Summary:

- Alphabet Inc. is set to release its Q1 fiscal 2023 results after the market closes on April 25.

- I have a very troubling feeling that the market has already priced in all the positives, and Google stock could face the “sell the news” phenomenon in the coming days.

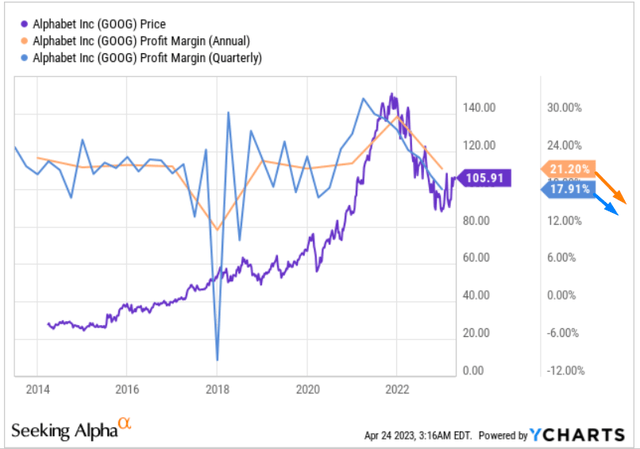

- I expect Google’s profit margin to remain under pressure for longer – if I am right, then ~19% EPS growth rates for FY2024 and FY2025 are out of the question.

- The absence of a reasonable upside and the vulnerability of existing estimates to fluctuations in the business cycle make me downgrade Google to Hold.

Alex Wong

Intro & Thesis

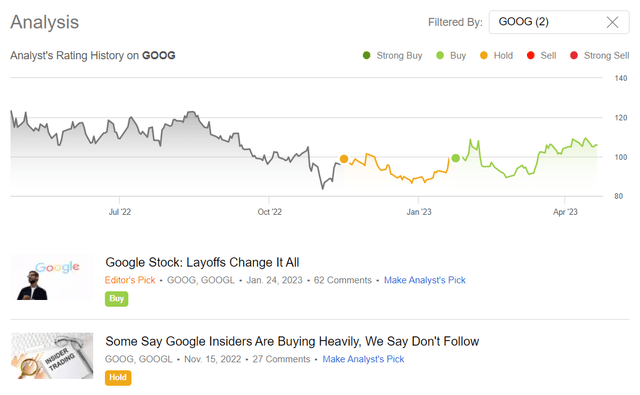

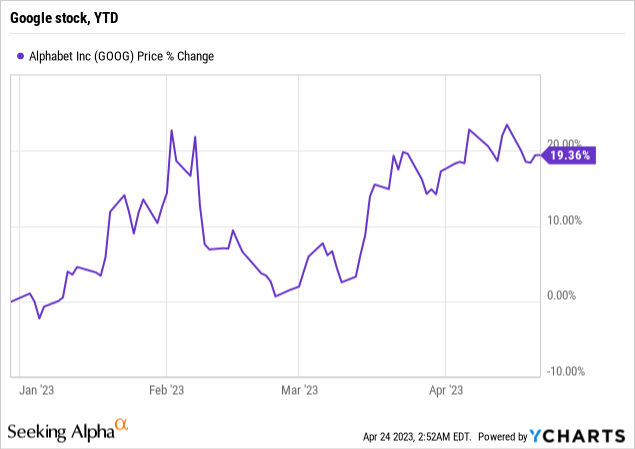

I started covering Alphabet Inc. (NASDAQ:GOOG, NASDAQ:GOOGL) aka Google stock relatively recently – in mid-November 2022. Initially, my rating was Neutral, then I became more optimistic and upgraded it to “Buy” after the company announced layoffs for a reasonably large number of employees that I did not think added much value. These cost-cutting measures, in my opinion, should have allowed the company to significantly reduce its operating costs in advance of difficult recessionary times shortly. Since that upgrade, the stock is up 6.75%, while the S&P 500 Index (SP500) is up only 2.9% over the same period.

Seeking Alpha, my past coverage of GOOG stock

The company will release its Q1 fiscal 2023 results after the market closes on Tuesday, April 25. As is so often the case, the post-earnings price action will likely depend on the management’s guidance, not on the actual results. Taking this fact into account, and also analyzing Wall Street’s EPS assumptions for the next few years, I have a very troubling feeling that the market has already priced in all the positives and Google stock could face the “sell the news” phenomenon in the coming days, as was the case recently with Tesla, Inc. (TSLA) stock – which I wrote about just last week. Therefore, I am again going down from the “Buy” rating to “Hold.”

Why Do I Think So?

We – equity analysts – love to describe trends and idiosyncratic features of the addressable market, some hidden projects of the company we are covering, to show how wrong the market is with its implicit expectations. This time, I decided to look directly at what the sell-side’s consensus revenue and EPS forecasts are for Google, and how out of touch with reality I think those estimations are.

But before we look at Google’s priced-in numbers, let me explain why looking at earnings estimates is important. Theoretically, investors are assumed to get an abnormal return – a higher return compared to the S&P 500 – only thanks to their out-of-consensus bets. For example, four years ago, the market expected Google to earn $2.59 per share in FY2020. This was the consensus that analysts had calculated well in advance – at the time, it represented a 1.14% decline in earnings per share compared to FY2019, according to data from Seeking Alpha Premium. But Google surprised everyone – at the beginning of 2021, the company reported FY2020 EPS of $2.93 – the surprise amounted to ~13.18% compared to consensus. After such a huge earnings beat, many times higher than the 2010-2019 earnings beats of 1-3%, the stock has risen more in the next 6 months than in the previous 12 months.

The Fed’s strong stimulus effect of pumping tons of liquidity into the markets has allowed Google and the rest of the FANGMAN stocks to grow very quickly and expand their moats in their target markets. Those Google investors who anticipated this effect in advance (say, in early 2020) could go against the consensus and double their capital investment within a few months, by buying the dips all the way up.

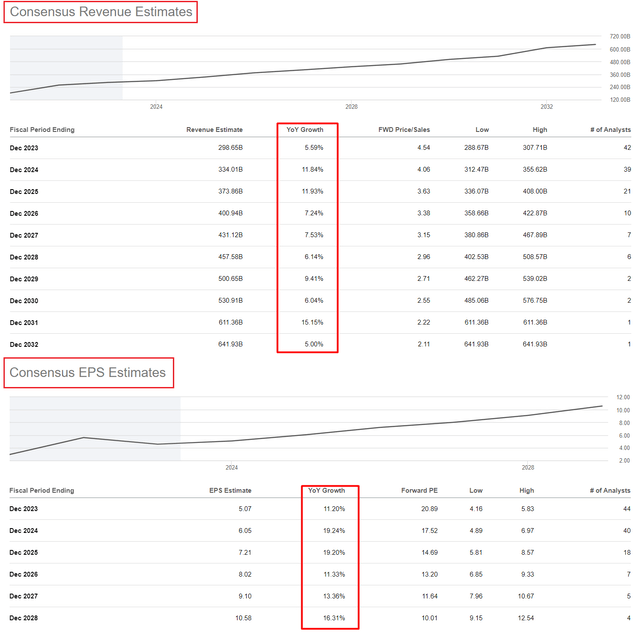

But what about consensus forecasts today? The sell-side – analysts at various investment banks – expect Google’s FY2023 revenue and EPS to grow 5.59% and 11.2% year-over-year, respectively. And over the next 2 years (FY2024 and FY2025), the effect of existing operating leverage should allow the company to grow its EPS by 19.24% and 19.20% year-over-year, respectively.

Seeking Alpha Premium, Google stock, author’s notes

You may ask – “Danil, so what’s the problem here?”

I’ll respond to you by stating that, from my perspective, the issue is the absence of a reasonable upside and the vulnerability of existing estimates to fluctuations in the business cycle:

Excel, author’s work (Seeking Alpha data)

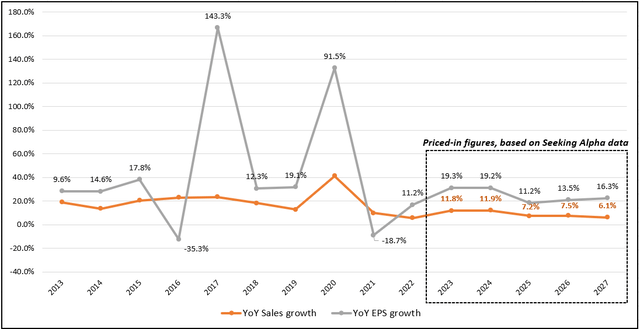

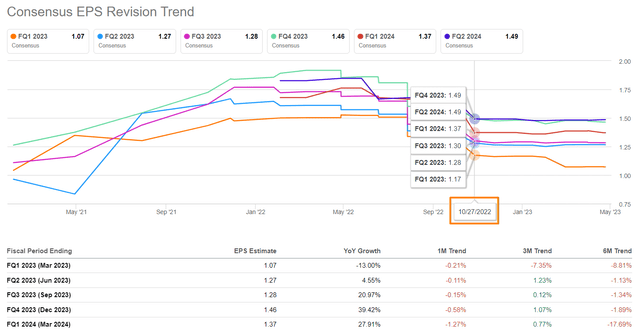

Analyst forecasts do not take into account the volatility of the company’s earnings at all – in the days before COVID, Google struggled with EPS growth – but the current consensus is that the company will get off easy this year and return to a growth path in a few months. I come to this conclusion for a reason – just look at the quarterly EPS revisions pricing in the dark days for Q1 2023 only.

Seeking Alpha data, Google’s EPS revisions

Since the end of October 2022, forecasts for Q2-Q4 2023 and beyond have only improved – and this is against the backdrop of new signs of an approaching recession (deep inversion of the yield curve, bank collapse, etc.). Microsoft Corporation’s (MSFT) attempts to slice off a part of Google’s search market share also seem to be ignored in these numbers.

In other words, the risks to equity markets have increased in recent weeks, and Google stock, which theoretically should take a hit due to its recession-prone business model with historically volatile earnings, has rallied on the expectation of a soft landing:

Of course, Google stock is no exception in today’s market – I see the same “de-risking” happening with Apple Inc. (AAPL), Netflix, Inc. (NFLX), and many others. This observation only adds to the discomfort – the surge in the stock prices of these companies alongside the upward revisions in EPS over the past few months renders their recent upswings unsustainable. The exaggerated consensus forecasts set a kind of bar for these companies, which puts their shares under tremendous strain precisely when the bar was not reached.

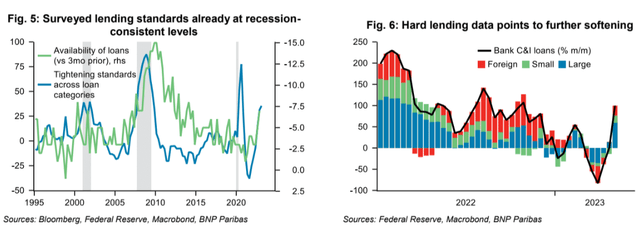

Today, there are early indications that credit tightening may continue, according to the study from BNP Paribas (April 2023, proprietary source). Market-based measures of financial conditions do not fully capture lending conditions, which may be tighter than indicated by traditional indexes. Banks were already tightening credit standards prior to regional bank failures, and this tightening was consistent with past recessionary episodes. Bank commercial and industrial lending growth slowed over the latter half of 2022 and contracted in February 2023, with a spike in lending likely reflecting companies drawing down revolving credit facilities to get ahead of a lending pullback. This may indicate deterioration rather than an all-clear.

BNP Paribas (April 2023, proprietary source)

If credit conditions do tighten further – or remain relatively tight for some time – corporate America will have less credit to grow. It varies, but usually, the first operating expenses to be cut are advertising spending – hence Google’s earnings vulnerability, which is not yet priced in by the Street as we could have seen above.

I expect Google’s profit margin to remain under pressure for longer – if I am right, then ~19% EPS growth in 2024 and 2025 is out of the question.

Moreover, Google’s moat prevented other participants in the search market from challenging the company’s leadership until 2023. Now everything has changed – in any case, Microsoft has now proven to be a stronger competitor than previously thought. This risk is not yet critical, in my view, but it is new in itself – what if Google’s market share actually decreases by at least 5-8% in the next few years? Will it be possible to achieve the same growth rates as before?

In the long run (10 years or more), I would not mind holding Google stock. I am happy to see implied earnings multiples shrink along the way given the still very optimistic EPS forecasts – from the TTM price-earnings multiple of 23.13x to 10.1x in FY2028. Even if EPS forecasts are cut in half ($5.29 vs. $10.58), a more realistic multiple of 25x yields an FY2028 price target of $132.25 per share, which is ~25% above GOOG’s last closing price. But that’s a CAGR of only 4.54% per annum – about the same as AA-rated bonds can give you now. Yes, here I am assuming 2 times lower EPS than priced in – but I am also assuming more than 2 times higher exit multiple.

In any case, what I see in the current Google EPS forecasts is that all the positive sentiment around the tech sector since the beginning of this year has already been priced in – I expect that we will continue to have at least a much lower growth rate in Google’s EPS figures, due to the initially high base, increased competition, and tightening corporate credit conditions and the resulting weakening of the company’s customer base. All of this seems to be overlooked by the market, in my opinion.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to navigate the stock market environment?

Keep your finger on the pulse and have access to the latest and highest-quality analysis of what Wall Street is buying/selling with just one subscription to Beyond the Wall Investing! Now there is a free trial and a special discount of 10% – hurry up!