Summary:

- Apart from the company’s dominant position in chips/AI-hardware, Nvidia is increasingly gaining recognition for its software offerings.

- Nvidia’s software business could likely unlock a $300 billion TAM by 2030, according to company estimates.

- Beyond Nvidia’s vGPU and GeForce NOW platforms, I see opportunities in (i) AI Enterprise, (ii) Omniverse, (iii) DRIVE as key growth verticals.

- Despite the positive tailwinds resulting from a leading market position in AI, Nvidia stock is not an easy pitch at approximately $279/share.

BlackJack3D

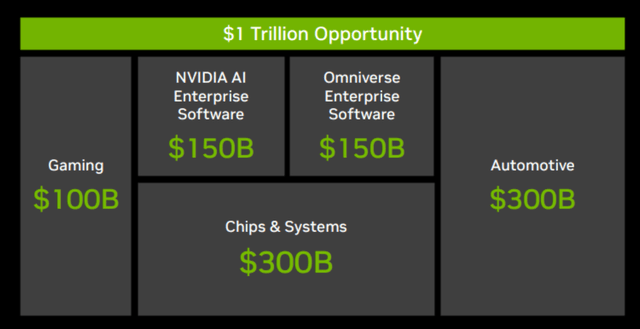

There is little discussion about who is the leader in AI silicon technology – it’s Nvidia (NASDAQ:NVDA). But apart from the company’s dominant position in chips/ AI-hardware, Nvidia is increasingly gaining recognition for its software offerings, which are still in the early stages of growth and adoption, but could likely unlock a $300 billion TAM by 2030, according to company estimates.

Beyond Nvidia’s vGPU and GeForce NOW platforms, I see opportunities in (i) AI Enterprise, (ii) Omniverse, (iii) DRIVE as key growth verticals where offerings are poised to enable novel use cases and applications across industries and technologies, opening up opportunities for substantial value accumulation.

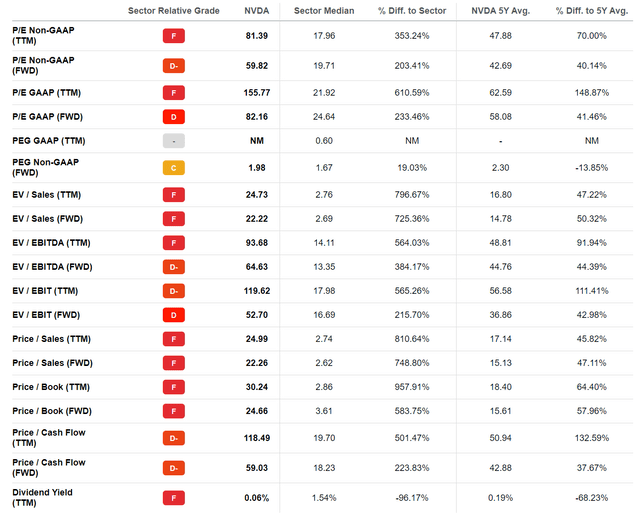

Despite my positive arguments, I am cautious assigning a Buy rating to Nvidia stock, given the tech giant’s x52 estimated 2023 EV/EBIT, which implies a valuation premium of more than 200% as compared to the information technology sector.

A Deep Dive On Nvidia’s Software Business

According to management estimates, Nvidia is on track to target a $1 trillion addressable market opportunity by 2023, of which software is likely to account for $300-$400 billion–almost symmetrically distributed on (i) AI Enterprise, (ii) Omniverse, (iii) DRIVE.

AI Enterprise

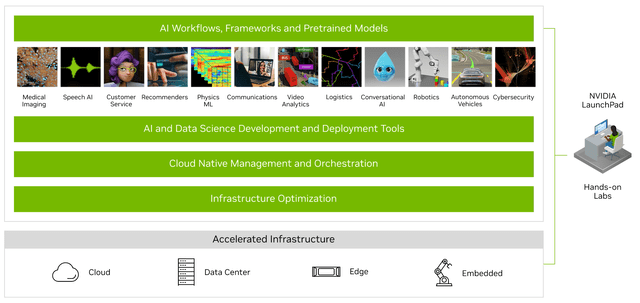

Nvidia’s AI enterprise software platform of enables human-like comprehension in language processing, recommendation systems, and understanding complex situations for intelligence-based decision making.

With that frame of reference, Nvidia’s AI enterprise platform can be understood as a collection of tools such as pre trained language models, as well as a toolkit and programming environment for developing and optimizing proprietary GPU-based applications, including libraries and tools for machine learning, deep learning, and other AI tasks. Accordingly, Nvidia’s enterprise AI platform will likely find demand for supporting applications and tasks across industries, including conversational AI, cybersecurity, logistics, recommendation algorithms, and more.

Nvidia benefits from its extensive hardware install base of approximately 50 million GPUs, which facilitates early and seamless adoption of its software solutions. Furthermore, investors should also consider that, where appropriate, Nvidia’s AI software licenses may be bundled with sales of enterprise-level H100 and A100 servers.

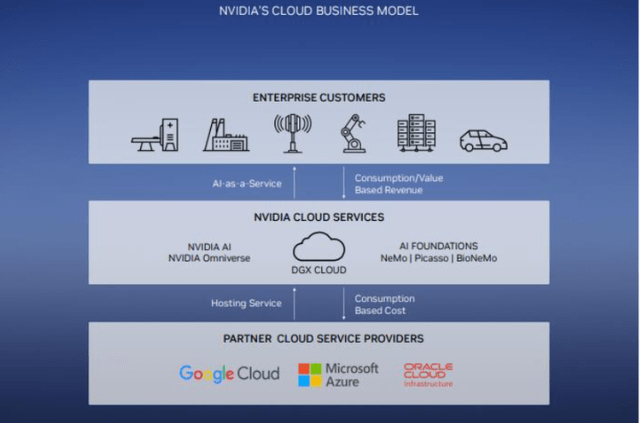

To support a large-scale application of Nvidia’s AI software solution, the AI enterprise platform is certified to operate across various environments, including multi-cloud, hybrid-cloud, and edge computing, also supported by partnerships with leading cloud players such as Amazon Web Services (AWS), Google Cloud, Microsoft Azure, VMWare and HPE Green Lake. Needless to say, this flexibility allows Nvidia to offer solutions tailored to different verticals and further enhances customer retention through offerings such as DGX and Nvidia Certified Systems.

Anchored on industry leading AI-technology, paired with strong hardware install base and partnership network, it is, in my opinion, highly likely that Nvidia’s AI enterprise software platform will capture a >20% market share of the $150 billion TAM opportunity by 2030.

Omniverse

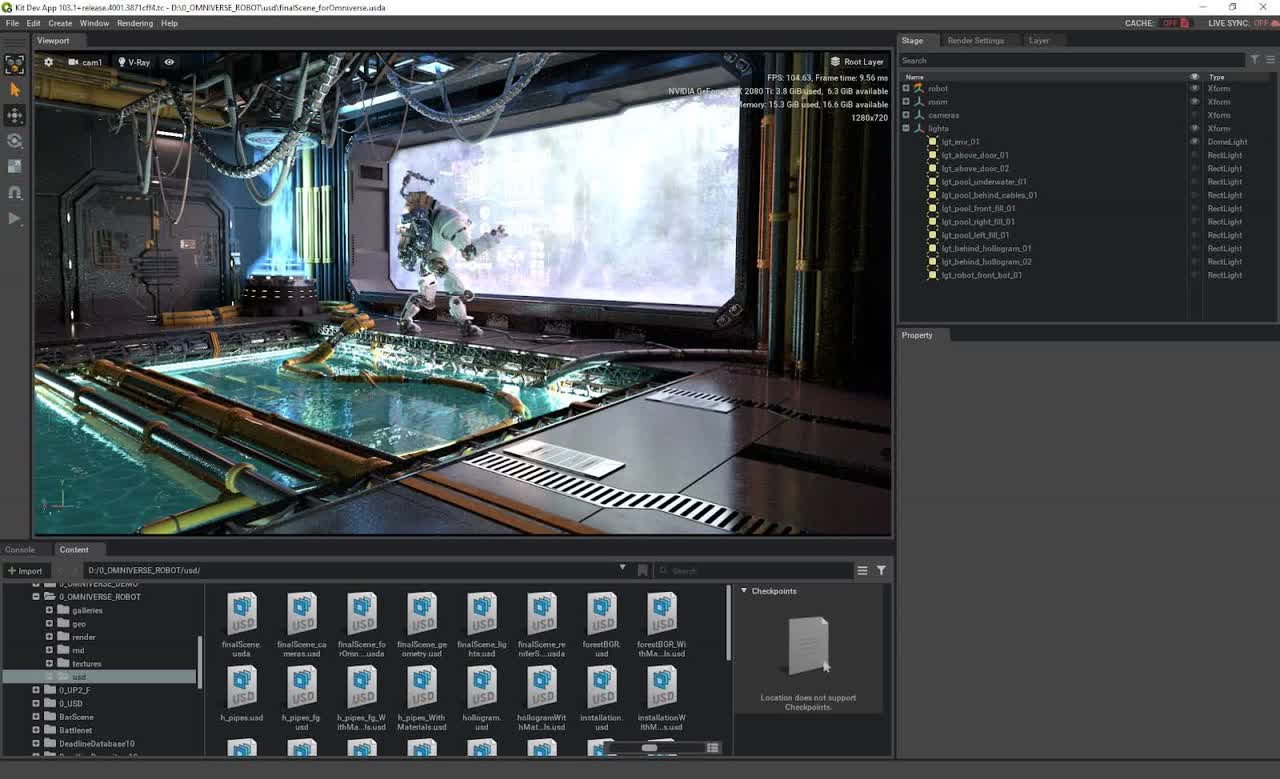

The Omniverse platform can be understood as an offering for creators and engineers who work with content that can be transformed into digital twin, allowing to facilitate real-time synchronization of networks, designs, and simulations. This feature allows for faster and more efficient iterations and optimizations of operations, leading to improved productivity and cost-effectiveness. Accordingly, the Omniverse value proposition is particularly beneficial for companies that deal with intricate conceptual designs, such as those in the manufacturing and supply chain industries (which is an enormous market covering automotive, construction, energy, logistics, etc.).

Notably, in the cumulative research and development (R&D) expenditure for the global automotive industry in 2023 is estimated to edge towards $120 billion, of which about 25% is attributable to software usage, licensing and procurement–according to suggestions from Nvidia partner Mercedes-Benz.

Nvidia – markets presentation

In other words, by leveraging mass simulations and AI technologies, businesses will be able to harness vast streams of data from both within and beyond their organizations to make highly accurate predictions about products, processes, and opportunities/ challenges in general, allowing to decide on the optimal courses of action.

Currently, Omniverse is serving approximately 700 customers, including Amazon, Siemens, Mercedes-Benz, DB Netze, DNEG, Kroger, Lowe’s and PepsiCo.

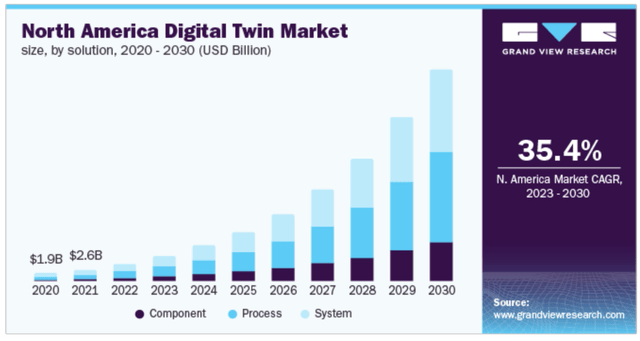

Although adoption of Nvidia’s Omniverse ecosystem is still in a very early stage, the unique and differentiated value proposition allows for truly promising growth prospects — allowing for a $150 billion TAM by 2030, according to estimates by Grand View Research (in line with Nvidia management’s estimates)

DRIVE

Nvidia’s DRIVE software platform is a collection of tool that offers a foundation for autonomous driving, and the future of mobility in a broader context. With that frame of reference, DRIVE offers comprehensive functionality for critical aspects such as perception, mapping, planning, and vehicle control. In context of broader mobility support, the DRIVE platform provides the necessary tools for building intelligent cockpits, enhancing the in-car user experience with features such as voice recognition, natural language processing, and advanced driver assistance systems (ADAS). Notably, Nvidia’s DRIVE platform also supports over-the-air upgrades, meaning that as new features, functionalities, and improvements are developed, they can be seamlessly delivered to vehicles powered by the DRIVE platform via wireless updates, ensuring that vehicles always have access to the latest advancements in autonomous driving technology.

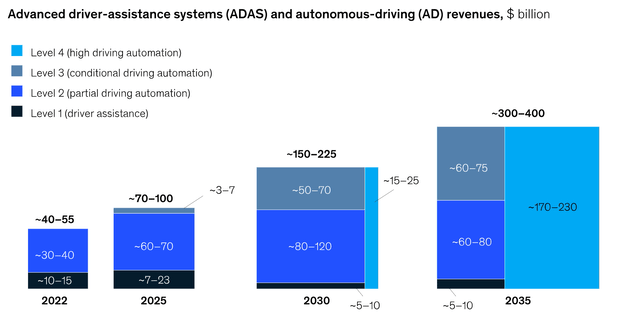

McKinsey estimated that the total market for ADAS and AD systems may grow to as much as $225 billion by 2030, and to as much as $400 billion by 2035, expanding at a CAGR of about 16% as compared to $55 billion in 2022. Moreover, McKinsey also estimated that more than 50% of the 2035 AD/ ADAS market opportunity will be attributable to Level 4 driving automation, where Nvidia is expected to focus its value proposition.

As an example for the financial potential of DRIVE, I would like to point out Nvidia’s collaboration with Mercedes-Benz, which references an agreement whereby Nvidia provides Mercedes-Benz with its ADAS/ AD and other DRIVE-related technology in exchange for a 50/50 split of the associated revenue, which Mercedes-Benz expects to grow to mid-single-digit billion dollars by the end of the decade.

Notably during Nvidia’s 2023 GTC conference (running from March 20th – 23rd), management raised the company’s DRIVE pipeline and associated revenue projection to $14 billion over the next 6 years, up from $11 billion previously.

Valuation Offers Little Upside

As argued in this article, Nvidia has lots of potential in AI-related business opportunities. However, despite the favorable tailwinds, I believe much of the positive momentum has already been priced in, given NVDA stock’s super rich price tag.

According to data compiled by Seeking Alpha, Nvidia shares are currently valued at a one-year forward P/E of x82, which represents a more than 230% valuation premium versus the information technology sector. Nvidia’s P/B is x24.5 and P/S is x22.2, implying valuation premia of 580% and 750%, respectively.

Conclusion

Nvidia is broadly recognized as the leader in AI technology, including silicon/ hardware and perhaps also software. Moreover, reflecting on the competitive landscape as of early 2023, Nvidia’s leadership position is likely to remain unchallenged for the near/- mid-term future. That said, I like Nvidia as the key enabler of AI adoption across industries, and I am confident to predict that Nvidia’s fundamentals will improve materially within the next 5, 10 and perhaps 15 years.

However, despite the positive tailwinds resulting from NVDA’s strong market position in chip technology and the growing momentum of generative AI adoption, Nvidia stock is not an easy pitch at approximately $279/ share. In fact, I argue that much of Nvidia’s future potential is has already been priced into the company’s stock price, and thus upside for the foreseeable future is quite limit. For reference, valued at a one-year forward P/E of x82, Nvidia is priced at a more than 230% valuation premium versus the information technology sector. Accordingly, in my opinion, Nvidia stock is trading too expensive to warrant an investment; I reiterate a “Hold” recommendation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice; market commentary and author's opinion only.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.