Summary:

- NextEra Energy reports first quarter 2023 earnings on Tuesday, 25th of April.

- NextEra Energy’s premium valuation is not justified in my view, given the company’s financials.

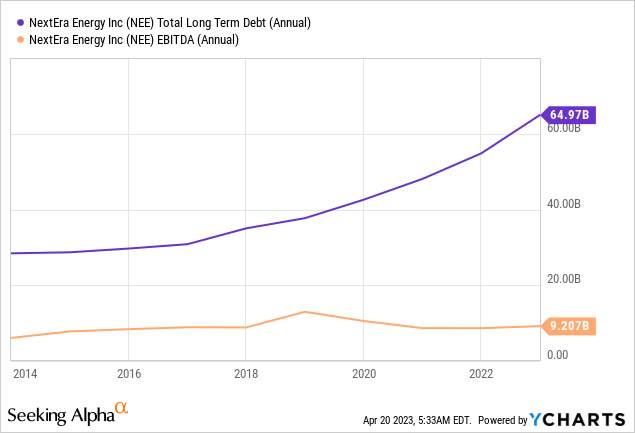

- NextEra’s total long-term debt compared to EBITDA has widened over the last decade.

- My outlook is bearish on the stock.

syahrir maulana/iStock via Getty Images

I took a closer look at NextEra Energy’s (NYSE:NEE) stock and its financials ahead of the company’s Q1 2023 earnings report. NextEra is a unique company in that it owns the largest electric utility in the United States, Florida Power & Light, which operates under government regulations. However, the company is also known for its forward-thinking approach to renewable energy, with a portfolio that includes wind, solar, and energy storage assets.

While NextEra Energy’s stock took a hit after the Q4 2022 earnings report, it has since recovered half of its losses. The company’s plan to recoup costs through rate increases and potential government incentives for green energy investments could help manage its debt burden. However, in order to justify an investment, I would like to see improvements in the company’s financial ratios. While the current debt burden keeps elevated and the stock is trading at a premium, my outlook is bearish on the stock.

Earnings History

NextEra Energy, the largest electric utility company in the United States, is set to report its first quarter 2023 results on Tuesday, the 25th of April, before the stock market opens.

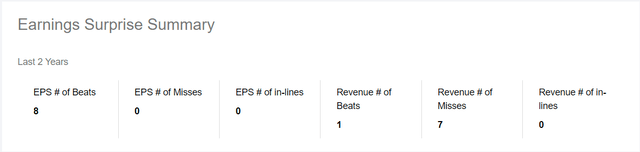

The company reported solid results for the year, with adjusted earnings per share growing 24% year over year. While the company surprised Wall Street with its earnings per share, it fell short of expectations in the top line. This has been a recurring trend for NextEra Energy.

Earnings Surprise Summary (Seeking Alpha)

Over the past eight quarters, NextEra has missed expectations on the top line seven out of eight times. However, the company has consistently beaten earnings per share expectations, with the last EPS miss dating back to December 2019.

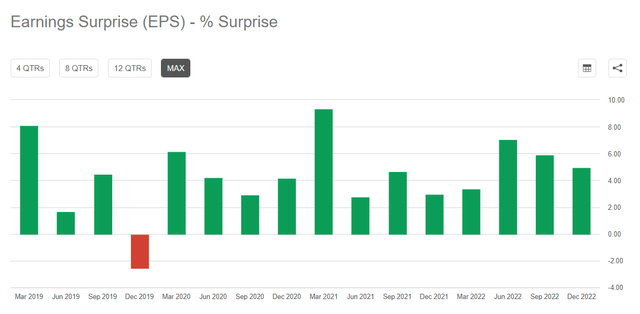

Earnings Surprise (Seeking Alpha)

The earnings surprise as a percentage has been above 2% for every quarter in the past three years, although we have seen a decline in the surprise percentage over the past three quarters. One reason for the decline could be that Wall Street is increasingly setting higher targets for the company.

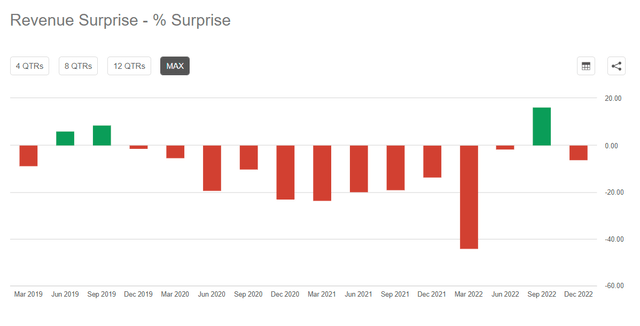

Revenue Surprise (Seeking Alpha)

In terms of revenue, the story is quite different. NextEra Energy has missed on the top line in 13 out of 16 quarters, but in the last three quarters, the company has only missed revenue estimates by 1.55% in June 2022 and 6% in December 2022, while beating the September 2022 forecast by 16%.

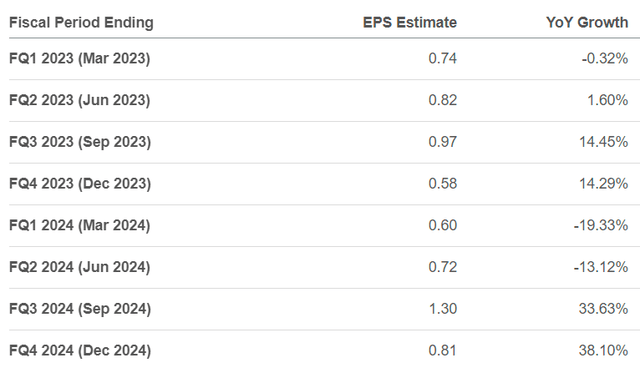

The stock price has shown no discernible pattern in reaction to earnings calls, with positive, negative, and neutral reactions occurring almost equally over the last 16 earnings calls. For Q1 2023, analysts expect NextEra Energy to report 74 cents a share, with revenue estimated to be $5.22 billion in the quarter. These estimates have been revised upwards in the last 90 days. However, investors looking at the next several quarters should expect negative year-over-year growth this quarter, becoming positive until the end of fiscal year 2023.

Company’s Debt Ratios

While NextEra Energy has demonstrated strong operational performance, I have concerns about the company’s financials. It’s not uncommon for utility companies to have high levels of debt due to infrastructure requirements, but NextEra’s leverage ratio has been on the rise. The company’s net debt has increased from $42 billion in 2019 to $63.7 billion in 2022, and its net debt/EBITDA ratio has also increased from 4.79 to 7.5 during this period.

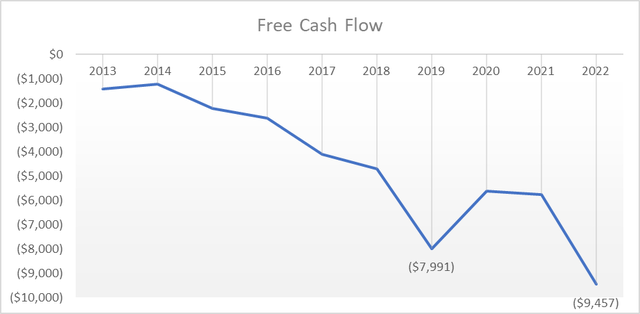

Moreover, NextEra’s total long-term debt compared to EBITDA has widened over the last decade, with debt more than tripling while EBITDA has remained relatively stable. Additionally, the company’s free cash flow has been negative, with a $9.4 billion deficit in 2022 after subtracting capital expenditures from cash generated from operations. Despite the cash burn, NextEra has increased its dividend payments, which grew from $2.4 billion in 2019 to almost $3.4 billion in 2022. The company has also announced a 10% year-over-year increase in dividends for this year, and while that might delight shareholders, it will once again increase the company’s dividend spending.

Given NextEra’s negative free cash flow, it relies heavily on debt to fund dividend payments. However, in a higher-interest-rate environment, the increased borrowing costs could threaten the company’s ability to pay dividends. It might sound unbelievable for a company that has a 27-year track record of increasing dividends, excess leverage poses a real risk that cannot be ignored. For instance, Algonquin Power & Utilities (AQN) recently announced a 40% cut to its dividend and a planned $1 billion in asset sales to address its financial challenges.

Valuation Compared With Peers

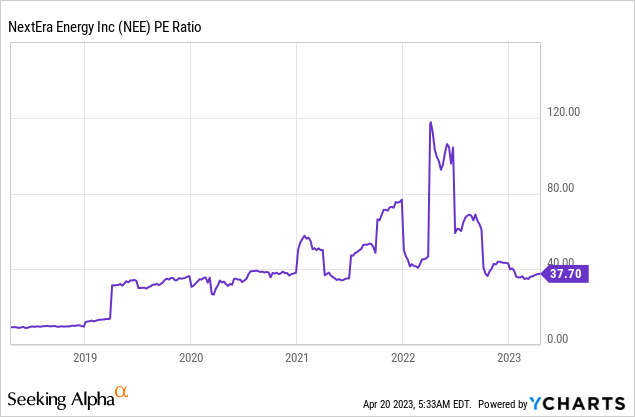

NextEra Energy’s stock has been trading within a range of $67 to $91 since July 2020, currently hovering around $70 per share. The company’s forward earnings multiple trade at 25x, with company guidance for FY23 earnings per share at around $3.64 – $3.74, compared to Seeking Alpha’s expected $3.11, which equates to a forward earnings multiple of 25x. For context, the S&P 500 is currently trading at 18.15x. While NEE is trading at a price-to-earnings premium compared to its peers, it’s trading lower than its historical levels.

Here’s a table that shows a comparison of some key financial metrics for NYT and its peers:

|

Company Name |

Market Cap |

Stock Price |

EPS |

P/E |

Price to Operating Cash Flow |

P/B |

ROIC |

|

158.43B |

$78.99 |

2.1 |

37.70 |

18.92 |

3.999 |

3.86% |

|

|

79.15B |

$72.78 |

3.26 |

22.25 |

12.49 |

2.606 |

3.98% |

|

|

75.07B |

$98.27 |

3.17 |

30.98 |

12.76 |

1.597 |

2.08% |

|

|

47.57B |

$93.28 |

4.49 |

20.73 |

9.057 |

2.006 |

3.75% |

|

|

42.61B |

$43.02 |

2.2 |

19.64 |

8.72 |

1.729 |

3.36% |

A comparison of key financial metrics with its peers shows that NextEra has the largest market cap by far. However, its price-to-earnings ratio of 37.70x is reasonable overall compared to its history, but not as favourable as its competitors. NextEra also maintains a premium position with higher price-to-operating cash flow and price-to-book ratios than its peers. Lastly, NextEra Energy’s return on invested capital is positioned on the higher end, having peaked at over 7.50% in 2019 and declined since then. As the pandemic wanes, it remains to be seen if the company can increase this ratio once again.

My Take

NextEra plans to recover fuel and storm-related costs by increasing customer rates in the next two years, along with potential government incentives for green energy investments, which could alleviate some pressure on the company’s debt load. However, before considering an investment in the stock, I would need to see improvements in the company’s financial ratios. I will closely monitor NextEra’s debt levels over the coming quarters, and if the company can demonstrate meaningful improvements, I am open to revising my investment thesis. In the meantime, I rate a sell on the stock while the premium valuation lasts.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.