Summary:

- Visa continues to grow in double digits despite the tough macroeconomic environment.

- The net income margin continues to be among the best in the world.

- Growing dividends and buybacks keep rewarding shareholders.

Justin Sullivan

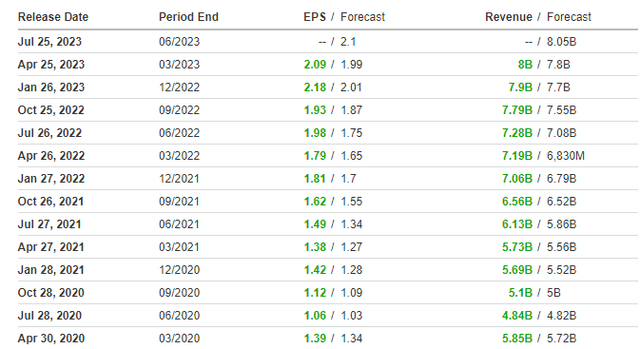

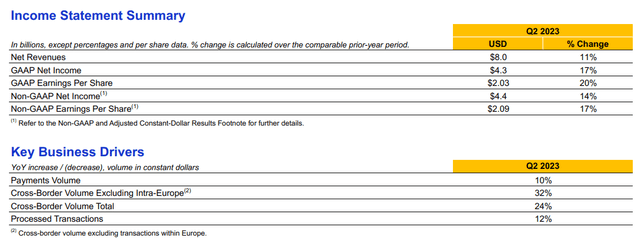

This is not news, but Visa (NYSE:V) once again beat analysts’ estimates, and not by a small margin:

- EPS was $2.09 versus $1.99 expected.

- Revenues were $8 billion versus $7.80 billion expected.

There is nothing out of place in this Q2 2023; on the contrary, Visa once again demonstrated its resilience in virtually any macroeconomic environment. Inflation has not been a problem and apparently neither has the current economic slowdown due to high interest rates. Read my previous coverage on Visa here.

According to the earnings conference call, CFO Vasant Prabhu reaffirmed that consumer spending remains in good shape and that overall business is doing better than they expected. In fact, the numbers prove him right.

Comment on Q2 2023

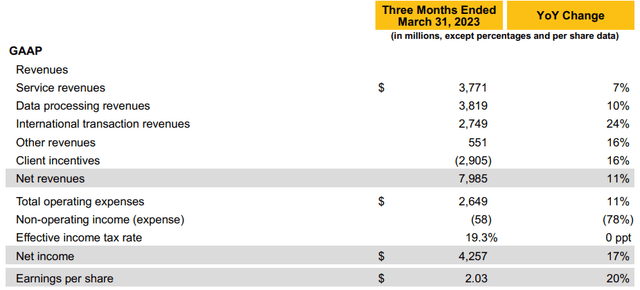

Once again net revenues increased by double digits (11%) and what is most striking is that net income increased even more. I wonder how far this company wants to go with improving the net income margin since it was 53% in this quarterly. It is simply impressive to have a net income margin like that.

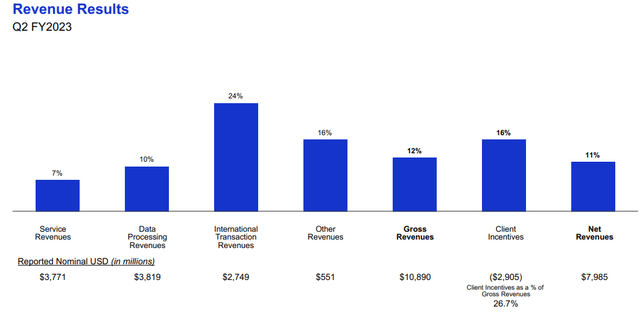

The main catalyst for revenue growth currently is in international transactions, up 24%. Data processing and Service are more mature segments but still continue to grow albeit more slowly. In any case, growing revenues are not enough to ensure a net income margin above 50%; it is crucial to control that operating expenses do not increase too much.

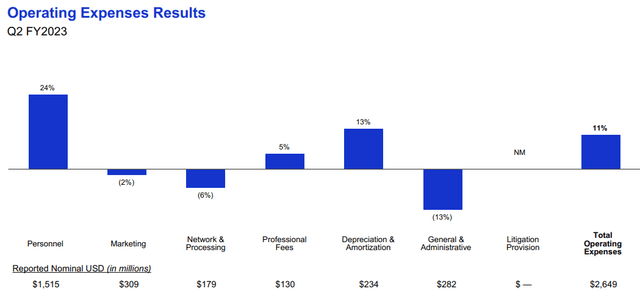

Total operating expenses rose 11%, exactly the same as net revenues. Weighing most heavily were personnel-related expenses, which grew much more than usual. In the current environment where tech companies are laying off employees on a massive scale, such an increase is certainly counter to the trend. On this issue, David Koning asked for clarification during the conference call and here is Vasant Prabhu’s reply.

It’s additions we had made over the last 12 months in head count. There’s also some unusual items that flow through there that are offset. This is the deferred comp. It hits you on the personnel line, but it’s offset on the nonoperating income line. So that distorts it a little bit. But you will see that growth rate start to decline quite a bit because we’ve been moderating headcount increases as we went through the year.

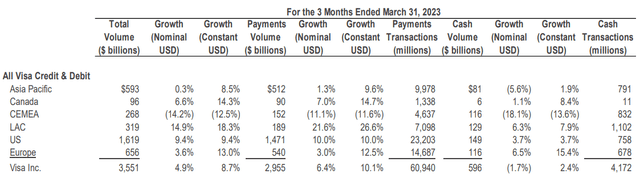

From revenues we now turn to volumes and transactions.

Payment volume increased by 6.40% and reached $2.955 billion. However, the strong dollar continues to weigh heavily, since with a constant exchange rate the growth would have been 10.10%. Latin America and the Caribbean [LAC] continues to be the fastest growing geographic segment, while Central Europe, Middle East, and Africa (CEMEA) once again the worst. U.S. returns to double-digit growth after an underwhelming Q1 2023, while payment volume in Europe was still affected by the exchange rate. At constant exchange rate, the increase is 12.50%, while nominal growth was only 3%. All in all, Europe performed above expectations and the CFO was pleasantly surprised.

US and Europe are responsible for 68% of Visa’s total payment volumes, but the weight of cross-border volume (excluding Europe) is becoming increasingly important.

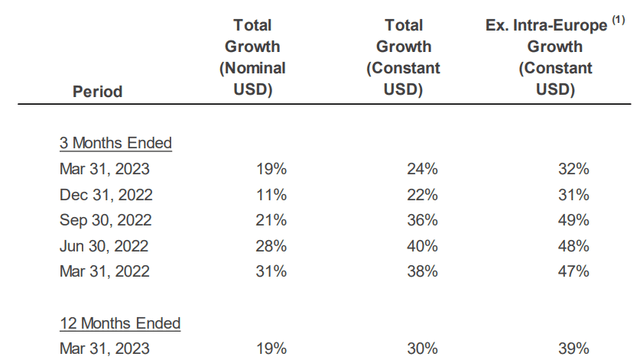

As can be seen, there was a major growth of 32% in constant currency this quarter, a figure that could not be achieved in developed economies: there are still new markets in which Visa can grow.

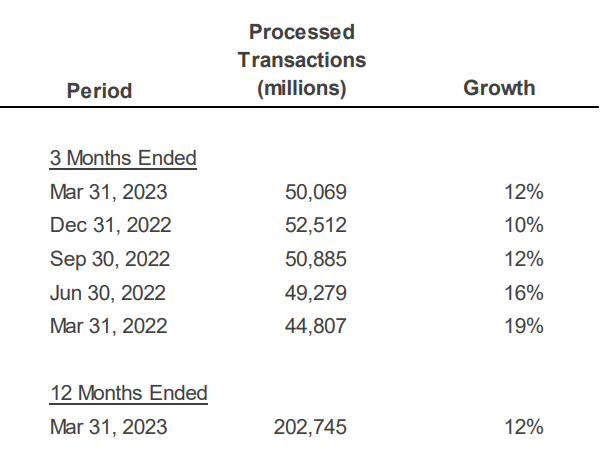

Finally, these are the transactions processed on the Visa network over the past quarter and 12 months.

Visa Q2 2023

The figure continues to increase in double digits and in the last 12 months has exceeded the 200 billion threshold.

In short, overall, all of the most important figures for this company have performed very well despite the current macroeconomic environment. But I am not overly surprised by this.

Visa and Mastercard form a duopoly in what is the secular trend of digitizing payments. Increasing efforts are being made to veer toward a cashless society, and cash is increasingly taking a back seat. More and more people around the world are ready to use Visa credit or debit cards, and this is fueling the revenues of this company. Not even inflation has stopped Visa; since much of its revenue is in the form of commissions, if the consumer spends a higher amount Visa earns a higher amount.

This company pretty much has everything a shareholder wants: double-digit growth, best net income margin in the world, competitive advantage, buybacks, and dividends.

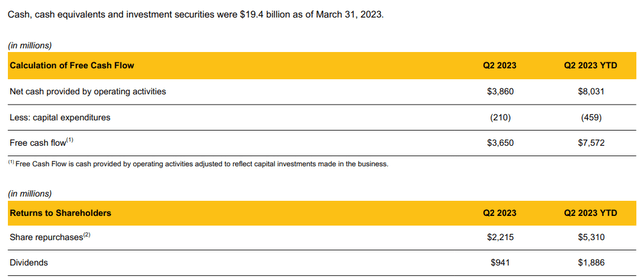

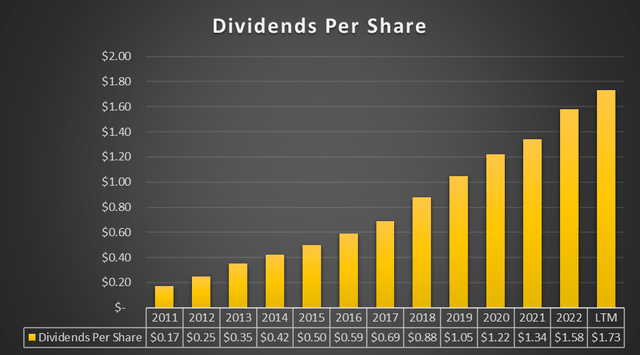

On the latter two aspects related to shareholder compensation, here are the figures for this quarter.

With free cash flow of $3.65 billion, $2.21 billion worth of shares were repurchased and $941 million was distributed in the form of dividends. The latter continue to grow year after year.

The current dividend yield is 0.78%, thus very low. In any case, it is important to note that in the last 5 years the dividend issued has basically doubled. In light of this final consideration, I consider Visa also an excellent dividend growth company.

I personally continue to hold Visa stock in my portfolio after this quarterly report and I am planning to increase my position. I am waiting for the right time as I find the current price per share a bit too high.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not a financial advice, just my opinion.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.