Summary:

- AT&T has seen its share price drop substantially, a gift to investors looking for long-term investments.

- The company is continuing to pay a dividend of more than 6% so that it can continue growing. We’d like to see the company start buying back shares.

- The company’s debt is manageable and short-term non-sticky investors can disappear, enabling stronger long-term returns.

Brandon Bell

AT&T (NYSE:T) had its worst day in years on the back of its earnings. The company has a $125 billion market capitalization and dropped almost 10%. However, it’s still up more than 20% above its mid-October lows. As we’ll see throughout this article, despite the company’s tough earnings, it has the ability to continue driving shareholder returns.

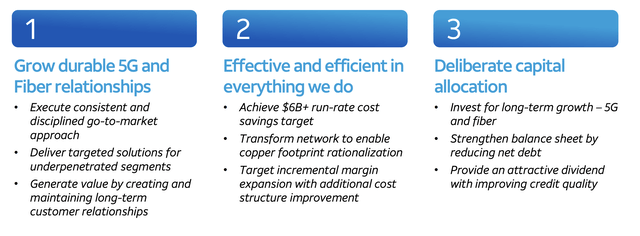

AT&T 2023 Business Goals

AT&T is continuing to move forward on its variety of business goals to drive continued returns.

The company’s core businesses are 5G and fiber. The company spent massive capital on 5G, which should ramp down, while earnings should improve. The company expects to continue maintaining customer relationships, and it has achieved its $6 billion cost savings target. The company is continuing to invest its capital for long-term growth while reducing debt.

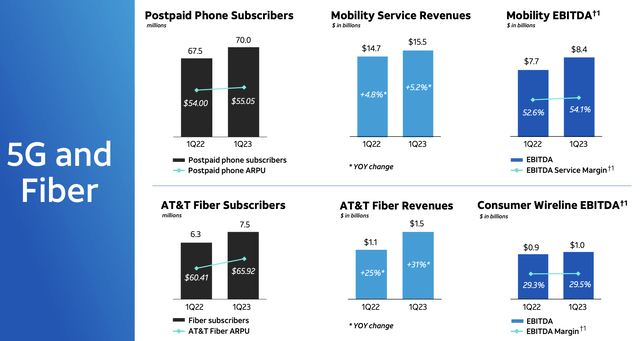

Here shows the performance of the company’s core businesses.

The company increased postpaid phone subscribers from 67.5 million to 70 million YoY with ARPU increased by 2% as well to $55. The company’s mobility service revenues increased by 5.2% YoY and it heavily translated to the company’s mobility EBITDA. The company’s margins went from 52.6% to 54.1%, increased profits on the bottom line.

More excitingly, the company’s fiber subscribers increased much faster. The company increased subscribers from 6.3 million to 7.5 million, with ARPU increased from $60.41 to $65.92. This resulted in a massive 31% YoY increase in fiber revenues enabling a 10% increase in EBITDA while margins have remained strong at just under 30%.

We expect the company’s fiber subscribers to continue increasing rapidly in future years. That will continue to lead to rapid revenue growth. The company’s new 2G and 5G offerings will enable revenue to increase even faster.

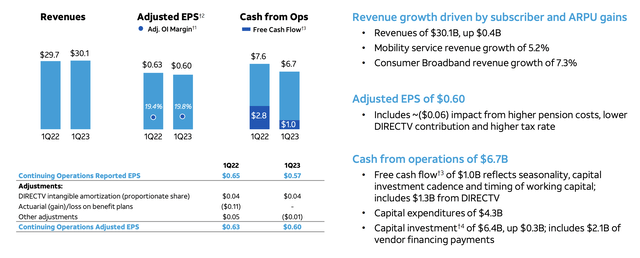

AT&T 1Q 2023 Financial Results

The company’s continued performance for its businesses has continued to help its financial results.

The company was punished by investors from weak FCF as it front-loaded investments and employee pay, but it’s continued to hold onto its guidance of $16 billion in FCF for the year. The company increased revenue slightly over YoY while EPS remained roughly constant. The company’s annualized EPS is roughly $2.4 which is a P/E of 7-8. That’s a high single-digit P/E that shows how strong its earnings.

The company continues to earn strong earnings from DirecTV. The company is continuing to invest heavily in its business, but its 1Q 2023 capital expenditure was also higher than guidance, resulting in the lower FCF. We expect the company to continue earning $16 billion in annualized FCF that can continue growing, showing its financial strength.

Valuation

Putting this all together, we look for what consists of a reasonable valuation for AT&T.

The core of the company’s valuation is FCF + FCF growth. The company earned $14 billion in 2022 FCF, is guiding for $16 billion in 2023 FCF, and $20 billion in long-term FCF. We’ll be punishing and assume no FCF growth after that point. It’s worth noting that we expect continued large investments into businesses such as fiber to make that statement false.

However, outside of that the company has roughly a $250 billion enterprise value and a $125 billion market cap. Even if the company did nothing besides paydown debt and maintain its dividend for the rest of the decade (7 years) it could generate 6% annualized returns from the dividend and repay $84 billion of debt.

That alone would take its FCF to $24 billion (saved interest) and in our view push the company’s market cap to $200 billion (saved debt) generating double-digit returns for the decade. Any growth etc. is cherry on the cake. The company’s valuation is strong versus peers (T-Mobile $13 billion FCF $180 billion market cap and Verizon $18 billion FCF $160 billion market cap).

AT&T has a tough history with the market, and if the company can keep its head down and fix it we expect strong returns.

Thesis Risk

The largest risk to our thesis is the company’s large scale operations and its ability to continue generating profits. The company can easily see large scale capital expenditures to remain competitive in the cellular markets. It also has a massive debt load that needs to be handled in a rising interest rate environment.

That could hurt the company’s ability to continue generating future shareholder returns.

Conclusion

AT&T was punished heavily by the market for the earnings. The company has a $125 billion market capitalization, with a more than 6% dividend yield, which costs it roughly $8 billion annualized. That’s ~50% of the company’s $16 billion expected annualized FCF. That’s a number that the company can comfortably afford and shows its double-digit FCF yield.

The company has $134 billion in net debt. The company is paying roughly $6 billion annualized in interest expenditures, showing the FCF improvements possible from paying down its debt. We’d like to see it get its debt down to roughly $50-60 billion, lowering risk in a higher interest rate environment, and enabling it to repurchase shares.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.