U.S. credit card delinquency rate and net charge-off rates increased month-over-month as consumer sentiment hit an all-time low.

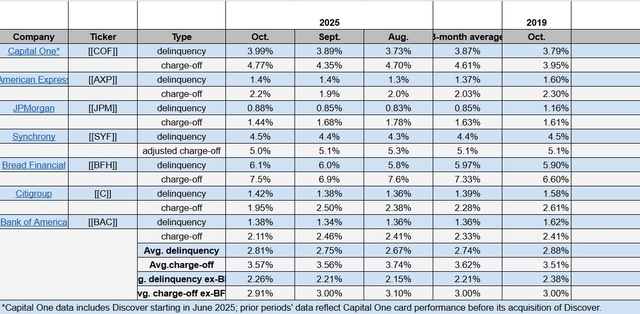

Average delinquency rate climbed to 2.81% in October from 2.75% a month ago, but was well-below the October 2024 rate of 3.14%. Comparatively, the pre-pandemic October 2019 level was 2.88%.

Meanwhile, the average net charge-off rate came in at 3.57%, up marginally from 3.56% in September but down from 3.69% in the same period a year ago.

The pre-pandemic October 2019 level was 3.51%.

“Credit card balances have climbed to a 12yr high, minimum payment rates remain elevated, and subprime auto DQs (delinquencies) reached a 25yr high – likely compounded by effects of the government shutdown,” noted Evercore ISI analysts.

The University of Michigan’s Consumer Sentiment Index hit an all-time low in November, noted the investment firm.

“While concerns regarding the health of lower-income consumers have persisted, such pressure has not become evident in overall credit card spend volumes,” the analysts said.

“Average loan growth was about stable at +18.8% y/y,” noted Morgan Stanley in a research report titled ‘October ’25 Master Trust: Credit Improvement Remains on Track; Loan Growth Stable’.

Here is a look at the October delinquencies and net charge-off rates

October 2025 credit card delinquencies, net charge-offs (Company filings, press releases)