Summary:

- AT&T reported decent first quarter earnings but only delivered $1 billion of free cash flow toward the annual plan of $16 billion.

- The company warned about FCF last quarter. It is driven by timing of when they pay suppliers for phones sold and when they pay annual bonuses.

- Long-term income investors should not use 1Q FCF as a reason to sell but there are less volatile ways to earn a high yield.

Tim Boyle

It Wasn’t That Bad Of A Quarter

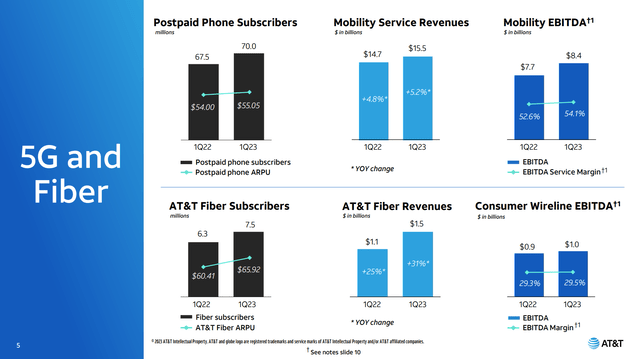

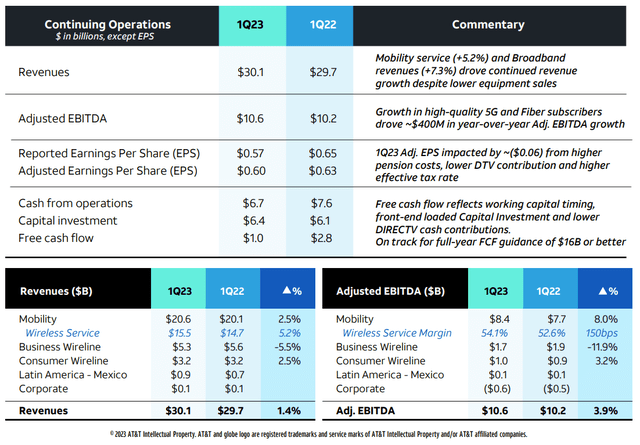

AT&T (NYSE:T) shares dropped 9% in the first hour of trading after reporting 1Q 2023 earnings. By the end of that day they were down 10.4%. This is despite solid operating performance against the company’s strategic goals of focusing on 5G wireless and fiber growth. I won’t dig as deeply into the quarterly earnings as I have done previously because progress remains steady and in line with what the company said they would deliver. In short, AT&T had net additions of 424,000 postpaid phone customers in the US in the quarter. The average revenue per user (ARPU) increased by 2% and service margin improved by 1.5%. In the consumer wireline business, fiber growth continues to offset declines in legacy technologies, leaving subscriber count about flat. On the bright side, fiber customers are higher-paying, and fiber ARPU grew by 9%. This led to slightly higher margins and EBITDA for the overall consumer wireline segment.

Overall for the company, AT&T managed to grow EBITDA by 3.9% compared to 1Q 2022 on revenue growth of 1.4%.

The EPS decline from 2022 is driven by non-operating impacts like pension and taxes. This was expected, as the consensus estimate was just $0.01 below the actual result. The main reason for the market freak-out appears to be the low Free Cash Flow result of $1 billion for the quarter, which is much less than ratable delivery of the full-year plan of $16 billion FCF.

The selloff seems excessive, as the company warned about FCF seasonality last quarter, and still expects to deliver the $16 billion for the full year. Most investors buy AT&T for steady income rather than growth, and the dividend is not at risk if the company meets its target. Long term buy-and-hold investors should not take one quarter’s results as a reason to sell. Still, the low growth leaves little prospect for capital appreciation, and there are less volatile ways to earn a 6% yield in today’s market. Alternatively, a trading or options strategy around a core position in AT&T stock can be a way to take advantage of the volatility and earn greater than the 6.3% dividend yield.

Can’t Say They Didn’t Warn You

The seasonality of free cash flow delivery was communicated by the company last quarter, when they first provided guidance for 2023.

Similar to last year, we expect greater free cash flow generation in the back half of the year based on higher capital investment levels and device payments in the first half of the year as well as the timing of the annual incentive compensation payout.

Source: Pascal Desroches, CFO (4Q 2022 Earnings Call)

In 2022, the cadence of FCF delivery was as follows:

- 1Q: $2.8B

- 2Q: $1.4B

- 3Q: $3.8B

- 4Q: $6.1B

70% of FCF was generated in the back half of the year. As mentioned, the seasonality comes from three factors. First, annual bonuses are paid during 1Q so there is a cash outflow even though the company accrues the expense more evenly throughout the prior year. Second, the fourth quarter is a big selling period for new phones. Customers generally pay for these in installments over a period of months or years while AT&T pays its suppliers within a few months. Finally, capex is typically higher in the first half of the year as well.

Unlike last year when the company guided down the original $16 billion FCF forecast to $14 billion, they have not done so this year. This was reiterated a couple times on the earnings call including by the CFO, who estimated these timing impacts on 1Q FCF at $3 to $4 billion.

Within the first quarter, as I mentioned in my prepared remarks, there is — we are at the high watermark of our device payments. And it’s the only quarter that has our annual incentive compensation. Those two things, coupled with our elevated CapEx relative to our full year guide, hurt Q1 to the tune of $3 billion to $4 billion, and we expect that to turn during the course of the year just mechanically. It really isn’t much harder than that. Like based upon our spend, what we expect to spend in those categories, those should turn mechanically. So we feel really good about being able to deliver 16% or better.

Source: Pascal Desroches, CFO (1Q 2023 Earnings Call)

So, There’s Nothing To Worry About?

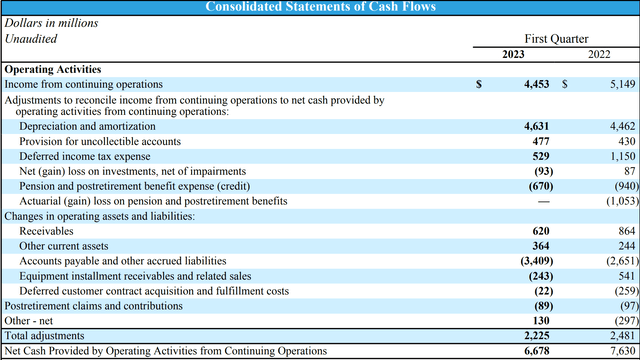

I wouldn’t go that far. When we look at the cash flow statement, we see that the cash draw from accounts payable was about $750 million worse in 1Q 2023 that a year ago. The change in equipment installment receivables drew another $780 million of cash. With FCF now the main concern of the market, management should be more transparent about the magnitude of these swings and why they still expect them to fully reverse.

Second, the macro environment is still a risk. The industry as a whole enjoyed customer additions and upgrades during the pandemic as part of the “stay-at-home” trade. With the environment normalizing, this demand growth is expected to slow. While the 424k postpaid net adds in 1Q were strong, they were not as strong as a year ago when there were 691k. A recession would impact the business, at least the market for low end customers and upgrades. On the earnings call, management saw this risk as “proportional” across the industry meaning they did not expect individual companies to gain or lose much market share.

Finally, the higher interest rate environment is an issue. If the company does deliver the $16 billion of FCF this year, about $8 billion will be needed to pay dividends. Looking at the balance sheet, we see that AT&T has $13.8 billion of debt due within one year. While they can pay down some of that with FCF, at least $5.8 billion will need to be refinanced in the current high interest rate environment.

With Those Risks, Why Own AT&T Stock At All?

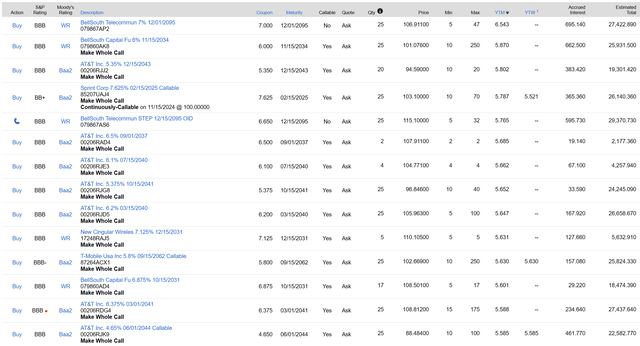

If you are willing to deal with volatility in the share price, the stock is a hold. The dividend cut in 2022 came as a negative surprise but risks of a further cut are now lower, though not completely eliminated. The dividend, which is 50% of expected free cash flow, now yields 6.3%, up from 5.6% before the earnings release thanks to the drop in share price. Bonds of AT&T, as well as those of T-Mobile (TMUS) are available yielding up to 5.87% (if we throw out the 72-year maturity one that yields higher.) Verizon (VZ) bonds yield slightly less, maxing out at 5.56%.

AT&T preferred shares (T.PA) (T.PC) have similar yields at 5.67%. Ahead of earnings, T common stock did not compensate investors at all for its lower position in the capital structure. Now, the common stock has a yield premium of 40-60 basis points above these bonds and preferreds.

Given the risks noted above, new investors should demand an even higher risk premium, say 100 bps, which would put the buy price at around $16 for a 6.9% yield. The shares traded below this level in late September and early October 2022.

For long term buy-and-hold investors, todays earnings release doesn’t say anything new about the long-term prospects of the company, only that FCF is seasonal. I see no reason to sell or stop DRIPing dividends but be prepared for volatility in the share price.

Both long term investors and traders can supplement their income, however. The simplest way would be trading around a core position, buying a few more shares below say $16 and selling a fraction of your position above $19. You may want to wait a week or two to see where the new range settles out following the big drop today.

Alternatively, selling options is a good way to generate extra income from a range bound stock. For example, the July $19 calls and $16 puts could both be sold for $0.25 at the close on 4/20/23. If you sell out of the money options expiring in 3 months and keep rolling them as they get closer to expiration, you could generate $1 per share of income every year, almost doubling your income compared to the dividend alone. I would do this on a covered basis, holding the stock if I sold calls or the cash to buy the stock if I sold puts. Needless to say, be prepared to have your stock called away or put to you if it trades outside the range.

Conclusion

First quarter results from AT&T were respectable based on net income and EBITDA. The company is delivering on its strategy to expand 5G wireless and fiber. The seasonality of free cash flow delivery was always expected to hit 1Q the worst. While the $1 billion FCF was even worse than expected, it does not necessarily indicate the company will miss FCF targets for the year.

The 10.4% drop in share price on earnings day puts some risk premium back into the dividend yield as the stock is now yielding 40-60 bps above bonds and preferreds. For new investors, I still don’t see this higher yield as worth chasing yet. Long term investors really did not learn anything new today about the company’s fundamentals, so I see nothing wrong with continuing to hold as long as you are prepared for volatility in the share price.

The stock will probably continue to be range bound moving forward, so investors and traders can both supplement their income by either trading around a core position or selling options.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.