Summary:

- The recent banking crisis has been interesting to follow, due to the notable impacts on big US banks, notably BAC in this article.

- The big bank has reported declining deposits QoQ and YoY, despite the increased funding costs, with much of the money likely flowing to money market funds.

- However, investors may still be encouraged by BAC’s improving NII, attributed to the elevated interest rates that may also remain over the next few quarters, before the Fed’s potential pivot.

- Its provision for losses appears decent as well, compared to pre-pandemic levels, with strict FICO scores of over 770 across its loans.

- Therefore, we remain cautiously confident that BAC remains well positioned to weather the short-term volatilities ahead, due to the exemplary execution thus far.

YinYang/E+ via Getty Images

The Big Bank Investment Thesis

We had been anticipating Bank of America’s (NYSE:BAC) FQ1’23 results, which we thought might shed more light on the health of the financial institution after the aggressive Fed rate hikes over the past few months.

Our expectation was that the deposit base might increase, which interestingly was not the case. Instead, BAC reported a declining total deposit base of $1.91T (-1% QoQ and -7.7% YoY) by the latest quarter, leaving us wondering where the $15B of deposits had gone in the aftermath of the recent banking crisis.

The same was experienced by JPMorgan (NYSE:JPM) as well, with deposits of $2.3T (-3% QoQ and -8% YoY), Citigroup (NYSE:C) at $1.36T (in line QoQ and +2.2% YoY), and Wells Fargo (NYSE:WFC) at $1.35T (-2.1% QoQ and -7.5% YoY). Perhaps much of it went to the money market funds at $350.8B (+610% MoM) and ETFs at $32.4B (+1,605% MoM) for March 2023, as reported here by Tom Roseen, “as investors looked for safe haven investments.”

Investors must also note that BAC reported higher funding costs of 1.36% (+0.15 points QoQ and +0.2 YoY) for Consumer Banking in FQ1’23, likely attributed to the need to retain more deposits after the recent banking crisis.

While we were unable to find more information on JPM’s and C’s funding costs, WFC similarly reported an expanded average deposit cost of 83 bps across the bank in the latest quarter, up by 37 bps QoQ and 80 bps YoY. Therefore, investors may need to closely monitor this cadence moving forward, due to the potential impact on the bank’s profitability, though still notably lower than its FQ1’19 level of 1.55%.

However, investors still need not fret, since BAC reported excellent net new checking accounts of 36.1M (+0.13M QoQ & +1.3M YoY) in the Consumer Banking segment, contributing net income of $3.1B (-13.8% QoQ and +3.3% YoY) in FQ1’23, despite the in-line deposit balances.

The bank also went on the same route for its Global Wealth & Investment Management, with expanded rates paid on deposits of 1.97% (+0.6 points QoQ and +1.94 YoY) in the latest quarter. While it increased the client balances to $3.5T (+2.9% QoQ and -5.4% YoY), the strategy also partly triggered lower net incomes of $917M (-23.5% QoQ and -16.6% YoY).

On the other hand, BAC’s Global Banking and Global Markets outperformed with combined net incomes of $4.3B (+43.4% QoQ and +30.3% YoY) in FQ1’23, attributed to growing Net Interest Income [NII] from higher interest rates and higher sales/ trading revenue, respectively.

Now, with the Fed’s recent meeting minutes already projecting a mild recession by the second half of 2023 and recovery over the next two years, we reckon that its prospects remain more than decent ahead. This is despite the potential moderation in its NII, assuming peak inflation by H2’23 and a rate cut from late 2023 through 2025.

For now, BAC reported a combined NII of $14.6B (-1.3% QoQ and +24.7% YoY) and a Net Interest Yield (excluding Global Market) of 2.85% (+0.04 points QoQ and +0.86 YoY) in the latest quarter. This was against the $12.5B and 3.03% reported in FQ1’19.

However, with St. Louis Federal Reserve President James Bullard suggesting a terminal rate of up to 5.75%, we may see the bank enjoy a few more quarters of improved NII prior to the normalization. Only time may tell how the Fed decides to proceed ahead, since the March CPI still shows rising inflationary pressures, albeit at a decelerating cadence.

Meanwhile, BAC’s provision for credit losses and net charge-off ratio still appeared reasonable at $931M (-14.7% QoQ and +3,003% YoY) and 0.32% (+0.06 points QoQ and +0.16 YoY) in FQ1’23. We must also highlight that these numbers were still below pre-pandemic levels of $1.01B and 0.43% in FQ1’19, despite the peak recessionary fears.

Furthermore, while the bank did report an elevated allowance for loan and lease losses of $12.5B (-1.5% QoQ and +3.3% YoY) in the latest quarter, it only comprised 1.2% (-0.02 points QoQ and -0.03 YoY) of its total loans and leases, compared to $9.6B and 1.02% reported in FQ1’19.

BAC continued to maintain a strict FICO score of over 770 for most of its loans as well, suggesting a robust consumer creditworthiness thus far, tempering much of the uncertain macroeconomic outlook over the next two years.

In addition, the bank’s performance in other segments remained stellar with ROTCE of 17.4% (+1.6 points QoQ and +1.9 YoY) and robust Global Liquidity Sources of $854B (-1.6% QoQ and -22.9% YoY) in FQ1’23. This was compared to 16.01% and $546B in FQ1’19.

Therefore, we remain cautiously confident that BAC is well positioned to weather the short-term volatilities ahead, due to its exemplary execution thus far.

So, Is BAC Stock A Buy, Sell, or Hold?

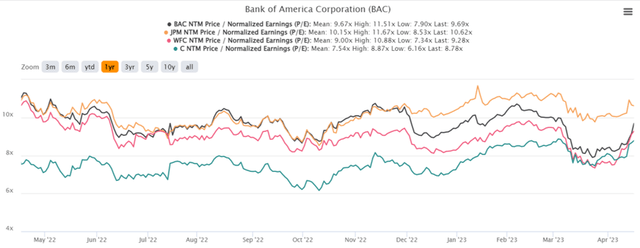

BAC 1Y EV/Revenue and P/E Valuations

BAC is currently trading at an NTM P/E of 9.69x, lower than its 3Y pre-pandemic mean of 11.52x though nearing its 1Y mean of 9.67x. The stock is also notably trading near its big bank peers, such as JPM at 10.62x, WFC at 9.28x, and C at 8.78x. This suggests to us that the arguably irrational fears from the recent banking crisis have mostly eased for the former.

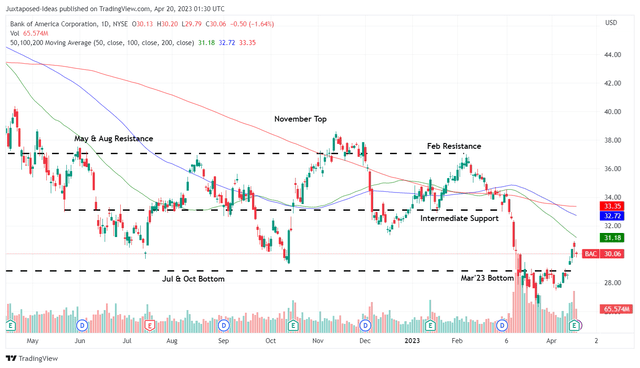

BAC 1Y Stock Price

BAC’s stock price is also notably climbing, likely returning to its intermediate support level in the near term, similarly buoyed by the double beats in the recent FQ1’23 earnings call. Despite so, the stock is still trading below its book value per common share of $31.58 (+1.1% QoQ and +6.3% YoY).

Therefore, we reckon interested investors may still add, since the stock is still trading below its 50/ 100/ 200-day moving averages, unlocking expanded forward dividend yields of 2.85% compared to its 4Y average of 2.28%.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.