Summary:

- I sold my Salesforce shares in January at an 8% loss after being disappointed for a lack of cost discipline, bad M&A and dilution.

- Several activist investors made management initiate a turnaround.

- The promises look great and address all my previous pain points.

- Salesforce now needs to follow its words with actions over the next quarters.

Sundry Photography

Turnarounds seldom turn

Warren Buffett

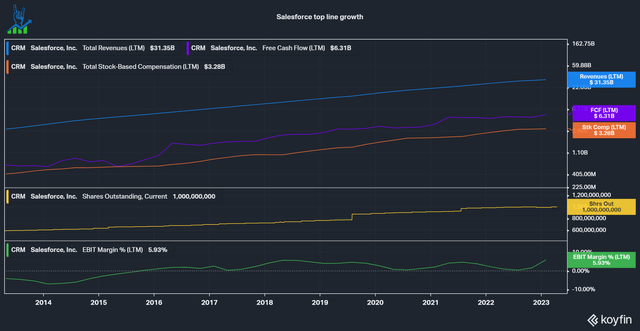

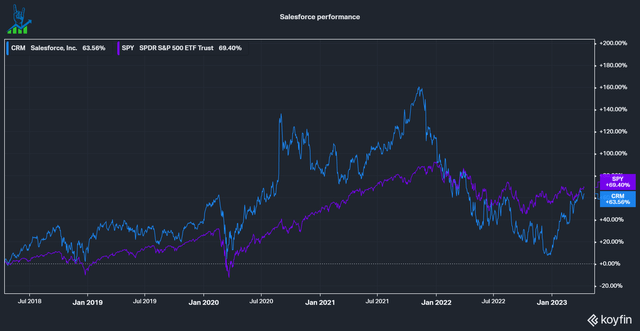

Salesforce (NYSE:CRM) is the Customer Relationship Management software leader and has struggled since the Bull Run ended. Shares fell over 55% in their trough but have since recovered to roughly match the S&P 500 return over the last five years. The company has gone from a wall street favorite to a fallen angel within a short period as the market changed its focus from top-line revenue growth to profitability. Although turnarounds seldom turn, Salesforce is progressing greatly toward a new, profitable version of itself.

Salesforce stock performance (Koyfin)

My personal Sale of Salesforce

I was a Salesforce shareholder from 2020 until January 2023, when I sold my shares at $155 (8% loss). I was increasingly getting frustrated with the lack of profitability, large questionable acquisitions that didn’t seem to work out too well and the high dilution. Salesforce was one of my older investments from my early investing phase and I grew attached to it. Finally, I decided to sell out because, as the saying goes:

Turnarounds seldom turn

But oh boy, does it look like Salesforce is making a turnaround.

The problems

Salesforce has been a tremendous growth engine over the last decade, growing revenues and cash flows tenfold. The company has produced steady cash flows with around a 20% Free Cash Flow margin but with little regard to GAAP profitability. The EBIT margin has been fluctuating between -5 and +5%. The most significant difference between the two metrics is the stock-based compensation expenses, which are an expense in GAAP earnings but are added back to traditional Free Cash Flows. This significant dilution made the share count almost double in the same period. As investors got increasingly worried about the insane amounts of stock-based compensation in many fast-growing tech companies and the lack of profitability if one was to exclude them, Salesforce was among the first in the firing line. We must remember that a part of this dilution was also used for M&A: Salesforce spent over $27 billion in cash. There were also some scandals about celebrities getting extensive checks to be “strategic advisors” for Salesforce, which I’d consider a red flag.

Around the end of 2022, Salesforce saw considerable attrition in its executive team, including Co-CEO Bret Taylor, the CEO of Tableau, the CEO, CPO and SVP of Marketing for Slack, all leaving within a short period. This led to questions because only shortly before, the company announced a pivot towards profitability and to offset dilution with share buybacks. Salesforce appeared like a ship without a captain and everybody was abandoning the ship. Soon after, activist investors started to buy large positions in Salesforce. Amongst the activists are Third Point, Inclusive Capital, Elliott Management, Strive Asset Management, ValueAct and Starboard Value. Activists don’t always improve the situation; they are often just in it for a short-term trade. Let’s see what the activists have managed to do so far.

Changes at Salesforce

In the Q4 23 earnings call, CEO and founder Marc Benioff started with a strong quote to cement the new focus Salesforce has, a sharp pivot from its previous history:

Improving profitability is our highest priority, and that really showed up this quarter. Our goal is to make Salesforce the largest and most profitable software company in the world, and that is what we are doing.

He also outlined four fronts for the transformation:

- Reignite performance culture and improve productivity.

- Cost control and focus on operational excellence and automation.

- Integration of prior acquisitions and focus on the core product portfolio.

- Disbanded the M&A committee and focused on margins.

This statement addressed my largest pain points with Salesforce: Lacking cost discipline/growth at all costs, questionable large acquisitions and high dilution. Additionally, Salesforce increased its Buyback program from $10 billion to $20 billion and sharply increased its expected profitability for FY 24 (Salesforce has a different Financial year cycle, so FY 24 equals calendar year 23). Salesforce is looking to develop from a heavy diluter to a net repurchaser of shares.

When Salesforce held its Investor Day in September 2022, I was disappointed about their disappointing guidance for margin improvements: 25%+ FY26 (Calendar year 25) Non-GAAP Operating Margin, inclusive of future M&A. In the prior quarter (Q3 23), the company had Non-GAAP operating margins of 22.7%, so not a big improvement projected at all two years out. For FY 24, Salesforce now guides a 27% Non-GAAP operating margin, already above its FY 26 forecast, and, most importantly, a decent GAAP Operating margin of 10.8%. This is a significant improvement, while they remain fast growing at an expected 15-16% FCF growth rate.

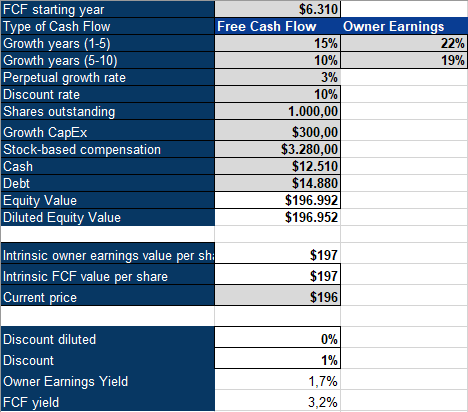

Pricing Salesforce

Pricing Salesforce remains tricky. The company will likely not dilute shareholders anymore, but we don’t know how aggressively they’ll repurchase shares. We also don’t know if they will manage to significantly reduce stock-based compensation or just offset it via buybacks. I did an inverse DCF calculation with Free Cash Flow and Owner Earnings. I define Owner Earnings as FCF + Growth CapEx – Stock based compensation. We can see that Salesforce still looks pricey, given the trailing 12-month numbers. The company expects 15-16% FCF growth, but Owner Earnings suggest we need 22% growth for the next five years, followed by 19% growth. The big variable here is stock-based compensation. If Salesforce can rear that back in, we can have a powerful lever for owner earnings. Overall the company looks fairly priced right now. In retrospect, I sold my shares around two months before they showed clear signs of a turnaround. However, I do not regret my sale; turnarounds seldom turn, but this could be one of those rare occurrences where it turns. So far, we have a lot of promises that need to be followed by actions. I will give Salesforce a cautious buy rating and investors need to keep a close watch if the actions speak as loud as Benioff’s words over the next quarters.

Salesforce Inverse DCF (Author’s Model)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is not financial advise.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.