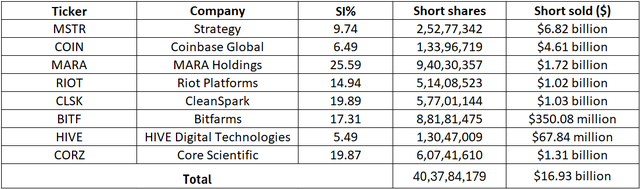

Crypto stocks saw mixed interest from short sellers in the month of October. While four companies saw short interest decrease, the remaining four saw it increase in the month.

Bitfarms (BITF) saw the highest jump in short interest this month to 17.31% from 8.79% last month. Short interest in Strategy (MSTR), Coinbase (COIN) and Core Scientific (CORZ) increased to 9.74%, 6.49% and 19.87% respectively.

On the other hand, short interest in MARA Holdings (MARA), Riot Platforms (RIOT) and CleanSpark (CLSK) declined to 25.59%, 14.94%, 19.89% and 5.49%.

The short dollar volume in the crypto stocks stood at $16.93 billion in October. Of these, Strategy and Coinbase attracted the most interest from short sellers, accounting for $11.43 billion of the total bets.

Bitcoin (BTC-USD) prices remained above the $100K mark throughout October. However, in November, the cryptocurrency plunged in tandem with the broader markets, falling below the $100K level. On November 13, bitcoin closed 1.91% lower at $99,765.06, its lowest since May 7.

Seeking Alpha