Summary:

- This is a technical analysis article. Earnings did not cut it because Tesla is dropping prices to maintain market share.

- That’s usually great for revenues but not for margins, so the price is dropping after earnings.

- If you have a monopoly, then you can cut prices to eliminate the competition, but Tesla does not have a monopoly.

- If there is great, unsatisfied demand for your product, you can drop prices and make it up on volume. However, there is no such demand for Tesla cars.

- Almost every car company has plans to produce electric cars and that competition is forcing Tesla to drop prices. It is overvalued and its price is dropping.

Olivier Le Moal

Tesla (NASDAQ:TSLA) dropped prices to beat increasing competition and that reduced margins causing a big selloff after earnings. The drop in margins would not have surprised any accountant, but analysts may have forgotten accounting when it comes to TSLA’s rocket ship trip to the top and its $2,000 target in five years as projected by one portfolio manager.

Now it is looking at a retest of its recent bottom as profits are sacrificed for revenue growth. The recent earnings reality check shows that even TSLA follows the basic lessons of accounting, namely lower prices usually mean lower profits. If the lower prices increase revenues dramatically, then total profits can increase. However, in the case of TSLA, the lower prices will just go to maintain revenue growth by sacrificing profits.

We always like to read the Seeking Alpha articles and the SA Quant System ratings to do our fundamental due diligence. Surprisingly, there are still articles with Buy signals and obviously these are for bottom fishing investors. ARK reportedly is still averaging down and buying TSLA with a 5-year target of $2,000. Traders usually never average down.

Meanwhile, short term, TSLA is going down looking for a bottom and bottom fishers. The chart below shows the long term downtrend in price that is killing portfolio managers’ performance. PMs will buy a bottom, but will not buy a downtrend, underperformer that still has no bottom in place. PMs are especially adverse to buying stocks below the 200-day moving average, but bottom fishers, like ARK, are not.

The SA Quant System confirms our view that it is too early to buy TSLA. SA gives TSLA high ratings for Profitability and Growth. However, it gets a poor grade for Valuation. That needs to change to attract bottom fishers. They want to see a lower price for Tesla stock before they buy. Also Revisions and Momentum have weak grades. These need to improve to attract most PMs other than bottom fishers.

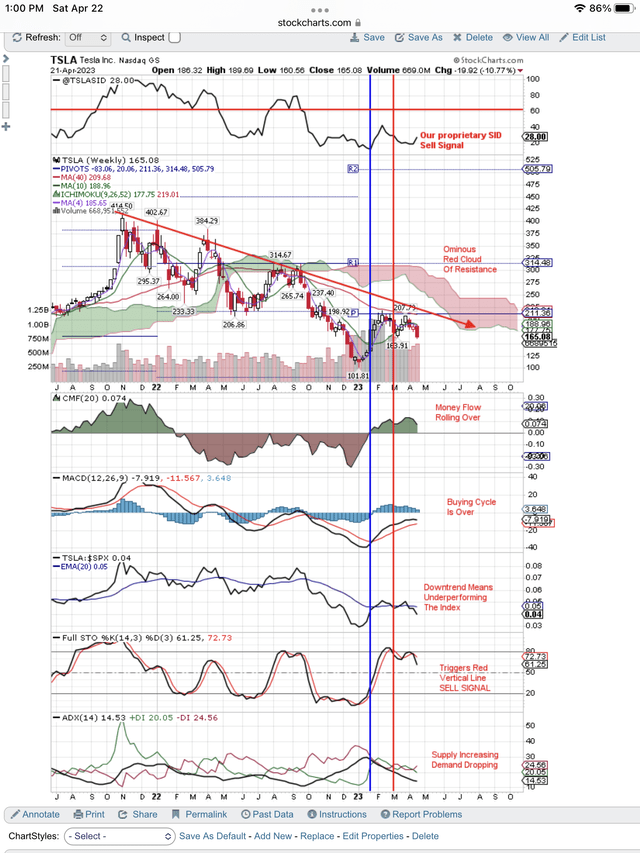

Here is our weekly chart showing the Sell Signals that we think will take TSLA back down to $102 where bottom fishers came in last time.

Tesla Sell Signals Target $102 Bottom (StockCharts.com)

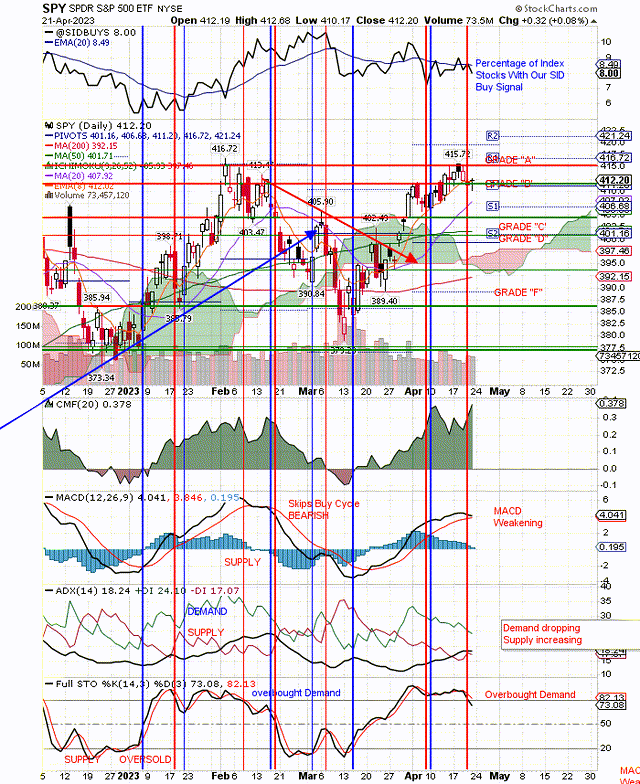

As long as this bear market bounce continues, we think TSLA will drop slowly, testing support levels to the bottom and bouncing on its way down. However, we expect the market (SPY) to finish this current bounce and then drop to retest the bottom of this bear market. When that happens we expect the market to take all boats down, but especially the stocks that have our Sell Signal, are overvalued and still don’t have a bottom in place. TSLA is a good example. Here is our daily SPY chart showing our red, vertical line, Sell Signal. We expect this market selling to take TSLA down short term.

TSLA Looking For Bottom Fishers (stockcharts.com)

As you can see on the above charts, short term Sell Signals in the market will help to take TSLA lower.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of SPY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: We are not investment advisers and we never recommend stocks or securities. Nothing on this website, in our reports and emails or in our meetings is a recommendation to buy or sell any security. Options are especially risky and most options expire worthless. You need to do your own due diligence and consult with a professional financial advisor before acting on any information provided on this website or at our meetings. Our meetings and website are for educational purposes only. Any content sent to you is sent out as any newspaper or newsletter, is for educational purposes and never should be taken as a recommendation to buy or sell any security. The use of terms buy, sell or hold are not recommendations to buy sell or hold any security. They are used here strictly for educational purposes. Analysts price targets are educated guesses and can be wrong. Computer systems like ours, using analyst targets therefore can be wrong. Chart buy and sell signals can be wrong and are used by our system which can then be wrong. Therefore you must always do your own due diligence before buying or selling any stock discussed here. Past results may never be repeated again and are no indication of how well our SID score Buy signal will do in the future. We assume no liability for erroneous data or opinions you hear at our meetings and see on this website or its emails and reports. You use this website and our meetings at your own risk

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Use our free, 30 day training program to become a succesful trader or investor. Join us on Zoom to discuss your questions.