Summary:

- Amazon could beat low earnings anchors next week when the company releases 1Q-23 earnings.

- Stronger-than-expected AWS performance could result in a recapture of the 200-day moving average and an upside breakout.

- I see Amazon as a great bargain based on present sales expectations.

4kodiak/iStock Unreleased via Getty Images

Amazon.com (NASDAQ:AMZN) will report earnings next week, and I am confident that the eCommerce company will easily exceed profit expectations for 1Q-23.

For starters, profit expectations have fallen in recent months as investors priced in slower sales growth amid signs of an overall economic slowdown. I believe Amazon will beat low profit expectations, especially if its high-performing AWS unit continues to deliver double-digit sales growth.

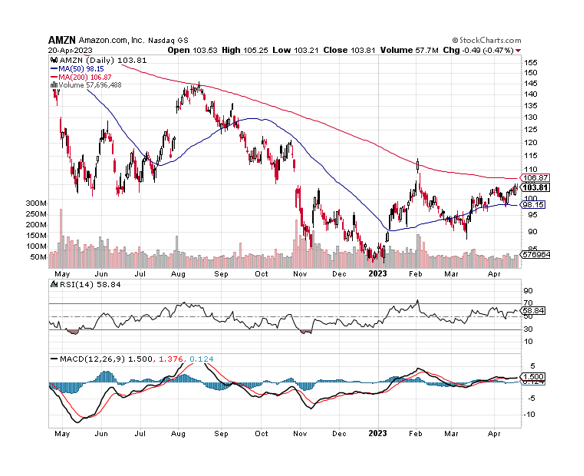

From a technical standpoint, I believe Amazon is on the verge of a larger breakout, as the stock has recently moved into an up channel and successfully recaptured the 50-day moving average line.

Amazon Is Practically A Steal Given Its Growth Potential

Amazon’s expected growth rates have reset to the downside since the pandemic ended, and Amazon is not expected to grow at the rates realized during the pandemic.

The market currently forecasts an average of $624.97 billion in sales for 2024, reflecting an uncharacteristically low sales growth rate of 12%. This 12% growth is still higher than the market expects Amazon to achieve in 2023 (8%), but it is still small in comparison to the much faster sales growth rates Amazon experienced during the Covid-19 pandemic.

Because of this slowdown in sales growth, the market has become much more pessimistic about Amazon’s short-term growth. In the long run, I believe Amazon will be able to return to higher growth rates, as AWS in particular could drive significant sales and profit gains for Amazon.

During the pandemic, AWS made a strong impression on investors, and the business unit could surprise with key performance metrics such as sales and operating income growth in 1Q-23. If AWS reports that large corporate customers continued to migrate to Amazon’s cloud service in the first quarter, as well as a re-acceleration of sales growth, the market’s rather pessimistic view of the eCommerce company may change.

AWS could eventually be spun off from Amazon as a separate cloud service provider. Given that AWS has a 33% market share and dominates the cloud service market, I believe that the fantasy of a potential spin-off could benefit Amazon’s overall market valuation.

If AWS were run as a separate business, the segment’s underlying profitability would no longer be obscured by Amazon’s eCommerce business, which is unprofitable.

While Amazon’s eCommerce segments are not profitable, I believe a spin-off announcement could create the world’s preeminent cloud service company with a leading market share and billions of dollars in operating income. This business could likely achieve a hefty valuation multiple in the market as well as investors gain clarity about the company’s core operations.

However, Amazon would still have to fix its eCommerce business and return it to profitability in the long run which is a challenge that I believe has held the valuation back in the last year.

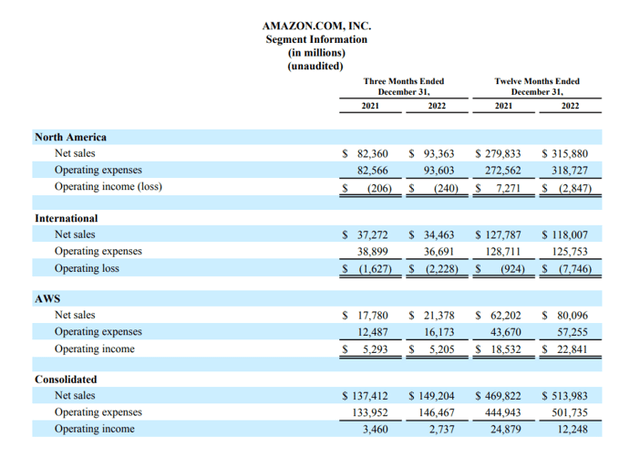

AWS generated $80 billion in sales in 2022, accounting for 16% of Amazon’s total sales, and $22.8 billion in operating income. The business will probably need another 2-3 years to grow in order to show rising net income profitability, but I believe that a spin-off is a logical decision for Amazon because the eCommerce business is losing money.

AWS Segment Information (Amazon.com)

Growing Importance Of AWS In Amazon’s Sales Mix

AWS is rapidly expanding due to two factors: large corporations are migrating to the cloud service platform, and AWS is expanding its footprint to other countries, creating significant sales and operating income upside for Amazon’s most valuable segment.

NASDAQ, which migrated its trading system to Amazon, and multiple companies, including Yahoo Ad Tech, Brookfield Asset Management, and Stability AI, all chose AWS as their preferred cloud provider in the most recent quarter.

I believe that AWS’s acquisition momentum could have resulted in higher-than-expected sales growth for AWS, especially since the segment has begun to expand into new regions such as Spain, Switzerland, and India.

Furthermore, AWS sales are steadily increasing, reaching 15.6% in 2022, up from 13.2% in 2021. In 2022, AWS increased sales by 29% YoY, which was three times faster than Amazon’s overall sales growth rate of 9%.

If AWS experienced ongoing customer migration in 1Q-23, which I believe was the case given recent acquisition momentum, the ongoing AI revolution, and a growing geographic footprint, Amazon could be in line for a strong showing in the AWS segment this week.

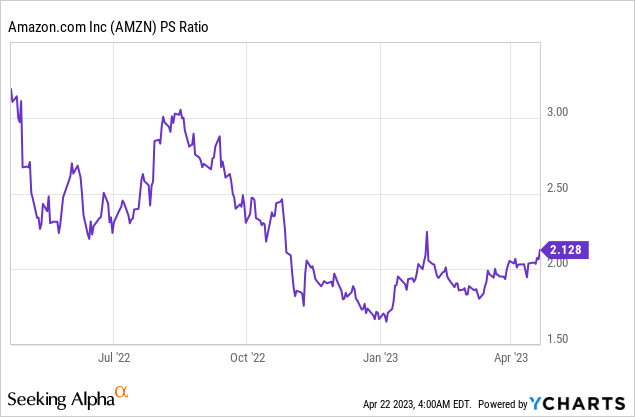

All of Amazon’s growth is currently priced at 2.1x sales, a much lower multiple than investors had to pay during the pandemic period. In fact, I believe Amazon is fundamentally undervalued, particularly in terms of AWS’s potential.

Investors paid a much higher multiple for Amazon’s growth last year, and I wouldn’t be surprised if Amazon returned to a 3-4x sales valuation if AWS continues to perform well in terms of sales and operating income growth in 2023.

Amazon Could Be Set For A Breakout

Amazon’s chart pattern looks promising ahead of 1Q-23 earnings. The stock recently regained control of the 50-day moving average line and is now on track to regain control of the 200-day moving average line as well. The 200-day moving average line is currently within reach, and I believe that Amazon’s earnings report for the first quarter will allow the stock to break through this resistance level.

Amazon is currently in an uptrend that began at the end of December. The stock is currently neither overbought nor oversold, according to the Relative Strength Index, but a strong earnings performance in 1Q-23 could give Amazon’s stock new life on April 27, 2023.

Moving Averages (Stockcharts.com)

Risks Amazon Might See A Lower Valuation

Amazon’s valuation may fall in the short term as a result of its earnings performance. However, as I previously stated, I believe Amazon has a good chance of exceeding low profit expectations, especially if AWS, Amazon’s core cloud business unit, has had a strong quarter due to ongoing customer migration to its cloud platform.

Rising economic risks and corporate customers’ reluctance to sign cloud commitments could also weigh on Amazon’s valuation next week.

My Conclusion

I’m rating Amazon as a Strong Buy ahead of the 1Q-23 earnings report because I believe profit expectations are too low for the eCommerce company and the chart picture shows growing positive momentum, which could result in a breakout.

The stock recently reclaimed the 50-day moving average, and the 200-day moving average line is within striking distance, and a better-than-expected earnings report could be the catalyst that allows Amazon to break through this barrier.

Furthermore, Amazon has some fantasies about the prospects of an AWS spin-off, and I believe the company’s stock is reasonably priced in relation to its potential.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.