Summary:

- In general, expectations for Tesla, Inc.’s future growth are far too optimistic.

- Even in the most optimistic scenario Tesla continues to be overvalued.

- The perception of the Tesla brand is changing for the worse.

VPanteon

After approaching $100 per share in early 2023, Tesla, Inc. (NASDAQ:TSLA) began a strong uptrend that culminated in a +107% rise. Weeks after that relative high, the stock has continued its long-term bearish trend and, in my opinion, this time it may not stop at $100 per share.

The red flags behind the current valuation of this company are many, and in this article I will lay out those that I think are most relevant from both a short-term and long-term perspective. Much of the data comes from the Q1 2023 earnings release.

The problem with Tesla’s growth rates

Since the valuation multiples of this company are extremely high considering its reference sector, I expect the growth rates to justify such a valuation. Indeed, according to analysts’ estimates, the future looks bright.

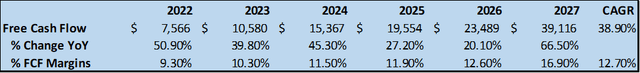

These are the estimates of TIKR Terminal analysts: basically, in 2027 Tesla will generate free cash flow of $39.11 billion thanks to a CAGR of 38.90%. It would seem that Tesla will not be affected in any way by the almost certain upcoming recession; in fact, free cash flow will grow steadily and rapidly each year. Moreover, margins will improve over time. In 2027 Tesla’s free cash flow will be almost equal to that achieved by Microsoft Corporation (MSFT) in 2019, an outstanding achievement for a company that sells cars.

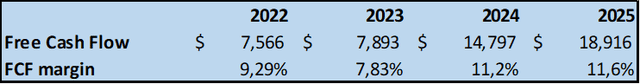

Instead, these are Marketscreener estimates. Free cash flow in 2025 is similar to previous estimates; however, a more complex 2023 is expected. Growth will be very low and margins will also be affected. In any case, from 2024 suddenly everything will return to normal, Tesla will almost double its free cash flow and continue to grow as in the past.

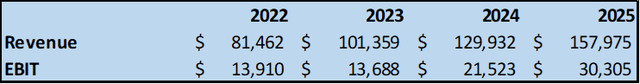

Finally, these are the Gurufocus analysts’ estimates. Here we have different parameters, but again the growth is very high until 2025. 2023 may not be the best year, but then everything will return to normal.

If these estimates turn out to be correct, there is no doubt that Tesla can become one of the best companies in the world if not the best. However, there is a problem: these estimates do not make any sense and there are at least 3 good reasons to believe that the analysts were too optimistic.

First reason: Tesla is an automotive company

Although this statement seems obvious, it actually is not, since many believe Tesla is much more than an automotive company. Personally, I do not doubt that Tesla over the next few decades may diversify its business in a way that makes selling cars secondary, but at the moment it remains an automotive company. It is true that valuations must discount what the company will be and not what it is, but it is implausible to think that Tesla in the future (5-10 years) could be anything so different from what it is today since 85% of revenues come from selling cars.

This premise was necessary since it implies that Tesla is also subject to the cyclicality of the automotive industry.

This is a relevant issue since the Fed itself expects a mild recession at the end of this year, with a recovery in the next two years. The trigger would be the sudden rise in interest rates that is hurting the banking sector, which is increasingly reluctant to lend money. In any case, after “temporary inflation,” I personally am quite skeptical that it will be a mild recession. After all, if the Fed were alarmist it would not improve the situation by any means.

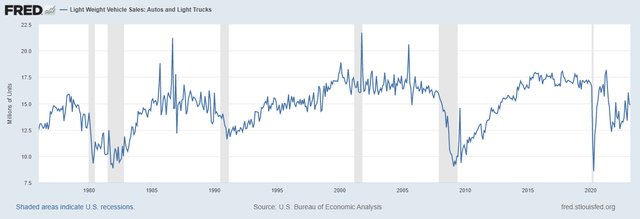

So, having ascertained that toward the end of the year there will be the long-awaited recession, here is how the automotive sector has performed in the past during an adverse phase of the business cycle.

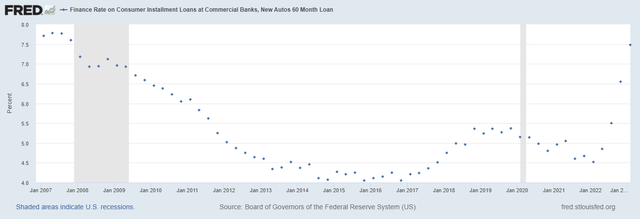

Federal Reserve Bank of St. Louis

As was easily guessed, during past recessions (shaded areas) the automotive sector has not fared well as car sales have definitely dropped. After all, the opposite would have been strange.

The only automakers that might not fit into this reasoning are those that produce extra-luxury vehicles. Those who can afford a Ferrari will probably not care that there is a recession and buy it anyway, but this is not the case for Tesla since its buyers are not only millionaires.

Federal Reserve Bank of St. Louis

Interest rates have skyrocketed, and getting a loan to buy a car is becoming very expensive. In particular, interest is almost 2 times more expensive than the 2015 lows.

All this obviously has a negative impact not only on Tesla, but on the entire automotive industry.

So, in light of this data, I wonder how one can justify such optimistic estimates by analysts in this 2023 and in 2024. If free cash flow in 2023 is the same as in 2022, already that would be an incredible achievement in my opinion. We have to accept the fact that we are facing a completely different macroeconomic environment this year than in past years. Gone are the years when money was cheap and the Fed was printing money like never before. In addition, analysts take it too much for granted that in 2024 and 2025 there will be a strong recovery for Tesla. What if the recession perpetuates in those years as well? We know it will be there, but we do not know its magnitude. Underestimating what is happening could prove to be a serious mistake, especially if you are buying stocks belonging to a cyclical market and moreover as speculative as Tesla.

The current crisis is not yet over, and even when it is behind us, there will be repercussions for years to come. This, however, is not coming from me, but from JPMorgan Chase & Co. (JPM) CEO Jamie Dimon.

Second reason: the first effects of the recession are already visible

Over the past several months, Tesla has reduced the selling price of its vehicles several times, and the consequences of this choice are showing the first negative results.

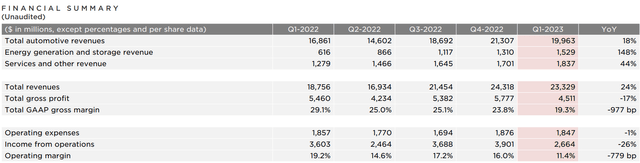

Although revenues increased 24% YoY, operating income saw a 26% YoY slump due to a significantly reduced operating margin compared to the past. Selling vehicles at a lower price has had a significant impact on Tesla’s profitability, which is worrisome since it has always been its strength over its competitors. Reconnecting to what I said in the previous paragraph, given the economic premise for this year and the next, I doubt we will see any improvement in the coming quarters.

In addition, it is worth noting that the decision to steadily reduce prices has been somewhat forced by the rapid increase in inventory. In a single year it increased by $7.6 billion, a clear sign of overproduction. This is a clear red flag, because a person intent on buying a Tesla may postpone his purchase knowing that the company is constantly reducing its selling prices. Why should he buy it now if in a month or two there is a chance he will save a few thousand dollars? Getting out of this vicious cycle will not be easy.

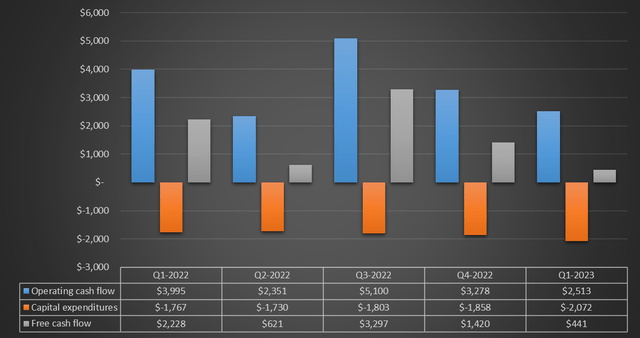

To conclude the margin aspect, obviously free cash flow also deteriorated and was lower than Q1 2022 by $1.78 billion. In short, a far from satisfactory result considering that analysts estimate that free cash flow will improve again this year. Tesla started badly and I think it will end even worse.

Finally, are we really sure that the reduction in margins is only a short-term problem and will be resolved in the long run? I have my doubts about this and will explain my view in the next paragraph.

Third reason: the Tesla brand is losing value

If you own a business and for whatever reason start to reduce the price of your products/services there is a risk that the perception of your brand could change dramatically. The customer does not like middle ground: either you apply a differentiation strategy from the beginning or a cost leadership/market penetration strategy.

The reason I state this is because Tesla currently seems to have unclear ideas about which strategy to apply.

Because of continuous price reductions, the sense of exclusivity that the customer perceived when buying a Tesla is being lost. Owning a Tesla was a real status symbol, as it set you apart from the crowd. To date, we can no longer say the same.

The Model 3 now costs $39,990, the Model 2 will cost around $22,000; in short, having a Tesla will no longer be at all exclusive, as even with an average salary it will be possible to buy one. Of course it will not be a Model S, but it will still be a Tesla.

In my opinion, this was the biggest mistake Tesla made as it lost its most important asset: a sense of exclusivity. The problem lies not so much in selling the cheaper cars, but in selling the very expensive ones, which is where the profit margins are the highest.

Wanting to make the Tesla brand accessible to everyone will drive away wealthier customers who were willing to buy a Model S at $115,000 because they have less incentive to spend so much on a car whose brand is affordable. There is a reason why Ferrari has never put a car on the market starting at $20,000 and if Toyota does not sell cars starting at $300,000. It is not because they cannot do it, they simply do not do it because it would only be a damage. No one would buy such an expensive Toyota while the Ferrari brand would only be devalued.

Finally, I would like to point out that my view is not just based on my personal perception but is supported by data.

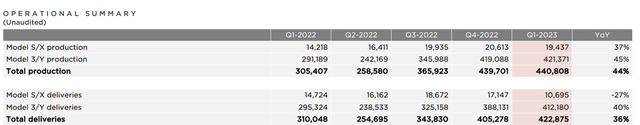

Production of premium Model S/X models increased by 37% compared to Q1 2022 but deliveries declined by 27%. In contrast, the less expensive models had a 40% increase in deliveries. Basically, fewer people are buying the premium models and more people are buying the cheaper ones.

This is a worrisome result considering that the premium models have had many price cutbacks, yet this was not enough to equalize last year’s result.

In light of these considerations, Tesla’s future seems to me to be increasingly geared toward selling vehicles that are not too expensive, thus going to compete with giants that already sell millions of vehicles a year. At that point, needless to say, Tesla’s famous high profit margin will be only a distant memory.

Valuation

Considering that Tesla’s current market capitalization is roughly the sum of that of Mercedes-Benz, Porsche, Volkswagen, BMW, Stellantis, Ferrari, General Motors, and Ford I think that is enough to show that something is wrong.

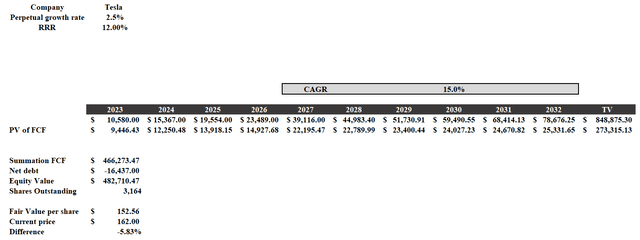

However, I want to make an extra effort, to be more optimistic and believe that Tesla in 10 years will be among the most important companies in the world; after all, never say never. Remember the absurd predictions of analysts? I will put them inside a discounted cash flow (“DCF”) analysis and subsequently consider an additional 15% increase each year until 2032. Here is how the model will be constructed:

- Free cash flow 2023-2027 will be equal to the TIKR Terminal analysts’ estimates (the most optimistic). Free cash flow 2028-2032 will grow at 15% CAGR. Basically, we are assuming that Tesla in 2032 will have a free cash flow similar to that obtained by Apple in 2020. In sum, all within the norm for a company that sells cars, which is losing its brand exclusivity, with growing inventory and deteriorating margins. It will not be affected by the recession, in fact it will improve its free cash flow despite the first quarter has already seen an 80% YoY decline. What could go wrong?

- The RRR will be 12% and was chosen by me. I preferred to opt for an arbitrary value rather than the CAPM formula since the latter was definitely high being Tesla a company with a beta of 2.01. At that point the discount rate would have been around 15% and the fair value of this company completely annihilated. I want to be optimistic and believe that 12% is an adequate return for a company with such a high beta. The perpetual growth rate will be 2.50%, in line with the average between long-term GDP growth and the inflation rate.

Author creation based on the data already discussed

Despite all this optimism, the result is rather disappointing since Tesla would still appear to be slightly overvalued. If I had calculated the discount rate with the CAPM, the fair value would have been $107 per share.

Needless to repeat, I personally do not believe in these absurd estimates, and even if they were true, Tesla would still not be a good investment at the current price. Even reaching half of the analysts’ expectations would already be a great achievement.

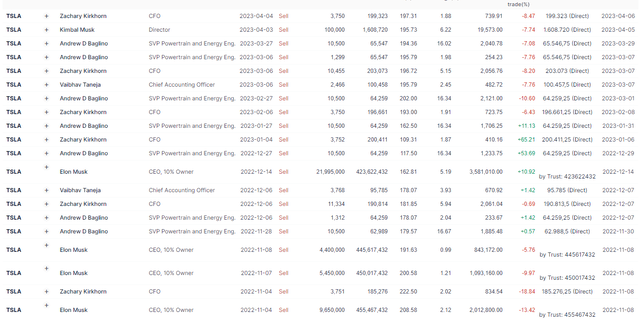

Finally, I conclude this article with insider transactions. Apparently, I am not the only one who believes that Tesla is not a good investment.

The last buy was on November 30, 2020, since then there have only been sales every single month. How come insiders don’t buy if Tesla, Inc. is the investment of a lifetime?

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Investment Idea For A Potential Recession competition, which runs through April 28. This competition is open to all users and contributors; click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Just my opinion, not a financial advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.