Summary:

- Netflix achieved an investment grade status during the first quarter, this achievement is a positive sign for investors and lenders.

- Netflix has started to crack down on the over 100 million password sharing households.

- Its advertising model is clearly working, with ad-supported plans generating more revenue than the standard plan.

Wachiwit

Business Overview and Investment Thesis

Netflix, Inc. (NASDAQ:NFLX) is one of the top players in the video streaming industry with a subscription-based business model. The company has also launched its subscription in combination with advertising model which has generated positive results so far. NFLX reports revenues from 4 different geographic segments with the APAC segment being the fastest-growing segment for the company. During the first quarter of 2023, NFLX delivered positive results from its new advertising model, the company has started cracking down on the over 100 million households sharing their password and achieved an investment grade status. Furthermore, NFLX bolstered its balance sheet thanks to the substantial free cash flow generated during the quarter. As a result of these developments, I believe NFLX continues to present an attractive long-term investment opportunity.

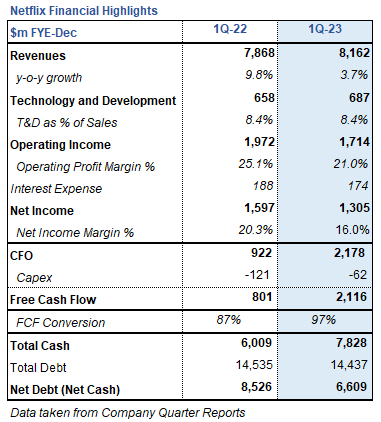

1Q-23 Financial Highlights

Netflix Financial Highlights (Netflix First Quarter Report)

During the first quarter of FYE 2023, Netflix recorded a modest revenue growth of 3.7% compared to the same period last year. Revenue growth was driven by the UCAN, LATAM, and APAC regions which saw revenue increases of 8%, 7%, and 2%, respectively. This was partly offset by a decrease in revenue in the EMEA region by 2%. Despite this modest increase in overall revenues, the company saw its operating income decrease to $1.7 billion, which equates to a 21% operating income margin. This decrease was mainly a result of higher cost of revenues which was primarily due to a $294 million increase in content amortization relating to existing and new content. Management also continued making solid investments in Technology and Development, amounting to 8.4% of revenues.

Even though its operating margin saw a decrease, NFLX was able to generate a robust operating cash flow from operations of $2.2 billion, which translated into a handsome free cash flow of $2.1 billion. Management used a part of this cash to return value to its shareholders through share repurchases worth $400 million. Furthermore, the company significantly bolstered its cash position to $7.8 billion. For reference, NFLX’s cash position at the end of FYE 2022 stood at $6.1 billion.

Key Takeaways:

Advertising Plan Delivered Positive Results

Management mentioned the initial success of the advertising plan, which was launched in November 2022 at a price of $6.99/month. This plan includes five minutes of advertising per hour, meaning NFLX is deriving revenues from the subscription charges as well as from the advertisement time sold. According to the shareholder letter from the first quarter, the ad-supported plan has already surpassed the standard plan in revenue. These are initial positive news items. Nonetheless, it remains to be seen if this trend can be continued during the next upcoming quarters.

Account Sharing Disruption Has Started

Management has been vocal for some period about its intention to disrupt the over 100 million household password sharing. As such, NFLX has started to offer an option to add additional households for $2.99 each. Similar to the advertising plan, there will be short-term challenges. However, if this problem is solved NFLX can generate significant revenues from this initiative. The initiative is expected to roll out during the second quarter of 2023.

Investment Grade Status Achieved

NFLX achieved an investment grade status from Moody’s during the first quarter of 2023. The upgrade was a result of the company’s ability to manage its debt effectively, furthermore, the company bolstered its cash position during the first quarter to $7.8 billion. The investment grade status is a positive sign for investors and lenders.

APAC Push with South Korea’s $2.5 Billion Investment

Netflix has announced that it will invest $2.5 billion in South Korean programming during the next 4 years. This initiative comes as a result of the successes of different South Korean shows such as Squid Game. Further to this, audience data has revealed that over 60% of all Netflix members watched Korean shows or films during the previous year. This investment initiative will help NFLX gain market share in its APAC segment which added 1.46 million paid subscribers during the first quarter. It should be noted that this is also the fastest-growing segment for the company.

Conclusion

NFLX’s financial performance during the first quarter showed mixed results. The company had a modest increase in revenues while at the same time recording lower profits. Nonetheless, the company recorded a robust cash flow from operations and was able to bolster its balance sheet. The company is seeing positive results from its ad-supported model, with the new model already generating more revenues than its standard model. Furthermore, the company is starting to crack down on the 100 million households which are sharing their password. This provides a nice opportunity for the company to expand its revenues. Finally, the company’s new investment grade status gives NFLX a more reliable and financially secure position. As a result of these factors, I believe NFLX continues to present an attractive long-term investment opportunity.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.