Summary:

- On the back of a solid quarterly print, Microsoft’s stock is jumping up +8.5% in the after-hours session. We review the quarter in this note.

- At $300 per share, MSFT sports a forward P/E multiple of ~30x, which is a significant premium to the market (S&P 500).

- Based on TQI’s Valuation Model, Microsoft’s stock looks like dead money for the next five years despite using generous assumptions.

- Hence, I am sticking to my “Sell” rating for Microsoft at $300.

David Becker

Brief Review Of Microsoft’s Q3 FY2023 Report

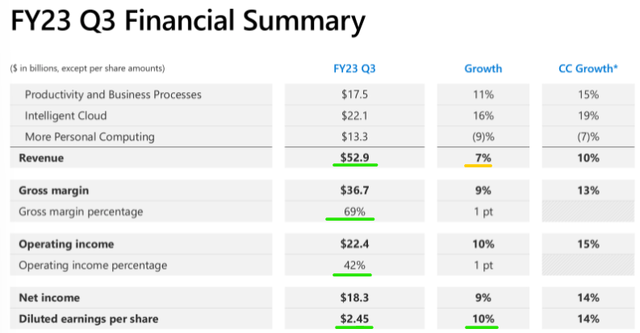

In Q3 FY2023, Microsoft Corporation (NASDAQ:MSFT) reported total revenues of $52.9B (up +7% y/y, +0.4% q/q), beating Wall Street estimates of ~$51B by ~$1.85B. On top of the revenue beat, Microsoft also delivered a solid beat on EPS, which came in at $2.45 (vs. est. of $2.20).

Microsoft Q3 FY2023 Earnings Presentation

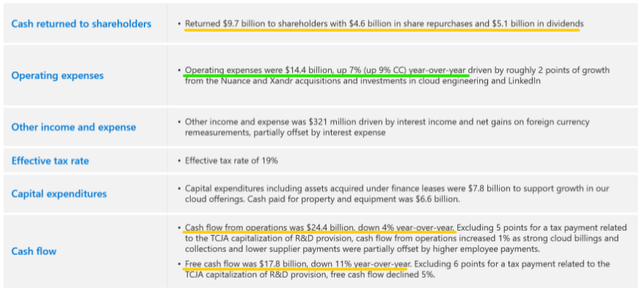

In my view, the earnings beat is a direct result of better-than-expected top-line performance and Microsoft’s recent cost-cutting measures. During the quarter, Microsoft’s operating expenses slowed while revenue growth rates re-accelerated. And as of today, the business trajectory looks far better than Q2, with operating expenses growth (+7% y/y) getting in line with MSFT’s top-line sales growth (+7% y/y). The quarterly free cash flow growth is still in negative territory (-11% y/y); however, Microsoft’s FCF is rebounding sharply as of Q3.

Microsoft Q3 FY2023 Earnings Presentation

Now, let’s look at these results more granularly. In Q3 FY2023, Microsoft reported beats across all three of its business segments:

| Q3 FY2023 Guidance | Q3 FY2023 Actual Revenue | |

| Productivity & Business Processes | $16.9B to $17.2B | $17.52B |

| Intelligent Cloud | $21.7B to $22.0B | $22.08B |

| More Personal Computing | $11.9B to $12.3B | $13.26B |

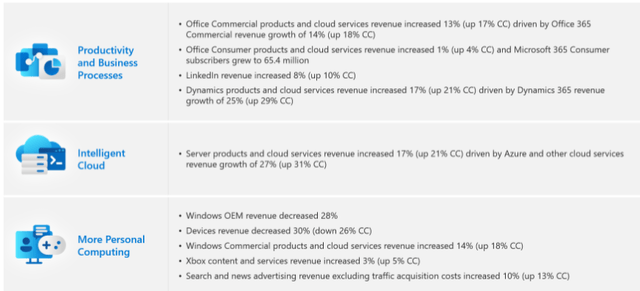

Once again, the highlight of Microsoft’s quarter was the Azure Cloud business, which grew by 27% y/y. While Azure’s revenue growth is decelerating rapidly, it is winning market share, according to Satya Nadella’s comments from the Q3 earnings conference call. With the advent of generative AI, Azure (cloud business) is expected to remain the primary growth driver at Microsoft for years to come. And as of now, MSFT’s cloud business looks resilient in the face of daunting macroeconomic conditions.

Microsoft Q3 FY2023 Earnings Presentation

As you may know, Microsoft is making big moves to increase market share in Search via a new AI-powered Bing. In Q3, Search & News advertising revenues grew by 10% y/y to $13B, despite a shrinking advertising market. Hence, Bing is winning market share, and Nadella said so on the earnings call.

While Microsoft’s “More Personal Computing” segment continues to remain under pressure due to malaise in the PC markets, the performance here was undoubtedly better than feared, with a big chunk of Microsoft’s revenue beat coming from this segment. Now, Productivity & Business Processes and Intelligent Cloud segment performance for Q3 is also looking solid, and it is a clear sign of Microsoft’s resilience.

In a nutshell, Microsoft’s Q3 report looks solid, with the company reporting a re-acceleration in revenue growth and a return to positive earnings growth. That said, I am sticking with a “Sell” rating for Microsoft. Here’s why:

Rationale For Sticking With A Sell Rating

Back in January, we saw that Microsoft’s stock was overloved and overvalued through the following reports:

Since then, MSFT stock price has shot up from $240 to $300 (after-hours price on 25th April 2023), a gain of ~25% in the space of 3 months. While I have missed out on these juicy gains, I do not regret my decision to sell MSFT at ~$240 per share. In fact, I believe Microsoft is close to becoming a “Strong Sell” after this latest pop in its stock. While I would never short a fantastic business such as Microsoft, its valuation is becoming untenable, and investors would be prudent to exit at current levels.

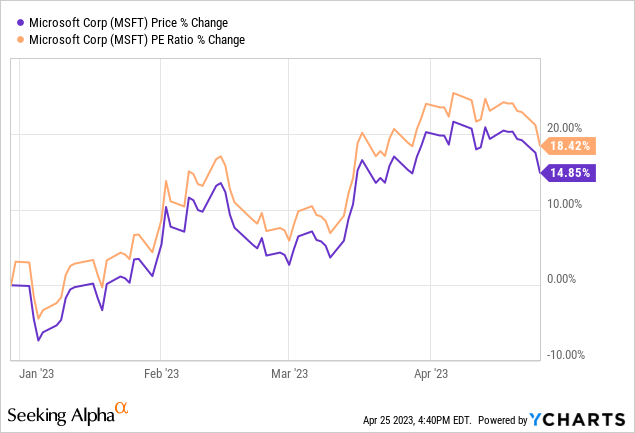

So far this year, Microsoft’s stock price rally has been driven purely by trading multiple (P/E ratio) expansion. As of writing, Microsoft’s P/E ratio stands at more than 32x, with the forward P/E ratio inching up to 30x.

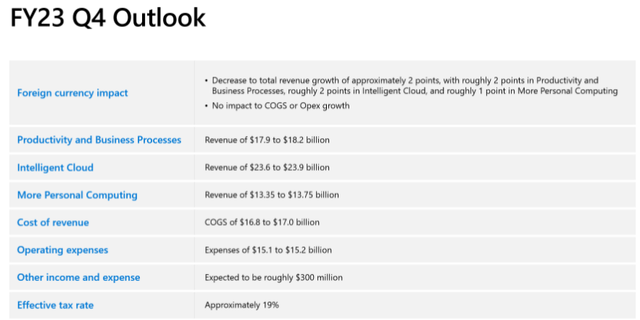

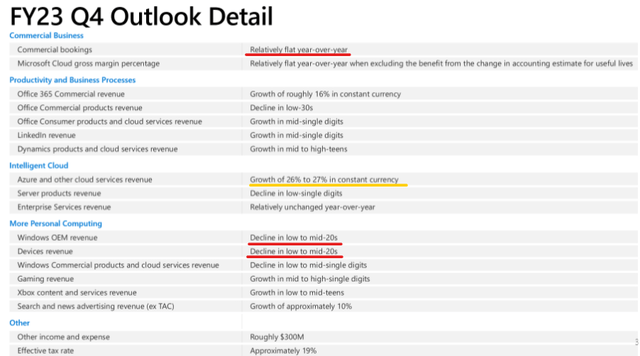

While Mr. Market is seemingly excited about Microsoft’s future prospects with tons of hype around AI (artificial intelligence), we are looking at a mature business that’s reporting single-digit revenue growth. In Q3, Microsoft’s revenue grew at 7% y/y, and management’s outlook for Q4 FY2023 calls for y/y growth of 5.7-7.6%.

Microsoft Q4 FY2023 Outlook

Microsoft Q4 FY2023 Outlook

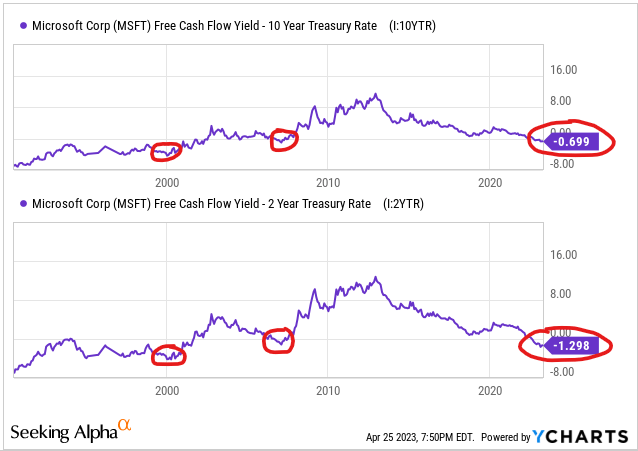

For a mature growth company like Microsoft, a 30x P/E multiple is very expensive, even in a zero-interest rate environment. And while bulls may disagree, we no longer operate in such an environment, with risk-free (debatable) US Treasury bonds yielding nearly ~4%.

With Microsoft’s equity risk premium firmly in the negative territory, the stock offers no margin of safety. Since the turn of the century, we have only seen such negative equity risk premiums for Microsoft during the 2007-08 (Great Financial Crisis) and 2000-2002 (Dot-com Bubble) periods, and we all know what happened with the stock market and Microsoft during and immediately after these periods.

YCharts

Considering Microsoft’s elevated trading multiples and negative equity risk premium, I continue to believe that the stock will undergo a painful correction in the near to medium term.

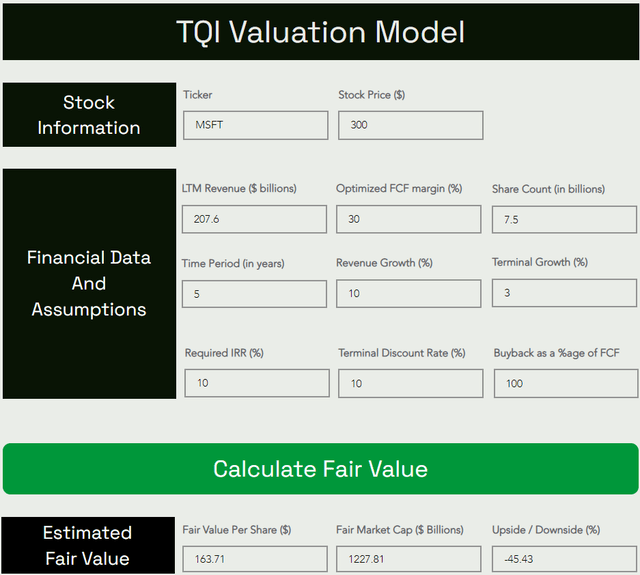

Alright, let’s forget relative valuations and immutable laws of money for a minute here and instead look at the absolute fair value for Microsoft using generous assumptions in TQI’s Valuation Model:

Microsoft’s Fair Value And Expected Returns

TQI Valuation Model (TQIG.org)

TQI Valuation Model (TQIG.org)

According to TQI’s Valuation Model, Microsoft’s fair value is ~$163.71 per share (or $1.23T). With the stock trading at ~$300 per share, I think it is grossly overvalued at current levels.

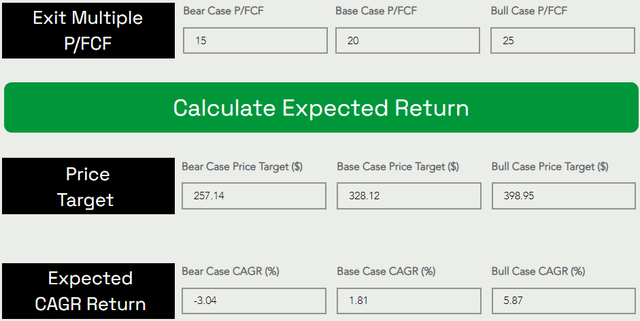

Predicting where a stock would trade in the short term is impossible; however, over the long run, a stock would track its business fundamentals and obey the immutable laws of money. If the interest rates were to stay depressed, higher equity multiples would be justifiable. However, I work with the assumption that interest rates will eventually track the long-term average of ~5%. Inverting this number, we get a trading multiple of ~20x [P/FCF].

Applying this figure as an exit multiple, I see Microsoft stock rising to $318 by 2027-28 at a CAGR of 1.81%. With Microsoft’s stock already sitting at $300, it looks like dead money to me for the next five years. At this point, treasury bonds offer significantly better risk/reward than Microsoft’s stock.

In the event of a hard landing, I could see Microsoft re-tracing to its fair value (and who knows, it could probably overshoot to the downside). Hence, I see a downside risk of 40-50%+ in MSFT. And this is why I said that Microsoft is close to becoming a “Strong Sell” at the start of this section.

Concluding Thoughts

Microsoft’s Q3 report showed a solid beat on revenue and earnings; however, the stock is priced for perfection, and these results do not justify the after-hours pop in the stock.

For FY2023, Microsoft is projected to grow revenue and earnings at single-digit rates. And with such a growth rate, Microsoft (at >32x P/E) is very expensive relative to the market (S&P-500 is trading at ~20x P/E). Furthermore, Microsoft’s free cash flow yield of ~2.9% remains below most (risk-free) treasury bonds right now. A negative equity risk premium for Microsoft violates the immutable laws of money.

While I continue to believe that Microsoft is a fantastic business, the risk/reward on offer is highly unfavorable. With the economy seemingly headed toward a hard landing as per leading economic indicators, the latest pop in Microsoft stock looks like a great opportunity to exit.

Key Takeaway: I rate Microsoft a “Sell” at $300.

Thank you for reading, and happy investing! If you have any questions, thoughts, and/or concerns, please feel free to share them in the comments section below.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are you looking to upgrade your investing operations?

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our investing group – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.

We have recently reduced our subscription prices to make our community more accessible. TQI’s annual membership now costs only $480 (or $50 per month) for a limited period only.