Summary:

- 3M reported first quarter earnings, which were down year over year but beat analyst expectations.

- The company reiterated 2023 guidance and announced a new restructuring plan.

- However, we think MMM still has more to prove to investors at this point.

jetcityimage

Background

Conglomerates may no longer hold the same favor among investors that they once did, but 3M (NYSE:MMM) refuses to go quietly into the night. On Tuesday morning, the company delivered its first quarter 2023 results, which handily beat analyst estimates. The company reported revenue for the first quarter of $7.7 billion, which was down almost 10% year over year (more on that later) but was above average analyst estimates by $190 million.

The stock moved modestly on the news, opening slightly higher. Today, we’ll go over the earnings report and what we think contributes to our longer-term thesis on 3M (which you can read here).

3M Company Overview

Of course, EPS and revenue beat over expectations don’t feel as good for investors when the overall result is negative year over year. So what happened?

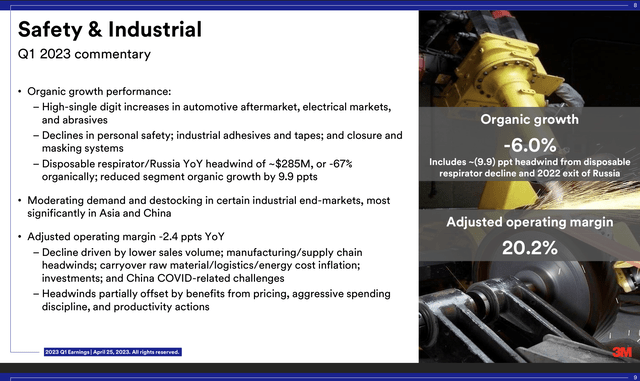

A quick overview for readers, 3M is comprised of four divisions: Safety & Industrial, Transportation & Electronics, Health Care, and Consumer. The largest division is Safety & Industrial, which produced $2.7 billion of revenue in the first quarter. Transportation & Electronics, Health Care, and Consumer generated $2.05 billion, $2.01 billion, and $1.19 billion, respectively.

Each of the segments experienced fairly significant headwinds, but for many of them the year-over-year reporting performance by segment was impacted by discontinuation of the company’s Russian operations (investors should, in our opinion, reasonably expect that this is the last quarter in which that excuse from management teams will hold water), experiencing a total organic growth decline of 6%. We point out that the company, disappointingly, does not break out what percentage of the $285 million headwind was from Russia and what was attributable to the decline in disposable respirator sales.

Further, the 6% decline is unfortunately not currency-adjusted. In the company’s press release, the currency-translated year-over-year decline was 8.9%.

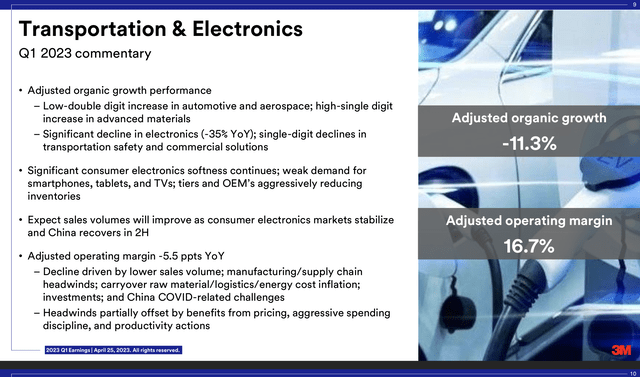

On this basis, the worst-performing segment for the quarter was the company’s Transportation & Electronics division. Declining demand for electronics is a near-term secular trend as consumers hold back on making purchases or extending the life of their existing devices, but a 35% decline in the electronics sub-segment still seems shockingly high.

The company reported adjusted organic growth in the segment of negative 11.3%, but this also doesn’t appear to reflect the full currency translation of the decline, since the press release denotes the total sales decline for Transportation & Electronics at negative 12.4%.

Looking Ahead

While the company put its best face on for first quarter earnings, it was at least good to hear the company reiterate its guidance for 2023. 3M still expects that 2023 will bring a decline in overall revenues in 2022 in the neighborhood of 2-6% and that it will deliver EPS for the year in the range of $8.50-$9.00.

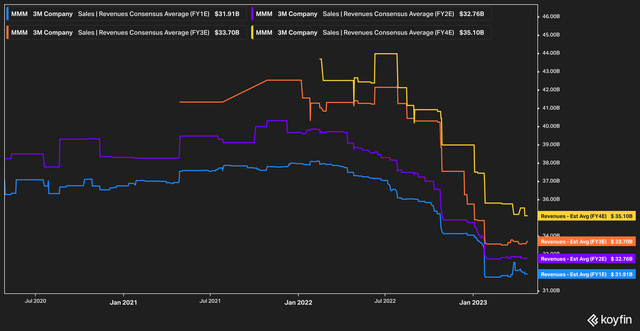

Analysts, for their part, seem to agree that business is no longer in decline, but is likely to level off here.

While analysts have been dropping their revenue forecasts for 3M with fair regularity since early 2022, they have recently leveled off, which is tentatively optimistic for investors (not as good, of course, as a revision upward, but always good to forecast a slowdown of the bleeding).

Restructuring

Arguably the biggest news – and the most positive sign that management is looking to take meaningful action against these macro headwinds is the announcement of strategic restructuring that was part of the first quarter press release. This, as investors likely expected, included a rather significant amount of layoffs.

In January 2023, the company announced that it was looking to eliminate 2,500 positions. The new restructuring plan looks to reduce headcount by a further 6,000, for a total reduction of 8,500, which is just under 10% of the company’s reported headcount.

These changes will largely come in the form of reducing physical footprints as well as consolidating and eliminating layers of management. CEO Mike Roman noted in the conference call that the company would streamline its division model by combining two business units within Transportation & Electronics, which should streamline reporting and reduce costs.

At a high level, Roman noted that “We will reduce costs at the corporate center by eliminating management layers across the company. We are broadly reducing our corporate shared services like our central design group. We are reducing rooftops worldwide, including exiting our conference center in Northern Minnesota.”

The company estimates that these changes will create annual pre-tax savings of $700-$900 million dollars annually. We think that this is certainly a move in the right direction for the company. As a legacy conglomerate, it is highly likely that there is quite a bit of corporate fat to cut. However, we retain a degree of skepticism about how impactful these reductions can be, and we will want to see how the company reports on the progress of the restructuring in the coming quarters. After all, even plans executed with the best of intentions can sometimes go awry.

The Bottom Line

While we think this quarter’s earnings were a positive sign that the company is moving in the right direction (evidenced by its revenue and EPS beat, as well as a reiteration of 2023 guidance), there are still plenty of items looming over the company.

It’s unclear at this time whether 3M’s proposed restructuring will be as effective as management hopes. Further, the high-profile earplug and PFAS litigation got short shrift on the call. While cost-cutting is good, investors will rightly be jittery about these lawsuits. Today, we reiterate our belief that for long-term investors, 3M is a hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Factual errors may exist and will be corrected if identified. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal, and readers should not utilize anything in our research as a sole decision point for transacting in any security for any reason.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.