Summary:

- Roku stock remains nearly 25% below its February highs as the company prepares to report first-quarter earnings on April 26.

- Investors are likely not expecting the company to outperform Wall Street estimates significantly.

- Improvement in ROKU’s valuation likely depends on how well the company can continue its growth momentum in global markets, which is still nascent.

- The risk/reward in ROKU at the current levels doesn’t suggest a highly attractive opportunity.

Justin Sullivan

Roku, Inc. (NASDAQ:ROKU) will report its FQ1’23 earnings release on April 26. ROKU’s momentum has been locked in a tight trading range since our previous update in March, as the company was caught in the Silicon Valley Bank, or SVB, (OTC:SIVBQ) debacle.

As a reminder, the company held nearly 26% of its cash holdings in SVB before the collapse. While we expect some pointed questions from analysts on the upcoming call, the issue is no longer a threat since SVB’s depositors received the guarantee on uninsured deposits last month.

With that in mind, investors’ focus will likely turn to the company’s ability to continue improving its operating leverage, which is critical to justify an upward re-rating in the stock.

We have kept a Hold rating on ROKU since February. ROKU buyers have since failed to recover its February highs ($77 level) as the bull trap or false upside breakout saw sellers swamping in to dismantle the surge in upward momentum.

Accordingly, ROKU remains nearly 25% below February highs. As such, market operators are likely not expecting the company to deliver a significant outperformance at its upcoming release.

According to the revised consensus estimates, Roku is projected to post $707.5M in revenue for FQ1 (above Roku’s guidance of $700M), down 3.6% YoY. However, its adjusted EBITDA is expected to remain firmly in the red at -$104.5M, which is also above the company’s -$110M guidance.

As such, analysts have penciled in a higher bar for the company to cross, which sets up a higher potential for disappointment if Roku fails to deliver.

Notwithstanding, Roku initiated recent actions to rein in its cost base to control spending. The company is restructuring to “reduce operating expenses and prioritize high ROI projects.”

As such, 6% of its workforce was impacted by its restructuring plans, resulting in non-recurring charges of about $32.5M (midpoint). These charges are expected to be incurred mostly in Q1 and Q2.

As such, we believe the recent optimism by analysts likely point to a potential inflection in its profitability trajectory through FY24.

Roku is the US market leader as “penetration is over 50% of broadband households.” As such, international expansion remains critical for the company to broaden its growth drivers to justify its valuation.

Morningstar analysts highlighted that their 14% revenue CAGR estimate over the next five years is predicated on Roku “expanding into international markets via its own players and smart TVs as well as cobranded smart TVs.”

As such, investors must assess the company’s growth cadence in global markets, which remains nascent.

Trefis’ sum-of-the-parts or SOTP estimates suggest that the company is expected to post 99M in active accounts by 2027. We assessed that the estimates are likely not aggressive, indicating a 5.2% CAGR from FY22-27.

Roku posted a 16.5% YoY growth in active accounts for FQ4’22. As such, investors will need to prepare for a further slowdown in active accounts growth moving ahead, even as Roku expands globally.

Furthermore, the company must demonstrate that its Platform gross margins have bottomed out in FQ4’22 at 56.5%. With Platform’s SOTP estimates accounting for nearly 86% of Roku’s fair valuation, Roku’s ability to recover its monetization will be critical.

The company highlighted interesting initiatives for advertisers for the annual upfront season. Accordingly, Roku offers “a prime-time reach guarantee” as it banks on its ability to reach out to more households to attract more ad spending.

We expect the company to discuss the recent initiative in greater detail with analysts at the upcoming call, helping lay the groundwork for its improvement in monetization.

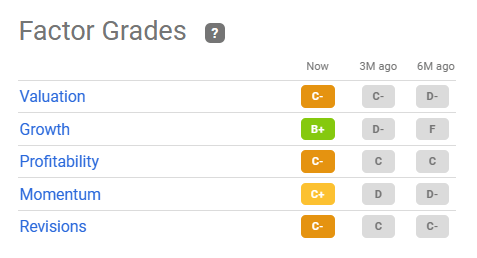

ROKU quant factor ratings (Seeking Alpha)

ROKU’s valuation has improved markedly from six months ago and seems to be in the neutral zone (C-), as rated by Seeking Alpha Quant.

Therefore, the main hurdle to improving buying sentiments is still likely centered on its profitability recovery (C-).

We also didn’t observe a highly attractive opportunity from ROKU’s price action, suggesting investors should jump on board now.

As such, we assessed that it’s appropriate for investors who didn’t capitalize on its late December lows to remain on the sidelines, as market sentiments don’t currently favor a highly attractive risk/reward opportunity.

Rating: Hold (Reiterated).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ROKU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!