Summary:

- Meta Platforms’ Q1 earnings report is more about solidifying its new course toward three things.

- One of the main ones is focusing on ad product innovation, not user product innovation; these cycles have been switched because of the headwinds over the last year.

- And something it needs to focus on for the long term is a non-advertising product capable of generating revenue.

- I’ll be focusing on these things and the timeline for them to be meaningful to free cash flow and net income.

panida wijitpanya/iStock Editorial via Getty Images

To say Meta Platforms’ (NASDAQ:META) Q1 earnings report is important would be an understatement. After two quarters of hectic guidance cuts to expenses and CapEx, the company should finally be settling into a new groove more aligned with the weak – and negative – revenue growth it has been experiencing for the last four quarters. And while Q1 revenue is expected to be negative, it’s about the rest of the year and how management expects the online ad industry to shape up. Lastly, with internal job cuts mostly complete and expenses and investments almost four months in the books for 2023, I’m looking for negative news to be out of the way and positive news to infiltrate the earnings call.

Let me start by saying Meta isn’t out of the woods yet. It has plenty to prove, and the first quarter of the year doesn’t make a trend after a pretty poor 2022. But if the narrative can shift from a gloomy ad market to one bottoming, investors can put the last several quarters behind them and look toward double-digit revenue growth once again.

But it needs to do two things, really three, to get the company on another trajectory like it enjoyed for the last decade before 2022:

- Stop the current blood loss

- Regain an innovative edge in the business product, not the user product

- Find a new non-ad product revenue stream

Stopping The Bleeding In Revenue Growth

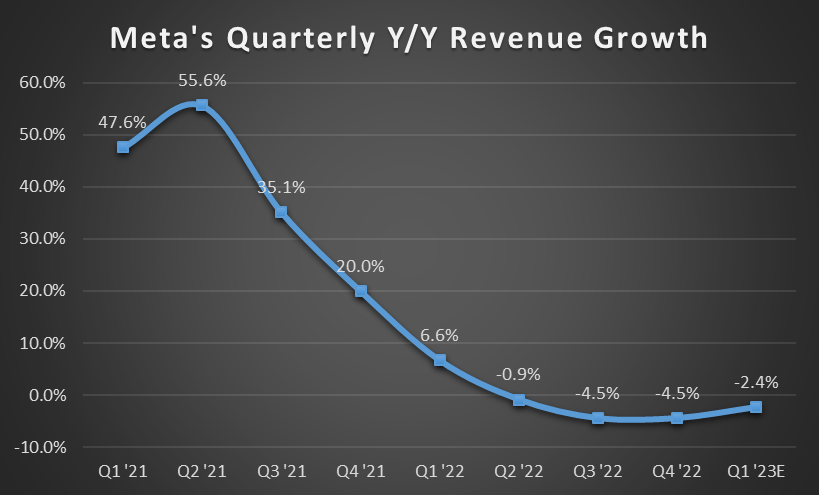

In my Q4 earnings analysis, I used the following chart to show the revenue growth bottom was already forming.

Chart mine, data from Seeking Alpha

I would like to see an outperformance of my -2.4% estimate in the report (which was created a week after earnings). And this is likely, as estimates have moved upward heading into the report to -0.94%. So the trend throughout this quarter has been positive. It’d only take a beat of $270M for revenue to be even year-over-year. This isn’t unlikely, considering the company had a $475M beat in Q4.

But the ad market must firm after last year’s considerable headwinds for this to happen. Headwinds like the hangover from the pandemic, ongoing iOS signal loss, and the growing concern of a slowing or recessionary economy. And, so far, signs of the online ad industry in 2023 maintaining growth – albeit less than 2022 – are still there.

An article from a few weeks ago in the Wall Street Journal detailed some differences between 2023 and prior recession-prone eras and why 2023 will remain positive.

The organic drivers that boosted the ad market in 2021 and the first half of 2022 are still around and mitigating the impact of stressful economic signals.

The reasons why are quite interesting but not surprising. Since the economy has seen pockets of rolling strength throughout the post-pandemic years, there’s always an area on the rebound.

The automotive industry in 2022 suffered from economic concerns, inflation and supply constraints due to production disruptions. That has led to a pent-up demand that could cause auto marketing to grow this year, Mr. Létang said.

Magna said car sales will grow by 10% in 2023, leading to a 10% to 15% increase in advertising spending by car dealers and car brands.

While automotive is but one of many industries requiring marketing to survive and thrive, these already-beaten-down industries are on the rebound while other industries tread water. But if 2023 is set to grow across the board for online advertising, and because Meta is the bellwether for the industry, it may be slightly ahead with the many AI changes it has and continues to implement.

Which is a key point to 2023’s outlook and leads into my second item.

Regain An Innovative Edge

Meta has been a pioneer in ad tech innovation over the last decade. It’s just that the era of post-iOS privacy changes and an unstable economy has come off-cycle for its innovation. Where it had been working on new user products, its new ad products were still getting off the ground. The situation has shifted the focus back to the business side to innovate and prioritize. And while Meta dragged its feet on this during 2022, thinking it was still in the product innovation cycle (i.e., the metaverse), the macro changes forced it to course correct to the actual need.

I want to hear this more than anything on its Q1 earnings call.

It should sound like the priorities are straight and doubling down on AI-driven ad product innovation for growth. No going back to “Oh well, the metaverse needs…” No, there will be a time to switch back to innovating the user product, but 2023 and most of 2024 will require ad product improvement and execution.

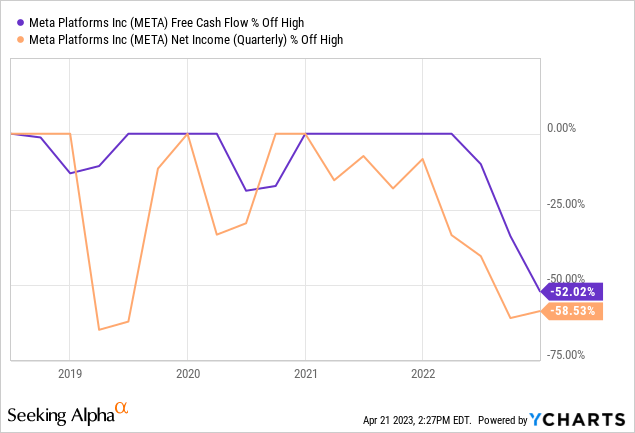

And the company needs to further detail the plan for the rest of 2023 to get investors back in the fight to show it can return to earnings and free cash flow growth.

These metrics are important in showing the market the company can lean itself out and drive innovation, where only the latter has been executed well over the last decade. But now, with workforce cuts nearing the end, it’s time to drive the financials with a lighter ship and gain more leverage than it had prior.

New Non-Ad Revenue Sources

I wouldn’t mind hearing more about products and services outside the advertising realm, even if they are still further down the road. For example, Snap (SNAP) has done a great job finding traction with its Snapchat+ subscription surpassing 3M subscribers.

Meta needs a path forward to a revenue stream outside advertising while being less costly and investment intensive than the metaverse. Will Meta Verified be the answer? I’m not so sure. But there aren’t too many more speed bumps going to be afforded to the company with its advertising business. The last two years have indicated there needs to be another workhorse driving the company’s growth – at least alongside advertising – so it doesn’t upend growth.

This is a pretty straightforward ask, and there’s nothing profound about it, either.

Final Thoughts Ahead Of The Report

Overall, management straightened its cart out on Q4’s earnings call. But now it’s time to fine-tune the year and set course on what’s being done in the innovation and revenue generation departments. With restructuring largely behind it, the focus must be on improving its ability to operate leaner and with higher AI intensity.

Guidance for revenue growth and milestones for ad product development, along with bringing in timelines for ad inventory ramping, is at the top of the list. Maintaining expense discipline and investments until revenue and free cash flow get their footing is a close second. If the earnings call doesn’t include these and is weak, it may set the stage for a lousy 2023.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, SNAP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Decrypt The Cash In Tech With Tech Cache

Do two things to further your tech portfolio. First, click the ‘Follow’ button below next to my name. Second, become one of my subscribers risk-free with a free trial, where you’ll be able to hear my thoughts as events unfold instead of reading my public articles weeks later only containing a subset of information. In fact, I provide four times more content (earnings, best ideas, trades, etc.) each month than what you read for free here. Plus, you’ll get ongoing discussions among intelligent investors and traders in my chat room.