Summary:

- Tesla was forced to cut prices once again as the company’s underwhelming quarterly results show crushed margins.

- We expect margins to decrease even further in the rest of the year as the company’s increasing inventory shows muted demand.

- The company has value, it generates profits, but nowhere near enough to justify its $600 billion valuation.

- Given the strength of the valuation disconnect we recommend shorting Tesla.

Xiaolu Chu

Tesla (NASDAQ:TSLA) cut prices on its Model 3 and Model Y vehicles in the United States on Wednesday, the 6th time YTD. Soon after, the company announced its earnings, showing a collapse in margins across the board, a trend that we expect to get markedly worst going into the rest of the year. As we’ll see, Tesla is an atrocious buy at its current valuation as a result, and it’s becoming a strong short opportunity.

Tesla Earnings

Tesla’s earnings were rough across the board as many of the key numbers dropped.

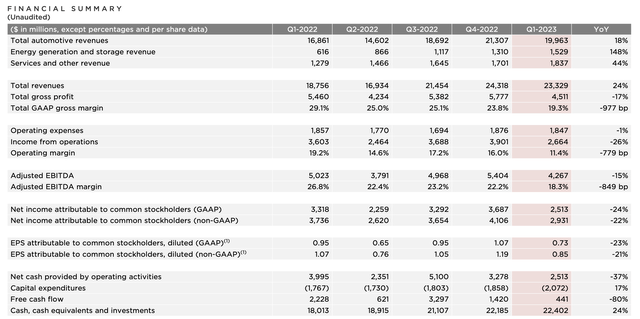

Perhaps the first to start with is the growth in the company’s automotive revenue of 18%. A respectable headline number in the automotive business, but also a clear sign of the impact of price cuts as total deliveries increased by double that or 36%. The company’s energy generation and storage revenue was a bright spot here but remains a fraction of the company’s businesses.

The company saw gross profit decline 17% YoY and GAAP gross margins declined by almost 10% YoY. As we discussed here, the company needs cuts in margins to maintain scale, and we expect continued margin cuts. Perhaps of note is that even with strong growth in services and energy generation / storage, it’s not enough to save overall corporate margins.

The company’s GAAP net income dropped 24% YoY to $10 billion annualized, giving the company a P/E ratio of almost 60x, in an expensive and competitive business with minimum growth. At the back end, FCF dropped an astounding 80% putting the company near negative territory. Cash and cash equivalents grew 24% to $22 billion.

However, that headline growth, also puts the company’s FCF yield at <1%. We’ll take this moment to highlight that the company has almost $2 billion in annual stock compensation, a real dilutive cost that isn’t reflected in the FCF.

Tesla Volumes

The story for Tesla and why it deserved a valuation triple that of the largest automaker globally be vehicles (Toyota) has consistently been its margins.

The latest price cuts push its cheapest Model 3 to <$40k from a peak of just under $47k. It’s worth noting that the company’s prices have dropped by towards early-2021 levels, but they are still above starting launch prices. That means the company has seen demand drop substantially versus supply to prior levels that no longer enable the COVID-19 induced price raising.

We see 1st quarter sales as a peak in the demand drop as customers took advantage of pricing cuts, with CEO Elon Musk saying that the price cuts sparked immediate short-term demand. Without additional price cuts we see that spike as settling. Additionally, we view the higher prices as a temporary impact of COVID-19 pricing, but not a long-term feature.

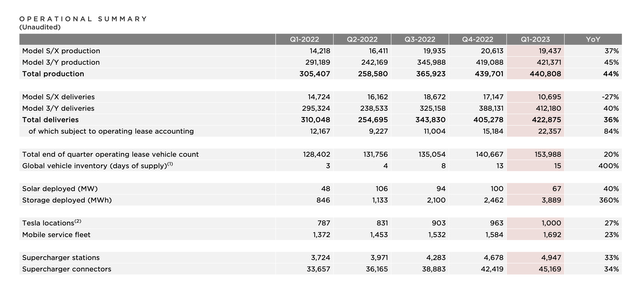

Additionally, it’s worth noting that the company’s production has increased much faster than deliveries, with lease accounting increasing the fastest, and the company now having a record 15 days of vehicle inventory. In our view, that’s another sign of decreasing demand, and a particularly worrying number for the company’s margins.

For perspective that supply number is getting closer to what’s seen by traditional dealers.

There are some bright spots in the company’s portfolio. Solar continues to remain negligible but the company is a large leader in energy storage. We expect that specific lead to continue, but don’t see it as significant enough to drive the business.

Tesla Self-Driving

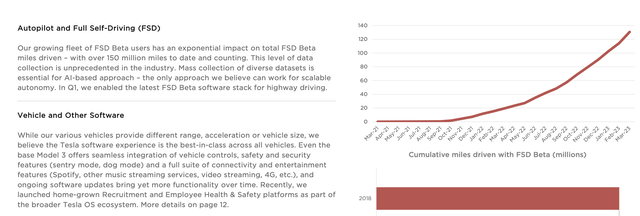

Another massive threat to Tesla’s business remains, specifically, with its consistently delayed (almost 10-years now) self-driving and purported SW revenues.

Let’s do some probably inaccurate back-of-the-envelope math. Tesla’s FSD beta is $15k. In 2022, 90 million miles were driven on it. Tesla drivers average around 12,500 miles / year. The company has delivered just over 3 million vehicles. The company announced it has roughly 400k purchases of the FSD beta.

That means two things.

1. ~15% of vehicle purchasers are buying FSD beta. 2. The average FSD purchaser (400k of them) is using it for just 2% of the miles they drive.

Another way to look at it is the company’s ASP was ~$46k / vehicle in the most recent quarter. Its operating margin of 11.4% was $5244 / vehicle. Taking the FSD price and 15%, its FSD SW sales account for $1000 / vehicle (on average) in margins. A substantial part of Tesla’s margins are based on continued FSD sales.

The company’s competitors are saying that they don’t think FSD (the obvious long-term goal) is feasible even. We agree and the reason why can be said in one word, “regulation”. Waymo has already stated, backed up by test results, that its AI drivers are safer than humans. That’s huge. But ultimately, the future, and value in self-driving is in people being able to do other activities.

Baby-sitting the car as it drives itself doesn’t make a self-driving car anything more than a fad. Being able to work, play video games, whatever, while your car is driving itself is immensely valuable. The issue with that is that accidents, will, at some point occur, and when they do in a car without steering wheels it puts massive liability on manufacturers and regulators.

Airplanes, which have been working on automation for much longer, but still require multiple pilots versus even 1, is a massive example of how far away regulatory approval at scale could be. That, combined with the technical challenge of being able to either mimic human thinking, or anticipate a variety of situations will continue to delay. That makes us agree with BYD’s view that it’s an unrealistic goal.

Tesla’s lack of ability to accomplish its timelines suggests it might be hitting the same problem. Even if it can someday accomplish its goals, it has deep-pocketed rivals that it needs to be able to beat (Waymo, Cruise) that have more complete self-driving miles. First mover advantage is huge. We agree with the competition that it’s unlikely for Tesla to dominate here.

If that’s true, and customers are disillusioned from purchasing FSD, that could quickly have a substantial effect on the company’s margins.

Tesla Other Businesses

Tesla’s other businesses have some pluses and minuses.

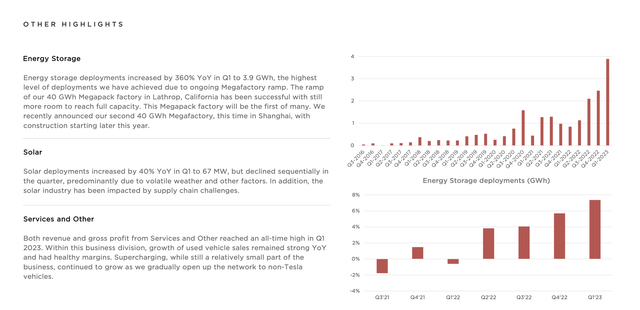

We will once again state the company’s solar business is irrelevant. Residential solar is ~$2k / kWh, meaning the company’s most recent quarter of deployments earned roughly $130 million in revenue. We see the business as a non-starter to the company’s long-term earnings where it has a minuscule market share and no competitive advantages.

The company is the 4th largest solar installation company in the U.S. with a 3.9% market share. The largest, Sunrun ($4.5 billion market cap), having a <15% market share shows how diversified the market is. The company’s solar panels aren’t in the top 10 by efficiency, and solar installation and production is a competitive low-margin business.

The most efficient panels below to SunPower ($2.5 billion market cap) showing that even if the company invests and grows to being the largest installer w/ the most efficient panels, something it doesn’t have a path to doing, it will hit 1% of its market cap in value.

The company’s services business has continued to grow, supported by used vehicle sales. We again see this as fairly minimal, used vehicle value has skyrocketed due to various new vehicle shortages, and especially with the decrease in new vehicle prices from the company we see this business as challenged.

There are bright spots in the company’s energy storage and super charger portfolios. The company has a head start on EV infrastructure and we expect the super charger to remain strong. It will remain a small part of the business, but we expect it to grow. The megapack is also interesting. The company is at 16 GWh annualized and we can see it hitting 100 GWh+.

However, the company’s margins are roughly 10% and it costs roughly $475 / KWh / megapack. Even at 100 GWh, which is years away, that’s $50 billion in revenue or $5 billion in profit, nowhere near enough to justify the company’s valuation. More so, megapack and battery storage is a much easier to solve problem for Tesla’s competitors than building a car.

Still it is a noteworthy bright spot in the portfolio.

Outlook and Our View

Tesla is facing massively increased competition. Ford is targeting 600k vehicles / year by YE 2023 and 2 million / year by YE 2026. In 2022 it sold 61k vehicles. Rivian is targeting 60k vehicles in 2023, more than double 2022, with continued growth. Many manufacturers with new vehicles are now focusing on ramp, which could rapidly increase market share taken.

Tesla’s market share has substantially declined. In some markets, where the competition is more robust, Tesla is no longer the largest EV manufacturer. Consistent price cuts show its struggles.

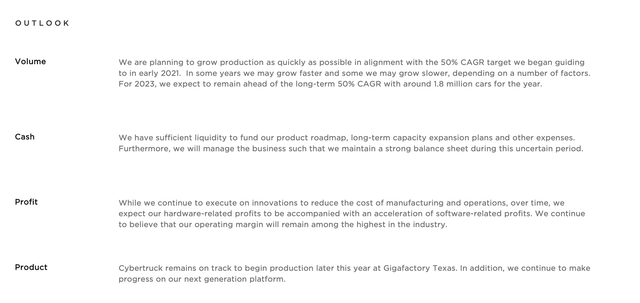

We expect the company’s margins to drop noticeably going into the back half of the year. Decreased profits are incredibly concerning when you’re trading at a 1% FCF yield off of the assumption of growth. The company has updated its volume guidance to account for volatility and its 2023 guidance of 1.8 million cars would be <40% growth and another year of underperforming.

The company mentions it expects its SW profits to accelerate, but as we discussed above, we see that as unlikely. Among the highest operating margin is probably, but that’s not the double the industry average that the company was maintaining, and it’s certainly not enough to justify the valuation. For these reasons, we see the company as a strong sell / short.

Valuation and Shorting

So we said Tesla isn’t worth $600 billion and it’s a short. What is it worth?

Tesla’s profit is roughly $10 billion / year in an expensive industry. We expect its margins to compress as competition grows and price reductions expire. Its FCF is roughly $6 billion / year. Historically, car company peers have traded at high single-digit P/E valuations, which we agree with and in our view results in an automotive valuation of ~$90 billion.

We don’t see the company’s profits growing as volume goes up for the aforementioned reasons.

We assign $5 billion (very generously) to the solar business and $0 to the self-driving business given its present day substantial R&D cost and lack of a pathway to earnings. We generously assign $50 billion in valuation to the megapack business, taking assumed values from when factories are up and running.

That would give a total valuation of roughly $150 billion or 30% of the current market cap. Especially with a downturn on the horizon, we expect the company to move towards this level.

Thesis Risk

In our view, the only way for Tesla to justify its valuation, and the risk to the thesis would be a ‘black swan’ event. Achieving the breakthrough to get full regulator approved self-driving would be an example. Finding a way to secure a massive battery supply that none of its customers would be another. 2030 battery demand is expected to be 10x 2020.

The shortage of certain metals is now a key concern. Tesla has first mover advantage as it’s worked to secure supply. However, existing manufacturers have realized the problem and have strong supply chains. Ford has secured 100% of the supply needed for its 2023 goal of 600k vehicles and is ramping that up.

We expect, if nothing else, Tesla will see an impact in margins to maintain its supply, another risk.

Another risk is the company’s new vehicles which do have substantial interest, specifically the Semi and the Cybertruck. The company has been beaten to first launch of the Cybertruck by other pick-up truck companies, but a successful rollout of both these products could enable at minimum a short-term revenue boost that could enable it to better survive a market downturn.

Short Risk

We do want to highlight that there’s a risk to shorting a stock. Tesla has a history of larger irrational price moves upwards, and we don’t expect that to change. With shorting, your downside is unlimited. For more risk adverse investors, we recommend options.

Tesla’s current share price is $160 and the Dec. 19 2025 $160 option is at $43 / share. It’s an expensive premium (25-30%) which means the share price has to drop by that much just for you to break even. But the upside is that the amount you spend buying the PUT options is the maximum loss you have.

Conclusion

Tesla has a unique portfolio of vehicles. The company’s Cybertruck has been hotly anticipated but delayed and other competitors have beaten it to the SUV space. Unfortunately for the company, the increased competition along with non white-hot market for vehicles is showing as the company has cut prices 6x YTD.

We expect the company’s profits to continue to drop, pushing up its lofty valuation of 60x P/E and 1% FCF yield. The company exists in a difficult industry and it’s clear that the industry expects a downturn from recent white-hot markets. As a result, at this time we recommend selling / shorting the stock.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.