Summary:

- Intel Corporation reported Q1 2023 results that were better than feared, but the company burned a ton of cash during the March quarter.

- The chip giant saw net debt soar during the quarter due the loss, large capex spending and the payment of the last large dividend.

- Intel Corporation stock is expensive at $30 with debt soaring, and with the best expectations for an EPS to top $2 not until 2025 at the earliest.

JHVEPhoto/iStock Editorial via Getty Images

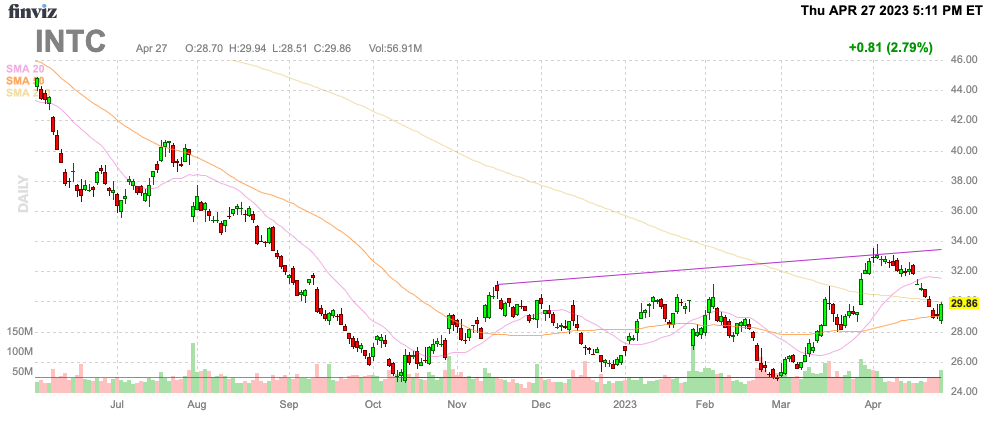

Intel Corporation (NASDAQ:INTC) got a quick pop on better than feared Q1 2023 results, but the numbers by no means were good. The chip giant saw its only growing business unit see a related stock collapse during the day after reporting their earnings. My investment thesis remains Bearish on Intel as the business starts losing money while investing aggressively into a very uncertain future, adding a large amount of risk to the story.

Source: Finviz

Better Than Feared Isn’t Good

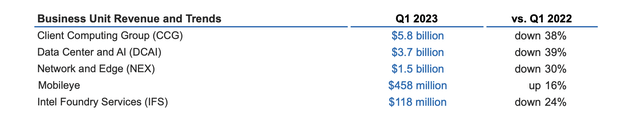

Intel reported Q1’23 revenues beat analyst estimates by $570 million, yet revenues fell 36% from last year to only $11.7 billion. The only business unit to report solid numbers was Mobileye Global Inc. (MBLY) that fell 16% today on the news of cutting guidance for the year.

Source: Intel Q1’23 earnings release

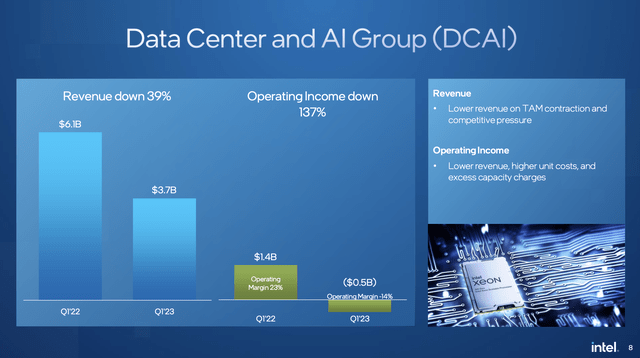

The prime Data Center and AI group saw revenues fall 39% to a level of only $3.7 billion. Intel turned a business with operating income of $1.4 billion last year to a major loss of $500 million this Q1.

Source: Intel Q1’23 presentation

The massive $1.9 billion shift from a large operating profit to a loss is emblematic of the problems facing the chip giant. This sector faces added pressure going ahead with indications that the new Sapphire Rapids server chip from Intel isn’t being bought by top customer Microsoft Corporation (MSFT).

Intel lost $0.04 a share during the quarter for the first reported loss in years after reporting quarterly earrings of $1+ per share for years now. The problem facing the chip giant is that gross margins plunged to 38.4% for a company that previously produced gross margins above 60%.

Burning A Hole In The Balance Sheet

The chip company now has a negative operating margin leading to Intel burning $1.8 billion in cash from operations during Q1 alone. The problem is that the company burned far more cash from capex and dividends.

Intel spent an insane $7.4 billion on capex during Q1’23 alone while the dividend payouts were still $1.5 billion, though cut 66% going forward. In all told, The chip company watched cash flow out of the business at an alarming rate of $10.7 billion.

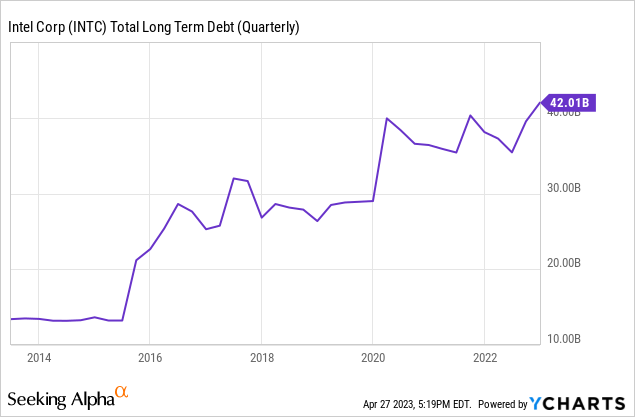

The chip giant has total debt of $50.3 billion now as the company pursues an aggressive fab building plan while still underspending leading competitor TSMC (TSM) by up to $15 billion this year. As the chart below highlights, Intel went into 2016 with hardly $10 billion in outstanding debt, no doubt offset by some cash, and debt levels had already reached $42.0 billion at year end.

The company now has total cash and short-term investments of $27.6 billion leaving net debt of $22.7 billion. The net debt levels were only $13.7 billion at the end of 2022.

Intel guided to an equally weak Q2, though the company has already cut the dividend payout and capex spending will be reduced going forward either via the company reducing spending or governments paying part of the bill. The guidance for Q2 revenues in the range of $11.5 to $12.5 billion does signal some stabilization in the business with signs the Client Computing business is stabilizing due to the inventory correction ending in the PC sector.

The stock has rallied back to $30 heading into earnings. Considering Intel has shown no ability to generate solid results in the face of competition from Advanced Micro Devices, Inc. (AMD) and NVIDIA Corporation (NVDA) on the chip design side and TSMC on the manufacturing side, investors should continue avoiding the stock while it is piling on debt.

Under the best case scenario, Intel Corporation would return to making a $2 to $3 EPS in a few years. The stock would appear to have limited upside in the next few years while tons of risk exists that the chip giant fails to execute and the debt load continues to soar on weighs on the business and stock.

Takeaway

The key investor takeaway is that Intel Corporation continues spending into a massive hole with no guarantee of catching TSMC on process technology in the next few years. The best outcome is a scenario where Intel becomes equally competitive with TSMC on manufacturing. Such a scenario could still leave Intel Corporation losing market share to the likes of AMD going forward making the stock not worth the risk here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.