Summary:

- AWS struggles to live up to expectations. That had been the crown jewel of the investment thesis.

- One very strong (and surprising) line was advertising jumping 23% y/y. A discussion of Amazon’s advertising business and how it compares with other tech giants.

- Amazon’s valuation starts to weigh on the stock.

AndreyPopov/iStock via Getty Images

Investment Thesis

Amazon (NASDAQ:AMZN) is priced as a secular growth story. One with a narrative that commands a premium valuation as a high-tech disruptor. At the core of the bull case is that irrespective of the macro environment, Amazon simply delivers.

From packages to data, Amazon has you covered. But what if it so happens that the investment got too crowded?

Perhaps, you’ll forgive me, as I’ve been bearish on AMZN stock for a while.

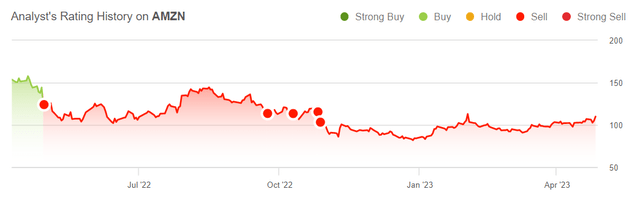

AMZN Author’s work

That being said, you can be reassured that I’ll be objective in my analysis.

Indeed, as you can see above, neither the bulls nor the bears have been gaining any traction on their thesis. Although, I’m inclined to believe that now the investment thesis sufficiently changes to leave the bears in charge.

Amazon Prospects Don’t Entice

Long ago Amazon stopped being a highly prized investment for its retail business.

The one thing that truly excited investors had been AWS. In fact, on the back of Azure growing by 31% in constant currency, as well as, Alphabet (GOOG)(GOOGL) Cloud growing by 28%, to then see Amazon’s AWS growing by 16%, left investors gaping.

But the lackluster AWS story doesn’t end there. Because looking ahead, even as Microsoft leads the market to believe that IT spending may not be slowing down meaningfully, or better said, had not been slowing down as much as the market feared going into this earnings season, it turns out that Amazon’s AWS guidance is pointing to around 12% y/y growth for Q2.

But the AWS story doesn’t end here. Allow me to elaborate. In the past several years, AWS had tremendous pricing power. This allowed AWS to massively ramp up its AWS revenue.

And investors believed that the digital transformation story was so strong, that AWS would be able to retain its leadership, while at the same time, raising prices.

That turns out to have been an inaccurate assumption by investors. Case in point, consider this quote from the earnings call,

[…] customers continue to evaluate ways to optimize their cloud spending in response to these tough economic conditions in the first quarter. And we are seeing these optimizations continue into the second quarter with April revenue growth rates about 500 basis points lower than what we saw in Q1.

[…] our AWS sales and support teams continue to spend much of their time helping customers optimize their AWS spend so that they can better weather this uncertain economy.

This demonstrates AWS is lowering its prices, as businesses reduce their AWS consumption. It’s awesome for the strength of AWS’ business relationships, to be able to show willingness to negotiate with customers. But honestly, strong brands don’t negotiate on price. Period.

Meanwhile, on the retail side of its operations, this is what Amazon’s CFO Brian Olsavsky stated on the earnings call,

The uncertain economic environment and ongoing inflationary pressures continue to be a factor, and we believe it’s continuing to drive cautious spending across consumers. This means our customers are looking to stretch their budgets further and are focused on value.

Looking ahead, its retail operations are having to fight to retain market share as consumers become more price-conscious.

On the other hand, within Amazon’s retail segment, its advertising business was up nicely, 23% y/y (adjusted for FX). As you know, the adverting sector has been on its back for so many quarters in a row, the fact that Amazon is up 23% y/y demonstrates that Amazon is beyond any doubt taking market share away from Alphabet and Meta (META).

Furthermore, recall, that advertising is such a coveted business since it’s an incredibly high margined business.

In fact, it wouldn’t surprise me if Amazon’s advertising business was able to command significantly higher margins than AWS’s. Could Amazon’s advertising business rival Alphabet’s at close to 40% operating margins? I believe that’s possible.

Amazon is Not A Premium Growth Business

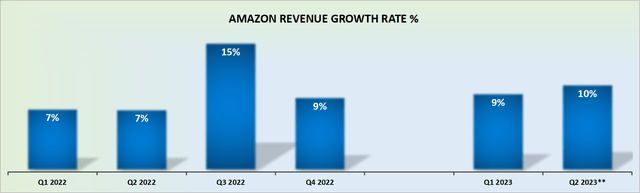

AMZN revenue growth rates

It has been more than 7 quarters since Amazon grew at more than 20% CAGR. And its guidance ahead point to an 8th consecutive quarter of sub-20% CAGR.

For all the spiel and ambition, this is not Day-1 any longer. And that’s the good news too.

Because on the back of slowing revenues, Amazon’s cash flows jumped 38% y/y. Clearly showing to investors that Amazon is ready to start bringing in that cash flow.

Is Amazon a High-Quality Business?

Guidance for Q2 2023 points to 4% operating margins. This is an expansion of approximately 130 basis points from the prior year.

However, this is the key question that investors have to come to terms with. Does a business that’s proceeding to struggle to have more than mid-single digits and is growing at double digits on the top line have the right sort of margin profile to be recognized as a “high-quality business“?

That’s really where the crux of the argument for both bear and bull finds itself.

The Bottom Line

Investors had been more than willing to pay substantially more than 60x forward EPS on the assumption that AWS would continue to rapidly grow, with its extremely high operating profit margins. But as it turns out now, AWS is not immune to the overall reduction in IT spending that’s percolating through the economy.

In conclusion, Amazon is more cyclical than investors were willing to believe.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.