for $279.31 per share. The company is overvalued according to multiple metrics. A forward P/E of 83.86 is significantly higher than the average of 15 for mature companies. Since this company is expected to experience continued growth, I would actually view a P/E of 15 as undervalued and expect fair value to be somewhere in the 20-25 range.

Their forward Price/Cash Flow of 60.25 is 120.54% above the average for the information technology sector. Their forward Price/Book of 25.7 is 480.39% above. In order to justify this valuation, Nvidia would have to experience years of sustained increases to its free cash flow.

NVDA Valuation (Seeking Alpha)

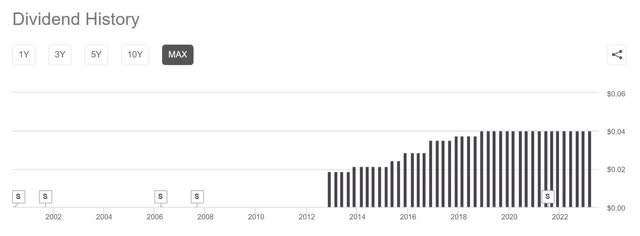

Nvidia pays a dividend, but it’s negligible. They began offering a dividend in 2012. The last time it was increased was 2018. Assuming no future dividend growth and using a discount rate of 9%, discounted cash flow estimates for 20 years of ownership would value this at $1.78 per share. It is a fair assumption that the people that are currently holding or buying NVDA are not doing it for its present day yield of 0.06%.

NVDA Dividend History (Seeking Alpha)

Risks

The chip shortage has spurred many companies into action. Nvidia faces increased competition from Taiwan Semiconductor Mfg. Co. Ltd. (TSM), AMD (AMD), Intel (INTC), Alphabet (GOOG) (GOOGL), Micron Technology, Inc. (MU), and others.

In my opinion, the present wave of euphoria which is gripping A.I. related stocks will eventually end. When the general public comes to the realization that the transition into an economy that relies on A.I. will take years, they will lose interest. The same story played out in automobiles 100 years ago, and with the internet at the end of the 1990’s. When it is clear to the public that a new technology will eventually become life changing, we get excited. When it finally sinks in that it is going to take years for us to truly experience the shift, enthusiasm wanes. Just like with the dozens of automobile startups in Detroit 100+ years ago, or the thousands of internet startups 25 years ago, very few of today’s A.I. companies are going to still be major players after the industry matures. I believe the present rally that is affecting the A.I industry is unsustainable and when emotions calm down, valuations will drop significantly.

Insiders have been selling Nvidia. While I was writing this, another contributor published a bearish Nvidia article which shows insiders have sold $63M in shares since the beginning of 2023. Insiders will sell shares for reasons unrelated to the health of a company so light amounts of insider selling can be ignored. However, when amounts are significant, especially when it is multiple insiders, it’s typically a sign that they believe their own company is overvalued.

Catalysts

The current wave of A.I euphoria could shift into an even higher gear. If the pace of A.I. adoption stays elevated, the rally A.I. companies have been experiencing may continue.

Even though the woes caused by the global chip shortage have been abating, they could get worse. If say, another major fire were to break out at a competitors manufacturing facility, or a significant rise in demand were to occur, it would be a boon for Nvidia. Because of the significant lag time between recognizing the need for additional manufacturing capacity, and achieving that additional capacity, we may forever be subject to cycles of under and over supply. In much the same way that shipping, mining, and oil & gas industries are cyclical, we may end up having to adopt a cyclical attitude toward chip manufacturing.

Conclusions

Nvidia is an excellent company with a bright future. Not only do they have very healthy financials, they also have significant moats. After many years in the industry, Nvidia has high brand recognition. The company is facing significant multi-decade tailwinds from expected demand increases. The only problem here is their present valuation.

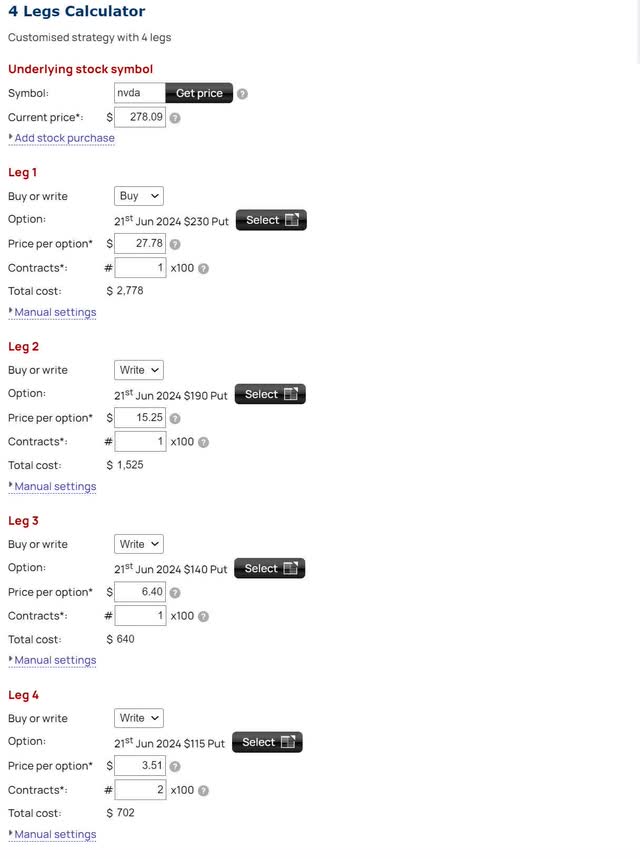

With the company currently riding high on a wave of A.I. fueled euphoria, I have to believe that when the euphoria ends, its valuation will decrease. But this drop may not happen soon, and the share price may continue to rise for some time yet. So while I think it’s presently overvalued, that doesn’t mean it can’t become even more so, or that it has to return to reality anytime soon. While Nvidia is too expensive to buy, it is also not currently safe to short it. Because of this, if I were determined to take on a position in Nvidia right now, it would be a modified front put ratio spread. Nvidia has made several lows in the $115 to $120 range over the last 3 years so I’m going to treat $115 as support.

While looking at a two leg strategy, I was able to buy a 21st Jun 2024 $230 Put, and sell two 21st Jun 2024 $190 Puts, but this had a break even of $147.27. I wanted to try and get below $115 so I could either shift the entire trade to lower strikes or stretch it out by adding legs. Since stretching will also produce a wider profit range I chose to look at adding a third leg. I was able to buy a 21st Jun 2024 $230 Put, sell one 21st Jun 2024 $190 Put, and sell two 21st Jun 2024 $140 Puts. This had a break even of $119.85.

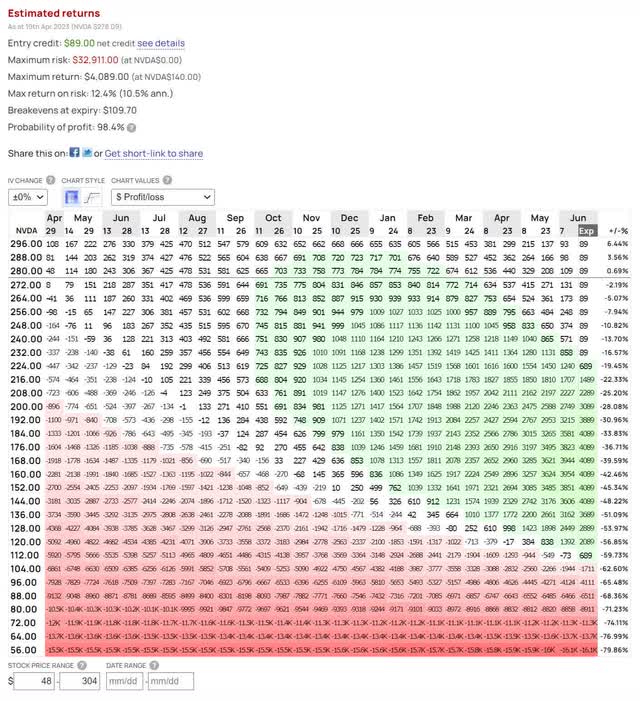

Because I wanted to get below $115, I eventually settled on the 4-leg strategy below. It has a break even of $109.70 per share and a probability of profit of 98.4%. While it is designed to reach max profit if the price of NVDA falls, if the share price moves higher over the following several months, it can be closed out for a gain.

NVDA Options Trade (Optionsprofitcalculator.com) Options Trade Profit/Loss Chart (Optionsprofitcalculator.com)

This trade has a max profit zone from $140 to $190 per share. While I am very happy with its break even being below support, and the lack of any risk to upside, I don’t like that this trade has a relatively low return compared to the amount of capital it places at risk. This trade is not as appealing as two other investments I have recently identified so I will not be diverting capital away from those to take it.

Since the A.I craze and present rally don’t show signs of slowing, it’s also worth exploring put calendar spreads on NVDA. Buying a put with a distant expiration and paying for it by selling multiple puts at nearby expirations also has the advantage of locking up your capital for less time.

It’s not up and running yet, but I am eager for Yieldmax to begin operations of its NVDA Option Income Strategy ETF (NVDY). Since it is involved in disruptive technology, disagreement over Nvidia’s valuation is likely to mean that volatility stays elevated. I expect the annual yield on NVDY to be quite attractive.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.