Summary:

- AbbVie Inc. reports Q1 2023 earnings on 4/27/2023.

- AbbVie has warned investors of several expected short-term headwinds.

- ABBV is a top pick dividend income stock for investors over the long term.

Lemon_tm

I have been a longtime AbbVie investor, bull and analyst. My most recent AbbVie Inc. (NYSE:ABBV) article was 01/2023’s “Abbott And AbbVie: 10 Years Of Blue Chip Outperformance, More To Come.”

In this article I review key factors driving expectations for AbbVie’s upcoming Q1, 2023 earnings.

On 04/27/2023 AbbVie reports earnings for Q1 of its 11th year as a separate company

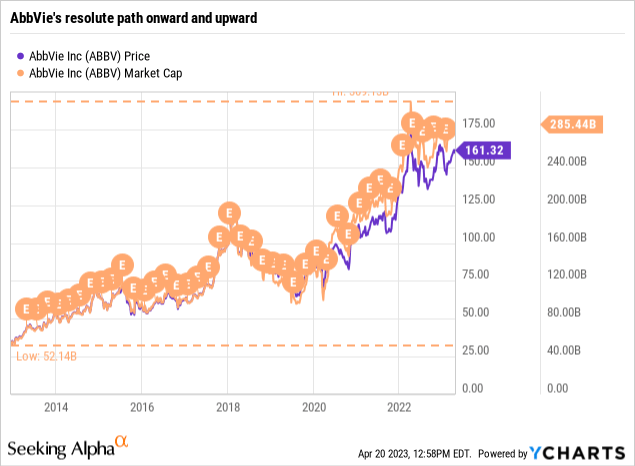

AbbVie reports its Q1, 2023 earnings on 04/27/2023 (premarket) as it embarks on the 11th year following its 01/2013 spinoff from Abbott Laboratories (ABT). The chart below shows AbbVie’s performance from its inception as a standalone company following its 01/2013 spinoff from Abbott:

Yes, the chart is too crowded to pick out discrete events. However it does convey one important message. AbbVie has weathered every storm it has encountered from its inception. Its share price and its market cap have oscillated but even as they do so they have steadfastly corrected to a positive direction — upwards and to the right.

Its initial market cap in 01/2013 was ~$52.14 billion. As I write on 04/23/2023, it boasts a market cap of >$285 billion. Investors who joined AbbVie at the beginning and who have held tight have scored a 5-bagger. They have also enjoyed top dividends as I discuss bellow.

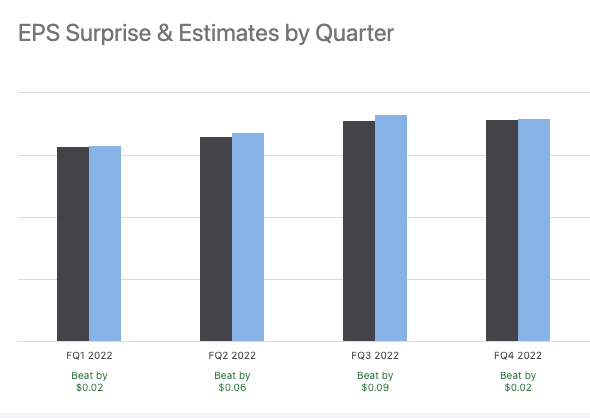

AbbVie has slightly beat consensus earnings each of its last 4 quarters as shown by the chart below:

seekingalpha.com

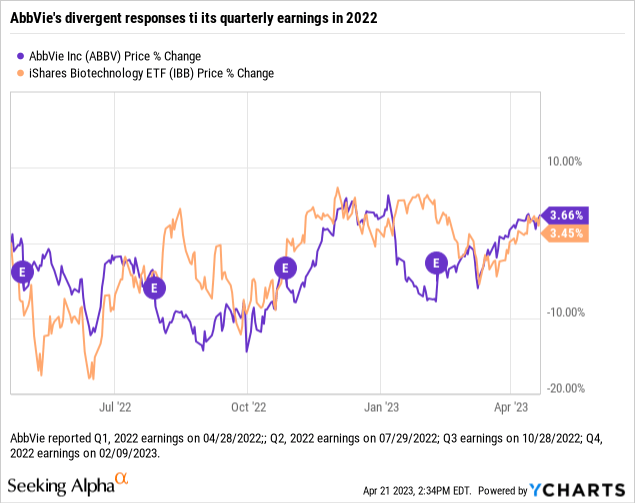

A more focused chart showing AbbVie’s share performance following its quarterly earnings reports for 2022 shows no discernible post-earnings pattern:

I would submit that AbbVie’s quarterly reports are hostage to the major question that has riveted attention of all AbbVie watchers since its inception as a separate company.

Impact of the following short term headwinds will affect AbbVie’s upcoming earnings

Humira’s rate of erosion

Humira’s huge long term success since its FDA approval in 2002 ultimately lead to AbbVie’s spinoff from Abbott. It has generated increasing revenues year after year. Initially, growing U.S. revenues shielded AbbVie as European revenues fell off more than expected under Humira biosimilar competition back in 2019.

Unfortunately 2023, the year of first Humira U.S. biosimilar exposure has been overhanging AbbVie as a threat to its major long term growth driver. AbbVie’s upcoming earnings provide a first glimpse at how severe this process will be. Expect it to be severe over the entire 2023 and 2024 period.

During AbbVie’s Q4 2022 earnings call (the “Call“), CEO Gonzalez set its Humira erosion expectations as:

…we expected headwind from direct biosimilar competition with U.S. HUMIRA sales down approximately 37% which is at the lower end of our previous erosion projection of 35% to 55%…

Vice Chairman & President Michael further articulated the situation in response to a question as to the expected cadence of Humira erosion in 2023. He advised that AbbVie expected 27% Humira erosion for Q1, 2023. Greater erosion will follow as the year goes forward.

During Q1, 2022, AbbVie’s Humira sales were ~$4 billion. An erosion of 27% would reflect expected Humira sales for Q1, 2023 of ~$2.88 billion. The bigger blow to Humira is not likely to hit until the second half of the year when more, possibly an aggregate of ten biosimilars, start pecking away at AbbVie’s mighty Humira franchise which is approved in 12 indications.

SKYRIZI and RINVOQ performance

As Humira fades, AbbVie is counting on its two new immunology stalwarts SKYRIZI and RINVOQ to take up some of the slack. In the Call it has these two pegged at aggregate 2023 revenues of $11.1 billion reflecting growth of 45%.

As I write on 04/23/2023, SKYRIZI is FDA approved in three indications, RINVOQ in seven. According to AbbVie’s 2022 10-K (the “10-K”), SKYRIZI netted 2022 revenues of ~$5.165 billion. This reflected a 78% increase:

… primarily driven by continued strong volume and market share uptake since launch as a treatment for plaque psoriasis as well as market growth. Net revenues were also favorably impacted by recent regulatory approvals and expansion of Skyrizi for the treatment of psoriatic arthritis and Crohn’s disease.

As for RINVOQ, its 2022 revenues aggregated ~$2.522 billion. This reflected a 58% increase for 2022:

…primarily driven by continued strong volume and market share uptake since launch for the treatment of moderate to severe rheumatoid arthritis [RA] as well as market growth. Net revenues were also favorably impacted by recent regulatory approvals and expansion of Rinvoq for the treatment of psoriatic arthritis, atopic dermatitis, ankylosing spondylitis, ulcerative colitis and non-radiographic axial spondyloarthritis.

With a full quarter of maturing revenues in RA plus its five more recently approved indications, I will be looking for enhanced growth from RINVOQ to play a starring role in Q1.

Aesthetics

Aesthetics’ ~$5.332 billion represents a relatively small <10% share of AbbVie’s overall $~58 billion in 2022 revenues. Nonetheless AbbVie sees it as an attractive market with exceptional long term growth potential. It has been disappointing for diverse reasons including:

- shuttering of its attractive aesthetics initiatives in Russia and Belarus over the conflict in Ukraine;

- COVID-19 restrictions in China; this is an area which could see favorable impact in Q1, 2023 with any lifting of COVID-19 restrictions, although the nature and extent of China’s COVID restrictions is highly uncertain;

- economic pressures, primarily in the US, impacting consumer discretionary spending and increased pricing promotions to support the market for discretionary aesthetics procedures and body contouring using toxins and fillers.

Miscellaneous puts and takes

In addition to the issues discussed above in providing his 2023 guidance, CEO Gonzalez called out the following:

- challenging market and share dynamics impacting IMBLUVICA —2022 revenues of ~$4.568 billion down from ~$5.408 billion in 2021;

- partially offset by strong sales growth of venetoclax;

- double-digit revenue growth of neuroscience including accelerating sales of Vraylar with recent MDD approval.

Despite headwinds, AbbVie is a long-term proven performer and should recover strongly after any downdraft

AbbVie is not a bargain at its current (04/23/2023) share price of $162.41. The three ratings covered by Seeking Alpha on its ratings panel show Seeking Alpha Analysts and its Quant system with Hold ratings.

Only Wall Street Analysts have it as buy. Their consensus price target is $164.80 reflecting an upside of a measly 1.47%. Given this near-unanimity of opinion, it is fair to consider AbbVie as fully valued.

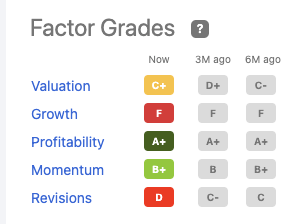

AbbVie’s Quant factor grade on 04/23/2023 below puts it on par with Seeking Alpha’s Big Pharma Stock group.

seekingalpha.com

AbbVie’s quant factor grades are remarkably similar to those of the six companies making up Seeking Alpha’s Big Pharma Stock group (the “Group”). All but Pfizer (PFE) have valuation grades equal to or worse than AbbVie’s C+. All but Eli Lilly (LLY) with its C and Merck (MRK) with its D-, have F’s for growth. All six match AbbVie’s A+ for profitability.

Such is the curse of Big Pharma, high profits, little growth. AbbVie offers its shareholders a sweetener. It pays a 3.49% dividend which has been growing for as long as it has been a separate company. Of the 6 in the Group, AbbVie is the highest yielding save Pfizer which yields 4.08%.

Conclusion

With earnings to be on tap later this week, AbbVie Inc. will likely draw attention primarily for updates on the headwinds it faces. I am sanguine about its report on Humira revenues during Q1, 2023. As for the balance of matters it will be reporting, I expect pluses and minuses with the pluses outstripping the minuses.

As for its stock’s reaction to earnings, I consider that a wildcard. If AbbVie Inc. were to go up, it might make a tempting case for lightening one’s position.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABT, ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I muy buy or sell interests in any company mentioned over the next 72 hours.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.