Summary:

- PepsiCo is relying almost entirely on unsustainable price increases, the company’s sales volume growth remains net negative.

- The company continues to deal with rising prices and forex challenges, and management has already stated that price increases will be more tempered moving forward.

- The Stock looks overvalued using several metrics.

Fotoatelie

Inflation has changed the economic environment dramatically over the last three years. While Companies have reacted differently to rising prices over the last several years, most management teams have tried desperately sustain earnings growth even as costs have continued to rise significantly for almost three consecutive years.

One company that has been successful in enacting a number of significant price increases during this inflationary period to offset negative volume growth and rising costs has been PepsiCo (NASDAQ:PEP). Previously, I covered PEP stock in Jan 2023.

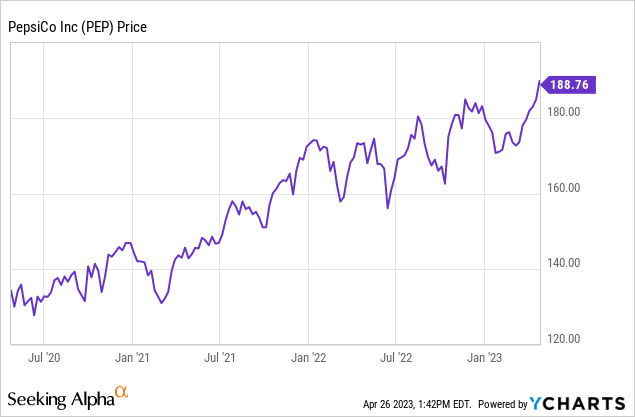

Pepsi is up 40.41% over the last 3 years. PEP stock has performed well even after prices began to rise significantly in March of 2021.

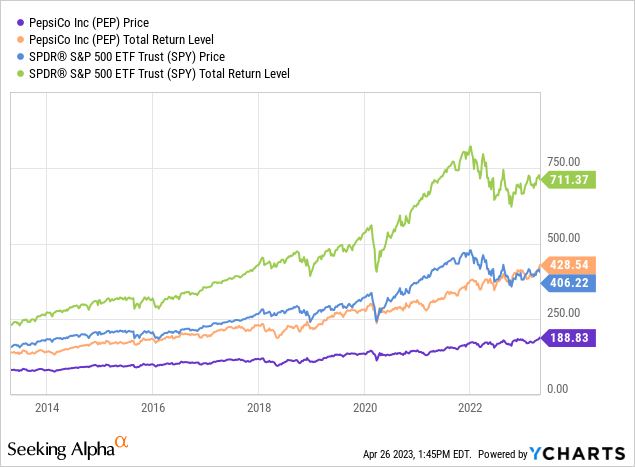

Still, Pepsi also consistently underperformed the S&P 500 (SPY) and most of the major indexes over the last decade.

Pepsi is up 127.91% over the last 10 years, while the S&P 500 is up 152.21% during the same time period.

Today, Pepsi is a sell. Management is relying on unsustainable price increases for most of the company’s revenue growth, sales volume in most major segments is declining, and currency headwinds remain a significant headwind. The company is also trading at what are likely unrealistic valuation levels.

Pepsi’s first quarter earnings report looked strong on the surface, but there were several warning signs. The company recently stated that non-GAAP earnings for the first quarter were $1.50 per share, beating expectations of $1.38 per share. Management also reported that the company grew net revenues by 10.2% on a year-to-year basis, and the company raised guidance as well. The company now expects revenues to grow by 8% this year, and earnings to grow at a rate of 9%. PepsiCo earned $6.42 a share in 2022, up 16.94% from the company’s 2021 earnings of $5.94 a share.

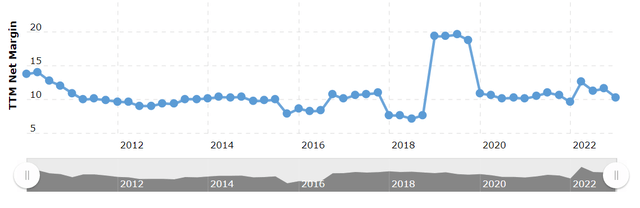

Pepsi’s recent headlines have been impressive, but the company is relying almost entire on likely unsustainable prices increases to drive earnings growth. Management enacted three significant prices increases just in the last year. The company raised prices by 10% in the first quarter of 2022, 12% in the second quarter of last year, and 7% in the fourth quarter several months ago. Pepsi increased prices by almost 30% in the last year, and that’s what management used to drive nearly all of the company’s earnings growth. Sales volumes were down 2% across the company’s segments, with a 3% volume drop in the food segment offsetting a 1% increase in sales volume in the beverage division. Management also indicated that price increases are likely to be much more tempered moving forward. Forex impacts lowered revenues by 2.5% and the earnings per share by 2% Pepsi’s current net margins are also at the high end of the recent 10-year range, at 10.31%

A chart showing Pepsi’s net margins (macrotrends.net/stocks/charts/PEP/pepsico/profit-margins)

This is why this company looks overvalued using several metrics. Analysts are only projecting PepsiCo to be able to grow earnings at 4-6% over the next 5 years, and the company currently trades at 27x likely forward GAAP earnings, 2.9x forecasted forward sales, and 13.52x expected forward book value. The sector median is 20.64x likely forward GAAP earnings, 1.73x forecasted forward sales, and 2.94x forward book value. Pepsi’s 5-year average valuation is 23.92x expected forward GAAP earnings and 13.11x likely forward book value.

Even though Pepsi obviously has multiple premium brands, and the company has a recession resistant business model, the company continues to face significant challenges with costs still rising and forex challenges likely to continue. The company was able to significantly raise prices across most major segments in 2022, but management has already stated that future price increases will be softer this year, and consumer income levels are likely to lower with the economy showing signs of slowing. While some of PepsiCo’s core brands such as Frito-Lays did see market share gains last year, the company still clearly relied on significantly and likely unsustainable price increases to offset rising costs and forex challenges. While Pepsi showed that consumers are willing to pay up for the company brands, management’s ability to raise prices moving forward should still be limited, this company is likely pricing in unrealistic expectations.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.