Walmart (WMT) CEO Doug McMillon will step down in January next year after being in the role for over a decade.

McMillon took the reins of the company in 2014, a time when Walmart (WMT) was facing increasing competition from its digital-first rivals. It was a challenging time, as the retail giant’s stock seemed to be producing only modest gains and the business was losing momentum due to the advent of online shopping.

He has led Walmart to incredible success over the decade, quadrupling the company’s market cap during his tenure and driving shares up 400% over the last 10 years, double the performance of the S&P 500.

McMillon started his Walmart career in 1984 as an hourly associate, picking orders and unloading trailers in a warehouse, according to his LinkedIn.

The company has tapped John Furner to succeed McMillon as the company’s new chief executive, effective February 1, 2026.

The way ahead was rough for McMillon, yet he headed into the challenge head-on, even though the early periods were difficult.

He also has seen a massive amount of success as compared to his predecessors when it comes to the stock performance of Walmart (WMT).

Under H. Lee Scott, WMT stock’s return was -26.9%; under Mike Duke, it was +60.4%; and under McMillon, it has been a whopping +323.4% so far.

The Early Years

After a modest gain of 9.1% in 2014, Walmart’s (WMT) shares plunged almost 29% in 2015—one of the worst years in its modern history—as the company poured billions into wages, store upgrades, and e-commerce. Profitability slipped, and investors questioned whether the retailer could catch up to its online rival Amazon (AMZN).

Walmart (WMT) under McMillon dived deep into expanding its online presence. In 2015 he had aggressively started increasing its online grocery shopping services with launches in new markets. At the time, WMT also went for a different strategy. The company combined online grocery shopping with a local pickup option at some stores across the U.S.

The Turning Point

But 2016 and especially 2017 marked a turning point. As online grocery rolled out and store operations improved, the stock was up 12.7% in 2016 and surged more than 40% in 2017 alone, reflecting renewed conviction in Walmart’s ability to modernize at scale.

In 2018, the stock did fall 5.67%. In 2018, WMT continued its push into online strategy. A CNBC report said the retailer had plans to expand its online grocery delivery service to about 800 stores by the end of that year.

But in the next two years, the firm staged a rebound. In 2019 Walmart (WMT) rose 27.6%.

The COVID-19 years

Walmart (WMT) under McMillon seemed resilient during the pandemic. In 2021, it churned out total revenues of ~$559 billion, up from ~$524 billion in 2020. It beat the COVID-19 slump, and its stock rose 21.3% in 2020.

In 2020 Walmart also launched the Walmart+ membership program.

The rise in revenue in 2021 was mainly driven by heightened demand in groceries, household essentials, and curbside services.

Walmart (WMT) also absorbed roughly $4 billion in pandemic-related costs, including safety measures and wage increases. Rising labor expenses and supply chain disruptions pressured margins, and investors grew cautious even as sales climbed.

However, its stock seemed to stagnate in 2021 and was only up 0.4% in the year.

Inflation worries and the turnaround

Inflation weighed heavily on consumer behavior in 2022. Higher inventory levels, cost inflation, and a shift in consumer spending patterns created additional strain. The stock fell 2% in the year.

Profit, however, continued to improve in 2022, climbing to more than $25 billion, even as Walmart absorbed higher labor expenses, supply chain disruptions, and inflationary pressures.

These shifts underscored Walmart’s (WMT) strategic approach under McMillon: prioritizing long-term competitiveness—automation, digital expansion, and improved store operations—while navigating a volatile macro environment that kept margins under pressure.

The turnaround came in 2023, with the stock rising 11.2%. However, it was last year that WMT had a breakout period, as its shares surged 71.9% in 2024.

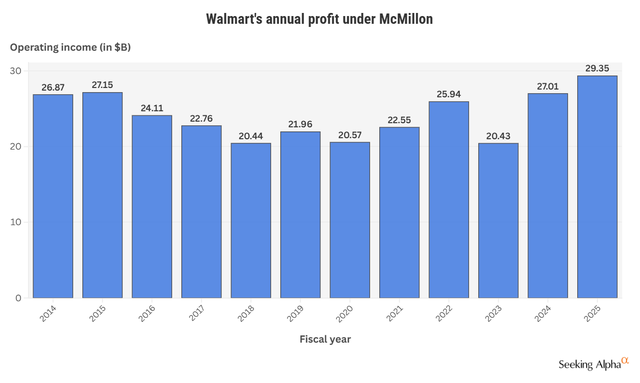

Operating income climbed to $27.01 billion in 2024 and then further to around $29.35 billion in 2025, marking its strongest profit performance of McMillon’s tenure.

For fiscal 2024, the increase was mainly driven by the Walmart U.S. segment. The rise was also helped by growing contributions from higher-margin businesses like advertising and membership services.

Under McMillon, Walmart (WMT) transformed from a traditional brick-and-mortar chain into a dominant omnichannel retailer.

He steered the company through a decade defined by digital disruption, global inflation, a pandemic, and a shifting competitive landscape.

How Walmart’s stock has performed since McMillon became the CEO:

Seeking Alpha

Here is a chart on Walmart’s reported operating income since McMillon took the post:

Walmart