Summary:

- Activision Blizzard will likely report healthy Q1 results and solid business growth.

- The takeover by Microsoft is still pending.

- ATVI stock is trading at a valuation that is mostly in line with its peer group.

Rich Polk

Article Thesis

Activision Blizzard (NASDAQ:ATVI) will report its next quarterly results next week. In this article, we will take a look at what investors can expect and at ATVI’s operational outlook for this year, while also delving into the ongoing Microsoft (MSFT) takeover saga.

What Investors Can Expect From Activision Blizzard’s Quarterly Results

Activision Blizzard last reported its quarterly results on February 6. During its fiscal fourth quarter, Activision Blizzard generated very strong results, both in absolute terms, when it comes to the performance versus the previous year’s quarter, and also when it comes to the performance versus what analysts had predicted:

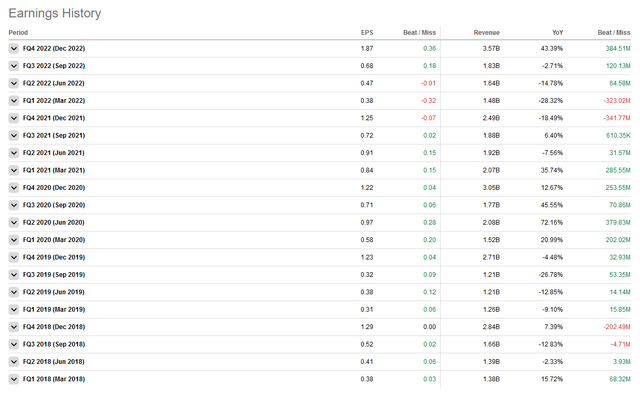

A revenue beat of more than 10% and a bottom-line beat of more than 20% were extremely encouraging for investors. Looking back at ATVI’s performance versus analyst estimates in the past, we see that estimate beats happened very regularly for many years, although there were some misses over the last couple of quarters:

Over the last 20 quarters, Activision Blizzard has beaten earnings per share estimates in 16 quarters. The three EPS misses in late 2021 and the first half of 2022 were outliers, the not-very-strong performance during that time frame can, at least partially, be explained by tough comparables, as ATVI showed healthy growth during the first phase of the pandemic when consumers were locked down and many were looking for stay-at-home hobbies. But it looks like momentum has improved, as ATVI has gotten back to beating estimates over the last two quarters. The year-over-year performance also has gotten better, especially during the most recent quarter, when sales exploded upwards by more than 40%. This was also driven by new releases, such as ATVI’s newest Call of Duty title Modern Warfare II. ATVI has explained that Modern Warfare II has been the best-performing title of the series when it comes to sales generation during the first quarter since its release. Likewise, Activision Blizzard also benefitted from new title releases in other areas, e.g. World of Warcraft, where a new expansion was released during Q4. Even existing titles performed well during the period, however, and ATVI also saw its mobile gaming business perform well on a year-over-year basis — during a high inflation environment, where many consumers were looking for ways to save money, that was surprising.

For the first quarter, analysts are predicting that ATVI will report revenues, or net bookings, of $1.78 billion, which would represent an increase of 20% year over year. The revenue number would be down, in absolute terms, versus the previous quarter, but that’s not surprising — ATVI almost always does best in its fiscal fourth quarter, due to factors such as holiday spending. A revenue and profit decline from Q4 to Q1 is thus far from discouraging — instead, it’s a very normal occurrence. The performance versus the previous year’s first quarter is more important, and analysts predict a huge revenue increase there. Due to the fact that the newest Call of Duty and World of Warcraft titles are still pretty new, there likely is strong demand still, which should have a positive impact on ATVI’s results in Q1, and likely also beyond. On top of that, last year’s Q1 was rather weak, with sales significantly weaker than in Q1 2021, and also below the level seen in Q1 2020, thus a major revenue increase is comparatively easy to achieve.

Of course, revenue is not the only thing that counts, as investors rightfully care about profitability as well. When it comes to that theme, ATVI is expected to report strong improvements on a year-over-year basis as well, although profits will, due to the seasonality impact, still be weaker compared to the very strong fourth quarter of 2022. Earnings per share are forecasted to have risen by 34% versus the previous year’s quarter, to $0.51. Earnings per share growth should be driven by several contributing factors — first, ATVI’s expected revenue increase translates into significant earnings growth, even at constant margins. But since a large portion of ATVI’s costs is caused by development expenses, and since those are mostly fixed and not dependent on the number of copies sold per title, the company benefits from considerable operating leverage — selling additional copies is highly accretive, thus margins can be expected to rise as the company’s business expands. Last but not least, Activision Blizzard has a significant net cash position, and in a rising rates environment, that cash can be expected to generate higher interest income, which is also beneficial for ATVI’s profitability.

All in all, there is a high likelihood that Activision Blizzard’s results during the first quarter were significantly stronger than those from the previous year’s level, and investors can be quite happy with that. On the other hand, ATVI’s underlying results are not the only important driver of its stock performance — the pending acquisition by Microsoft is at least as important.

The Microsoft Takeover Saga Continues

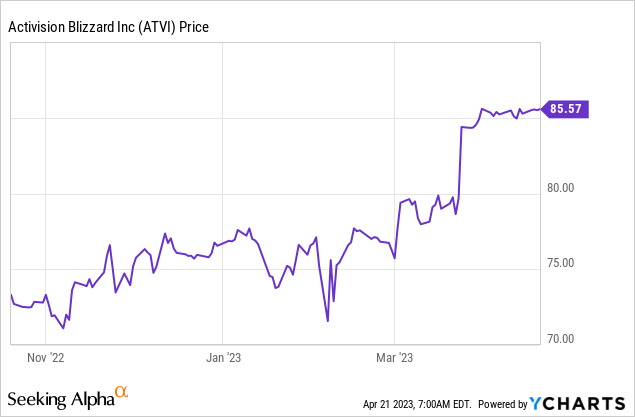

We still don’t know whether the takeover will ultimately happen or not, but the likelihood of the takeover happening has improved in recent months. Not surprisingly, that is reflected in ATVI’s share price:

From the lows in the low-$70s, ATVI’s shares have rallied to $86 over the last six months. The spread versus the deal price of $95 is still meaningful, at around 10%, but by far not as large as it was a couple of months ago. This suggests that the market now sees a way higher likelihood of a successful takeover relative to how the market estimated this likelihood a couple of months ago. And there was, in fact, some positive news when it comes to the likelihood of this deal closing:

– UK regulator, the Competition and Markets Authority, have “provisionally concluded that the anticipated acquisition by Microsoft Corporation of Activision Blizzard, Inc. will not result in a substantial lessening of competition in relation to console gaming in the UK“, as reported by Seeking Alpha. The UK regulator has been seen as one of the major hurdles for this deal in the past, and it now looks like this will not be a hindrance to the takeover by Microsoft any longer.

– The Japanese FTC has also issued a statement that the takeover by Microsoft will not limit competition. Since Japan is the home country to competitor Sony (SONY), some had feared that the Japanese FTC might interfere, but it looks like no problems are coming ATVI’s and MSFT’s way from Japan.

– While analysts naturally aren’t all-knowing, the fact that they are seeing a higher chance of this deal happening is still encouraging for investors.

It looks like the deal is progressing nicely, and the chance of MSFT being able to close the deal has risen in the recent past. Of course, there’s still a chance that the deal gets blocked, but that risk has shrunken. On the other hand, with the deal spread now significantly narrower compared to a couple of months ago, both the risk and the reward have declined — the potential upside to the deal price is now by far not as attractive as it used to be.

Is ATVI A Good Investment?

Gaming is a somewhat cyclical and seasonal industry, but it also is a growth industry. Companies with established franchises and strong intellectual property, such as Activision Blizzard with its Call of Duty, Warcraft, Diablo, etc. franchises should be able to benefit from the expected market growth to a large degree.

Activision Blizzard’s Q1 results likely were healthy, and the analyst community is forecasting that the remainder of the year will be solid as well — earnings per share are forecasted to grow at a double-digit rate this year, to $3.81.

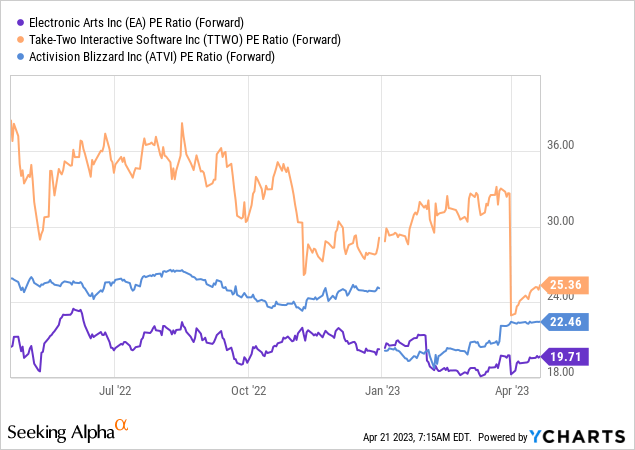

This means that ATVI is trading at 22x net earnings right now, which is not a low valuation any longer — shares have risen considerably over the last couple of months, and they now trade at a premium compared to the broad market, while the valuation seems reasonable relative to how ATVI’s peers Electronic Arts (EA) and Take-Two Interactive Software (TTWO) are valued:

From a valuation perspective, ATVI thus seems neither especially attractive nor especially unattractive. Its share price performance will likely be driven primarily by news related to the pending takeover by MSFT in the foreseeable future. Should the deal fall through, which seems unlikely right now, ATVI’s shares would likely react negatively in the near term, although the company could still be a solid longer-term investment in that scenario, thanks to its strong IP and healthy balance sheet. On the other hand, there is upside potential of around 10% if MSFT is able to close the deal. All in all, I’m neutral on ATVI right now and rate it a “hold”.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.