Summary:

- Merck beat estimates on both lines.

- While the COVID impact resulted in a sales decline, the underlying performance was positive.

- Keytruda remains a major growth driver and should see further approvals in the future.

Marko Georgiev

Article Thesis

Merck (NYSE:MRK) reported its first-quarter earnings results on Thursday morning. The company beat estimates on both lines thanks to a strong performance from its most important drug, Keytruda.

The operational outlook is quite positive, but shares aren’t as cheap as they were in the past. Still, over the long run, Merck could deliver very solid total returns.

Merck Q1 Earnings Results: What Happened?

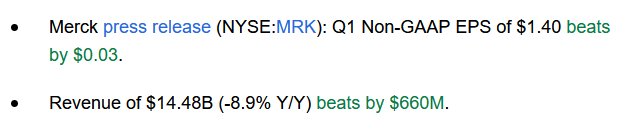

Merck announced its Q1 earnings results on Thursday before the market opened. The company’s top-line and bottom-line results can be seen in the following screenshot:

Seeking Alpha

Revenue came in at $14.5 billion, or almost $60 billion annualized. That beat estimates easily, but revenues were down year over year. That was not due to a bad operational performance or due to weak demand for its drugs, however. Instead, the sales decline was driven by the impact that Lagevrio (molnupiravir) had during the previous year’s first quarter. Lagevrio, Merck’s COVID drug, generated substantial sales during the first quarter of 2022, when the pandemic was still raging and when many patients wanted COVID treatments. It was clear from the beginning that those sales would not be generated forever, as everyone knew that the pandemic would come to an end eventually.

Merck: Strong Execution

I believe that Merck shouldn’t be faulted for not generating these COVID-related sales forever. It seems like the market agrees with that, as Merck’s shares are up at the time of writing, despite delivering lower sales compared to the previous year’s quarter.

It seems better to focus on Merck’s ex-Lagevrio sales, which are more telling about the company’s future performance potential. Looking at those, Merck delivered appealing growth of 11% year over year. Things get even better when we look at the company’s sales performance in constant currencies. Merck is active in many different countries around the globe, thus its reported sales are impacted by currency rate movements. In some periods, those boost Merck’s reported sales, while currency rates are a headwind in other periods. During Q1, currency rates were a headwind for Merck’s reported results (and for those of most other US-based companies), due to the US Dollar strengthening versus many other currencies over the last year. That’s not Merck’s fault, and it is, I believe, highly likely that currency rates will not be a headwind forever. Eventually, Merck’s reported results should be closer to the underlying currency-neutral revenue performance. During the first quarter, this currency-neutral revenue performance was very positive, as sales rose by 15% (also excluding the Lagevrio impact).

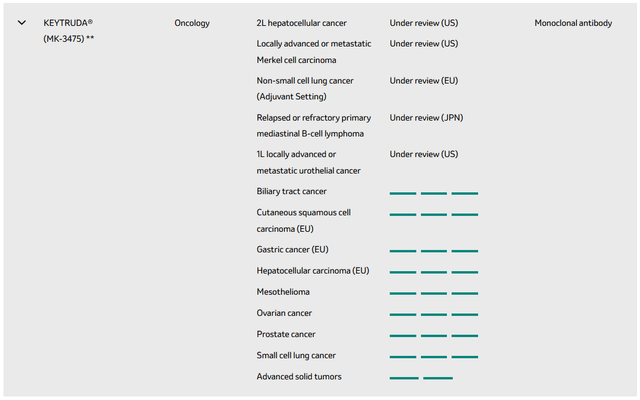

There is no guarantee that growth will remain this strong, of course, but the fact that Merck’s core drugs have delivered a growth rate this strong is highly encouraging. This was made possible by strong demand for important drugs such as Keytruda, Merck’s mega-blockbuster oncology drug, and due to the nice performance of some other drugs on top of that. Keytruda sales rose by 20% year over year, to almost $6 billion, while the currency-neutral growth rate was even better. Keytruda (pembrolizumab) is being used for the treatment of a wide range of indications, including melanoma, non-small cell lung cancers, lymphoma, and so on. And yet, Merck is planning to get additional approvals for this drug in the future. Keytruda is currently being evaluated in many additional indications:

We see that, according to Merck’s website, Keytruda is currently being evaluated for eight indications in phase III trials, and for one indication in a phase II trial. On top of that, several other studies are currently under review. That’s not all, however, as Merck is also testing the combination of pembrolizumab and favezelimab in some indications, such as small cell lung cancers and hematological malignancies. Of course, not all studies will eventually lead to approval by authorities, not even when it comes to late-stage phase III studies. But with Merck’s strong track record of getting approvals for Keytruda so far, and with this many studies still being done, I believe that it is likely that there will be at least some additional approvals going forward. While Merck already is a gigantic drug in terms of revenue generation, it should thus get even bigger in the future, through a combination of additional approvals, new patient starts in currently-approved indications, and price increases.

While Keytruda plays a huge role in Merck’s growth outlook in the foreseeable future, there are some other growth drivers as well — which is a good thing, as risks would be higher if Keytruda was Merck’s sole growth asset. Gardasil, Merck’s HPV vaccine, showed compelling growth of 35% during the most recent quarter, for example. Merck has been investing a lot of cash in its vaccine business in recent years and sees considerable long-term growth potential in this area. While we don’t know yet what the performance of Gardasil and other vaccines will look like in the future, the recent performance is encouraging for sure. Gardasil sales came in at $2 billion for the quarter, which is considerably less than what Keytruda is generating, but which is still easily enough to make Gardasil a very important blockbuster drug for Merck.

In other therapeutic areas, Merck is pursuing growth as well. This includes its cardiovascular health program and its infectious diseases program. In the latter, Merck has opened enrollment in its phase III study for once-daily doravirine, an HIV drug. HIV is a huge and growing market with annual sales of more than $30 billion, and while Gilead (GILD) has a strong market position here, even small market share gains could add meaningfully to Merck’s top line if the company is successful with its doravirine trial. Merck and Gilead have also started cooperation on a phase II study in the HIV space for a once-weekly treatment regime. While this is less certain to be successful due to being a phase II study, it has potential for sure, for both patients and Merck (and Gilead).

Due to the strong execution in Q1 and due to the ongoing pipeline progress in different therapeutic areas, Merck has increased its previous guidance for the current year. The company is now forecasting sales of $58.3 billion for the current year, using the midpoint of the guidance range. At the same time, Merck has increased its adjusted (non-GAAP) earnings per share guidance for the current year, now forecasting EPS of $6.88 to $7.01. This includes a forecasted 4% headwind from currency rates, thus Merck’s underlying performance is even better.

Is MRK Stock A Buy?

While the quarterly results were strong and while the operational outlook for the foreseeable future is appealing, Merck may not necessarily be a great buy. Valuations should be considered as well, and since Merck has seen its shares rally quite a lot over the last year — MRK stock is up 35% — the valuation has become less attractive.

Today, at $116, Merck is trading for 17x this year’s expected net profits, using the updated midpoint of Merck’s EPS guidance. That’s not an overly high valuation, but it also isn’t an especially low valuation for a pharma company. Many other big pharma names, such as Pfizer (PFE), Johnson & Johnson (JNJ), and AbbVie (ABBV) are trading at lower valuations.

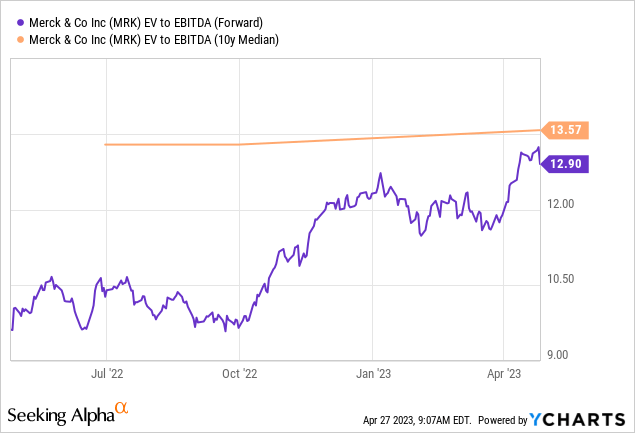

Merck is now trading relatively in line with its historic valuation:

The EV/EBITDA multiple is 13 for the current year, which is a couple of percentage points lower than the longer-term median EV/EBITDA multiple. The difference is by far not as large as it was last fall, however. When MRK was trading at a single-digit EV/EBITDA multiple, it was highly attractive and very inexpensive, and there was considerable upside potential. Now, shares are looking relatively fairly valued and MRK’s upside potential is less pronounced.

Looking at Merck’s dividend, the yield has declined to 2.5% — that’s not bad at all, but less attractive than the dividend yield of well above 3% Merck offered last fall. Due to its valuation now being relatively fair and not especially low any longer, I believe that Merck is a good long-term holding, but not a great buy any longer. The best time to buy shares is when they are truly cheap, after all, and not when they are fairly valued.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MRK, JNJ, ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!