Summary:

- Southwest Airlines Co. is faced with some airline-specific costs as well as macroeconomic uncertainty and cost drivers.

- Despite all of that, Southwest Airlines stock is significantly undervalued.

- Even if we were to model in significantly lower EBITDA compared to consensus, double-digit upside remains for Southwest Airlines.

- Southwest Airlines expects 20 fewer Boeing 737 deliveries this year.

DaveAlan

Southwest Airlines Co. (NYSE:LUV) reported first quarter earnings on the 27th of April. Results missed analysts estimates and the airline’s stock is now trading down over 4%. In this report, I will be discussing the Q1 2023 results, and the guidance update, and provide a valuation for Southwest Airlines stock which might trigger a rethink of my buy rating for the stock.

In a recent report, I maintained my buy rating for Southwest Airlines but pointed out that the current CEO – and probably with him some board members – should leave. Specifically, the CEO has been tone-deaf on the technological nature of the meltdown of the operations in December which disrupted travel plans, eroded trust in the airline, and hurt investors.

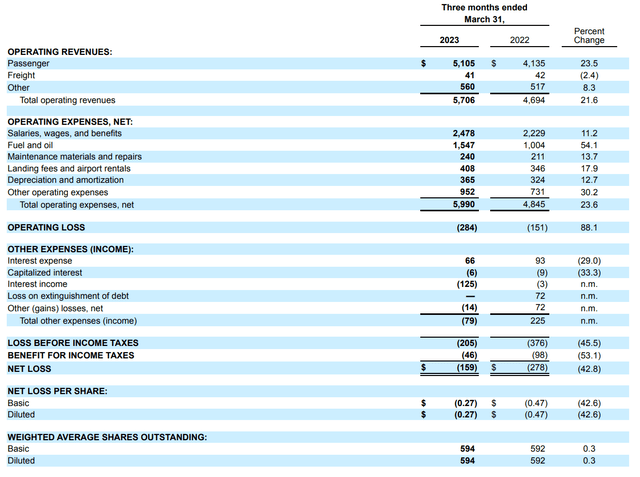

Southwest Airlines: An Uninspiring Quarter

Operating revenues grew by 21.6%, and that was in line with the updated guidance issued in March to reflect a reduction of $325 million in revenues due to cancelled holiday returns in January and February. Putting it simply, since Southwest Airlines messed up the December holiday plans of travelers, there also were no passengers to fly back from their holidays and there was a short-term reduction in bookings. Overall, revenues were missed by $20 million, which I think is not too bad of a miss and could reflect that analysts had expected a $300 million impact rather than the posted $325 million. Nevertheless, on 10.7% higher capacity we saw even bigger revenue growth showing strong growth in unit revenues, but that is also driven by Q1 2022 being impacted by the Omicron variant, which means that, in the remainder of the year, the comp will be more difficult.

Salaries were up in line with the capacity expansion, but up less compared to the 18.7% increase in headcount. Fuel costs were up 54%, driven by 10% higher fuel consumption and 38.7% higher economic prices. Maintenance expenses were up 13.7%, and that is something that is going to continue this year as more Boeing (BA) 737-800 airplanes are going to enter heavy engine maintenance. Excluding fuel costs were up 16%, mostly reflecting labor pressures. Overall, Southwest Airlines missed expectations by $0.04 or $24 million. Connected with the missed revenues were $55 million in costs. So, you could look at the loss as either being produced at the top line and not passing fully through to the profit, or alternatively, you could explain it by maintenance cost increases or the higher costs connected to the missed revenues.

So, there are a lot of moving parts, but with all that, I do believe that results came more or less in line with the expectations of management.

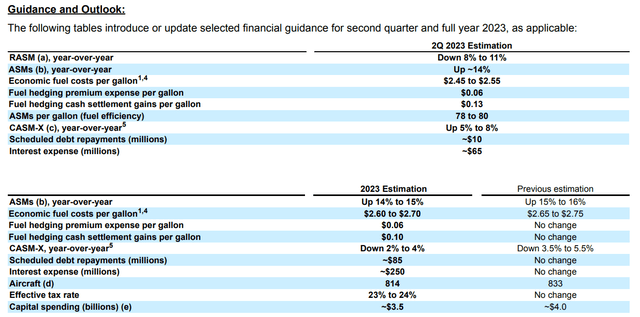

Southwest Airlines Revises Guidance Downward

If we look at the second quarter, what we see is that unit revenues are expected to be down 8% to 11%. That is driven by Q2 2022 being strong for domestic unit revenues, as international was still pretty much closed, and this year travelers can also choose for international travel. Those two markets are not completely unlinked but provide some potential RASM pressure on an evolving comp. The tailwind is lower fuel costs in the $2.45-$2.55 per gallon range, compared to $3.19 in Q1. Very roughly speaking, higher capacity should have resulted in CASM-X reduction, but that is not the case as higher maintenance costs are expected, there will be investments to improve operational reliability, and there is inflation.

For the full year, capacity has been dialed down by 1%, as Boeing will not deliver 20 airplanes that were expected in late 2023. That resulted in CASM-X declining by 1 percent less, and the rest is driven by retiming of maintenance. The delivery delays will result in Southwest Airlines spending $500 million less on CapEx this year, but they will also end the year with fewer aircraft, which is not a desirable situation. Overall, for 2023, the company will benefit from lower fuel costs and realize some unit cost reductions, but the company has been continuously lowering its capacity outlook, and that results in more modest reductions in CASM-X. The company is retiming its hiring as airplane deliveries are delayed, but it does seem that Southwest Airlines overall is caught by long overdue costs, higher maintenance expenses which I believe the company should have seen coming at the start of the year already, and there could be some RASM pressure due to a more difficult comp. That doesn’t mean unit revenues will not be strong, but they might be softening.

What Is Southwest Airlines Stock Worth?

|

Valuation Southwest Airlines |

|||

|

Market Capitalization ($ bn) |

$17.51 |

||

|

Preferred stock ($ bn) |

$ – |

||

|

Total debt ($ bn) |

$8.10 |

||

|

Cash and equivalents ($ bn) |

$11.70 |

||

|

Minority and controlling interests ($ bn) |

$ – |

||

|

Total Enterprise Value ($ bn) |

$13.91 |

||

|

EBITDA 2023 ($ bn) |

$3.63 |

||

|

EV/EBITDA |

3.8x |

||

|

Current price |

$29.43 |

||

|

Median |

Current |

Industry |

|

|

EV/EBITDA |

6.7 |

6.54 |

8.3 |

|

Price target |

$51.49 |

$50.26 |

$63.78 |

|

Upside |

75% |

71% |

117% |

Parsing the numbers for Southwest Airlines gives significant upside. While peers gained 4% year-to-date, Southwest saw its stock price decline by 9.2%, which gives the stock significant upside based on current EBITDA expectations for 2023. Airline names tend to be volatile, so I would consider the price target from this valuation method as the valuation in strong market conditions, but even if we cap the upside to take this into consideration, we end up with around 50% upside.

Conclusion: A Lackluster Quarter But Stock Remains A Buy

When looking at the results and also by listening to the earnings call, I have to say that I was expecting that I would mark Southwest Airlines Co. stock as a sell. The call was rather uninspired, and they basically seem to be taking it on the chin as headwinds come their way, but that is still better than not addressing things at all and upholding an obsolete outlook.

Currently, the Southwest Airlines Co. stock is priced fairly, but that also creates an opportunity for significant stock appreciation ahead. 70% upside might seem high for a company that surely had its big problems on operational reliability, and if you expect those issues to persist, then Southwest Airlines might not be your cup of tea. However, even if Southwest Airlines should suffer another earnings blow, a significant upside would remain.

While there are macroeconomic concerns and Southwest Airlines Co. has a set of cost elements unique to its business this year, a stock price that is actually lower than during the pandemic makes no sense, especially not for a business that pays a dividend and is in a net-cash position with an investment grade rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum for the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.