Summary:

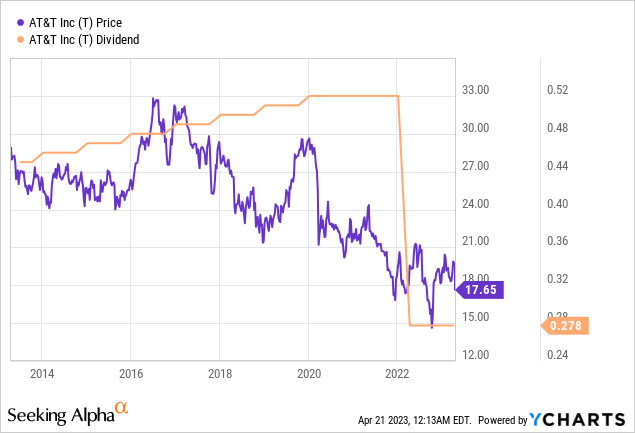

- AT&T stock has been a perennial underperformer.

- Dividend cuts, poor management decisions, stagnant revenue, and flagging free cash flow are not signs of a yield-focused blue chip company.

- While there’s still plenty of cash to go around, AT&T hasn’t demonstrated that it’s worth an investment, especially with interest rates on the rise.

Brandon Bell

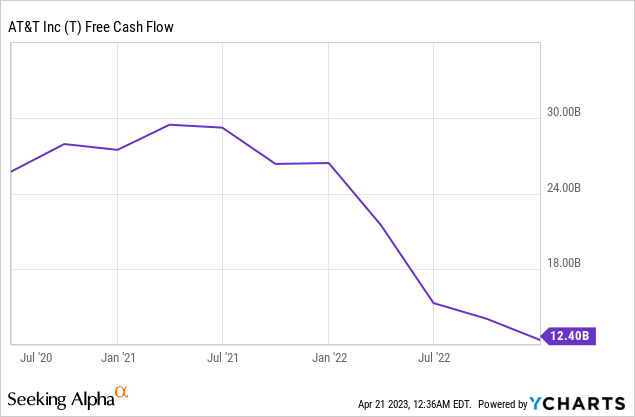

AT&T (NYSE:T) stock is in the doldrums yet again after reporting Q1 2023 results that met expectations on the top and bottom lines but revealed that free cash flow was an alarming $1 billion, well below expectations of $2.6 billion. The discrepancy was mainly a result of increased capital expenditures that the company claimed were seasonal, and management reiterated that they still expect to generate $16 billion in FCF for the 2023 fiscal year, as they forecasted at the end of FY2022. Q1 is where costs peak and Q4 is where revenues peak according to comments from CEO John Stankey, so the annual target is still achievable.

After AT&T’s years of underperformance, dividend decrease, and being overtaken in value by competitors T-Mobile (TMUS) and Verizon (VZ), I think it’s fair to be skeptical.

AT&T stock and the dividend are at 10-year lows (an unusual coincidence, no?), the company is coming off one of the most disastrous mergers in a long while, and now free cash flow is looking uncertain again. It’s not a great look. We can talk about revenue, net income, net subscriber adds, and all those other metrics, but what investors in T stock really care about is cash flow.

Now I’ve seen some folks countering on Seeking Alpha comments sections and elsewhere on the Internet that what we’re seeing now is exactly what happened last year, where Q1 2022 free cash flow came in at a measly $0.7 billion, but management stuck with its $16 billion FCF target and made the same claims that the difference would be made up over the next three quarters of the year. So nothing to worry about?

While this bullish take on the Q1 2023 FCF results has merit to an extent since AT&T did generate a lot more FCF throughout the rest of FY2022 than it did in Q1 2022, what it ignores is that the very next quarter, Q2 2022, the company did actually cut its annual FCF forecast from $16 billion down to $14 billion! The company eventually met that revised forecast, generating $14.1 billion of FCF in FY2022, but the lower-than-expected FCF for the current quarter has investors rightfully spooked that another downward revision might be in the cards. Now, I don’t want to make a prediction about whether $16 billion in FCF is achievable for FY2023, but with management’s past missteps, can you really blame investors for taking the cautious route?

It was not reassuring when this exact point was brought up on the conference call by a JPMorgan analyst and Stankey mostly dodged the question:

Philip Cusick

Let’s start with free cash flow. Given the 2Q free cash flow guide down last year, what can you add to your comments already to get investors comfortable that we aren’t walking into another one of those?

John Stankey

Phil, thank you for the question. Overall, our — we came in exactly as we anticipated. Remember, in my commentary on at the year-end when we gave guidance, we said that was going to be the low watermark for free cash flow for several reasons. One, it’s the highest quarter of device payments.

Recall, Q4 holiday sales is the heaviest volume for devices we pay for those in Q1. You saw our capital spend is elevated relative to the annual guidance that we gave. And Q1 is the quarter we pay incentive comp. When you factor all those things in, along with our expectations that we will continue to grow EBITDA, we feel really good about delivering $16 billion or better.

Stankey essentially avoided the question by talking about why FCF is lower for Q1 than it is for any other quarter of the year, but that wasn’t really the question being asked. I thought perhaps there would be some explanation for why FY2023 will be different than FY2022 from a cash flow perspective in the face of another snafu, but alas Stankey appears to be content to let the results speak for themselves. How that goes is anyone’s guess.

Personally, despite these issues, I think AT&T’s dividend is currently safe where it is with no more cuts coming anytime soon. Slashing it any further would be tantamount to self-immolation, as retirees and yield-chasers, who have held on through the low-rate environment, would likely finally cut bait on this “yield” stock with diminishing cash flow:

However, this is a small comfort to those who have been holding for years, only to see their investment depreciate and their dividend payouts crater. With free cash flow now further in jeopardy, the risk-reward profile continues to shift towards the risk in my opinion.

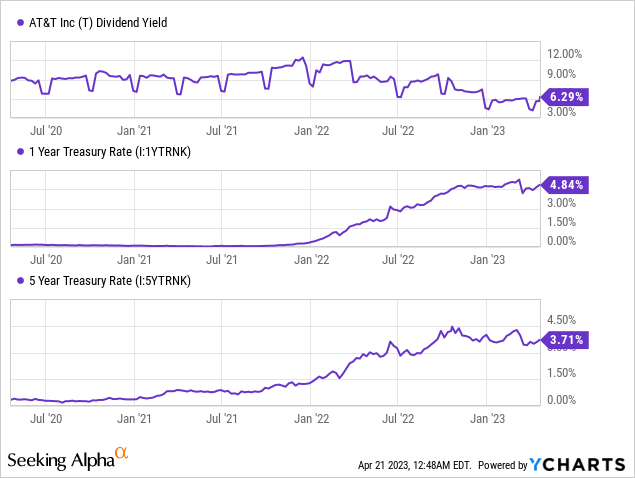

In that vein, the opportunity cost of holding T stock is also gradually rising as interest rates go up and yield becomes easier to find:

The return on a 12-month treasury bill, which is risk-free and doesn’t drop 10% in a single day based on the whims of the market, is approaching 5% and will exceed it when the Fed in all likelihood raises rates again this year. This means the risk-free rate is fast approaching AT&T’s dividend yield, and though it probably won’t surpass it, every point it ticks up is another point of unnecessary risk that T shareholders are taking by owning the stock: risk of further capital depreciation, risk of another dividend decrease, risk of another value-eroding M&A deal, risk of a recession, etc.

All that said, I don’t think AT&T is a completely lost cause. I’m always a fan of prioritizing spending for long-term growth over generating cash in the short term, so I applauded when the company slashed the dividend to reinvest in its future. However, this is a turnaround that will take years to bear fruit, if it ever does, and the current investor mix for T stock won’t be happy with much more cash flow or yield erosion. AT&T is treading on extremely thin ice, and I don’t think the potential upside outweighs the albatross of risk hanging around the company’s neck.

Investor Takeaway

In the face of cash flow deterioration, a decline in dividend yield, and rising interest rates, T stock is not well positioned for the next few years. After the most recent pullback, we could see some buying pressure as investors jump on the dip, but in the medium term, the company will have to tackle a bunch of issues for which I don’t think investors should stick around. If it’s yield you’re looking for, there are better options to be found, especially in the current rate environment.

In the long term, AT&T is still a behemoth of the industry, and despite its current obstacles, the company still generates a ton of cash and will be around for a while to come. There’s work to be done before the stock is good for anything but a passive income, but a return to glory is not out of the question. For investors who believe that the management team can execute that turnaround and want to either buy this dip or continue to hold shares, then by all means disregard me, but from everything I’ve seen from AT&T’s current management and the company’s recent track record of destroying shareholder value, I’ll be looking for better opportunities elsewhere for the time being.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.