This year’s Dubai Airshow delivered a mix of twists and unexpected wins as Airbus (OTCPK:EADSF) (OTCPK:EADSY) and Boeing (BA) sparred for prominence, with communist China’s Comac stepping onto the global stage in a more serious way than ever before.

Emirates kicked off the event with its headline purchase: 65 more Boeing (BA) 777X jets valued at $38 billion. The decision to renew its commitment to Boeing’s (BA) delayed flagship surprised some observers, given recent schedule setbacks. Still, analysts noted the Dubai-based carrier is already planning for the 2030s as it prepares to retire some of its massive A380s.

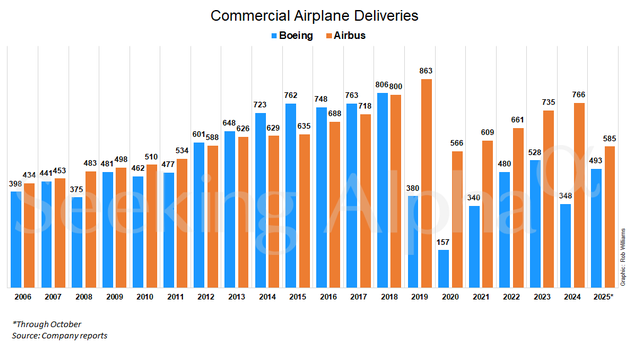

Commercial airplane deliveries for Boeing and Airbus through October (Company reports)

Airbus (OTCPK:EADSF) (OTCPK:EADSY) answered on day two with its own stunner, securing an order from Flydubai, long viewed as a Boeing (BA) loyalist thanks to its all-737 fleet. The European planemaker’s aircraft would give the low-cost carrier more flexibility to open thinner long-haul routes, according to industry specialists.

But Airbus (OTCPK:EADSF) (OTCPK:EADSY) again failed to land the prize it covets most: a major A350-1000 order from Emirates. President Tim Clark said he won’t commit until he sees more from the jet’s engines, echoing the same stalemate seen at the previous Dubai show.

Both manufacturers chalked up wins midweek. Boeing (BA) locked in a Flydubai agreement for 75 more 737s plus options for an equal number, while Airbus (OTCPK:EADSF) (OTCPK:EADSY) secured a top-up order for Emirates’ A350-900s. Airbus also signed Buraq Air of Libya as a new customer for 10 A320-family aircraft.

The rapid cadence of announcements captured the high-pressure nature of Dubai’s show, now one of the industry’s main arenas for blockbuster deals. Negotiations often come together overnight or collapse at the last minute, and many signings represent early commitments rather than final contracts. The surge of demand only adds pressure to manufacturers still struggling with long backlogs and supply-chain constraints.

Dubai’s role as a global aviation crossroads, anchored by Emirates’ long-haul network, has turned Gulf carriers into essential customers for Airbus (OTCPK:EADSF) (OTCPK:EADSY) and Boeing (BA), rivaling the massive order volumes coming from China and India. While the duopoly still dominates the widebody market, competition is emerging elsewhere.

China’s Comac used the show to promote its C919 outside Asia for the first time, flying the narrow-body jet alongside the Airbus A350 and Boeing 777. The aircraft resembles the A320 in size and profile, though it still lacks certification in Europe and the United States. Even so, its appearance underscored that the long-standing two-player rivalry could be entering a new era.