Summary:

- AT&T Inc. lost about $13 billion in market value on earnings day. In my view, the P&L looked decent, and so did key operating metrics.

- The problem was the expectation for free cash flow in Q1 which proved to be substantially higher than the management team’s internal projections.

- I like AT&T Inc. less for the potential rebound following the earnings panic, but for the diversification benefits and attractive dividend yield.

Ronald Martinez

Being a contrarian usually feels uncomfortable. But as I watch AT&T Inc. (NYSE:T) shed some $13 billion in market value on its Q1 earnings day, I can’t help but think that the stock is a buy at these depressed levels.

No, I do not believe that the boring U.S.-based carrier will grow beyond analysts’ and investors’ expectations. I also don’t think that AT&T will gain substantial market share, thwomp its competition, or otherwise pull a rabbit out of a hat. Rather, I continue to appreciate the nuanced benefits of owning this stock, which I revisit below, as the market panics over Q1 results that I believe have been far from disastrous.

AT&T’s results: not catastrophic

First, let’s address the news of the day. On April 20, AT&T delivered a small top-line miss coupled with a penny-deep beat on EPS. The P&L seemed to be in decent shape, as GAAP op profit grew by 8% YOY and adjusted EBITDA inched higher by 4%. Again, nothing too exciting to see here. Remember that we are talking about a mature, quasi-utility company that largely runs an old-school subscription business.

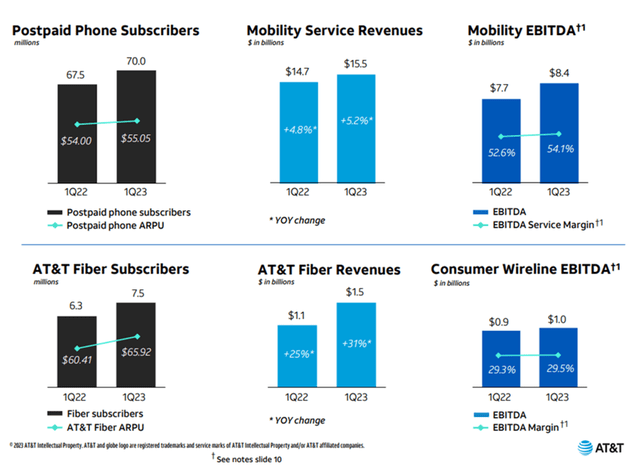

Regarding operating metrics, I have a hard time finding good reasons to justify the 10% post-earnings selloff. The charts below show that, relative to last year, post-paid subs and average per-unit revenue climbed; mobility revenues and margins improved; and the smaller fiber business continued to trend in the right direction. Net adds came in below the post-pandemic trend, but this is expected as the stay-at-home days that favored telecom services have been left far behind.

The big deal seems to have been a free cash flow (“FCF”) of $1 billion that was expected to come in at a much higher $3 billion instead. Because AT&T is both heavily levered and a generous dividend payer, apparent cash flow issues can easily trigger investors who fear the company’s inability to cover its dividend payments in the future.

It begs the question: did AT&T underdeliver on FCF or did analysts set the expectations too high for the quarter? While the answer is probably a combination of both, I suspect that it skews more heavily toward the latter. As CFO Pascal Desroches explained in the earnings call, FCF in Q1 was aligned with the management team’s expectations that accounted for “several seasonal and anticipated working capital impacts” or headwinds.

More importantly, the chief executive elaborated:

We remain confident in our full-year outlook for free cash flow of $16 billion or better. This expectation is largely due to the timing of capital investments, device payments, and incentive compensation, which all peaked in the first quarter.

It is pretty clear that the FCF miss in Q1 should be largely blamed on working capital and capex factors, both of which companies usually have more control over than EBITDA (generally the most important component of FCF). To reiterate, there was nothing particularly wrong with AT&T’s P&L, as evidenced by the small non-GAAP EPS beat.

To be fair, the company’s managers can always be proven overly optimistic in their FCF projections. So, let’s assume that they are, and AT&T delivers a “pitiful” $12 billion in free cash flow this year that is a solid $5 billion or so below the company’s own projection. While less debt could be retired in this scenario, the sum would still be more than enough to cover the projected dividend payments of around $8 billion in 2023.

Why bet on AT&T stock?

A small part of my argument for owning T shares at less than $18 apiece is the potential coil spring effect that could push the stock higher if or when the company delivers on its 2023 FCF promise — or at least gets close enough to it. But I would hardly consider this the main pillar of the bullish thesis.

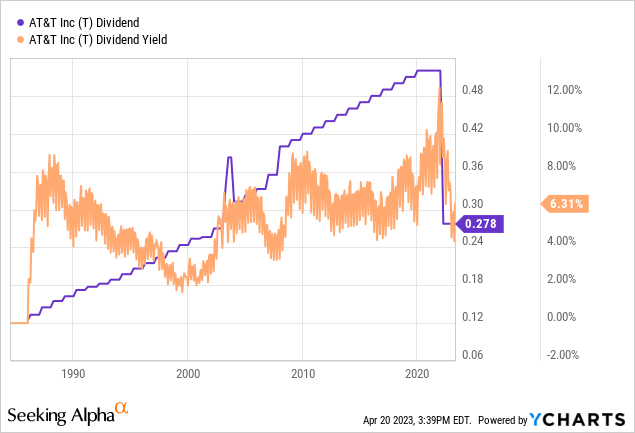

More importantly, especially for growth investors, T has historically been only lightly correlated with the performance of the S&P 500 (SP500), at a factor of +0.4. With the dividend yield now rising to 6.3%, the expected return on this stock is very likely to come primarily from the dividend payments rather than capital appreciation, which could make this bond-like investment a good diversifier to an otherwise aggressive growth portfolio.

Considering the Federal Reserve’s own expectation for a drop in short-term interest rates, from above 5% this year to around 3% in 2025, AT&T’s 6%-plus yield could become even more desirable. Of course, this would certainly depend on the company’s ability to support its dividend policy and, ideally, modestly grow the payments over time as it had done before the WarnerMedia deal in 2022 (see graph below).

In summary, I like AT&T Inc. at current levels, but I think that investors should set the expectations right. The share price is unlikely to skyrocket, although it could rebound from this post-earnings panic if AT&T can regain investors’ trust in its ability to produce cash flow. More importantly, this high-yielding stock could be a good diversification play, especially if interest rates plateau in the summer and begin to decline, as currently expected.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in T over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join EPB Macro Research

EPB Macro Research is a thriving community of investors seeking better risk-adjusted returns, while optimizing their portfolios to benefit from the next economic cycle. I invite you to join EPB, where you can read more about multi-asset diversification and participate in the discussions about the markets, the economy and investment strategies.