Summary:

- Eli Lilly and Company releases its Q1 2023 earnings on Thursday, 27th April.

- Lilly’s revenue growth has been so-so and its earnings hit-and-miss over the past couple of years – but that is not the real story.

- Recently approved Mounjaro is expected to become an all-time best-seller in Type 2 diabetes and could also win approval to treat obesity.

- The main rival to Novo Nordisk’s Ozempic / Wegovy, Mounjaro is forecast to become an all-time best-selling drug if approval in obesity is won.

- That could happen this year – as could an approval for Alzheimer’s drug Donanemab. Lilly stock is almost absurdly overvalued based on current performance, but could be significantly undervalued based on pipeline potential.

jetcityimage

Investment Overview

Eli Lilly and Company (NYSE:LLY) will announce its Q1 2023 earnings this Thursday, 27th April. In this post, I will provide an overview of the company, its assets, expected Q1 2023 performance, and my short- and long-term takes on Lilly’s valuation and share price growth potential.

Let’s begin with a quick discussion of the subject that is on the lips – although not necessarily on the hips – of every Lilly-watcher – the incredible potential of miracle diabetes (and soon to be weight-loss) drug tirzepatide.

The Miracle Weight Loss Drug Skewing Lilly’s Valuation

The only place to start with Lilly is with tirzepatide, which must be one of the most hyped drugs ever to be developed by a pharmaceutical company. The drug is described as follows by ScienceDirect.com:

Tirzepatide is a peptide molecule which acts as a dual agonist at GLP-1 and GIP receptors. It enhances the insulin response, suppresses glucagon secretion, promotes satiety and improves insulin sensitivity.

When tirzepatide was approved – under the brand name Mounjaro – to treat patients with Type 2 diabetes, as an adjunct to diet and exercise by the FDA in May last year, the agency noted that:

In trials comparing Mounjaro to other diabetes medications, patients who received the maximum recommended dose of Mounjaro had lowering of their HbA1c by 0.5% more than semaglutide, 0.9% more than insulin degludec and 1.0% more than insulin glargine.

HbA1c is a figure describing average blood glucose (sugar) levels for the last two to three months – a higher score is a sign of high blood glucose, therefore a drug that can lower HbA1c better than current standards of care can potentially command sky high sales in a market as large as Type 2 diabetes – there are 37m people with T2D in the U.S. alone, and the list price for Mounjaro has been quoted as nearly $13k per annum – a $470bn market opportunity!

And there is more – tirzepatide is also in the running for an approval to treat patients with obesity. You may well have read about Danish Pharma Novo Nordisk’s (NVO) weight loss drug Wegovy, which is causing a sensation in the weight loss market.

The drug has a similar mechanism of action to tirzepatide, and the actual name of the medicine is semaglutide – as you can see above, Mounjaro, or tirzepatide has proven marginally superior to Semaglutide in treating T2D – semaglutide is approved in this indication under the brand name Ozempic, earning $8.5bn of revenues in 2022.

It is possible that Lilly’s tirzepatide could prove superior to semaglutide in both T2D and weight-loss, if approved as seems likely, and that opens up a mind-boggling market opportunity. In fact, Wall Street analysts expect tirzepatide to become the biggest selling drug of all time, and believe it could earn $25 – $48bn in its first year of sales!

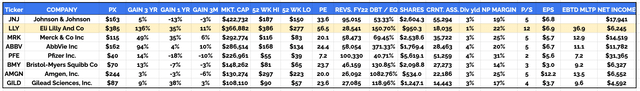

“Big 8” US Pharmas key metrics compared (data collected from TradingView, Google Finance)

This helps to explain Lilly’s apparently anomalously high valuation. Lilly’s market cap is presently ~$367bn – only Johnson & Johnson (JNJ) of the “Big 8” U.S. Pharmas has a higher market cap – despite its revenues in 2022 being $28.5bn, versus Merck’s (MRK) $58.5bn, AbbVie’s (ABBV) $58bn, and Pfizer’s (PFE) $100bn of revenues in 2022.

How does a Pharma generating half the revenues of its rivals have a market cap nearly $100bn larger? By being about to launch the world’s biggest selling drug of all time, that is how! This also explains why Lilly’s current price to sales ratio is 12x versus the “Big 8” average of 5x, and its price to earnings ratio is 57x versus a sector average of 26x.

In summary, the promise of Tirzepatide – despite its being only recently approved in T2D (2022 revenues were just $482m) and not yet approved in obesity – is so great, that Lilly has delivered wonderful returns for longer term shareholders – its stock price is up >350% across the past years, it has been by far and away the best performing pharma stock over this period (and also across the past 3 years, 1 year, and so far this year).

Q1 ’23 Earnings – This May Be A Tough YoY Comp For Eli Lilly

Turning to the here and now, what should the market expect from Q1 ’23 earnings?

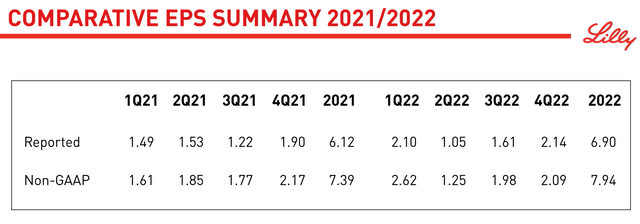

Eli Lilly EPS per quarter (Lilly Q4 earnings presentation)

As we can see above, Lilly’s EPS per quarter across the past couple of years has been a little hit and miss, but a good sign is that there is little difference between the reported and GAAP figures – if these are too wide apart it can hint at underlying issues such as asset write downs or cashflow problems – and both GAAP and reported EPS grew year-on-year, by respectively 13% and 7.4%.

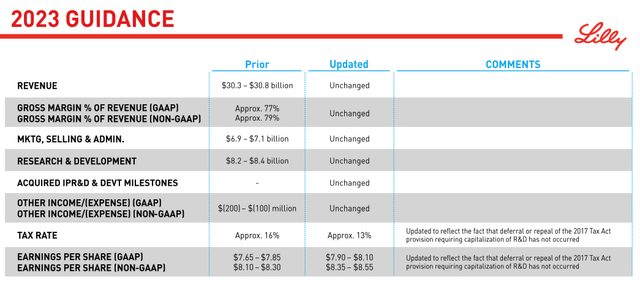

Eli Lilly 2023 guidance (Lilly earnings presentation)

As above, Lilly’s guidance for FY23 is for top line revenue growth of 7%, and for EPS growth of ~16% on a GAAP basis and 6.5% on a non-GAAP basis – steady rather than spectacular growth.

According to Seeking Alpha, analysts’ consensus is that Lilly will report EPS of $2.04 on a GAAP basis, which is slightly lower than last year, and revenues of $6.87bn, which is substantially lower than last year, as show below.

Lilly revenues per quarter historical (Seeking Alpha)

Lilly’s shareholders needn’t panic about the sliding revenues – the explanation is the absence of a contribution from COVID antivirals this year, as discussed by Lilly’s Chief Financial Officer (“CFO”) Anat Ashkenazi on the Q4 2022 earnings call:

As I shared in December, the most significant headwind in revenue growth in 2023 versus 2022 will be the impact of COVID-19 antibody sales. This year-over-year comparisons will be most pronounced in Q1 2023 given that we had $1.5 billion of COVID-19 antibody sales in Q1 2022.

Unlike rival Pharmas such as AbbVie, for example, whose Q123 earnings I have also previewed, Lilly does not generally go in for detailed product by product guidance or provide long term peak revenues targets.

However, the company has been driving some good growth from its flagship Diabetes division – sales of current best-selling asset Trulicity were up 15% to $7.44bn in FY22, and the diabetes division as a whole drove 10% annual revenue growth last year, whilst the growth of cancer drug Verzenio in 2022 – 84% to $2.5bn, saved an otherwise underperforming oncology division in which revenues fell 1% to $5.7bn in 2022.

The 12% annual growth of psoriasis medication Taltz to $2.48bn in 2022 offset a 26% decline in sales of Rheumatoid Arthritis therapy Olumiant, to $831m, meaning the immunology division growth was flat in 2022, whilst the Neuroscience division’s revenues fell by 19%, to $1.55bn, and the “Other” section of the portfolio saw revenues decline 15%, with declines in COVID antibody revenues of 10%, to $2bn, and Forteo and Cialis revenues falling respectively 24% and 18% to $613m, and $587m respectively.

In summary, were it not for the fact that Lilly is about to unleash potentially the world’s biggest ever selling drug on the market, Q123 earnings might have made for a difficult year-on-year comparison, but frankly, who is studying the revenue numbers of older drugs like Humalog, or cancer therapy Alimta, set to lose its patent protection in 2023, when the newly launched products and pipeline are supposedly pure 24-carat gold?

Looking Ahead – Does Lilly’s Pipeline Justify The Hype?

I’ll admit, I was consistently bearish on Lilly stock throughout 2022, as I felt that the market had taken leave of its senses valuing Lilly – revenues of ~$28bn and showing no revenue growth – higher than Pfizer – breaking the $100bn revenue barrier by adding >$50bn to its top line thanks to its COVID vaccine and antiviral.

When we look at the hype surrounding Novo Nordisks’ Ozempic / Wegovy however – and the growth – with sales rocketing to >$8.5bn in 2022, it is hard to see how Lilly’s Tirzepatide doesn’t drive similar, if not better growth. In fact, it would not necessarily surprise me if Lilly’s beats analysts’ EPS forecasts easily in Q1 2023, as Mounjaro may be capable of driving blockbuster (>$1bn) sales in Q1 2023 alone.

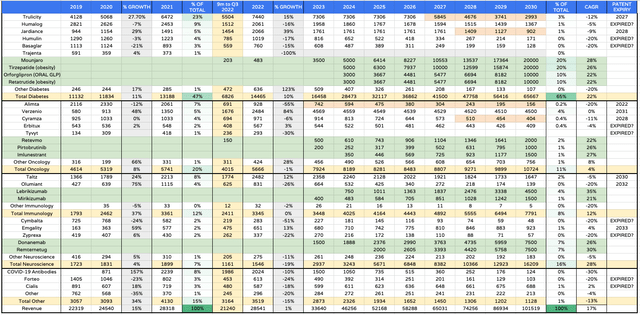

I shared product revenue forecasts in a post on Lilly back in early January which supported the company driving revenues >$100bn by 2030, based on $20bn per annum sales of Mounjaro in Diabetes, and the as-yet unnamed weight loss version of Tirzepatide also achieving $20bn sales in that year.

Additionally, Lilly is moving 2 more molecules into Phase 3 studies for diabetes and obesity – the oral GLP-1 Orforglipron in diabetes, and a triple agonist, Retatrutide for obesity. For good measure, I gave these 2 drugs peak revenues in 2030 of $10bn each.

It doesn’t stop there, either, because Lilly has a potentially best-in-class Alzheimer’s drug, Donanemab, in development. Donanemab’s rolling submission New Drug Application (“NDA”) was rejected by the FDA in January, with the agency asking for more data, but the consensus is that this drug is approvable, with a peak sales opportunity close to the double-digit billions.

For good measure, Lilly has another potentially approvable Alzheimer’s drug in its pipeline, Remternetug, answering an unmet need that runs to ~6m patients. Therefore, I forecast for ~$15bn of potential peak revenue generation in Alzheimer’s by 2030.

Lilly revenue guidance by product to 2030 (my table and assumptions)

I have reproduced my forecasts in full in the table above, and would stress that I have deliberately made them as bullish as reasonably possible to try to answer the question of whether Lilly’s share price justifies the hype.

After completing discounted cash flow (“DCF”) analysis (working is shown in my previous post), I was able to calculate a share price target of $426, implying a ~12% upside opportunity.

When the most optimistic scenario only offers an upside opportunity of 12%, there must be a question as to whether buying Lilly stock at its current price of $381 is a sensible option. The high share price has driven the dividend yield to just 1.2%, and Lilly’s future earnings are not guaranteed while some of its key drugs are not yet approved in their target markets.

Whilst Donanemab’s rejection was widely expected, Lilly had expected an approval for its immunology drug Mirikizumab, but its biologics license application (“BLA’) requesting marketing approval in the U.S. was rejected by the FDA earlier this month. This drug has a peak sales forecast of ~$1.5bn, and the issues with the FDA may well be resolved and Mirikizumab approved at a later date, but it serves as an example that not every drug in a Pharma’s late-stage pipeline is a slam dunk approval in waiting.

Where Tirzepatide is concerned, however, Lilly’s management appear to have boundless confidence, announcing today that they are planning a head-to-head trial of the drug against Novo-Nordisk’s Wegovy in weight-loss. This is simply a gigantic market – 42% of the U.S. population was considered obese in 2017, according to the Centers for Disease Control and Prevention (“CDC”), therefore, we could argue that the obesity opportunity is 5x larger than the diabetes opportunity. The mind boggles!

Conclusion – Too Late To Buy Into Lilly – Or Too Risky? The Answer May Well Be Neither

When Lilly’s Q1 ’23 earnings are released on Thursday, in my view it would take something quite unexpected for them to significantly move the share price needle, given the market only has eyes for tirzepatide, and perhaps donanemab also, and nothing relating to these 2 drugs will be decided when earnings are announced. Management may divulge new information about the drugs’ progress, although nothing out of the ordinary is expected.

It won’t be of huge importance if EPS in Q1 2023 is slightly above, or slightly below $2.04, although such is the optimism around Lilly that if Mounjaro’s sales figures are better than expected, there may be a buying frenzy, driving the share price higher. Equally, a slight miss may make the market jittery, leading to LLY stock selling.

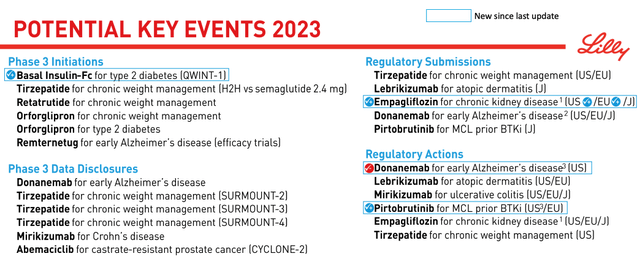

Lilly key events in 2023 (Lilly presentation)

When we review Lilly’s key events for 2023 (shared in February when Q4 ’22 earnings were released), we can see Donanemab rejection highlighted, and now we also have a Mirikizumab rejection, so there are 2 red crosses on the board so far this year.

When I adjust my discounted cash flow model slightly to drive the weighted average cost of capital upward towards 10% (my standard figure for modelling all big pharma companies – I used a lower figure of 7.4% in my previously shared model), my target price comes crashing down to $333 per share. That is based on revenues exceeding >$100bn by 2030, surely as bullish a growth trend as can be reasonably considered.

Ultimately, however, we know that the market is not rational – consider the valuation of vaccine maker Moderna, Inc. (MRNA) at the height of the pandemic, for example, achieving a market cap valuation of nearly $190bn – today that market cap valuation has fallen <$55bn.

I regret not fully appreciating the sheer size of the tirzepatide opportunity earlier, although I can still see Lilly stock roaring into the $400s, and quite possibly the $500s on market optimism. I don’t think that is entirely unjustified when we consider that markets often price stocks based on what may happen tomorrow, rather than what has happened today.

On the downside, Lilly stock has a long, long way to fall if tirzepatide does not quite live up to its early promise – and unlike semglutide, it is not yet approved to treat obesity (although that may well happen this year). It is worth remembering that Lilly stock has traded as low as $315 quite recently.

As such, although I think Eli Lilly and Company Q1 ’23 earnings will not necessarily have a significant effect on share price performance, unless Mounjaro sales significantly outperform of underperform, I do think Lilly still has hurdles to overcome on its quest to deliver the world’s “most valuable ever drug,” and we may see the Eli Lilly and Company stock price dip again on any suggestion of a setback.

I would, therefore, be against buying Eli Lilly and Company stock at the current price, but if I see the stock price drop <$320 for a second time in 2023, I suspect I will be buying.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV, BMY, GILD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.