Summary:

- Generative AI will likely not have any material impact on Microsoft’s earnings in the near future.

- Speculation that Microsoft’s Bing will become a default search engine for Samsung or any other phones are likely unrealistic.

- There seems to be too much optimism baked into Microsoft’s current valuation making it expensive.

jewhyte

Introduction

The launch of OpenAI’s ChatGPT 3 is viewed as revolutionary. The generative AI through ChatGPT has shown not only the future potential of this new technology, but it has also shown the current progress in such an innovative technology sparking a massive interest in the industry. It seemed as if everyone from normal consumers to investors and even leading global corporations were all seeing a future in a world with a generative AI technology similar to ChatGPT. This market sentiment has led to Microsoft’s (NASDAQ:MSFT) 49% stakeholder in OpenAI to see massive valuation growth throughout 2023 in hopes that generative AI such as ChatGPT will bring massive future potential, and some investors pointed out as challenging Google’s (GOOG) (GOOGL) search engine as the biggest potential for Microsoft. However, while the future can be revolutionized through advancement in AI technology, I do not believe Microsoft deserves such a valuation premium today. Not only will generative AI not have any material impact on Microsoft’s top of the bottom line, but the idea of Microsoft’s Bing replacing or challenging Google in the near future using generative AI also seems extremely far-fetched. Thus, I believe investors should be more cautious as future potentials could have driven up MSFT stock’s valuations to an expensive level.

No Material Impact on Microsoft

Without a doubt, I do believe that artificial intelligence will bring revolutionary changes to the world. OpenAI’s ChatGPT, even in its early form, was truly revolutionary and mind-blowing. However, I do not see this having a material impact on Microsoft in the near future. In positive macroeconomic conditions, the future potential may be enough to warrant a valuation expansion, but as macroeconomic conditions cause investors to expect a potential recession in the coming months, I believe it is hard to justify Microsoft’s increased valuation multiple that came from a future potential with no real material gain in the present.

ChatGPT makes money by utilizing its API. According to OpenAI, the company, for 8K context, charges cents for 1000 tokens, or about 750 words. For the 32K context, the company charges 18 cents for 1000 tokens. Through this, the company is expected to generate $1 billion by 2024. Although the growth story is impressive, Microsoft’s revenue for the fiscal year 2022 was $198 billion, which means that even if OpenAI’s $1 billion revenue is reported entirely under Microsoft’s earnings, it would have accounted for only 0.5%. Considering that Microsoft’s revenue is expected to reach $232.64 billion in the fiscal year 2024, it is hard to see generative AI having a material impact on Microsoft’s operations.

TSMC’s (TSM) recent earnings call further supports this thesis. When the management team was asked, “what is TSMC’s view on the growth outlook for AI data centers?” the company answered the question by saying that the company “haven’t [had[ enough data to summing it up to see what is the contribution and what kind of percentage to TSMC’s business.” This may be due to the industry being in its infancy, but I believe it could also mean that the size of the industry is too small to quantify as of today.

Hard to Challenge Google

Beyond fees OpenAI charges, there has been speculation that Microsoft’s Bing, powered by ChatGPT, could potentially replace Google. Some investors argue that because generative AI technology gives Bing an upper edge, Microsoft may finally be able to challenge Google in the search engine industry massively expanding Microsoft’s future growth potential. This could be monumental for Microsoft because consumers will likely use a default search engine over anything due to ease of use. However, I do not view this to be realistic.

First, it will be difficult for Microsoft to replace Google as a default search engine in any Android device, which includes Samsung (OTCPK:SSNLF). This, in my opinion, is a very unrealistic view as Google has significant leverage over Android phone makers like Samsung as their operating system runs on Google’s Android. Further, Samsung attempted to create its own operating system called Tizen back in 2014, which did not succeed. Thus, I believe it is highly unlikely for Samsung to attempt to create its own operating system today as the company’s identity is already embedded in Android throughout the past decade, and because Samsung uses Google’s operating system, Google will likely have leverage over Microsoft.

Second, there has been no evidence of a massive consumer exodus from Google’s search engine to Bing. In early February, Microsoft announced a Bing-powered by ChatGPT, which has garnered significant attention. Yet, in March 2023 data showed no material market share change in the search engine industry. Google continued to hold about 93% market share, which was about 2 percentage points higher than in 2022 March. Therefore, considering the fact that consumers continued being loyal to the Google search engine despite Bing adopting a generative AI earlier, I believe it is reasonable to argue that consumers prefer Google’s services: a service that is ingrained in the majority of the population’s life.

Finally, I do not believe that consumers always want the most innovative and technologically capable products. In today’s world, most of the products in the market are unnecessarily good for the average consumer. For example, most consumers do not use the full 16GB RAM and the most technologically advanced CPU and GPU in their PCs or laptops. Even in cars, the ability of the car to drive over 150 miles per hour or even 100 miles per hour is simply unnecessary, which leads to consumers purchasing brands that they relate with over a product with the best functionality as even an average product is good enough. Thus, because Bing has a generative AI functionality embedded in its search engine for some users, I do not think most consumers will switch over to Bing today, and during this time, Google will attempt to match Bing’s functionality making the battle even harder for Microsoft. Google, beyond search engine, through so many account connections has become a necessity for consumers to switch.

Overall, because of these reasons, I do not believe that Microsoft’s Bing will see any material improvement to impact the company’s earnings in 2023 or even in 2024.

Valuation

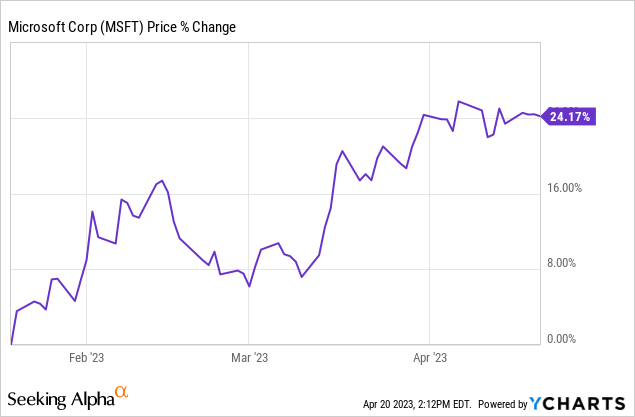

In January of 2023, Microsoft announced a $10 billion investment in OpenAI, and as the chart below shows, the company’s stock price increased by about 24%. Investors, in my opinion, were too early to value the monumental potential of generative AI since it will likely take years for the benefit to impact Microsoft’s earnings.

[Chart created by author using YCharts]

Given this, I believe Microsoft’s stock valuation is in the expensive territory as massive optimism has priced the company’s stock close to perfection. Microsoft currently has a forward earnings-per-share of about 30.8, which is near its relative peak of about 34 during the pandemic’s positive market sentiment period. Therefore, considering that optimism may be too early and that macroeconomic conditions are nowhere near a pandemic’s positive sentiment, I believe Microsoft may be expensive today.

Summary

Generative AI and ChatGPT’s functionality was revolutionary, and I do believe that AI will dramatically reshape our society in the future. However, I do not see this happening in 2023 or even 2024. The growth of such technology is likely similar to an exponential graph, a graph where the growth is slow in the beginning before picking up speed over time. Therefore, I believe Microsoft’s valuation is expensive today. Although there will likely be no material impact on Microsoft’s earnings in the near future, investors gave Microsoft a significant premium since the company announced a stake in OpenAI.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.