Summary:

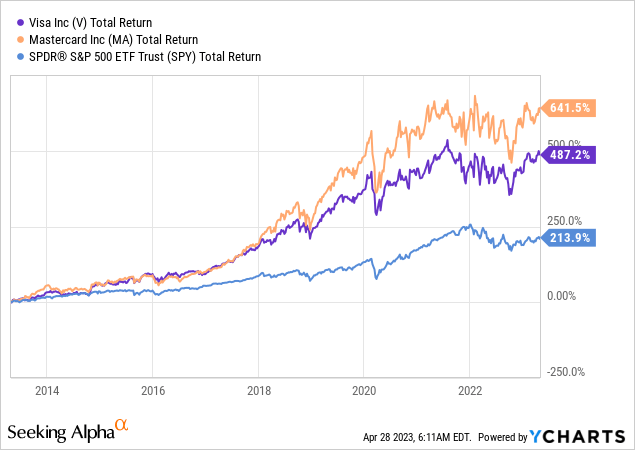

- Visa and Mastercard operate two of the best businesses in the world, as the duopoly responsible for processing most of the world’s transactions.

- Even after decades of market outperformance and high double-digit growth, the companies have plenty of room for growth, as their new services expand and cash usage continues to decline.

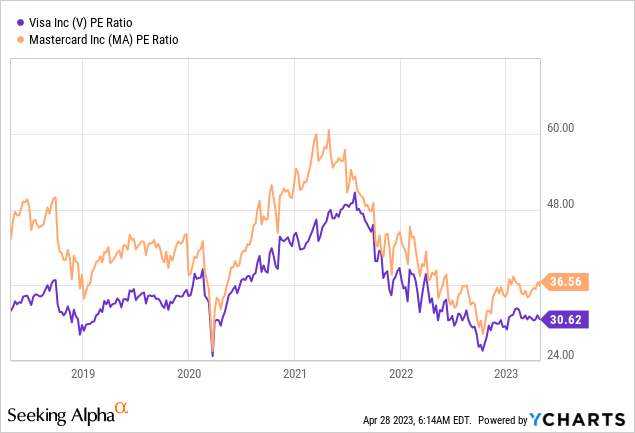

- Based on the companies’ P/E ratios, both trade below their historical valuations, and Mastercard trades at a 19.4% premium over Visa.

- As I expected, their recent quarterly results proved once again the underlying assumption behind Mastercard’s premium is wrong, as both Visa and Mastercard grew at a similar 11% pace.

- I estimate both stocks will provide market-beating returns, and expect Visa to outperform due to its better margins and similar growth prospects.

Justin Sullivan

Visa Inc. (NYSE:V) and Mastercard Incorporated (NYSE:MA) are international brands, trusted by billions of people to process their payments all over the world. Even after decades of outperformance and impressive high double-digit growth, I believe there’s still plenty of room for upside, as cash still takes a major portion of global transactions, and the companies are diversifying their offerings to new services.

As the companies trade below their historical multiples, I believe both will provide market-beating returns. However, I find the underlying assumptions in Mastercard’s 19.4% premium over Visa wrong, and thus I estimate Visa is the better buy.

Background

At the beginning of April, I wrote articles covering both Mastercard and Visa. In both articles, I covered the companies’ businesses in-depth, described their complicated revenue streams, and provided comprehensive valuation models.

In the Mastercard article, I focused on detailing my investment thesis in payment networks, and explaining why I found Visa a superior investment, after comparing the companies’ margins, growth, and valuations.

In the Visa article, I focused on the companies’ immense growth prospects and addressed the main risks with their businesses. Specifically, I talked about competition from the likes of FedNow, and the regulatory pressures the companies face occasionally.

I found Mastercard’s premium over Visa unjustified, due to Visa’s higher margins, and more attractive valuation. Additionally, and unlike what the market seems to think, I estimate Visa’s growth will be at least on par with Mastercard’s. Therefore, I assigned Visa a Strong Buy rating, whereas I rated Mastercard a Buy.

I urge you to read both articles because this article will be dedicated to comparing the companies’ recent earnings results and providing updated valuation models.

Now, let’s see how the companies performed in the first three months of 2023, which of them provided better results, and reassess our investment thesis accordingly.

Spoiler: Both Visa and Mastercard beat expectations and continue to grow at a double-digit pace despite all kinds of headwinds. Visa and Mastercard performed similarly, yet Visa’s discount compared to Mastercard expanded. Thus, I reaffirm my previous ratings and still find Visa as the better investment.

Reaffirming The Investment Thesis

Both Visa and Mastercard have been the engine for the digitalization of payments worldwide for many decades now. Riding their self-created trend, the companies have provided investors with market-beating returns, through sequential double-digit growth in earnings.

As penetration continues to increase at a fast pace and cash becomes less and less popular, investors worry the future isn’t as bright as the past. Accordingly, both stocks are trading at the low end of their 5-year P/E ratios.

As I mentioned in my previous articles, cash still accounts for trillions of dollars in transactions worldwide. Both companies are still seeing volumes grow at a double-digit pace, despite the general perception of a slowing consumer economy. Additionally, the non-consumer-payment businesses of both companies are growing rapidly, with 21.0% growth for Mastercard and 20.0% for Visa.

I estimate the non-consumer-payments categories will continue to grow sequentially at an above-double-digit pace, as both companies continue to add new services, expand services into new geographies, and penetration with existing clients deepens.

In short, I am still extremely bullish on Mastercard and Visa, and I believe both are still great investments, with a market-beating future ahead of them.

Who Won the Quarterly Earnings Battle?

Let’s not fool ourselves, Mastercard and Visa are essentially identical businesses. Yes, they have some different partners and some different solutions, but in essence, both companies are qualitatively the same.

Some investors decide to own both, but I see no reason to do so, as I aim for a concentrated market-beating portfolio. As we acknowledged that qualitatively they are almost identical, the only way to differentiate between Visa and Mastercard is by comparing their quantitative aspects.

At the time of writing this article, Mastercard is trading at a 19.4% premium compared to Visa, based on the companies’ P/E ratios. In my Mastercard article, I wrote the following regarding its premium:

In my view, the main reason the market values Mastercard at a premium compared to Visa is simply its size. Generally speaking, if all else is equal, a smaller company has a higher potential to outgrow a larger peer. Looking at 2022, Visa is 1.3X larger than Mastercard in terms of sales. Thus, it’s understandable the market assumes Mastercard will outgrow Visa, meaning that there isn’t a real gap if we’re going to base our multiple on future earnings.

Then, I showed the underlying assumption of the market isn’t supported by the companies’ results, as Visa and Mastercard grew revenues and volumes at the same pace between 2016-2022. Based on the valuation gap and Visa’s much better margins, I came to the conclusion Visa is the better investment.

Let’s see how the companies fared in the first three months of 2023, and find out if my conclusion is still valid. Just one important thing to note beforehand, Visa’s fiscal year is a quarter ahead of Mastercard’s, meaning Visa’s fiscal Q2-23 is comparable to Mastercard’s Q1-23.

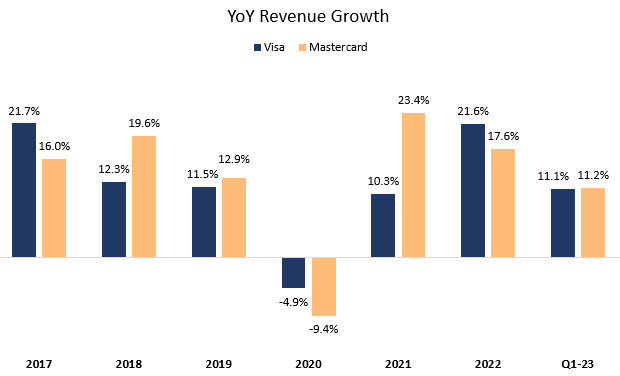

Revenue Growth – It’s A Tie

Created by the author using data from the companies’ reports

In the first three months of 2023, Mastercard grew revenues by 11.2%, whereas Visa grew by 11.1%. In absolute dollars, Visa outgrew Mastercard by $215M. Remember, as Mastercard trades at a significant premium over Visa, a tie is essentially a win for Visa shareholders.

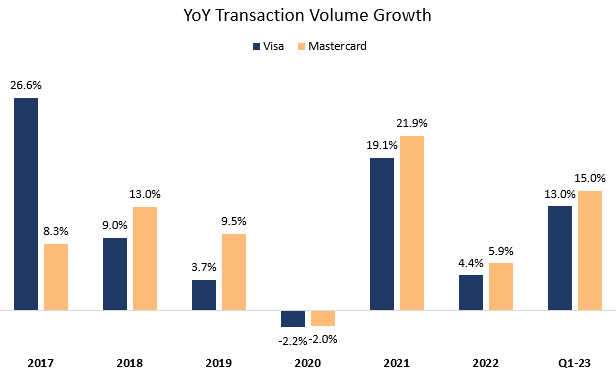

Volume Growth – Mastercard Wins Marginally

Created by the author using data from the companies’ reports; Volume numbers are in constant currency and exclude Russia and China impacts.

In Q1-23, Mastercard outgrew Visa by two percentage points. In absolute dollars, Visa outgrew Mastercard by $185B. Visa still processes a much larger volume of transactions, almost 75% bigger than Mastercard’s. In my view, the gap between the companies’ volume growth isn’t significant enough to even remotely justify the 19.4% premium.

Margins – Visa Wins

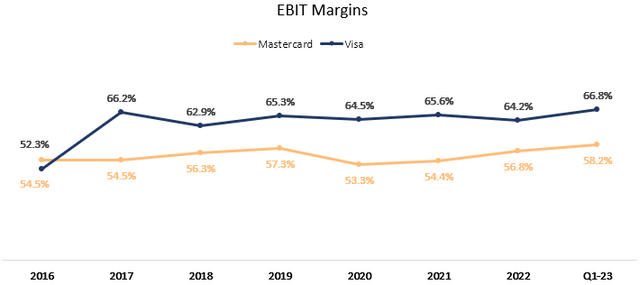

Created by the author using data from the companies’ reports; Mastercard’s Q1-23 margin is adjusted for litigation expenses.

As we can see, the margin gap between the companies has widened, increasing from 7.4 percentage points in 2022 to 8.4 percentage points in the first calendar quarter of 2023. Visa being more profitable than Mastercard, increases the importance of Mastercard’s relative growth. To put it simply, for each incremental dollar, Visa makes $0.68 in operating profit, whereas Mastercard makes $0.58. Thus, in order to grow operating profit at the same pace as Visa, Mastercard needs to outgrow its revenues by 17%. In the last quarter, Mastercard managed to outgrow Visa by a mere 1.5%.

Visa Won The Calendar Q1-23 Battle

It’s important to remember the strength of the network effect of their businesses, both the traditional and new ones. A customer cannot pay with a Visa-powered card if the merchant, acquirer, and customer’s issuer aren’t interconnected. Currently, Visa has 4.23 billion credentials, compared to Mastercard’s 2.77 billion. Each of those credentials is strengthening and enhancing the payment network, which is still the main source of revenues for Visa and Mastercard.

By itself, the fact that Mastercard is starting at a lower baseline doesn’t automatically mean it will easily outgrow Visa. Looking at their quarterly results, I can easily reaffirm my initial conclusion. The premium Mastercard is getting has only increased since my previous article, as Visa’s EPS grew by 17.0% while Mastercard’s grew by 1.5%. Visa is still growing on par with Mastercard, despite being the larger company. Visa also continues to be more efficient and more profitable, whilst innovating at least at the same level as Mastercard, with the former growing its non-consumer-payment services by 20%, compared to the latter’s 21%.

Thus, I still find Visa more attractive.

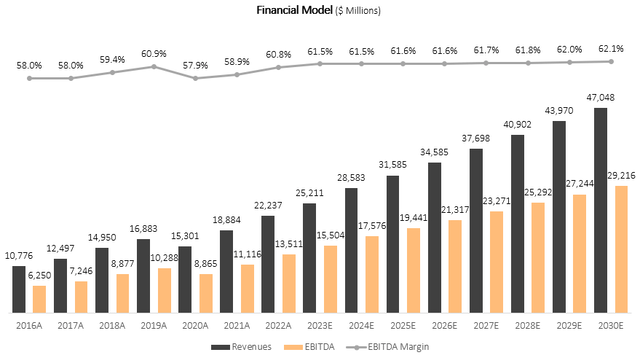

Updated Mastercard Model

I used a discounted cash flow methodology to evaluate Mastercard’s fair value. I assume the company will grow revenues at a CAGR of 9.8% between 2022-2030, which is according to the company’s long-term growth targets. I believe revenues will grow at that pace due to sequential declines in cash usage which will result in high GDV growth. Additionally, I expect the continued introduction of new value-added services and the growth of existing ones. I find this growth rate to be reasonable, as there’s still a huge untapped market, which amounts to $7.6T worth of volumes.

I project Mastercard’s EBITDA margins to increase incrementally up to 62.1%, which is slightly above the company’s Q1-23 numbers. This projection results in EBITDA growth slightly above revenue growth, which is based on my assumption Mastercard will benefit from operational leverage.

Created and calculated by the author based on Mastercard’s financial reports and the author’s projections

Taking a WACC of 7.5%, I estimate Mastercard’s fair value at $413.9B or $437.1 per share, which represents a 17.0% upside compared to its market value at the time of writing.

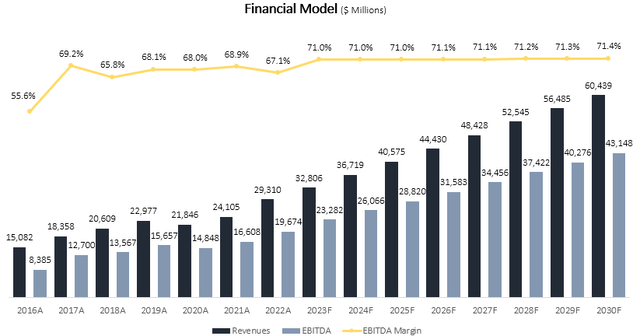

Updated Visa Model

I used the same methodology to evaluate Visa’s fair value. I assume the company will grow revenues at a CAGR of 9.5% between 2022-2030, which is according to the company’s long-term growth targets, and slightly below my projection for Mastercard. I believe Visa shares the same growth prospects as Mastercard, yet it starts at a higher baseline.

I project Visa’s EBITDA margins to increase incrementally up to 71.4%, which is in line with the company’s guidance for the next quarter. This projection results in EBITDA growth slightly above revenue growth, meaning I forecast Visa will benefit from operational leverage as well.

Created and calculated by the author based on Visa’s financial reports and the author’s projections

Taking a WACC of 7.5%, I estimate Visa’s fair value at $586.3B or $285.1 per share, representing a 26.2% upside compared to its market value at the time of writing.

Conclusion

Mastercard and Visa operate two of the best businesses in the world as an essential duopoly. The companies show no sign of slowing down, with a whole lot of cash transactions still occurring, as well as the introduction and expansion of new non-consumer-payment services. As both companies are currently trading 14.0% below their past 5-year average P/E ratios, I estimate both will provide market-beating returns well into the future. However, the 19.4% Mastercard is getting over Visa is unjustified in my view, reflecting Visa is more attractive at current prices.

Thus, I reiterate Visa stock as a Strong Buy and Mastercard stock as a Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.