Summary:

- I am bullish on Google heading into Q1 earnings, as I believe that the market may be too pessimistic about the search giant’s earnings power.

- Although I understand that the market for digital advertising continues to be under-pressured, I see upside coming from two major tailwinds.

- As compared to 2022, ad business has likely stabilized and OPEX spending has likely been more disciplined, with further upside potential.

- Going into Q1, I suggest investors consider 105/115%-moneyness call spreads with a May 5th expiration date.

400tmax

Google (NASDAQ:GOOG) (NASDAQ:GOOGL) is expected to release Q1 2023 earnings on the 25th of April, after market close. That said, given the global decline in digital ad spending, the general market sentiment is pessimistic, and analysts are projecting only a modest 1.2% year-over-year increase in revenue for Q1 2023 compared to the same period in 2022, despite the ongoing inflationary pressure.

However, it is worth noting that several factors may work in Google’s favor. Firstly, compared to the previous quarter, there has been an improvement in global macro conditions, and the ad business appears to stabilize/ recover. Additionally, foreign exchange headwinds that were caused by a strong dollar have subsided. And finally, it is expected that Google’s operating expenses may have been much more disciplined in early 2023 as compared to early 2022, suggesting the possibility of a margin expansion.

In my opinion, Google stock is undervalued; and I reiterate a ‘Buy’ rating with a $156/ share target price.

For reference, Google stock has outperformed since the start of the new year 2023. YTD shares are up about 18%, as compared to a gain of only about 8% for the S&P 500 (SP500).

Google Q1 Earnings Preview

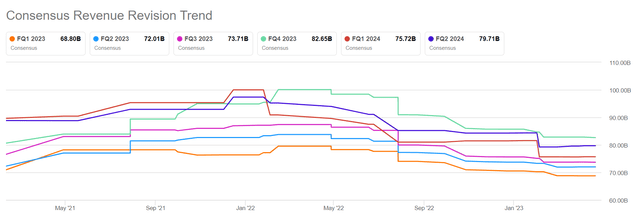

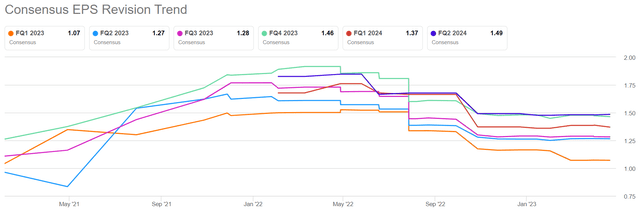

Based on data gathered by Seeking Alpha as of April 22nd, a total of 33 analysts have weighed in with their estimates for Google’s Q1 results. Their projections suggest that the search giant’s total sales for the quarter will fall within the range of $67.27 billion to $70.67 billion, with an average estimate of $68.81 billion. If we take the average analyst consensus estimate as the reference point, consensus estimates suggest that Google will’s topline will increase by only about 1.2% YoY versus the same quarter in 2022. With regards to Google’s earnings power, analyst estimates project an EPS range of $0.8 to $1.34, with the average pegged at approximately $1.07

It is worth noting that the consensus analyst expectations for Google’s revenue have steadily worsened over the past 12 to 14 months, with current sales projections being roughly 20% lower than those made in September 2021.

Likewise, there has been a significant drop in EPS projections for Q1 2023. In early 2021, analysts had predicted a figure of nearly $1.5, but the current consensus estimate stands at just $1.07, reflecting earnings revisions of approximately 30%.

The Ad Business Is Stabilizing/Recovering

Depressed sentiment around Google’s Q1 2023 results may be exaggerated, considering the latest evidence in context of a stabilizing/ recovering advertising business.

For reference, according to a survey by William Blair that covered about 30 decision-makers for advertising budgets, the majority of respondents, approximately 72%, indicated that they expect an increase in their advertising budgets for 2023 as compared to the previous year; A minority of 19% expect their budget to remain the same; And only 9% predict a decrease in their budget. On a second question of the survey, decision makers said that they plan to split their ad budgets relatively between search, social, and video advertising, which would give Google about 2/3 exposure to budget considerations. [Source: William Blair: Proprietary Survey Points to Digital Budget Growth in 2023, April 05th].

Similarly, Evercore ISI recently published a research note where analysts Mark Mahaney et al. argued that although the environment for advertising could be better, ‘Google Search has shown great resilience’, further adding that the increased focus on cost-consciousness is pressuring advertisers to shift budgets to high ROI platforms, benefitting META and GOOGL.

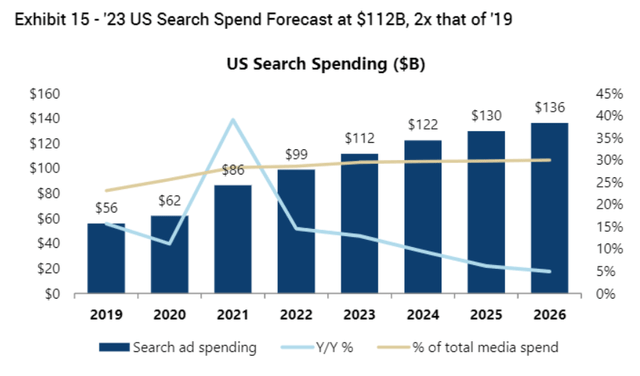

Moreover, Jefferies now models US search advertising in 2023 to expand to $112 billion, versus $99 billion in 2022 (up about 12% YoY). [Source: Jefferies, Time to Rebalance Expense Priorities – Deep Dive into Headcount, April 5th].

Earnings Upside

Reflecting on current consensus expectations as compared to a stabilizing/ recovering ad business, I see material upside to Q1 2023 topline expectations for Google. In addition, I would like to point out that greater focus on cost discipline could be another upside to markets’ Q1 2023 expectations — which may not necessarily have been materialized in the January quarter already, but may prompt an upward revision in earnings expectations going forward on further headcount reduction guidance.

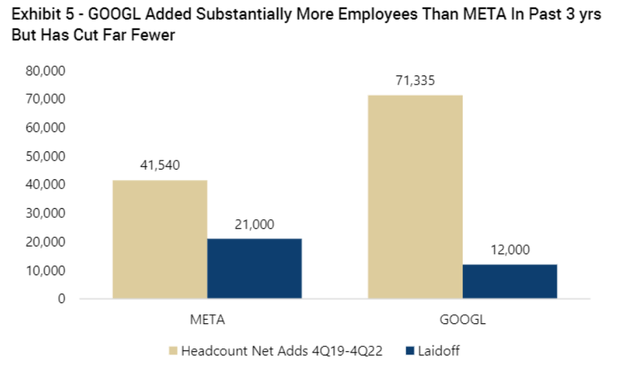

For reference, if we take Meta Platforms cost-cutting strategy as a reference point, Google may still have ample room to improve operating margins. In fact, since 2020 (COVID reference) Google has added about 71,000 employees, as compared to Meta adding about 42,000. With that frame of reference, Google has recently cut its headcount by approximately 12,000, versus Meta cutting the employee-base by 21,000 — a reduction from the two company’s headcount-peak of about 6% versus 24% respectively, suggesting that Google’s ambitions to save costs have thus far been rather timid and primed for further upside.

Conclusion

Google shares have thus far performed quite strongly YTD, with GOOG stock being up about 18%, after crashing almost 40% in 2022 in context of a broader market sell-off. Now, Google equity is priced at a P/E of approximately x20, which is more-less in line with the respective industry median valuation of the Communication Services sector, despite a monopoly-like position in Search, a highly popular video entertainment platform (YouTube), and attractive positioning in Cloud, with further AI optionality.

Personally, I believe Google will exceed analyst Q1 expectations, which could spark a share price appreciation towards about $120 per share, before rallying to $156 on supportive AI-related news flow. That said, I am increasing my investment in Google stock and buying time-sensitive call options as a short-term strategy. I suggest investors consider 105/115%-moneyness call spreads with a May 5th expiration date, as they have the potential for a 4:1 payoff if the stock closes at above $120/share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is not financial advice; This is market commentary and author's opinion only.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.