Summary:

- Google will probably print higher margins for its cloud business in Q1 FY23, which agrees with my view on the surprise potential of Google Cloud margins.

- But this print will only be optical, aided by a segmental reclassification that would boost Cloud Margins by 400bps at the expense of a 150bps hit on Services margins.

- I believe a revenue beat is likely as consensus estimates don’t seem to factor in the more positive industry outlook trends in 2023.

Wooden easel with word Google Ekaterina79

Introduction

In my last article on Alphabet/Google (NASDAQ:GOOG) (NASDAQ:GOOGL), I shared my view that Google Cloud can become more profitable and faster than what Wall St was expecting. It’s almost certain that the numbers will show this to be true in the Q1 FY23 results. But that would be a purely optical move due to reclassifications between segments. I would like to understand the reasons for the reclassification better before validating my views on a faster ramp up to profitability.

In this article I discuss the impacts of the segmental reporting changes to recalibrate the metric comparisons before the Q1 FY23 results release, which is expected to be announced on April 25th after market close. I also share why I think Google may post an overall surprise over consensus revenues.

Segmental profit reclassifications

Alphabet is moving some unallocated corporate expenses into its Services business. Fair enough. But what makes me a little cautious is their decision to take some of the costs allocated to the Cloud business and attribute it to the Services business. The rationale and criteria for reclassification seems like quite a subjective call:

[allocate costs] based on an updated measure of the relative benefit derived from the services.

– Author’s bolded highlight

I hope management is questioned a bit more on the updated measures of benefits; that’s something for which I would love to get more clarity.

Impact of segmental profit reclassifications

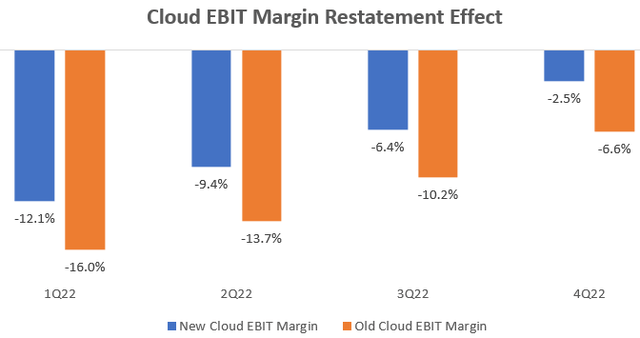

Cloud EBIT Margin Restatement Effect (Company Filings, Author’s Analysis)

On average, cloud EBIT margins get an optical boost of about 400bps. Google Cloud’s incremental EBIT margins that I discussed in my previous article look better than ever:

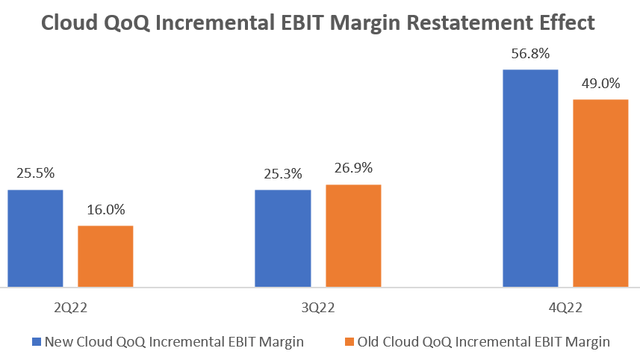

Cloud QoQ Incremental EBIT Margin Restatement Effect (Company Filings, Author’s Analysis)

The new classification shows a much sharper (+780bps) ramp up in the QoQ incremental EBIT margins.

Perhaps this new reclassification is more representative of economic reality. If that is the case, it’s a very strong signal that Google Cloud’s margin profile looks better than it seems. However, I prefer to get further clarity on the nature of these reallocations before validating my thesis.

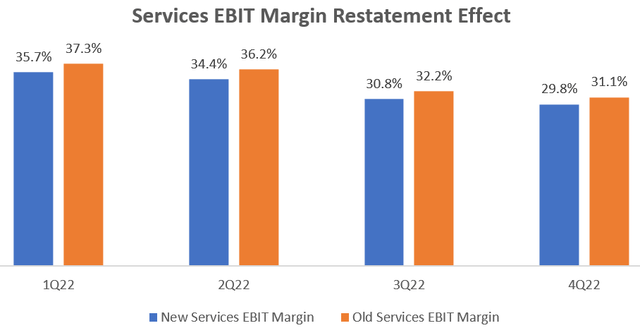

Note that the 400bps margin boost in Google Cloud has come at the expense of an average 150bps margin hit on the Advertising Services business:

Services EBIT Margin Restatement Effect (Company Filings, Author’s Analysis)

The case for a revenue beat

Consensus estimates for Q1 FY23 revenues are pegged at $68,800 million. This implies a QoQ fall of 9.5%. Statistically, this seems a bit steep to me since the mean QoQ fall in the 1st quarter over the last 10 years has been only 5.1% with a standard deviation of 3.4%. Based on this short time series, I note a crude conclusion that a 9.5% revenues fall in Alphabet’s Q1 FY23 would be a little less likely than a 1-sigma event.

Since almost 78% of Alphabet’s revenues come from advertising operations, another way to think about the expected revenue growth is to look at the global ad spending outlook for FY23:

According to eMarketer, worldwide digital ad spends are expected to grow at 10.5% YoY. Given that most of Google’s revenues comes from advertising where it has a market leadership position (89% Search market share), I believe it is reasonable to assume that it would grow similar to the market average.

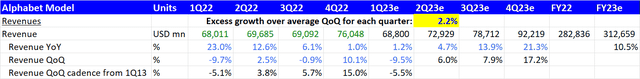

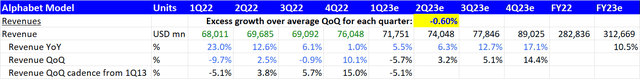

The issue is that if I lock in the consensus $68,800 million revenue print for Q1 FY23, then there is a very tough ask of 2.2% excess growth over the QoQ cadences (average QoQ growth for each quarter) for the subsequent 3 quarters:

QoQ Revenue Ask Rate Under Consensus Estimate Revenues (Company Filings, Author’s Analysis)

To me, this seems like a less realistic scenario. I suspect that it is more likely that the FY23 quarters (including Q1 FY23) perform only slightly worse than their historical quarterly QoQ growth track record. For example, assuming that FY23 sees a consistent 0.6% underperformance vs a typical quarter seems more probable to me to get to the overall 10.5% YoY growth expected in the industry:

A More Balanced and Likely FY23 Growth Track (Company Filings, Author’s Analysis)

For these reasons, I think there are decent chances for Alphabet to beat consensus expectations on revenues.

Takeaway

When we analyze Q1 FY23 results for Google on Tuesday this week, it is important to recalibrate our segment margin comparisons; due to a segment reporting change, Google Cloud’s restated EBIT margins are higher by 400bps and Google Services’ restated EBIT margins are lower by about 150bps.

Regarding quarterly result expectations, I notice some dissonance between the consensus revenue estimates and what industry research is implying about the digital ad spending outlook for 2023. Upon running some scenario numbers, I err to the side of favoring industry research insights and hence concluding that a revenue beat vs consensus is more likely than not.

Overall, I retain my ‘buy’ rating on GOOG stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.