Summary:

- Alphabet announces a market-pleasing $70 Billion buyback program.

- Restricted Stock Units water down the impact of these buyback programs.

- Nonetheless, it at least reduces dilution, and the stock is the cheapest among the big names.

400tmax

Alphabet Inc. (NASDAQ:GOOG) reported its Q1 earnings after hours as Seeking Alpha has covered here. The company beat on EPS and revenue while addressing its focus on Artificial Intelligence and improving numbers on YouTube. But the focus of this article is on the $70 Billion buyback that was announced on the same report.

I reviewed Meta Platforms Inc’s. (META) buyback program here. Since Alphabet and Meta are similar in many ways including but not limited to the following points, I am using the same template to evaluate Alphabet’s buyback program:

- Both were part of the original FANG and later the FAANG

- Despite recent blues, both companies are still at the bleeding edge of technology and innovation

- And more importantly, both companies have Restricted Stock Units (“RSU”) as a heavy part of their employee compensation packages. Hence, any buyback announcement should be viewed with a great deal of skepticism.

Let us get into the details.

Potential impact of the latest buyback on EPS

- Total shares outstanding: 12.81 Billion

- Although shares have been under pressure with Microsoft Corporation (MSFT) breathing down on Google’s search dominance, let’s assume an average repurchase price of $125, which is almost 20% higher than the current market price.

- The company can retire about 560 Million shares if the entire $70 Billion is used. That is, $70 Billion divided by $125.

- Using FY 2023’s projected EPS of $5.07 and current shares outstanding (12.81 B), we can calculate 2023’s net income to be around $65 Billion.

- Now, if 560 Million shares are retired, 12.25 Billion shares will remain. That immediately bumps Alphabet’s FY 2023 EPS hypothetically to $5.30.

- That’s an EPS growth of about 4.50% as a direct result of this buyback. Not too shabby.

But Wait, Beware of These Pitfalls

While a near 5% jump in EPS without lifting the fingers on growth and operational side is great, there are some pitfalls to be mindful of.

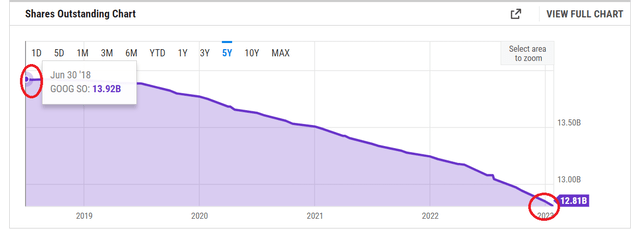

- First of all, the company may not actually end up spending the entire $70 Billion on buying shares within a reasonable time frame, say a year or so. Case in point, the share counts chart shown below, which shows only an 8% or 1.11 Billion reduction in five years. Notice the $70 Billion figure is good to retire about 560 Million shares at $125. The fact that only 1.11 Billion shares were reduced in 5 years suggests the buybacks likely never had a strict timeline (addressed below) and the buybacks were merely offsetting dilution (also addressed below).

- Despite the recent layoffs and the stock getting dinged in 2022, Alphabet is still a poster child of high-paying technology companies. I have no qualms about rewarding deserving employees with cash but as a shareholder, my problem is when a company issues new shares to reward employees under the still lucrative Restricted Stock Unit (“RSU”) program. In other words, I don’t have the same trust on Alphabet’s or Meta’s buyback programs actually retiring shares as I have with, say, Altria Group’s (MO) recently announced buyback program.

- As an example, Cisco Systems, Inc. (CSCO) spent $76.9-billion between September, 2001, and January, 2013, to buy back 3.8 billion shares. But the number of outstanding shares declined by just over half that amount, or 2 billion shares. No points for guessing where the other half went.

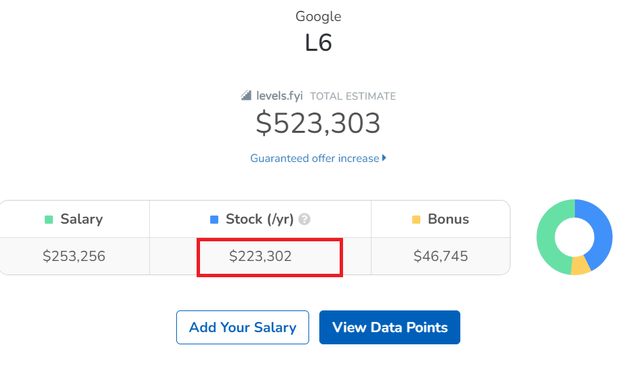

- Coming back to Alphabet, the company rewards its employees well and like any big organization has many levels of employees. Proliferation of websites like Levels.Fyi have not only leveled the playing field for employees and employers but also give investors valuable insights into the compensation packages of employees. I am using Level 6 at Alphabet as an example here because that is the middle of the pack. A typical mid career Software Engineer at Alphabet gets $224,000 in RSUs each year or roughly 1,800 shares. Multiply that by roughly 100,000 employees times 5 years. Add in the much higher RSUs granted to executives and you get the picture.

- In addition, I did not like the fact that the buyback does not have a specific timeframe, as mentioned below in the earnings report:

“On April 19, 2023, the Board of Directors of Alphabet authorized the company to repurchase up to an additional $70.0 billion of its Class A and Class C shares in a manner deemed in the best interest of the company and its stockholders, taking into account the economic cost and prevailing market conditions, including the relative trading prices and volumes of the Class A and Class C shares. The repurchases are expected to be executed from time to time, subject to general business and market conditions and other investment opportunities, through open market purchases or privately negotiated transactions, including through Rule 10b5-1 plans.”

- Lastly, timing is key with buybacks as well. There is a possibility that the buybacks are done at the wrong time and shares are retired at a higher price than what the market may deem it worth at a later date.

Goog Shares Outstanding (YCharts.com) Google L6 (Levels FYI)

Conclusion

I recommend reading this article about Google’s Q1 and the stock’s outlook but will leave you with my outlook for the stock below:

Trading at a forward multiple of 21 with an expected earnings growth rate of 16%/yr over the next five years, Alphabet is trading at Price-Earnings/Growth (“PEG”) of 1.31 and easily represents the best value among mega-cap tech stocks. As a comparison, Microsoft is trading at a PEG of 2.60 as we speak. While it may appear now like Microsoft is holding the upper hand due to its ChatGPT and Bing synergy, it is hard to make a case for it to trade at twice Alphabet’s valuation.

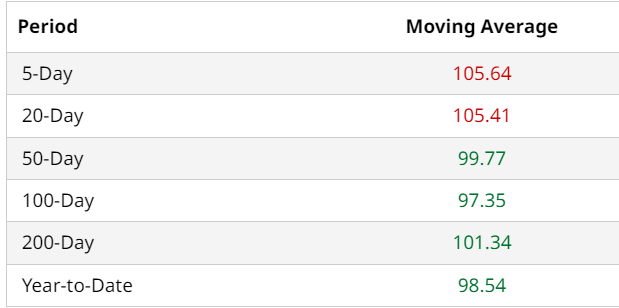

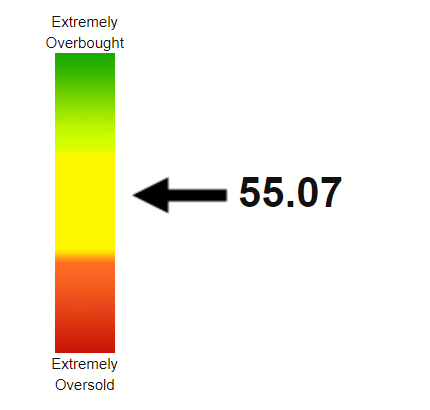

From a technical perspective, the stock has recently broken above the all important 200-Day moving average in addition to taking out the 50- and 100-Day moving averages as well. If market conditions even holds steady, I expect the stock to act strong on the back of Q1 earnings and the buyback announcement. The stock is trading in the sweet spot when it comes to the Relative Strength Index (“RSI”) as shown below.

To summarize, it is an understatement to say Alphabet is a great company. But one that is going through short-term doubts in the mind of Mr. Market. But I fully back the company to find its mojo sooner than later and the stock may noy remain a bargain for long. Despite not being sold on the effectiveness of the new buyback program, I rate the stock a buy here and on further weaknesses.

GOOG Moving Avgs (Barchart.com) GOOG RSI (Stockrsi.com)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, MSFT, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.