Summary:

- Nike is undoubtedly one of the best-known consumer brands in the world.

- Their strong brand recognition, diversified product portfolio and focus on sustainability make this a desirable stock for any type of investor.

- Nike distributes all of its free cash flow to shareholders through dividends and a robust share repurchase program.

- Nike is a company I like in my portfolio, the growth expectations are high, but I am waiting for a better buying opportunity.

Robert Way

Introduction

Nike (NYSE:NKE) has become one of the biggest and best-known sports brands in the world. It amazes me that a “shoe company” has achieved such fame. By forming partnerships with famous athletes, Nike has built a huge loyal customer base.

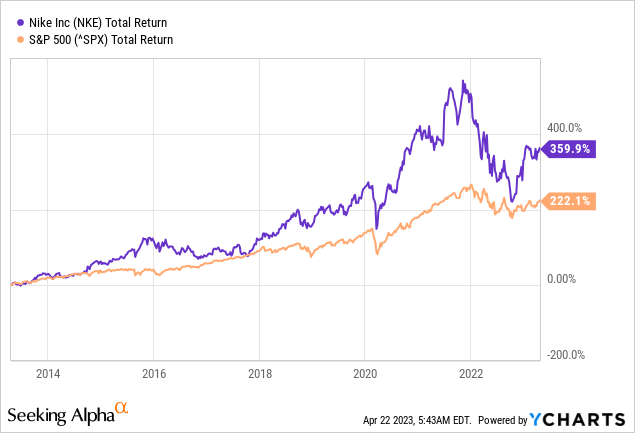

Investors in Nike see stunning returns over 10 years totaling 360%, an investment in Nike yielded more than in the S&P500 (222% 10 total annual return).

The investment case for Nike is strong due to their strong brand recognition, diversified product portfolio and focus on sustainability. Nike’s management is very shareholder-friendly. Its total free cash flow is returned to investors through dividend distributions and share repurchases. Still, I think the share price has risen too strongly, the valuation is expensive and that is why I have put Nike on hold.

Earnings Came In Strong

The figures for the fiscal third quarter of 2023 were strong, Nike reported revenue of $12.4 billion, up 14% year-over-year and 19% on a currency-neutral basis. Nike had strong Digital growth of 24% thanks to a strong increase in mobile traffic. Direct sales remained strong, up 17%. Growth was visible globally, even in China, sales increased 1% in China despite Covid challenges. Due to logistical problems, Nike decided to increase its inventory levels by 16%.

Diluted earnings per share fell 9% due to higher markdowns to liquidate inventory, unfavorable exchange rates and higher costs. Global inflation caused not only the United States to raise interest rates, but also Europe and other countries. As a result, the euro is strengthening against the dollar which could benefit Nike in the coming quarters.

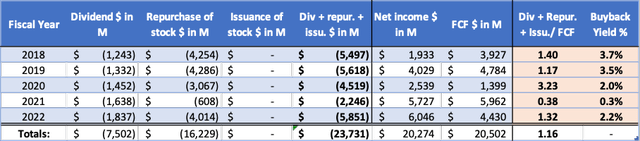

Dividends And Share Repurchases

Nike’s dividends have risen sharply over time due to sharply higher earnings and partly due to share repurchases. Share buybacks are a tax-efficient method of returning capital to investors. It also reduces the number of shares outstanding and buybacks in the open market increase demand and reduce the supply of shares. This is an ideal recipe for share price appreciation. In 2022, the share buyback ratio was 2.2%.

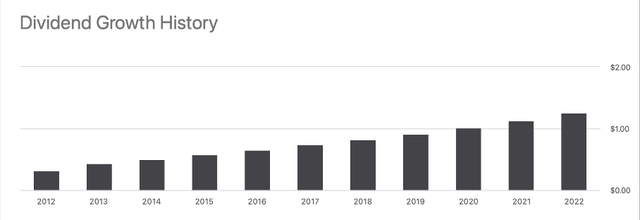

Currently, the dividend rate is $1.36 per share, which represents a dividend yield of 1.1%. Over the past 5 years, its dividends increased at an average CAGR of 11.2%. Analysts are positive about its forward dividend rate and expect an increase of 10.2% for next year.

Dividend growth history (Nike ticker page on Seeking Alpha)

Nike returned all free cash flow to shareholders through dividend payments and share repurchases. Share repurchases fluctuated in recent years, but for the past 4 years Nike paid out slightly more than it generated in free cash flow. This increased their net debt somewhat. I expect Nike to continue its shareholder return policy in the future and to be sustainable in the long run.

Cash flow highlights (Annual Reports and analyst’ own calculations)

Valuation Seems A Bit Expensive

Of course, stock valuation also plays a role in estimating the ideal buying moment. Take for example Coca-Cola (KO) in the late 1990s, which was a high-growth company at the time but with a high stock valuation. Many remember the huge stock price crash in the early 2000s – the cause was low earnings estimates combined with a high valuation.

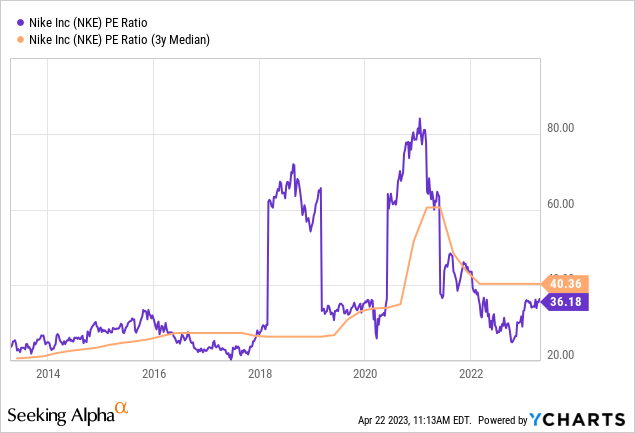

So a cheap valuation is essential for share price appreciation. I examine the current valuation and compare it to the historical valuation. The PE ratio is a widely used valuation measure that YCharts shows in the following chart.

The PE ratio has peaks and troughs, and the average GAAP PE ratio is 40, quite high, especially in this period with high interest rates. The current PE ratio is 36, in line with the 3-year average, but still quite expensive. Note that YCharts takes the GAAP PE ratio rather than the non-GAAP PE ratio.

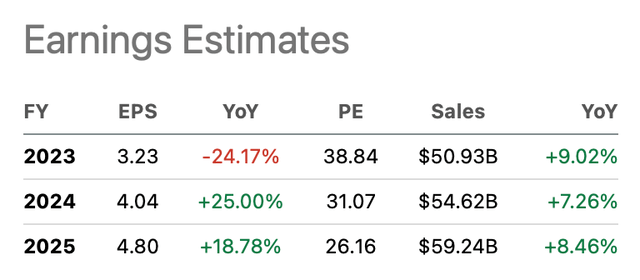

After 2023, strong earnings growth is expected with 25% earnings per share growth for 2024 and 19% earnings growth for 2025. Revenue is expected to grow by high single digits. That puts the non-GAAP PE ratio at 26 for 2025, which I also think is an expensive valuation.

Nike Earnings Estimates (NKE ticker page on Seeking Alpha)

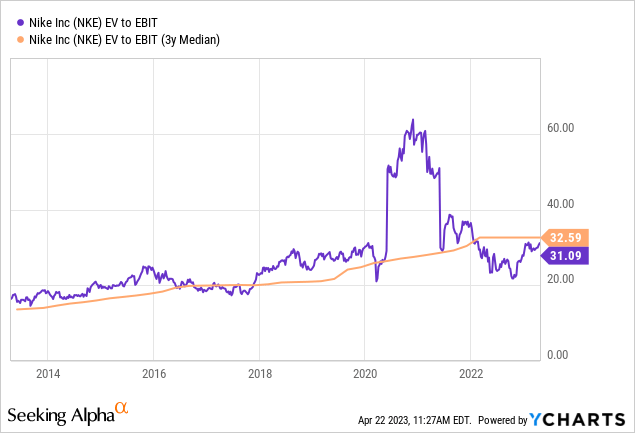

Finally, I look at the ratio of enterprise value to EBIT. Here we see a value in line with the 3-year average. We also see that the EV/EBIT ratio has been increasing over the last 10 years. Enterprise value increases only when market capitalization increases because all cash flows flow back to investors and the. I think the EV/EBIT ratio of 31 is on the high side and would prefer to see it below 20. Nike is a strong performer and I like to see the stock in my portfolio, but only at a more attractive valuation.

Conclusion

Nike is undoubtedly one of the best-known consumer brands in the world. The stock is experiencing strong growth and a 10-year return of as much as 360%. Their strong brand recognition, diversified product portfolio and focus on sustainability make this a desirable stock for any type of investor. Nike distributes all of its free cash flow to shareholders through dividends and a robust share repurchase program. So management is very shareholder-friendly. Quarterly results were good with revenue growth of 14% and currency-neutral growth of 19%. Every region grew steadily and even in China sales rose slightly. Nike is a company I like in my portfolio, the growth expectations are high, but the high stock valuation keeps me from buying the stock. I am waiting for a better buying opportunity.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.