Summary:

- Roku reported mixed Q1’23 results due to a large EBITDA loss.

- The streaming video platform saw key Active Accounts and Hours Engaged grow at ~20%, providing the prime reason to own the stock.

- The stock is too cheap with a forward EV/S multiple below 2x.

Justin Sullivan

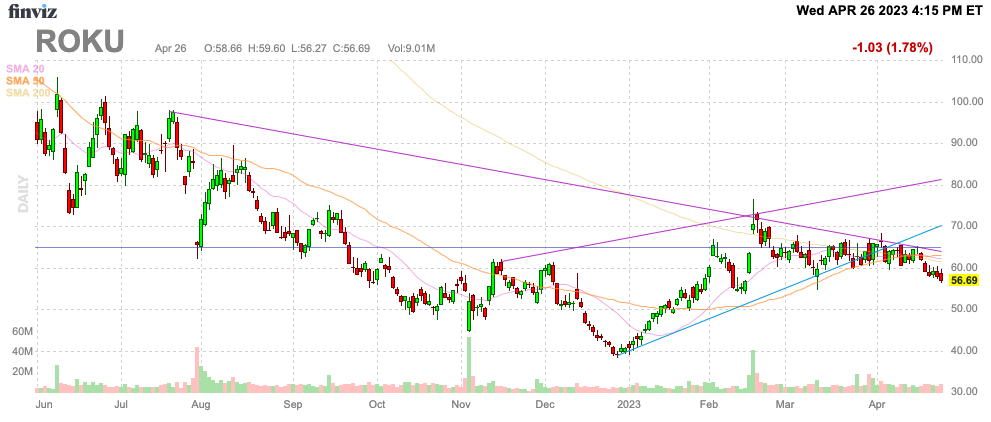

Roku (NASDAQ:ROKU) headed into the Q1’23 earnings report treading water. The stock has already fallen from a high above $400 in mid-2021 to a low of $56 now. My investment thesis remains ultra bullish on the video streaming service with the business set up for strong growth when the digital advertising market improves.

Source: Finviz

Setting Up For Recovery

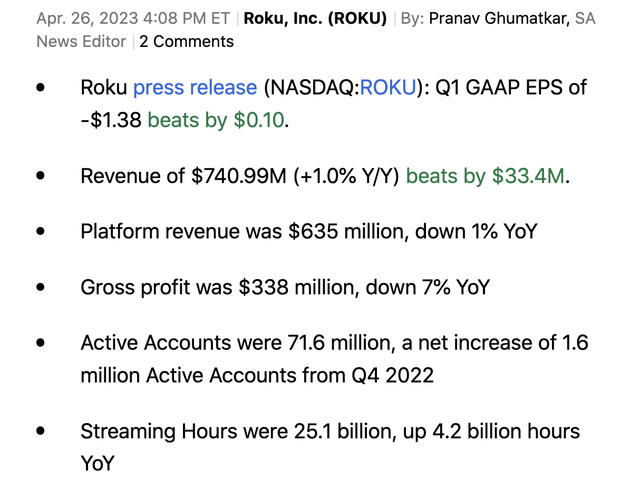

Roku reported generally mixed Q1’23 results with numbers beating estimates, but the streaming video platform still reported a large loss. Not to mention, revenues only grew 1% from last Q1 as follows:

The company guided to far worse results in Q1. The primary beat was an adjusted EBITDA loss of only $69 million while the target was for a massive loss of $110 million due in large part to revenues beating analyst estimates by $33 million.

Where the company is setting up for the future was the 1.6 million boost in Active Accounts sequentially and the 4.2 billion hours watched boost. Active Accounts are up 10.3 million YoY with Streaming Hours up 20% from last Q1.

Roku will ultimately be able to monetize these users at far higher rates in the future when the advertising market improves. And again, the bullish investment thesis is that the streaming video platform will shift more and more into digital advertising and away from the ad scatter market that is suddenly very weak.

In total, ARPU was down 5% YoY to $40.67. Roku reported peak ARPU back in Q3’22 at a rate of $44.01.

If the company had monetized Active Accounts at just a 5% higher ARPU, normal of this inflationary environment, Roku would’ve produced an ARPU of $44.73. Platform revenue would be on a path to top $800 million vs. the slight dip in Q1 as ARPU weakness was offset by account growth. When combined with Devices revenue of $106 million, total revenues are on a pace to reach $900 million.

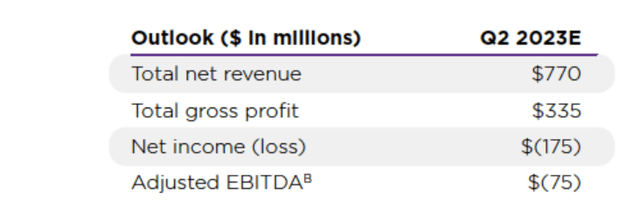

Roku guided to Q2’23 revenues of $770 million for some solid sequential growth, though revenues are targeted at only 1% growth YoY. Investors won’t necessarily like the adjusted EBITDA target for a loss of $75 million, growing from the $69 million loss in Q1.

Source: Roku Q1’23 shareholder letter

One does need to keep in mind the guidance beats discussed above where management appears to have sandbagged Q1 numbers. With Roku forecasting a $29 million sequential revenue increase, investors shouldn’t expect the adjusted EBITDA loss to expand during Q2 with a typical revenue beat leading to a greatly reduced EBITDA loss.

Investing For 2024

The market abhors companies investing for the future right now, but Roku has a large cash balance of $1.9 billion heading into 2023 to warrant the investing while other competitors might not have the cash. The company had $487 million at risk form the SVB bank collapse, but with the uninsured deposits not at risk Roku ended Q1 with $1.7 billion in cash to fund operations.

Management promises to reach adjusted EBITDA profits for the full year in 2024. Roku burned $153 million in cash from operations during Q1 due in large part to paying nearly $100 million in accrued liabilities. In addition, the company spent $54 million on the purchase of property and equipment during the quarter.

Roku was very adjusted EBITDA positive heading into the ad market slowdown last year. With the cash balance and past performance, investors shouldn’t necessarily fear the current spending rates, though the streaming platform needs to adjust the level of losses in the 2H to reach their EBITDA targets and preserve cash.

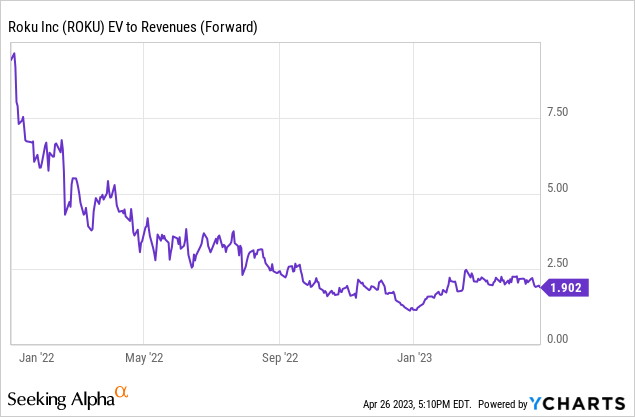

The stock has seen the forward EV/S multiple dip to below 2x now. Roku traded at a far higher multiple for all of 2022 and the stock could easily return to these EV/S multiples of 50% to 100% higher with a return to solid sales growth.

The company is set up for a far better 2024. As Roku returns to growth and the adjusted EBITDA losses are cut, the stock should rebound to reflect the improved operations and the strong growth in accounts and engagement.

Takeaway

The key investor takeaway is that investors should focus on the engagement growth at Roku. These numbers feed into the bullish investment thesis for the streaming video platform to vastly expand digital ad revenues over time.

The stock is too cheap with a forward EV/S multiple below 2x.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ROKU over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.