Summary:

- Lucid disappointed the market with its production and delivery results for Q1’23.

- Investors may now be more doubtful that the EV company’s production guidance for FY 2023 can be achieved.

- Lucid is still an attractive choice in the EV segment as it ramps up deliveries and becomes a mass producer of electric vehicles.

hapabapa

Electric vehicle company Lucid Group (NASDAQ:LCID) dropped a bombshell on investors earlier this month when it pre-released production figures for the first-quarter that raised concerns about the company’s ability to meet its production target for FY 2023. Lucid’s production figures also fell short of market expectations, despite deliveries tripling year over year. Although Lucid has seen a significant increase in deliveries compared to the year-earlier period, the company’s production accomplishments in Q1’23 indicate that a challenging year may lay ahead for the electric vehicle company: Tesla’s aggressive price cuts and shrinking demand pose a challenge to Lucid’s premium valuation factor. The pre-released production figures raise questions, but it is too early to write off Lucid entirely.

Lucid Air deliveries and production update for Q1’23

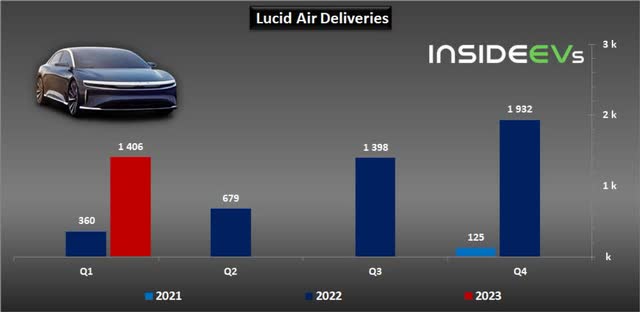

Lucid Air deliveries tripled in the first-quarter, compared to Q1’22, but the market has become fearful that the electric vehicle company may suffer from consumer spending headwinds that may result in weaker than expected production and revenue growth in FY 2023. According to Lucid’s delivery and production update for the first-quarter, the EV company produced 2,314 vehicles in Q1’23, showing a year over year increase of 235%. Deliveries of the Lucid Air also ramped up nicely with Lucid delivering 1,406 electric vehicles, showing a 290% increase over the corresponding period a year earlier.

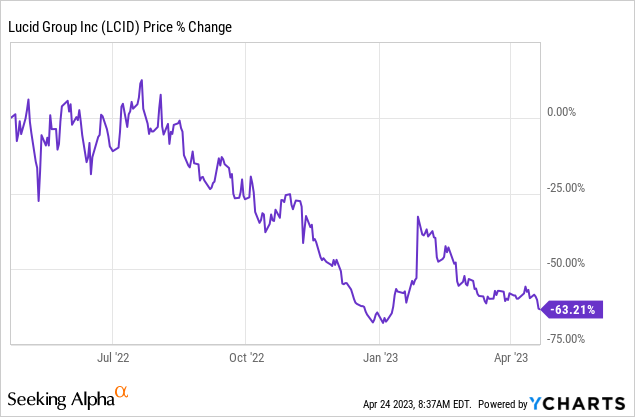

While the company’s production and deliveries are ramping up, investors rightfully have concerns over Lucid’s guidance for FY 2023. The EV company has guided for total production volume of 10,000 to 14,000 electric vehicles, which represents approximately a doubling of production year over year. In FY 2022, Lucid produced 7,180 electric vehicles and the company marginally beat its own full-year guidance of 7,000 EVs. However, Lucid’s guidance for FY 2022 was lowered and the current trajectory in deliveries and production indicates that it may be challenging for the EV company to fulfill its current year guidance. Considering that Lucid lowered its guidance twice in FY 2022 related to challenges to source vital auto parts, shares of Lucid have seen a scary re-valuation to the down-side in the last twelve months.

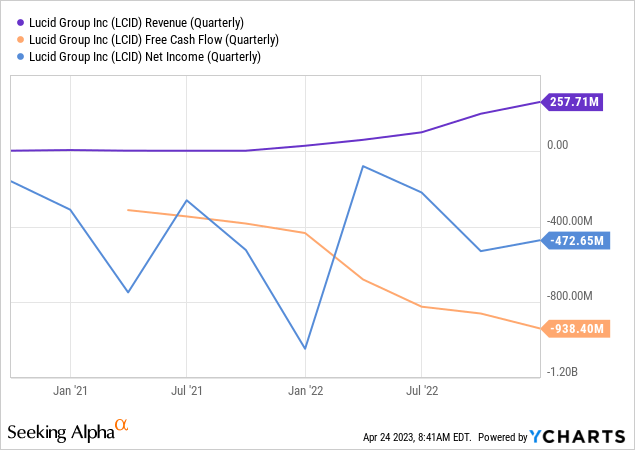

Additionally, investors have become more skeptical of the near term earnings prospects of electric vehicle companies, many of which have limited factory output, negative free cash flow and generate large losses. Lucid, as an example, generated negative free cash flow in the amount of $938M just in the fourth-quarter and total FCF losses reached $3.3B in FY 2022. At least for the next 2-3 years Lucid is not going to see enough revenue volume to move towards positive free cash flow and a slower than expected revenue ramp may result in hundreds of millions of dollars of revenues getting pushed into the future.

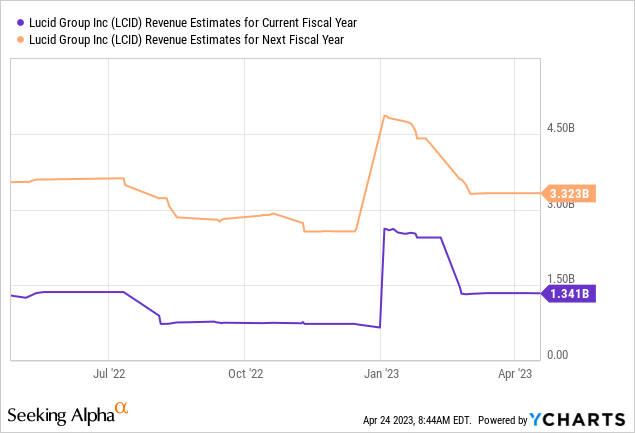

Lucid’s revenue estimates have fallen sharply in FY 2023 as investors priced in the possibility of slower production and top line growth. The current estimate for FY 2024 revenues is $3.32B, implying a year over year growth rate of 148%. The short term revenue revision trend may continue to be negative and analysts may adjust their estimates downward if Lucid once again lowers its production guidance.

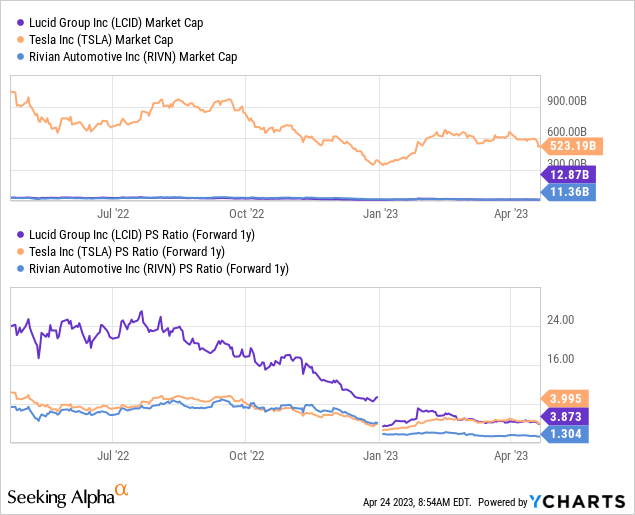

Lucid’s valuation relative to rivals

Lucid is one of the most expensive EV companies currently available in the U.S. stock market, and only slightly less expensive than Tesla. This is because Saudi Arabia’s cashed-up sovereign wealth fund, PIF, is a backer of Lucid which has translated to Lucid having one of the best balance sheets in the industry, perhaps with the exception of Rivian Automotive (RIVN). Lucid also made waves with its first-ever production car, the Lucid Air, which came to market with a category-busting range of 520 miles on a single charge. Investors currently pay a P/S ratio of 3.9X for Lucid’s revenue potential while Tesla, which produces millions of cars a year, has a P/S ratio of 4.0X.

Risks with Lucid

The biggest commercial risk for Lucid at this time is that the company will have to lower its production target a third time. If the market perceives falling demand for EVs to be a credible threat in an increasingly cut-throat market, investors may not be willing to pay Lucid’s premium valuation factor. There is also the risk that Lucid may not realize its expected revenue potential and revenue revisions as well as stock downgrades may hurt Lucid in the short term as well.

Final thoughts

Lucid’s pre-released delivery and production numbers for the first-quarter were a bombshell for investors because have to content with the possibility of another guidance revision to the downside if demand weakens. The result of this could be the third guidance revision in a row which could weigh on the company’s valuation factor, but also potentially push revenues into the future. With demand factors now determining the EV trade rather than supply chain issues, FY 2023 is likely going to be a highly challenging year for Lucid. However, I believe that Lucid’s long term potential is not affected by short term production challenges. However, I acknowledge the growing risks for EV companies in this market and lower my Lucid rating from strong buy to buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LCID, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.