Summary:

- Here we go again. Rumors of an AT&T Inc. dividend cut are once again swirling.

- Moreover, it appears the dividend cut fears are well placed. As many have pointed out, AT&T’s free cash flow for the past quarter was only $1 billion.

- In the following piece, we do our best to distinguish reality from repartee and come to a conclusion regarding whether or not a dividend cut is in the cards for AT&T Inc.

Brandon Bell

Executive Summary

Here we go again. Rumors are once again swirling that the AT&T Inc. (NYSE:T) dividend is in danger of being cut. On top of this, the nattering nabobs of negativism are back out in force. The telecom giant’s 10% drop after reporting last quarter’s earnings was akin to a big pot of honey for the bumbling bears. Before I get into the gist of the article and address whether or not I believe the dividend is in danger, I want to clarify my current thinking on the name.

My Current Take

After the dramatic drop, AT&T is back on my watch list, believe it or not. I have been investing in AT&T for decades. I actually audited and consulted for AT&T back in the late 90s. I feel I have somewhat of a sixth sense when it comes to the company. My in-depth knowledge of the company coupled with my 30 years of experience in the markets has allowed me to move in and out of the stock successfully over the years.

I am an Income Investor

Let me make one thing clear, I am not a “trader.” I am an income investor. I am in the process of building up my retirement portfolio at 59 years of age. Now, if you are older and have already built up a retirement nest egg you feel comfortable with, you probably won’t and shouldn’t be quite as active. That is your prerogative. Yet, I am still in the retirement portfolio growth phase and, therefore, take advantage of stock “mis-pricings” when I see them. Here is why.

Recent AT&T Buys and Sells

I initially bought into AT&T for my Seeking Alpha Income Investing Group back in October of 2022. This was when fears of a dividend cut were rampant as well. I wrote an article detailing my thesis, “AT&T Stock: Be Fearful When Others Are Fearful.” The stock was beaten down due to reporting lower free cash flow numbers. Sound familiar?

Nonetheless, I have learned from my 30 years of experience, investing in the stock market is ultimately a counterintuitive endeavor. You must zig while others are zagging. Now, don’t get me wrong. It’s not always advisable to go against the herd. As my father would say, sometimes you get trampled when going against the herd. What this means is the herd is not always wrong. The key is doing the proper amount of due diligence coupled with a solid risk management strategy. Luckily, after my bottom tick buy back in October of 2022, the stock ran up very quickly.

AT&T Current Chart

After an extraordinary 30% gain in 4 months, the bulls started coming out of the woodworks. Once again, this alerted me to the fact being long at this point may not be advisable. A plethora of newly converted AT&T bulls entering the fray was a red flag that the stock may be nearing a top. What’s more, the macro setup heading into the next earnings announcement was extremely similar to the first drastic drop in the stock back in 2022. So I took profits and sold out.

One other thing I’ve learned over the years is that capital gains seem to come and go at the same speed. If I have a stock run up 30% in 4 months’ time, there is a much higher probability they will dissipate just as fast. It just so happened I got lucky by top-ticking the stock just before the next big drop. I wrote an article regarding my thesis at the time “AT&T: Dogs And Cats Living Together, Mass Hysteria!” As it turns out, it was a prescient call once again. The stock has sold off after reporting Q1 2023 earnings, as I anticipated. What’s more, the bears are now out in force declaring a dividend cut is back on the table. This is due to the company reporting a mere $1 billion in free cash flow for the first quarter and the heavy debt load.

These appear to be a legitimate gripes due to the fact the annual guidance calls for $16 billion in free cash flow (“FCF”) and rates are on the rise. Nevertheless, to the informed observer, these fears seem vastly overblown. In the following sections I will explain why.

The $1 billion Q1 FCF is expected

The fact of the matter is the $1 billion in free cash flow for the first quarter was what the company actually guided for. The first quarter is always bereft of free cash flow due to the fact there are several one-time items hitting the books. According to AT&T’s CFO Pascal Desroches on the latest earnings conference call:

“Cash from operating activities came in at $6.7 billion versus $7.6 billion last year. This was largely due to the timing of working capital, which includes lower securitizations. As a reminder, the first quarter is typically the high watermark for device payments, and we expect payments to progressively get lower as we make our way through the balance of the year.

Free cash flow for the quarter was $1 billion. This was consistent with our expectations and accounts for several seasonal and anticipated working capital impacts. We remain confident in our full year outlook for free cash flow of $16 billion or better. This expectation is largely due to the timing of capital investments, device payments, incentive compensation, which all peaked in the first quarter.”

So the $1 billion was “consistent with AT&T’s expectations” and they “remain confident” they will “achieve their $16 billion free cash flow target” for the year. It seems as though many analysts who are now pounding the table stating the dividend is in danger of being cut once again didn’t bother to listen to the conference call. Furthermore, they must not have taken the time to review last year’s earnings and stock action either. The fact of the matter is this same exact situation arose last year. Just FYI, AT&T came out just fine. So now let’s move on to the next big issue the befuddled bears bring up: AT&T’s debt dilemma.

AT&T’s debt explained

The next big issue the cacophony of confused columnists continually bring up is AT&T’s debt load. This is once again nothing more than an attention-grabbing red herring in my book. The fact of the matter is AT&T has done an impeccable job managing their debt and shoring up the balance sheet. In fact, CEO John Stankey stated on the latest conference call:

“As the economy adjusts to a likely period of tighter capital availability and higher interest rates, I take comfort in the state of our business for two reasons. The first is the heavy lifting we did to strengthen our balance sheet over the last several years. We’ve reduced our debt, taking advantage of the prior low interest rate environment on our remaining debt and managed our debt towers for the next several years. As a result, more than 95% of our debt is now fixed at an average rate of 4.1%.”

It seems as though the bears have once again failed to dig deeper into AT&T’s debt management mitigation tactics. The company still has a substantial debt load, yet not nearly as much as previous to the sale of the Time Warner assets. What’s more, many bears have pointed to the issues of rising rates causing the debt load to eat into profits. This conclusion is obviously reached without taking the time to consider the fact 95% of the debt is fixed at an average rate of 4.1%.

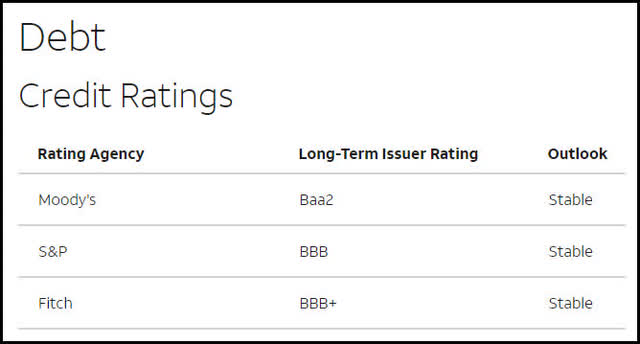

Not to mention, a majority of the debt doesn’t come due for decades. Some of the debt doesn’t come due until 2097. That is 74 years from now. You can check out AT&T’s debt maturity schedule for yourself here. When it comes to the debt of companies, I like to check what the three primary ratings agencies have to say. This easily accessible information is often lacking from the bearish reports.

AT&T Debt Rating

As you can see, all three ratings agencies have the debt rated as Stable. This is most likely why you never hear about it from the bears due to the fact it doesn’t fit the “debt debacle” narrative.

The final point I’d like to make regarding why the dividend appears safe is the fact the company already cut the dividend. Let me explain.

AT&T already cut the dividend

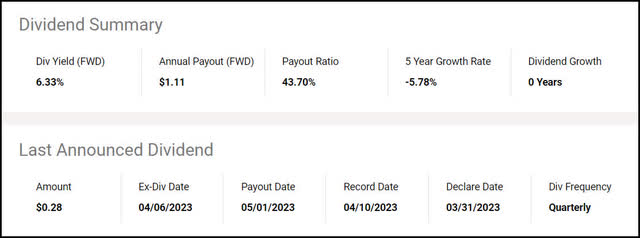

When AT&T sold off the Time Warner assets, they halved the dividend to a $1.11 per share annual payout.

Seeking Alpha AT&T Dividend Summary

This was no fun for long-time AT&T shareholders, yet was a necessary evil due to the fact the company was selling off substantial revenue streams as well. The current payout ratio of 43.7% is satisfactory. Furthermore, with the recent selloff, the yield has now entered what I consider the “buy zone” at 6.33%. Now let’s wrap this piece up.

The Wrap-Up

Once again, I find myself considering initiating a new position in AT&T Inc. stock. I feel the selloff was easily anticipated. This is based on the fact that the bewildered bears seem to make the same mistake every year. With AT&T management confirming free cash flow guidance for the year, I see now as potentially an ideal time to jump back in the stock. I haven’t just yet. But when I do, I will definitely layer into the position over time to reduce risk.

What’s more, they are on track to achieve their robust cost reduction goal of $6 billion this year. This augurs well for an improved bottom line and free cash flow number. CEO John Stankey stated on the latest conference call:

“Even in the midst of increased macroeconomic uncertainty, we’re executing more sharply and efficiently after repositioning our operations around our connectivity strengths. We remain on track to achieve our $6 billion plus cost savings run rate target by the end of the year, if not sooner.”

So the future once again looks bright for AT&T Inc. I suspect the “nattering nabobs of negativism,” as Vice President Spiro Agnew once said, are again playing checkers rather than chess. In investing, you need to be able to think more than one move ahead in order to be successful. It is the abiding principle of investing greats, like Warren Buffett. His often quoted line, “Be greedy when others are fearful, and fearful when others are greedy” commemorates this contrarian fact. Many market participants recite this quote by heart. Yet, the hard part is putting it into practice. Those are my thoughts on the matter, I look forward to reading yours.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in T over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

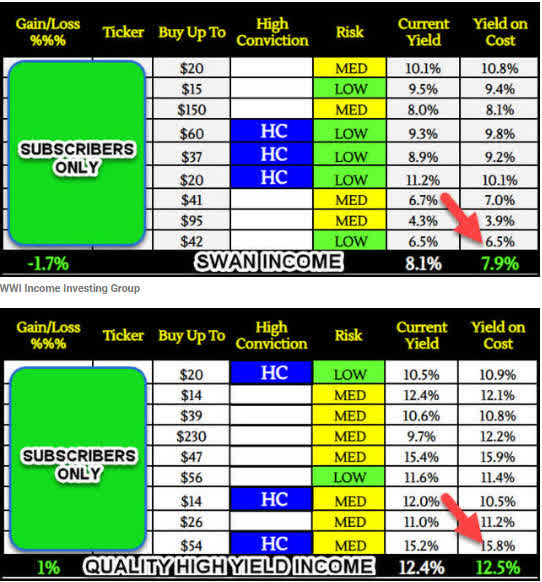

Join the #1 fastest growing new Income Investing Group! Our SWAN and High Yield Income Portfolios are substantially outperforming the market!

We have opened up an addition 50 Charter memberships at the legacy rate! Memberships are going fast with 30 new members already signed up! We have 17 FIVE STAR reviews in the first few months!

~ Quality High Yield Income – Current Yield – 12.5%

~ SWAN Quality Income – Current Yield – 7.9%

~ High Quality Growth

~ Ultra-High Growth

Join now for top income buys, timely macro insights, and a lively chat room! A portion of the proceeds are donated to the DAV (Disabled American Veterans).