Summary:

- BAC preferred shares offer limited benefits compared to T-bonds due to their non-cumulative and perpetual covenants.

- BAC common shares provide a more attractive risk/reward profile with a reasonable valuation of 8.8x forward P/E ratio.

- Despite the challenging macroeconomic environment, BAC Q1 2023 results show strong performance across all business segments.

- BAC’s commitment to returning capital to shareholders enhances its appeal as an investment.

Spencer Platt/Getty Images News

Investment Thesis

Bank of America preferred shares have attracted some attention from investors seeking to secure returns above long-term treasury bonds. However, these shares present considerable drawbacks, such as being non-cumulative and lacking maturity, which calls into question their value when compared to other options available on the market today. The interest rate premium that BAC preferred shares offer is simply too small to offer a convincing investment proposition against other fixed-income securities, including T-bonds.

In recent weeks, I’ve made decent returns capitalizing on the panic selling in the banking sector in the aftermath of the Silicon Valley Bank collapse. I believe that BAC common shares offer a better risk/reward profile compared to the company’s preferred shares. Although the common shares yield 3% (compared to 6% for the preferreds), the valuation seems reasonable at an 8.8x Forward PE ratio, especially when taking into consideration the long-term growth prospects.

Inverted Yield Curve

The US treasury yield curve has been inverted since March 2022. This means that the yield on 3-months, 6-months, 1-year, and 2-year treasury bonds is now higher than 30-year, 10-year, and 5-year rates. This is an unusual phenomenon, and under normal conditions, long-term rates tend to be higher than short-term interest rates, reflecting the greater risk associated with holding investments over longer periods of time.

This inverted-yield scenario has a detrimental impact on the profitability of banks, affecting net interest margins. One primary source of BAC revenue is the interest rate spread between rates they pay on deposits (and other short-term borrowings) versus the rates they charge on loans. The impact of the inverted curve on BAC’s operations weakens my bullish thesis on the common stock (which I will defend in the following paragraphs) but, at the same time, strengthens the hold rating on BAC’s preferred shares.

Unlike a bank, retail investors don’t have to worry about matching maturities of assets and liabilities or interest rate risk. For a retail investor investing in shorter-term fixed-income such as T-bills (through (BIL), which has a forward yield of 4.8%, or TreasuryDirect, which allows investors to participate in treasury auctions) should be a clear choice, and the advantage of T-bills over BAC’s preferred shares (Series GG 6% perpetual, non-cumulative preferred shares (NYSE:BAC.PB) — or (NYSE:BAC.PP) non-cumulative 4.125% (5.6% yield-on-cost) series PP and (NYSE:BAC.PK) non-cumulative 5.875% (5.9% yield-on cost) for that matter- is even starker, as summarized in the table below.

| 6-Months T-Bill | BAC.PP | BAC.PK | BAC.BP | |

| Yield | 5.1% | 5.6% | 5.9% | 6% |

| Maturity | After 6 months of issuance | Perpetual | Perpetual | Perpetual |

| Rating | Aaa | Baa3 | Baa3 | Baa3 |

As a non-cumulative preferred, the only guarantee of payment is trust that management will adhere to principles of good governance. There are no obligations for BAC to pay a dividend on the preferred, but it is critical that they continue to do so, to the extent capital requirements and regulatory limits on dividend distribution allow, in order to establish trust with investors and maintain its reputation. On the other hand, holders of US government bonds have a legal right to receive all due dividends at maturity.

The fact that BAC.PB, BAC.PP and PAC.PK are perpetual preferreds is also a drawback. No one knows what the future holds for BAC. If conditions worsen and the value of the preferred goes down, one can’t hold the ticker until maturity (because the shares are perpetual with no maturity date) to guarantee the preservation of capital, unlike T-bills, where the risks of price fluctuations can be completely eliminated by holding the bond until maturity, where an investor is almost guaranteed to receive their capital plus interest.

The 0.9%, 0.8% and, 0.5% interest premium that investors gain from investing in BAC non-cumulative preferreds (BAC.BP, BAC.PK, and BAC.PP, respectively) are offset by the multiple drawbacks mentioned above, underpinning the sell rating.

The Case for BAC Common Shares

The recently-released Q1 2023 results highlight an impressive performance across all BAC’s business segments, demonstrating the company’s resilience and ability to navigate through the challenging macroeconomic environment and possibly maintain strong growth in the medium and long run, notwithstanding the expected recession in H2 2023.

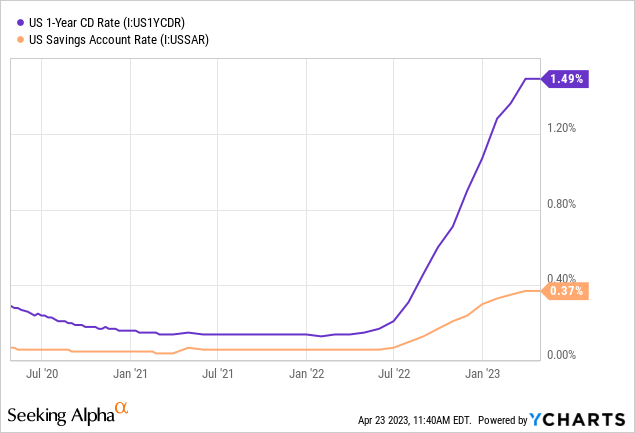

The company reported a 15% increase in net income, rising to $8.2 billion, compared to $7.1 billion in the same period last year. The growth can be attributed to a 13% increase in revenue as management was able to maintain healthy interest rate margins, benefiting from a broad conservatism among banks in competing for deposits while capitalizing on the higher interest rate environment for loan underwriting. On the liabilities side, although bank customers can earn higher interest by putting their savings in short-term treasury, for now, many are happy with the 1.5% CD rate and 0.4% savings account rate. These dynamics could change, and there are signs that banks are increasingly competing for deposits. BAC’s consumer deposits decreased 2.8% YoY and 2% sequentially.

On the assets and loan underwriting side, loan balances showed a steady increase in the consumer banking segment, increasing from $284 billion in Q1 2022 to $303 billion in the most recent quarter, a 6.9% YoY growth. The growth in the Consumer Banking segment mirrors management’s success in maintaining its client base in a tough macro-environment, possibly through an attractive loan offering and customer loyalty. For those new to BAC, the company is the #1 in US retail deposit market, according to BAC management.

In the Global Wealth and Investment Management “GWIM” segment, average loans grew by 5% from $210.9 billion in Q1 2022 TO $221.4 billion in Q1 2023. However, there was a slight decline on a sequential basis from $225.1 billion in Q4 2022 TO $221.4 billion in Q1 2023. The YoY increase indicates that the bank has been successful in extending credit to high-net-worth individuals and businesses, but the slight decline from Q4 2022 could signal a potential slowdown in credit demand within the segment.

Global Banking experienced a 6.2% increase in average loans, from $358.8 billion in Q1 2022 to $381 billion in Q1 2023. This growth suggests that the banks have been effective in expanding their lending operations to large multinational corporations.

Valuation

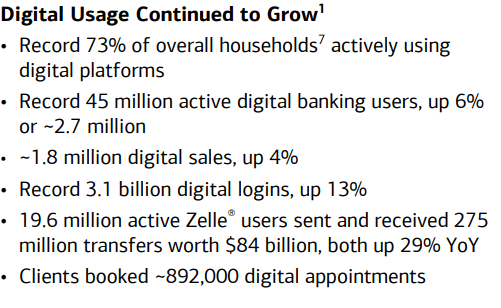

BAC’s Q1 results are a continuation of a spectacular performance the company enjoyed in the past decade. The 27% decline in share price opens an opportunity to start accumulating shares while keeping in mind the possibility of a recession. The performance going forward will depend on how the economy fairs and, in case of a recession, the duration and severity of the slowdown. I personally don’t expect a disruptive economic slowdown, and I am buying the ticker and prepared to double down in case of further deterioration in the stock price. BAC is a critical institution in the US banking system, subject to significant capital regulatory requirements that enhances its safety as an investment. If the economy stabilizes, BAC is in a good position to capitalize on macroeconomic tailwinds, enhanced by management’s emphasis on digital innovation and customer experience and investment in technology, as shown from the snapshot from the Q1 press release.

Bank of America

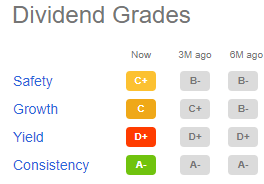

Over the years, BAC demonstrated its commitment to dividend payments, even during challenging economic times (notwithstanding the great recession and subsequent Dodd-Frank Act, which put limits on BAC’s ability to pay a dividend). Dividend safety and growth rate are within the industry average, while a yield of 3% could see some improvement.

Seeking Alpha

Still, when considering the risk/reward returns of BAC common and preferred shares in light of the growth potential, I see the scale tilted towards the former.

Summary

Bank of America’s preferred shares offers limited benefits to investors when compared to other fixed-income securities like T-bonds. The relatively small interest rate premium and inherent risks associated with the non-cumulative and perpetual nature of these shares make them a less attractive option. Instead, BAC’s common shares present a more compelling risk/reward profile with a reasonable valuation at an 8.8x forward PE ratio.

Despite the challenges posed by the inverted yield curve, BAC’s Q1 results show strong performance across all business segments. This robust growth, along with BAC’s commitment to dividend payments and technology investments, makes the bank’s common shares a more attractive investment proposition.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.