Summary:

- Bank of America’s Series E floating rate depositary shares currently offer a 6.3% yield on cost, 355 basis points more than the yield on the common shares.

- They’re trading at an 18.5% discount to their $25 par value as they followed the common shares lower over the last year.

- The bank’s fiscal 2023 first quarter was strong, with GAAP earnings growing by 17.5% over its year-ago comp to reach $0.94 per share.

Spencer Platt

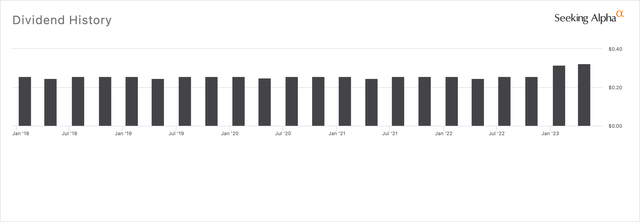

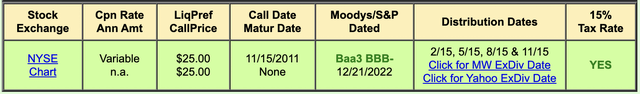

Bank of America’s (NYSE:BAC) Series E floating rate depositary shares (BAC.PE) last declared a quarterly cash dividend of $0.3222 per share, a huge 26.1% increase from the prior distribution to offer a 6.3% yield on cost. This is 335 basis points higher than the 2.95% yield currently being paid on the common shares. These started trading in 2006 with Bank of America selling 74 million depositary shares at $25 per share. Each share represents a 1/1,000th interest in a share of Bank of America’s non-cumulative preferred stock. There is a lot to like here with the perpetual depositary shares currently trading nearly 12 years past their call date.

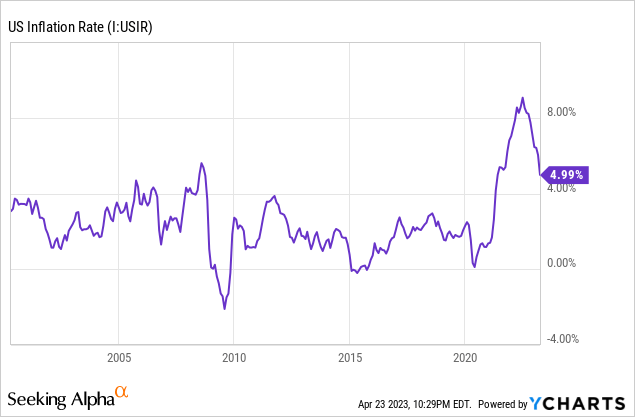

Firstly, they’re currently swapping hands at $20.37 per depositary share, a $4.63 difference, and an 18.5% discount to their $25 par value. This discount to par began widening when inflation started to pick up, and the Fed embarked on its fastest and most dramatic period of monetary tightening in well over a decade. Preferreds are essentially fixed-income securities with equity-like features, hence, the positive duration effect has come into play to an extent. These floated at a rate per year equal to the greatest of the three-month LIBOR plus a 0.35% spread or 4% per annum.

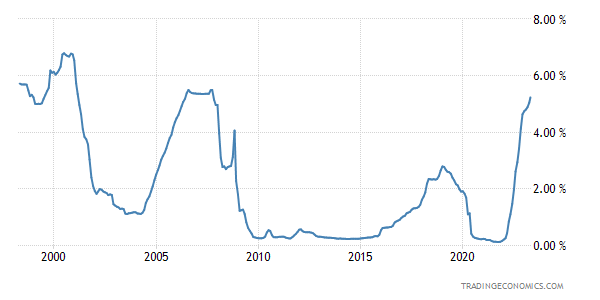

Trading Economics

The US dollar LIBOR three-month rate currently sits at 5.26%, up from near zero from the end of 2021. A still-rising Fed funds rate now sits at 4.75% to 5% and is likely set for one more 25 basis point hike at the May 2-3 FOMC meeting. This has set the backdrop for the yield to move higher, with the Fed likely to keep rates elevated through 2023. At the crux of this is a still lingering uncertainty around the direction of inflation.

Inflation And The March Banking Panic

Russia’s invasion and war on Ukraine have thrown the global energy market into turmoil and affected the prices of critical agricultural commodities like wheat. Hence, whilst the headline inflation rate continues to drop and looks set to move to the Fed’s 2% target rate by the end of summer, the overall situation is still somewhat prone to disruption. Critically, as the Series E has not been spared from broader equity market weakness, their holders should not expect a return to par in the near term. Indeed, the commons are down 23% over the last year and are still yet to fully recover from the March mini-banking panic.

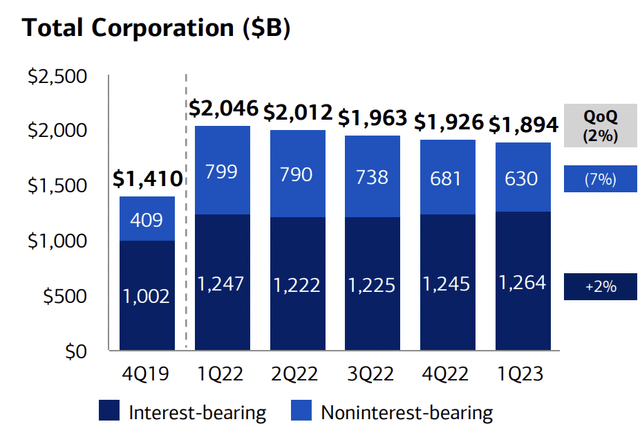

Whilst systematically important banks have benefitted from some uninsured deposits moving away from Silicon Valley Bank and regional banks like Signature Bank, the consensus is now that the deposit outflows have slowed and in many cases reversed following a stream of first-quarter earnings from the regional banks. Bank of America’s deposits reached $1.9 trillion, a 2% sequential decline from the fourth quarter.

Bank of America’s fiscal 2023 first-quarter earnings were strong with revenue coming in at $26.3 billion, a 13.4% increase from the year-ago comp and a beat by $1.02 billion on consensus estimates. This was driven up by a 25% year-over-year expansion of its net interest income to $14.4 billion with noninterest income increasing by $154 million, around 1%, over its year-ago comp to $11.8 billion. This was on the back of weak asset management and investment banking fees.

2023 Total Returns Come Into View

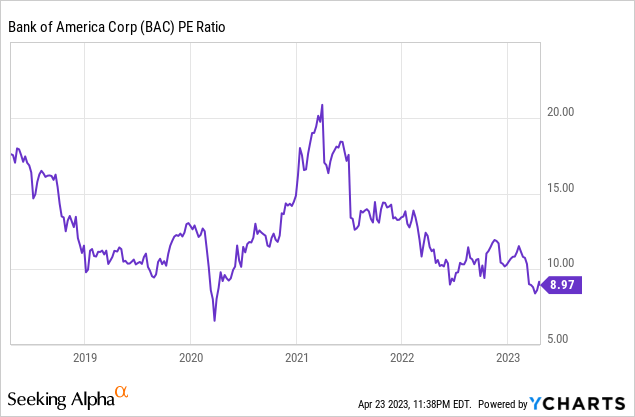

GAAP EPS grew by 17.5% over its year-ago comp to reach $0.94 from $0.80 in the year-ago comp to cap the earnings report. Hence, the bank’s price-to-earnings ratio has fallen to a level only eclipsed by the early pandemic panic. This has set the backdrop for returns through 2023 with bulls looking to a recovery of current negative sentiment to pull Bank of America back up to its 5-year average of 12.66x. We could see a similar positive movement with the depositary shares, whose anchor around their $25 redemption value has been dislodged. However, as these have been trading for so long past their redemption date, the anchor to par fundamentally becomes less rigid. Hence, I don’t expect a move back to $25 this year, and the common shares likely stand to outperform on a total return basis through 2023.

Over the last year, the Series E was down by only 0.5% on a total return basis versus a loss of 21.3% for the commons. Over the last three years, the commons are up 48% versus a 5.19% total return for the preferreds. Further, whilst LIBOR currently remains elevated, once it starts to fall, it could do so markedly. The Series E will likely form the better choice if you think inflation reverses its current downward trend or stays sticky. The commons form the better play on the continued normalization of inflation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.