Summary:

- The AT&T Inc. cash flow is likely to be loaded into the second half.

- Management listed a lot of expenses loaded into the first quarter.

- The business is growing, and it is not unusual for catch-up expenditures as the company focuses on its remaining businesses.

- The free cash flow shortfall is largely from less DirecTV distributions and large unfavorable accounts payable balance swings.

- Vendor financing payments made up the rest of the free cash flow shortfall. Both vendor financing payments and the accounts payable balance swing are likely timing differences.

Ronald Martinez

(Note: This article was in the newsletter on April 20, 2023.)

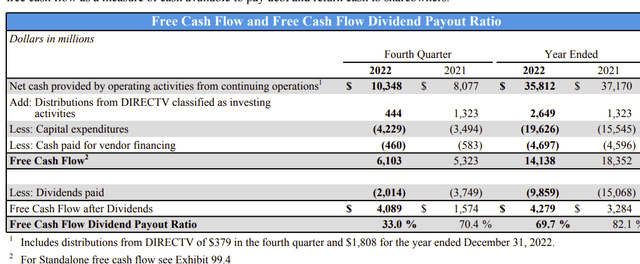

AT&T Inc. (NYSE:T) had a hefty cash flow level in the fourth quarter of fiscal year 2022.

AT&T Free Cash Flow Calculation Fourth Quarter 2022 (AT&T Supplemental Schedules That Show Reconciliations Fourth Quarter 2022)

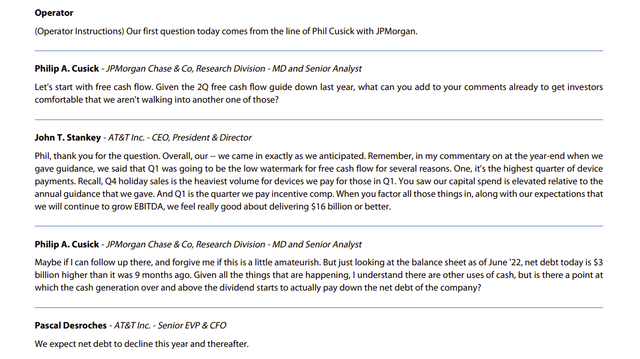

Basic math should dictate that when you have more cash flow, you get more free cash flow. Furthermore, management warned about the first quarter. They repeated that warning in the first quarter conference call.

AT&T Answer On The Level Of First Quarter Cash Flow (AT&T First Quarter 2022 Conference Call Transcript)

Despite the management’s answer to the question in the above image, the analyst persisted with the question that fully indicates that he did not hear the answer or at least did not process it. The analyst showed very little faith in the answer from management. This, unfortunately, indicates an attitude that is all too pervasive in today’s world. There is an implied distrust in the answer given by management despite the history that I have posted. Mr. Market promptly sided with the analyst and the stock promptly dropped quite a bit. As I will show, the pattern of last year appears to be playing out again this fiscal year. Investors need to decide if they believe AT&T Inc.’s management or not for themselves.

Why anyone would expect a cash flow pattern to change without an explanation or warning from management about the change is beyond me. Clearly, management is expecting more cash flow later because various costs touched upon by management are front end loaded and will remain that way until management tells you otherwise. The issue with free cash flow is that it is dependent upon a lot of things that management can control, such as when to pay things. Management decided to pay a lot of things compared to the first quarter in the previous year, and the market has clearly panicked because of that. Yet there is no indication that many of those items will repeat.

The market had a clear mistaken impression about cash flow, and the stock is clearly paying the price.

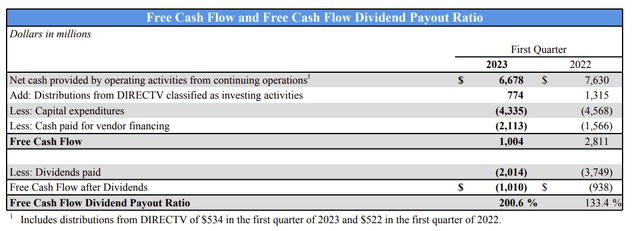

AT&T First Quarter 2023, Free Cash Flow Calculation (AT&T Supplemental Report Showing Reconciliations Of Non-GAAP Measures First Quarter 2023)

Notice that free cash flow after dividends is about the same as the year before. This is really the first-first quarter after the large divestiture to Warner Bros. Discovery, Inc. (WBD). So, we can sort of go with management as to what to expect in the future from the remaining business. The pattern of cash flows and free cash flows will likely clear up as a track record of the post-divestiture company becomes established.

There were clearly some unfavorable first quarter cash flow swings in the business and from DirecTV. As a result, free cash flow did take a dive in a weak quarter. But that does not mean there is a problem. Relatively small quarters can fluctuate without a lot of effect on the fiscal year results. But the key is that this is a relatively small quarter for cash flow to begin with. So, that shortfall that has the market worried is likely to get made up as the fiscal year progresses and more significant cash flow follows in later quarterly reports.

Management did guide to $16 billion (roughly) of free cash flow. Management reiterated that guidance. Since they are maybe $2 billion short in one quarter, that shortage can easily be made up through the absence of the costs (and some account balance reversals) noted by management in later quarters and the growth of the business. The percentage of the shortfall (when reviewing the full fiscal year guidance) is likely a normal fluctuation that the market did not want to see.

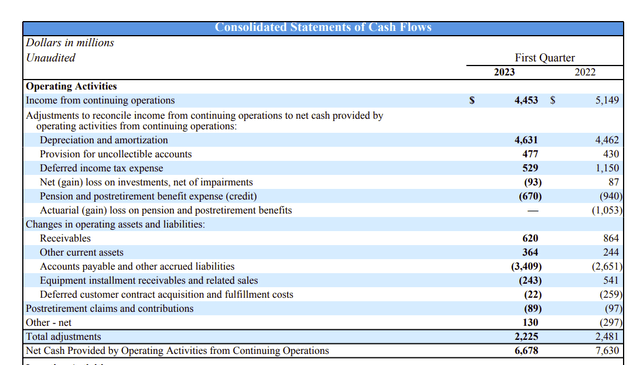

AT&T Calculation Of Net Cash Provided By Operating Activities First Quarter 2023 (AT&T First Quarter 2023, Supplemental Calculations)

To bolster what management stated in the conference call, the unfavorable change in accounts payable and accrued liabilities would indicate a lot more payments were made. Management gave the reason for this in the conference call.

In addition, first quarter 2022 earnings benefitted from a pension fund gain and additionally benefitted from deferred income taxes that were larger than in the current year. It certainly looks as though continuing operations (in terms of cash flow) “hung in there” without sustaining an adverse material trend. The calculation follows.

Fiscal year 2023 cash flow before changes in accounts was $9.327 billion. Fiscal year 2022 cash flow before changes in accounts was $9.285. So, in terms of cash flow from operating activities (before changes in accounts), the cash flow was level before management paid more, as shown by the accounts payable swing.

Earnings

Now earnings did get off to a slow start. But that “slow” is hardly such a variance that it cannot be overcome throughout the rest of the fiscal year.

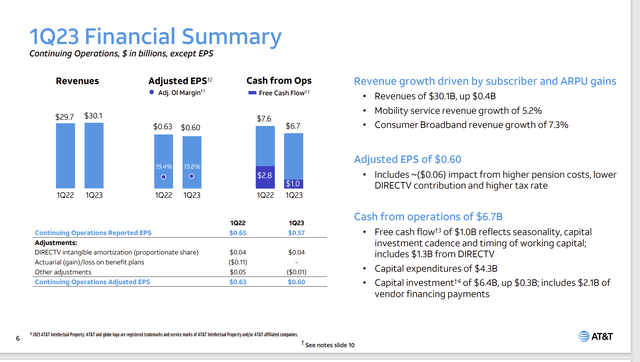

AT&T Summary Of First Quarter Results (AT&T First Quarter 2023, Earnings Conference Call Slides)

As was noted above, there is an explanation in some detail provided by management for the cash flow. Now the adjusted earnings per share show some higher expenses that may concern the market. Expenses can certainly careen out of control if not properly monitored. But as the fiscal year 2022 demonstrates, one quarter like this does not make the whole fiscal year.

The lower DirecTV and the higher pension costs are things that management really cannot control on a quarterly basis. Tax rates more or less have some control in the finance department. Taxes can somewhat be planned in terms of payments as deferred taxes are usually very closely monitored to maximize benefits. The key here is that much of the shortfall came from things that management would not classify as operating issues on a quarterly basis.

DirecTV, in particular, will likely continue to decline over time. Hopefully, the decline is not large and sudden. As long as the decline is predictable, then management can reinvest whatever cash is received in more profitable parts of the business. Eventually what happens is that continually reinvested cash will outweigh some of these other expenses to the point where the swings will become insignificant. It is clear, however, that pension costs need to be closely monitored and appropriate action taken on a long-term basis.

Key Takeaways

The AT&T Inc. business itself appears to be transitioning to slow growth. It would not be unusual during such a transition for a combination of catch-up type expenses to appear. It is also not unusual for a fair amount of capital to be spent at the beginning of a transition.

All of this and more, as the company focuses, makes cash flow and earnings a little trickier in the beginning. In this case, free cash flow could have been nearly $800 million higher simply by delaying the payment of some accounts payable. That would have allowed the account balances to remain the same, and then the free cash flow calculation would have started with more cash flow to begin with. This alone would have cut the free cash flow (market) perceived deficit in half. The accounts payable balance change is likely to be a timing issue that reverses as the fiscal year proceeds.

Further free cash flow shortfall explanations came from the vendor financing payments (this is likely part of the accounts payable unfavorable balance swing) and the lower DirecTV distributions. Neither of these indicates a problem with the core business. In fact, the vendor financing payments are likely a timing issue that will reverse throughout the fiscal year.

About the only concern, and this one is a relatively minor concern, would be the increase in pension fund costs. Management will likely gain long-term control of that over time. After all the explanations, the free cash fall shortfall is a small fraction of the original number. Management gave qualitative explanations for that remainder.

In the meantime, capital costs will remain front-end loaded with higher costs in the first few years of transitioning away from the old company composition. But the business is growing. The last fiscal year turned out to please the market as it progressed. There is little to no reason to believe that will not happen this fiscal year. One quarter does not make a fiscal year when a management like this is firmly focused on a successful transition.

Management noted the challenges. Any management willing to discuss issues like this management is very likely to resolve things in a way the market will eventually like. The managements to worry about are the ones that sweep stuff like this under the rug.

Clearly, that is not the case here. So, AT&T Inc. stock remains a strong buy because the typically seasonally light first quarter is probably not a material representation of the full fiscal year. It has a lot of things that are “front loaded.” The next few quarters will benefit from that.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T, WBD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation for the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits its own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I analyze oil and gas companies, related companies, and AT&T in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.