Summary:

- Those that are newer to energy tend to invest in the majors due to diversified revenue streams and a proven operating history.

- Exxon Mobil stands basically alone in its approach to hydrocarbon development over the next decade – this is a positive rather than a negative in my view.

- Shareholder returns are set to grow, bridging the valuation gap. The company looks cheap on a discounted cash flow basis. It’s worth a buy for those that are risk averse.

CHUNYIP WONG

The energy landscape continues to change, with continued pressure from governments worldwide to cut emissions flying in the face of the reality of the energy transition: moving away from fossil fuels will be neither cheap nor quick. Oil and gas companies find themselves in a challenging position, trying to supply the world with its needs while navigating changing regulations and a deeply negative public that views them as the bad guy.

There is a Japanese proverb that translates as “the nail that sticks out gets hammered down”. The supermajors make compelling targets for both lawsuits and political vitriol because they are both well-known and have assets to go after. In response, majors have acquiesced to demands nearly universally. Net zero by 2050 (or better) targets have been put in place, production estimates have been cut, and capital expenditures continue to shift towards renewables that have had mixed returns on invested capital at best.

Enter Exxon Mobil

There is one exception: Exxon Mobil (NYSE:XOM). In contrast to its peers, Exxon Mobil has been pursuing a differentiated strategy compared to other supermajor oil companies by prioritizing production growth rather than simply keeping production flat. At the end of last year, management put out a Progress Report on its 2019 – 2027 Investor Strategy Outline, marking almost the halfway point. It got a lot of flak for that strategy during the pandemic downturn, with the company sticking to what ended up being counter cyclical investment: it continued to invest heavily in growth even at the bottom of a commodity cycle.

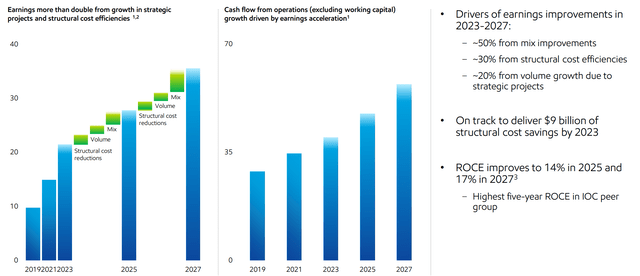

In its communications to Wall Street banks and myself over the several months, senior leadership remains committed to what was the main anchor of that Investor Strategy pitch: a doubling of corporate cash flow by 2027 that is grounded in both growth and driving efficiencies across its businesses. And while that growth is grounded across all of its segment lines including petrochemicals and refining, more than half of that cash flow growth is going to come from upstream production growth. In other words, more oil and gas production.

There is even a growing sense that upstream targets might be a layup. Even with the impact of its exit of its Russian businesses, there has been significant positive project news out of its major projects. Guyana has had nothing but positive news year after year. Exxon Mobil has embedded expectations of below 900,000 barrels of energy per day (“boepd”) in production out of Guyana by 2027, but current pacing suggests installed floating production storage and offloading (“FPSO”) pro rata capacity of 1,200,000 boepd by then given the pace of one FPSO put in place per year. That excludes backfill opportunities.

On the liquefied natural gas (“LNG”) side, Golden Pass will have three trains online by 2024, giving it more leverage to global gas benchmarks in Asia and Europe. Options beyond 2027 include Papua LNG, the Rovuma Basin, and perhaps a return to considering development at Mozambique. Domestically, the Permian continues to see strength, with Exxon Mobil continuing to add rigs and planning further development. Contrary to other producers like Pioneer Natural Resources (PXD) or Occidental Petroleum (OXY) that have seen declining well results in 2022 and in 2023 versus older vintages, Exxon Mobil has not seen the same kind of declines which could indicate a bit better acreage quality.

What Guyana and the Permian have in common is that they sit lower on the cost curve than other existing legacy production pathways at Exxon Mobil. As production grows over the next several years, marginal production costs per barrel will decline. Guidance has learned towards overall portfolio breakeven sliding closer to $30.00 per barrel even given with the current inflationary environment, down from $40.00 per barrel right now.

Exxon Has Everything

Generally, investors have to give up something when picking companies to put their money behind. Compromise is everywhere in the markets, but I think Exxon has an unusual setup: growth, defensive, and a penchant for returning excess capital to shareholders. That combination is pretty darn rare.

- Growth. Despite the challenges faced by the energy industry, Exxon Mobil has been steadfast in its pursuit of production growth. The company’s differentiated strategy of prioritizing production growth over maintaining flat production sets it apart from its peers and positions it to benefit from potential unexpected increases in oil and gas demand in the future. Its focus on expanding its production capacity, particularly in high margin projects, lays the foundation of earnings growth over the next several years.

- Defensive in Nature. While not touched on here, Exxon operations span multiple geographies and segments of the energy value chain. That’s one of the value propositions for majors in the first place: less earnings volatility. valuable provides it with a defensive position in the face of market volatility. Holding upstream exploration and production, downstream refining and marketing, and chemicals manufacturing mitigates risks associated with fluctuations in oil and gas prices and regional demand patterns. The cherry on top is Exxon Mobil’s long-standing presence in the industry, extensive infrastructure, and established customer relationships.

- Strong Shareholder Returns. Exxon Mobil has established a proven track record of delivering strong shareholder returns through a combination of dividends and share repurchases. I expect dividends to grow alongside expanding cash flows, bolstered alongside a sector-leading buyback program which has helped lower share count and thus its nominal dividend obligations. Exxon has been actively repurchasing its shares to return value to shareholders. The company’s commitment to shareholder returns is supported by its strong cash flow generation, which provides it with the ability to maintain its dividend payments and undertake share buybacks.

Now, Exxon does trade more expensively compared to peers – particularly those across the pond. Investors are paying for these traits. That said, I think the gap between Exxon and its peers is less than it might appear given the growth outlook. All else equal, the gap is much tighter a few years down the line as peers see stagnant earnings and Exxon continues to bolster cash flow. As always appears to be the case in energy, investors tend to be cash flow seeking: they want to see dividends and meaningful share count retirements. That is what drives perception of value – not theoretical numbers. European majors are a great example. All of its European peers (e.g., Shell (SHEL), BP (BP), others) have underperformed significantly since their respective dividend cuts despite no real meaningful change in operating free cash flow.

Takeaways

In conclusion, Exxon Mobil Corporation is operating a differentiated strategy compared to other supermajor oil companies by focusing on production growth and capturing market share. The company’s goal to double cash flow by 2027 looks more than attainable, and combined with its innate characteristics of growth, defensive nature, and strong shareholder returns, the stock is an attractive investment option for investors seeking exposure to the energy sector.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are you an investor looking for quality research within the oil and gas industry? Energy Investing Authority is the source. While commodity prices are up and so too are shareholder dividends, it can be easy to chase yield and buy the wrong firms. Income investors cannot afford those mistakes.

Deep dive analysis forms the foundation of the platform. Hundreds of companies fall under the coverage universe, from pipelines to renewables to producers. Receive actionable research to keep your portfolio outperforming benchmarks – the EIA portfolio has done so five out of the past six years.

Sign up for a NO OBLIGATION FREE TRIAL today!