Summary:

- Mastercard beats earnings amid much uncertainty in the overall economy.

- Earnings are still expected to grow going forward as well, defying the gloomy outlook.

- Strong buybacks and expanding their brand into new markets can help drive growth going forward.

Digitalroomm

Written by Nick Ackerman.

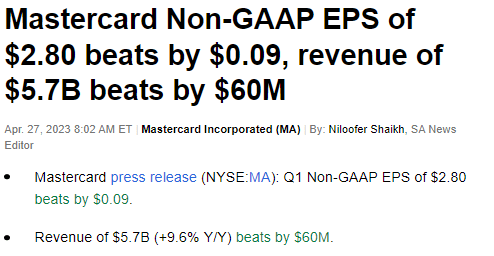

Mastercard (NYSE:MA) is entering the year with some strength. The latest earnings gave us a beat on both the top and bottom lines for Q1.

MA Q1 Earnings Metrics (Seeking Alpha)

Though this is hardly anything new when this company regularly beats earnings expectations. Previously, nine of the last nine quarters have been beats to the upside, making this now 10 out of the last 10. There has been only one EPS miss in the last 16 quarters. Perhaps unsurprisingly, this is the same streak in terms of their revenue as well, with only one miss in the last 16 quarters.

This isn’t only a beat on their non-GAAP EPS, but it’s also higher year-over-year. Q1 2022 saw adjusted diluted EPS of $2.76. Sure, the growth hasn’t been massive, but there have been quite a few earnings beats we’ve been seeing that are still showing year-over-year declines. The revisions lower also haven’t been overwhelming as we got closer to these results.

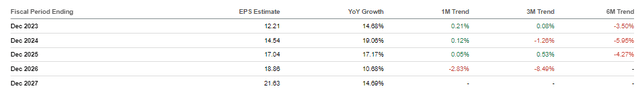

MA Earnings Revisions (Seeking Alpha)

Adjusted net revenues jumped by a much larger amount year-over-year, but it appears that the adjusted effective income tax rate also leaped higher by 13 points. The operating expenses also were seen climbing 10%. Thus, why we would see profitability take a more muted climb over the last year. This was right around where MA management saw their tax rate coming in, approximately at around 18% and 18 to 18.5% for the entire year.

MA Key Quarterly Metrics (Mastercard)

Helping to drive this growth was gross dollar volume coming in with a 15% increase, up to $2.1 trillion from $1.92 trillion a year ago. Purchase volume was up 17%, and switched transactions were up 12%. However, the payments network net revenue increased by 7%, while the value-added services and solutions net revenue increased by 19%.

They still experienced this growth despite what should be a slowing economy with the Fed hiking interest rates. There continues to be resiliency in spending from consumers. This also was going up against the quarter when they were still doing business in Russia.

Once again, the CEO emphasized cross-border travel as showing “continued recovery.” That was up 35% year-over-year. In the prior quarter, they mentioned that most areas had recovered to “well above 2019 levels in Q4.” So a continued recovery seems to be a bit odd, but that could be referring to China as they reopened.

The payments businesses can be rather resilient during recessions as people don’t stop swiping in a weaker economy, though they may alter where they shop and how much they spend. Travel could slow down as well going forward, which has been an important growth driver, as noted in their previous Q4 earning call.

There’s a lot of deals with financial institutions, but there’s also a lot of deals with partners out in the travel space, and the travel space is really the one that’s been most promising for us, and that is coming back right now. So this is a near-term opportunity. Cash and checks dominated existing tools, existing partners. This is right for us to go after it, and we’re leaning in.

With the latest quarter once again showing strong growth in travel, this risk remains yet to be seen.

Growing by entering new markets and partnerships and potentially taking away market share from competitors can help them continue to grow going forward. They noted 3.2 billion in branded cards being issued at the end of March 31, 2023, a climb from the year-ago period when there were 2.9 billion branded cards. They also highlighted that with the latest quarter, they have now surpassed “100 million acceptance locations worldwide.”

Despite the risk of slowing spending during an economic slowdown, I believe that being able to drive growth through partnerships and entering new markets can still lead to positive results. That doesn’t mean they’re recession proof, but they aren’t necessarily as cyclical as one might expect.

Competition Isn’t Really A Problem

Visa (V) isn’t the only competitor but also American Express (AXP) and Discover Financial Services (DFS) in the e-commerce space. PayPal (PYPL) also is competition but is a bit of an oddball competitor because they are partnered with MA but also competing. Perhaps this arrangement can be best summed up as “frenemies.”

Competition can often be a main risk, but MA’s strong results came on the back of V announcing a beat on the top and bottom line for their own release a couple of days ago. So the success of one doesn’t necessarily mean the downfall of the other; there is room enough for MA to grow while its competitors do as well.

Growth Expectations

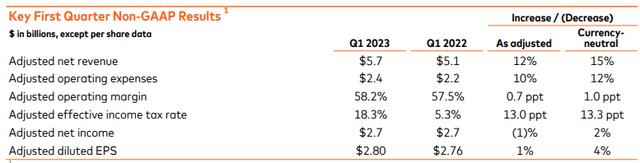

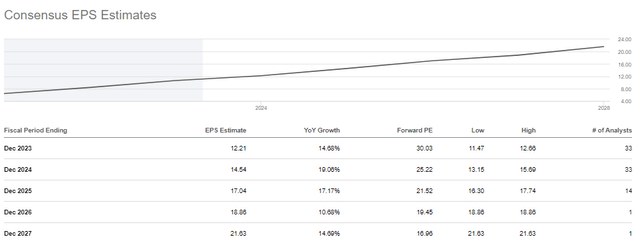

Going forward, analysts expect MA to grow earnings by nearly 15%. Starting off with a beat in Q1 gives them a great head-start on achieving this target.

MA EPS Estimates (Seeking Alpha)

Analysts actually expected Q1 to show a marginal decline year-over-year at $2.71 before climbing higher in the latter quarters. Q4 and Q3 were anticipated to show over 20% growth. Given their tendency to beat expectations, it wouldn’t be completely unsurprising to see earnings growth above that ~15% expectation.

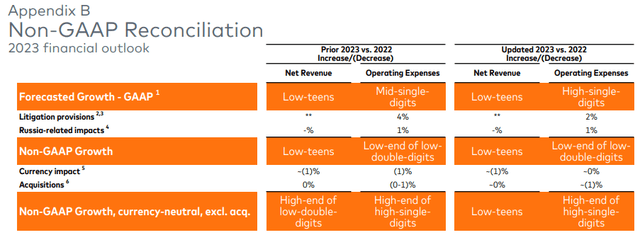

For their own outlook of net revenues, they expect low teens from the “high-end of low-double-digits.” Suggesting that overall they still see business performing well. That could see them hitting their EPS targets outlined by analysts.

MA Net Revenue Outlook (Mastercard)

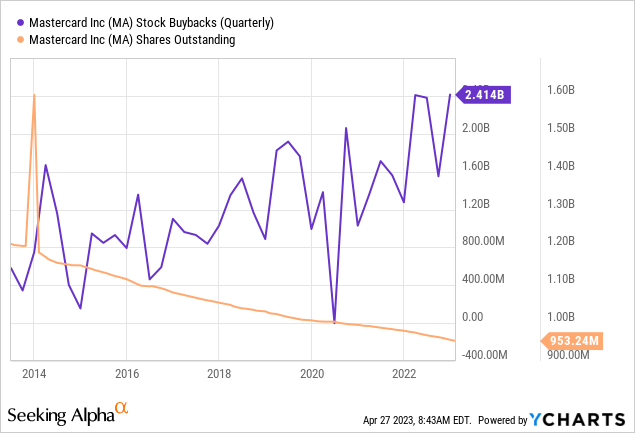

Helping to contribute to growth has been an aggressive buyback of shares. In fact, in the latest quarter, they noted another 8 million shares with a cost of $2.9 billion. The buybacks have seen an accelerating trend, too, looking back at their history.

Ycharts

For the dividend, they only paid out $545 million for the latest quarter, so that really highlights how aggressive they can be with buybacks. In fact, they actually already spent another $602 million for this quarter.

Quarter-to-date through April 24, the Company repurchased 1.6 million shares at a cost of $602 million, which leaves $8.7 billion remaining under the approved share repurchase programs.

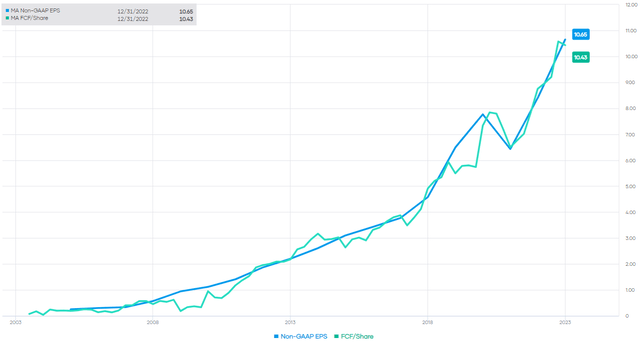

Either way, it should ultimately benefit shareholders. With the profits and free cash flow this business generates, they have no problem pulling this off, either.

MA EPS And FCF/Share (Portfolio Insight)

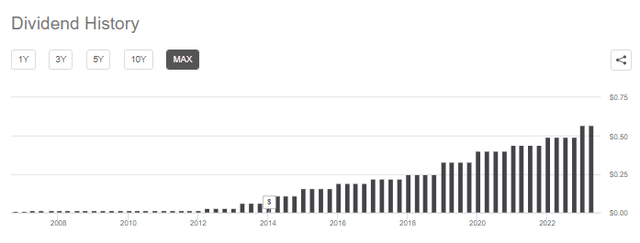

They’ve been able to grow their dividend over the years rapidly. The 10-year CAGR comes in at a blistering 30.32%. However, the latest increase saw that cool down a bit to 16.3%. At that time, they also announced the $9 billion buyback program.

MA Dividend History (Seeking Alpha)

Valuation

Given the potential headwinds that the overall economy faces going forward, investors seemed to have been letting this name get cheap. Not that it’s being sold off necessarily, but it has been moving sideways for the most part for the last several years. The exception was a relatively quick dip around October 2022, when the rest of the market also reached its lows.

On a P/E basis, one might view MA as quite expensive, but relative to its trading history, the fair value from here is actually quite a bit higher if we look back at the last five years.

MA Fair Value Estimate Based on Historical P/E (Portfolio Insight)

With the type of growth we’ve seen, usually names such as MA trade at a richer valuation. That’s what the above is reflecting, and that’s why it shows there could be some upside from here.

From another perspective, Wall Street analysts have an average price target of $426.14. That would represent an upside move potential of more than 16%. So that’s a bit less aggressive than the nearly $470 fair value price target we see above.

Which I don’t think it is completely out of the question for either of these prices to be hit at some point, though it could take a little while before we start seeing a higher valuation. There appears to be too much uncertainty in the economy right now.

Sector Change

Mastercard recently underwent a bit of a transformation, although it wasn’t fundamental or structural to MA itself. Instead, it was a sector classification change.

For years MA was categorized as an information technology company or a tech company. The reason seemed fairly straightforward when understanding that the company operates a network for payments and not any actual financial services or products that traditional banks offer. However, the recent change saw MA and its competitor V added to the financial sector category. Going along with this change was also PYPL.

That was effective in March, but there was much bigger news going on around that time. Overall, it shouldn’t have a material impact on the company itself, but perhaps in the performance going forward, it could be a boost to the financial sector. MA has exhibited strong growth over the years and is expected to remain a growth engine even despite the current economic outlook.

Conclusion

MA has given investors tremendous returns over time through appreciation and a rapidly growing dividend. If history is any guide, shares still look quite cheap relative to where they normally trade in terms of their P/E. That’s despite what would appear to be quite a lofty P/E ratio in the first place. The latest earnings show us that there’s still more room to grow going forward as well, leaving the door open for more happy shareholders.

However, the nearer-term uncertainty is likely to lead to volatility and a potentially lower price to enter a position. For the longer-term investor, that’s likely to create some potential buying opportunities to average down or start a position. With that said, a long-term investor could probably enter a position even around these levels.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Interested in more income ideas?

Check out Cash Builder Opportunities where we provide ideas about high-quality and reliable dividend growth ideas. These investments are designed to build growing income for investors. A special focus on investments that are leaders within their industry to provide stability and long-term wealth creation. Along with this, the service provides ideas for writing options to build investor’s income even further.

Join us today to have access to our portfolio, watchlist and live chat. Members get the first look at all publications and even exclusive articles not posted elsewhere.