Summary:

- The race for artificial intelligence (AI) is on, and tech companies are advancing with this capability to offer stocks with competitive advantages and enormous potential for upside appreciation.

- I have three Strong Buy AI stocks, spread across different tech industries, with great investment characteristics and performance that outpaced the tech sector during the downturn.

- Each of these tech companies has revolutionized their businesses and showcases stellar revenue and earnings growth, strong profitability, and analysts that are enthusiastically revising their estimates up.

- The AI and semiconductor tech industries are a marriage worth capitalizing on, and each of my picks is rallying near a 52-week high.

- Well-positioned to maintain wider margins despite macroeconomic headwinds, consider 3 top Ai stocks with strong fundamentals, competitive advantages, and excellent Seeking Alpha’s factor grades.

BlackJack3D

Should I buy tech stocks now?

One of the most important segments in technology is artificial intelligence aka AI. In recent months, AI has been a popular investment on the basis of revolutionary advancements, strong growth stories, and widespread applications. And, let’s face it, this tech is simply cool and amazingly productive! Companies that possess AI technology can benefit from increased efficiency, cost savings, enhanced decision-making, scalability, competitive advantages, and improved customer experiences, making them more attractive to investors, customers, and employees. In addition to the underlying markets that keep expanding and are ripe for growth, the cross-selling of solutions, use of the cloud, and benefits provided by AI as best-in-class technology is becoming more deeply entrenched in its customer base and businesses.

Even as it has fallen from peaks over the last few years, what makes tech unique is its industry diversification, offering something for every investor. One of my favorite tech industries is semiconductors, and artificial intelligence offers chips the next wave of economic value. By deploying neural networks and analytics like facial recognition, target marketing, and the electrification of vehicles, AI is transforming the semiconductor industry from research, to design, and production through sales, according to McKinsey & Company, and chips have proven resilient despite geopolitical headwinds, downturns, and China-Taiwan risks. Because chips are essential components of most tech-advanced products, including our electronic devices from phones to healthcare and transport, semiconductors offer a resilient hedge compared to other options. However, as we’ve seen over the last two years, risks are involved when investing in tech.

Risks to Investing in Tech

Volatile price swings, competition, and geopolitical factors can affect each of my stock picks, which offer products and services globally. Taiwan and China are two of the world’s leading producers of information and tech products and tensions between the two nations have prompted some falls in stock prices, another war could disrupt supply chains. During periods of downturn and high volatility, tech stocks have also historically suffered losses that can affect long-term returns. Semiconductors, as a key component of AI, should benefit as the two work hand-in-hand, and the global AI market is expected to grow to nearly $400B by 2025, a CAGR of 55.6%.

When assessing the types of tech stocks to buy, AI has been the talk of the town, and stocks with more resilient qualities for up or down markets are why I’ve selected three stocks made in America. As AI technologies advance to replace human capital, the upfront investment in building and training Ai machines may be high, but the overall costs associated with paying humans for the same jobs are lower in the long term. As a long-term-focused investor, consider three of my top quant-rated Ai stocks for a portfolio.

Best AI Stocks to Buy

Artificial intelligence is modernizing industries by offering simplified, quicker, and cost-effective solutions and the ability to leverage machine learning to enable computers to mimic human intelligence. Those utilizing Ai to advance and maintain their competitive advantages are seizing the opportunity to capitalize on customer relationships, cybersecurity, and data extraction to scale and deliver solutions to users and customers. As Amir Husain, Founder and CEO of SparkCognition said, “[Artificial intelligence], it’s a form of software that makes decisions on its own, that’s able to act even in situations not foreseen by the programmers. Artificial intelligence has a wider latitude of decision-making ability as opposed to traditional software.”

Because AI is helping develop better products, improving efficiencies, and the ability to market to customers, I’ve selected three tech stocks in different industries that are rated Strong Buys.

Top Semiconductor Stock

Ranked #1 in the semiconductor industry according to our quant ratings, Axcelis Technologies offers a solid valuation and tremendous momentum and has consistently beaten earnings. Offering solid fundamentals that have benefited from chip shortages and the demand for artificial intelligence, ACLS designs semiconductors for electric vehicles (EVs), Ai, and the Internet of Things (IoT).

1. Axcelis Technologies, Inc. (NASDAQ:ACLS)

-

Market Capitalization: $4.10B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 4/21): 11 out of 594

-

Quant Industry Ranking (as of 4/21): 1 out of 29

Semiconductor Materials and Equipment company Axcelis Technologies, Inc. designs, manufactures, and services some of the highest purity, precision, and productive ion implantation platforms in semiconductor device fabrication. Ion implantation is a low-temperature doping process used to control the electrical processes and avoid damage in finishing chips. Given the advancements in Ai, including the electrification of vehicles and the race to digitization, ACLS is a contributor to the world of Ai. With bullish momentum and a solid valuation, Axcelis is a stock to consider.

ACLS Stock Valuation & Momentum

The semiconductor industry has become very popular, and ACLS, along with it, has given its ability to weather the economic storms within the industry. As WisdomTree writes:

“As we begin 2023 looking at technology-oriented investments, a “consumer slowdown” and related macroeconomic factors are front and center in investor considerations:

-

Worldwide shipments in personal computers (PCS) totaled 286.2 million units in 2022, a 16% decline from 2021.1

-

Global Information Technology spending contracted 0.2% in 2022, dropping to a total figure of $4.38 trillion…

-

Taiwan Semiconductor Manufacturing Co. (TSM) has indicated that its revenue may drop as much as roughly 5% in the current quarter.”

Despite some of the cyclical shifts in the industry, semiconductor companies like ACLS have rallied.

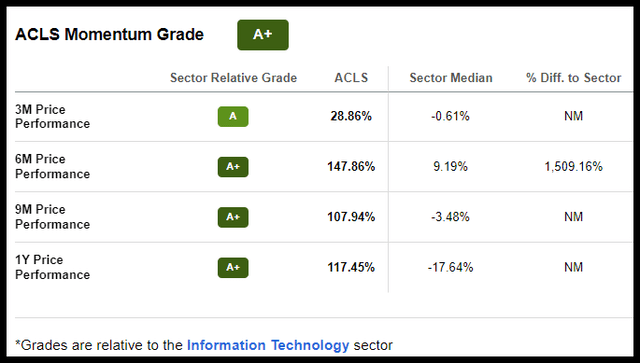

ACLS’s current $122/share price is trading near its 52-week high of $136.38, yet still relatively discounted compared to its tech peers. ACLS has a Forward P/E more than 12% below the sector at 21.54x, and a forward PEG Ratio more than 37% below sector value; the C Valuation Grade makes this stock attractive, especially as we look at its A+ Momentum.

ACLS Stock Momentum (SA Premium)

Showcasing bullish momentum with gradual quarterly price-performance increases, ACLS has room for upside. As evidenced by its stellar grades above and tremendous six-month price performance of 1,509% above its peers, this stock has upside potential, highlighted by continued growth and profitability.

ACLS’s Growth & Profitability

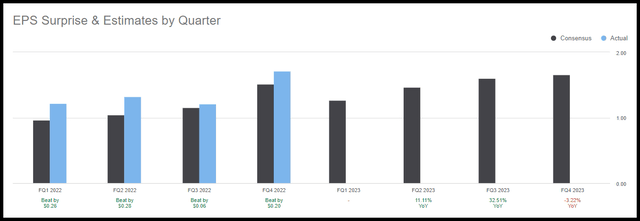

Delivering consensus-beating earnings, Axcelis’s growth and profitability continue to rise, so much that four analysts have revised their estimates up over the last 90 days.

ACLS Stock EPS (SA Premium)

Delivering consistent and consecutive top-and-bottom-line earnings beats, Axcelis’ Q4 EPS of $1.71 beat by $0.20 and revenue of $266.05M beating by nearly 30% year-over-year, with a year-end backlog of more than $1.1B. In addition to this tremendous growth and success, ACLS management expects the first quarter of 2023 to deliver revenues of ~$240M, gross margins of approximately 41.5%, operating profits of nearly $48M, and EPS of approximately $1.25. Despite some of the headwinds the company has faced involving the challenging macroeconomic climate, supply chains recovering, and capacity constraints, Axcelis has been resilient and met the challenges head-on, highlighted by the company’s CEO & President, Mary Puma, during the Q4 Earnings call:

“For the full year 2023, Axcelis revenues are expected to exceed $1 billion. This represents revenue growth of over 8% in a year in which overall wafer fab equipment is expected to decrease by over 20%. Additionally, we are introducing a new long-term implant-only model with revenue of $1.3 billion that we believe is achievable within the next 2 to 3 years. The mature process technology market continues to be an area of strength for Axcelis, with 76% of fourth quarter system shipments going to mature foundry logic customers, 4% to advanced logic customers, and the customers comprised of 15% DRAM and 5% NAND.”

With a focus on advancements in technology that aid in the development of artificial intelligence, ACLS is a Strong Buy consideration, along with one of the top-performing Tech Hardware & Storage stocks in IT.

Cloud and Software Stocks

Inflation, interest rates, and currency fluctuations have put a dark cloud over many cloud-based and software stocks this past year, which have experienced a downside of -21%, according to the cloud index. Still, demand for AI products and services amid the digital transformation is proving fruitful for investors willing to consider strong buy stocks with solid fundamentals for portfolios. My final two picks are capitalizing on the future of AI.

2. Super Micro Computer, Inc. (NASDAQ:SMCI)

-

Market Capitalization: $5.7B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 4/21): 3 out of 594

-

Quant Industry Ranking (as of 4/21): 2 out of 30

One of my Top 10 Tech Stocks for 2023, Super Micro Computer, Inc. (SMCI), and its subsidiaries capture market share in the Ai industry. Developing and manufacturing high-performance server and storage solutions for Ai and High-Performance Computer (HPC) workloads, as Kingsley Park Research writes:

“Super Micro was at the center of a major AI tailwind driven by its extremely close relationship with Nvidia (NVDA). This tailwind has continued, with NVDA stock up dramatically and reports of AI server shortages in March as large enterprises and startups invest heavily in AI.”

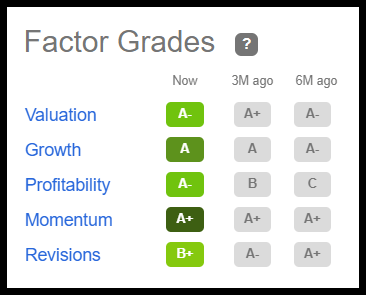

Not only is this stock’s momentum extremely bullish, with some of the most attractive underlying factor grades of any stock pick. Factor Grades, which rate investment characteristics on a sector-relative basis, showcase below how SMCI is strong on each of its collective metrics of valuation, growth, and revisions, and has excellent momentum and profitability, to indicate it is a fast-growing and profitable IT company. Despite trading near its 52-week high of $119.24/share, SMCI is extremely undervalued.

SMCI Factor Grades

SMCI Stock Factor Grades (SA Premium)

SMCI Stock Valuation & Momentum

Trading at an extreme discount, SMCI has a forward P/E ratio with a -57% difference to the sector and an A+ forward PEG ratio difference of -79%. Strong growth tailwinds, given the demand for HPC solutions accommodating artificial intelligence applications and the overall push toward tech advancements, have given SMCI a competitive advantage.

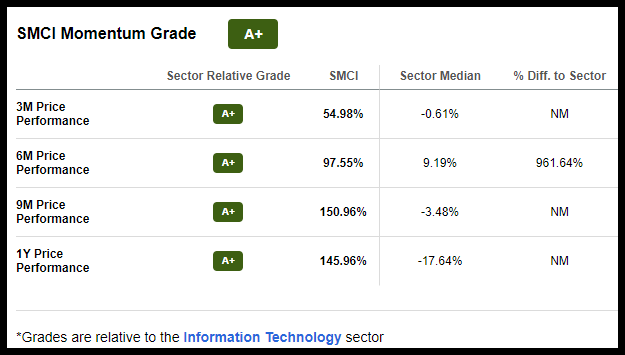

SMCI Stock Momentum (SA Premium)

Headquartered in San Jose, CA, SMCI has captured market share globally, especially as supply chain disruptions have affected companies abroad. On a longer-term uptrend, SMCI has A+ Momentum and ramped up manufacturing capacity, giving more businesses looking to artificial intelligence to scale and optimize performance. Introducing new products and solutions critical for the Ai computing infrastructure, SMCI is on a mission to grow in one of the sector’s hottest tech trends.

SMCI Stock Growth & Profitability

I have always loved the quote by Will Ferrell, Talladega Nights character Ricky Bobby: “If you ain’t first, you’re last.” In general – and in the race to digitization – it’s no different. SMCI provides crucial solutions for Ai data computing and infrastructure, and with its robust growth, especially with its all-in-one rack solutions, SMCI’s goal to become a global leader in rack scale and play IT solutions is taking place.

“We have created rack-level solutions that are targeted at the fastest growing and most demanding workloads, including Cloud, AI, and 5G. Designed for superior performance, efficiency, and costs, the solutions incorporate state-of-the-art technologies…we are bringing our system design expertise and building block architecture to the rack level to deliver true at-scale data center solutions, helping our customers to deploy a complete tested, and validated solution with minimal lead time,” said Charles Liang, president, and CEO, Supermicro.

Consecutively beating estimates, growing its EPS, and crushing another earnings season, Q2 2023 EPS of $3.26 beat by $0.23 and revenue of $1.80B beat by nearly 54% Y/Y, despite the challenging environment. With operating margins up 12.8% and strategic goals for FY23 revenue guidance to reach $6.5B to $7.5B or 25% to 44% Y/Y growth, SMCI, whose already strong financials and performance just added a cherry on top as it partners with NVIDIA for a new AI development platform. The AI solution is a three-year subscription license changing how Ai-based software runs. Consider SMCI for a portfolio, along with my final pick, Salesforce.

3. Salesforce (NYSE:CRM)

-

Market Capitalization: $197.51B

-

Quant Rating: Strong Buy

-

Quant Sector Ranking (as of 4/21): 10 out of 594

-

Quant Industry Ranking (as of 4/21): 4 out of 214

The Customer Relationship Management (CRM) technology that took the world by storm and built the bridges between companies and customers together, Salesforce Inc. uses cloud computing to drive success. Introducing the world’s first generative AI for CRM called Einstein GPT, Salesforce delivers AI-produced content for sales, service, marketing, commerce, and IT interaction at a hyper-scale and makes employees more productive for a better customer experience. In a recent press release, Salesforce announced:

“With Einstein GPT, Salesforce will transform every customer experience with generative AI. Einstein GPT will infuse Salesforce’s proprietary AI models with generative AI technology from an ecosystem of partners and real-time data from the Salesforce Data Cloud, which ingests, harmonizes, and unifies all of a company’s customer data. With Einstein GPT, customers can then connect that data to OpenAI’s advanced AI models out of the box, or choose their own external model and use natural-language prompts directly within their Salesforce CRM to generate content that continuously adapts to changing customer information and needs in real time.”

CRM Stock Momentum (SA Premium)

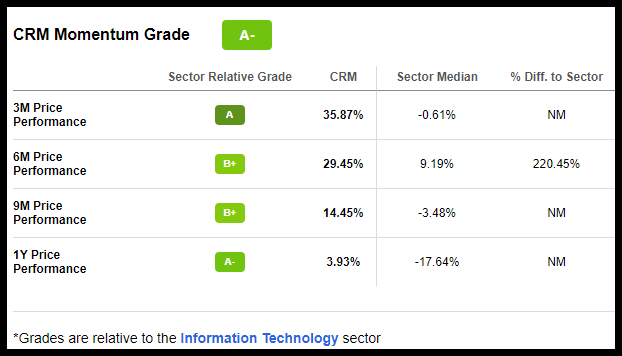

Through the integration of cloud technology, Salesforce has been a trailblazer, responding to customers’ needs as shifting technologies give way to the need for real-time advancements through generative Ai. Although the stock’s rally has resulted in its price being at a premium, CRM’s forward PEG ratio of 1.14x is a 31% difference to the sector, and it maintains bullish momentum, outperforming its sector peers quarterly, as highlighted in the table above.

Salesforce Stock Growth & Profitability

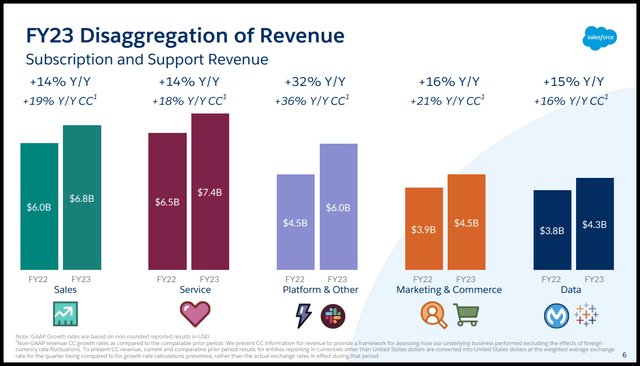

Offering substantial profitability that includes an operating margin of 29.2% versus last year’s 15%, year-over-year revenue growth of 14% to $8.38B, with eight of its 13 cloud products delivering ARR year-over-year growth of 50%, Salesforce is a force to reckon with. Delivering new products and services in the advancement of Ai technologies, CRM is a company that may represent one of the most significant long-term investment opportunities in technology.

CRM Q4 Revenue Segments (CRM Investor Presentation)

From 2022 through 2023, CRM’s business segments continues to grow. Not only did CRM deliver a Q4 2023 EPS of $1.68 that beat by $0.32, revenue of $8.38B beat by $391.63M. Its tremendous growth and success have resulted in 37 analysts revising their estimates up over the past 90 days with zero downward revisions. Dominating the Sales Force Automation (SFA) space, CRM has revolutionized the software industry and SaaS business model. Coupled with its stellar metrics and continuous improvement through its capital allocation strategy, the stock continues to drive shareholder value, with geographically strong new business growth worldwide. Consider CRM, ACLS, and SMCI, three strong buy stocks with ties to artificial intelligence for your portfolio.

Conclusion

Negative sentiment surrounding the economic outlook, inflation, and recession uncertainties have contributed to market declines and the fall in tech stocks. But there are tech stocks that have remained resilient, highlighted by bullish momentum that has given way to trading volumes above 200-day moving averages, growth, and profitability in the face of supply chain and labor shortages, resulting in analysts’ upward revisions.

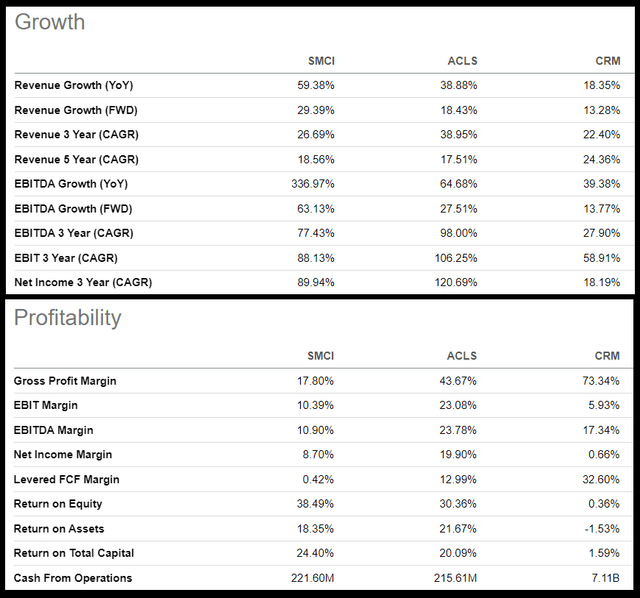

Technology continues to shape our world, with artificial intelligence becoming the path forward. Those stocks focused on AI, like ACLS, SMCI, and CRM, possess robust fundamentals compared to the beaten-down tech stocks that have driven down the Nasdaq and S&P 500. Offering double-digit growth and profitability with strong cash from operations, each stock benefits from fundamental tailwinds.

ACLS, SMCI, and CRM Growth & Profitability (SA Premium)

Although the Fed has maintained a hawkish stance which has affected the corporate earnings of many stocks, these stock picks have positive demand factors and fundamental tailwinds to outweigh the headwinds, as evidenced by the increasing Wall Street analysts’ earnings estimates for each of these stocks. Consider these strong buy picks as measured by Seeking Alpha’s Quant Ratings and Factor Grades to help ensure investors have the best resources to make informed decisions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.