Summary:

- Visa reported its Q2 earnings on April 25 and managed to report both revenue and EPS above the analyst consensus.

- Management continues to solidify its position in the payments industry by reaching new agreements with leading financial institutions and FinTech companies, as well as introducing new products.

- Visa is still seeing no real slowdown in payment volume growth and guides for another quarter of solid double-digit revenue and EPS growth.

- With management focused on long-term growth and stability, an unchallenged moat, and looking to expand its offering into other verticals of the payments industry, Visa looks well positioned for impressive growth.

2Ban

Investment thesis

I maintain my buy rating on Visa Inc. (NYSE:V) and update my revenue and EPS estimates following the company’s 2Q23 results which came in above the Wall Street consensus for the 13th consecutive quarter and came in above my own previous estimates.

I have been bullish on the company before when I covered it in January and rated the shares a buy. Visa is a multinational financial services corporation that operates a global payments technology network active in more than 200 countries and territories. The company practically operates in a duopoly with Mastercard (MA) and processes a huge part of all digital payments. As a result, Visa has a massive moat in the financial services industry with over 5 billion active credit and debit cards globally and is a prime beneficiary of the shift from cash to digital payments and the increase in payment volume globally.

Visa is also a terrific compounder and has delivered excellent results for investors over the last decade with the share price increasing by 413%. Moreover, the company is a genuine money printing machine as it reported a free cash flow margin of above 50% in FY22. On top of this, with management focused on long-term growth and stability, an unchallenged moat, and looking to expand its offering into other verticals of the payments industry, Visa looks well positioned for another decade of impressive growth. Therefore, I have been building on my Visa position over the last 5 years, making it one of my largest personal holdings.

The latest quarter once more confirmed my bullish thesis as Visa delivered another strong quarterly report and has seen a fair share of positive revisions from analysts. With the share price around the same levels as back in January and Visa outperforming estimates, now could be a great opportunity for investors to step in or increase a position. Therefore, in this article, I will take you through the latest developments and financial results and update my estimates and view on the company accordingly.

Visa’s Q1 financial results indicate another impressive quarter.

Investors can count on Visa to perform consistently and show impressive growth, regardless of economic conditions, making it an investment that requires little attention while driving impressive results. The company’s duopoly in the payments processing industry gives it a very wide and impressive moat and positions it very well to benefit from the global increase in digital payments. This strength is also reflected in its consistent revenue growth and the fact that the company has outperformed the top and bottom-line Wall Street consensus for 13 quarters in a row, or more than three years.

The most recent quarter was no different with Visa once more outperforming the consensus estimates and delivering continued strong growth. Net revenues increased by double digits once more as these grew by 11% YoY and totaled $8 billion, $210 million above the consensus. Revenue outperformed previous guidance as growth in value-added services and new flows was incredibly strong. Moreover, EPS was up an even more impressive 17% to $2.09, which was $0.10 above the consensus.

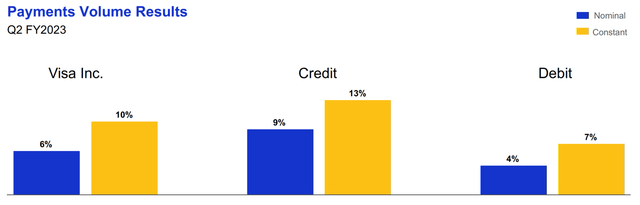

Payment volume might be the most important indicator of company health for Visa as the company takes a fee for every transaction made through its platform and this was up 13% YoY, while transactions were up 12%. Again, cross-border volume drove volume growth as this grew by 32% YoY as travel is still recovering from covid-19 measures, primarily in China. Visa sees more activity in cross-border volume among Chinese customers, but this is still below pre-covid levels, allowing for more growth over the next few quarters. In addition, volumes in the US were up 10% YoY, while international volumes increased by 17% YoY.

Visa 2Q23 payment volume growth (Visa)

Visa saw operating expenses grow by 13% YoY, driven by headcount increases as Visa continues to hire new personnel. The company’s financial strength allows it to keep hiring while other FinTech companies are forced to announce mass layoffs. The company remains very healthy and continues to report excellent growth rates. The balance sheet is in excellent shape with $16.59 billion in total cash and debt of $20.61 billion, which is well covered by Visa’s excellent free cash flow generation with a best-in-class free cash flow margin of approximately 50%.

This stellar free cash flow generation ability also allows the company to return significant amounts of cash to its shareholders through dividends and share repurchases. During the latest quarter, Visa returned approximately $2.2 billion to shareholders by buying back its own shares, in addition to distributing $941 million in dividends. Shares currently yield a relatively low 0.79% but considering Visa has been growing this dividend at a 5-year growth rate of 17.55% and is not planning on slowing down, I am not all too negative about this. Visa is poised for solid growth going forward, and the same can be said about the dividend, making it a great dividend growth investment. In addition, the dividend is well supported with a payout ratio of around 20%, leaving plenty of room for additional dividend increases.

Visa remains focused on the future and solidifies the business.

Visa remains confident in the consumer payments industry and sees this as a revenue driver. This is primarily due to the shift from cash payments to digital which, despite the massive increase in digital activity over the last several years, is still far from over. There is still a massive amount of cash spent globally, leaving a long growth runway for Visa. According to research from McKinsey, still, only 62% of consumers use a digital payment form, leaving plenty of room for further growth. This is also reflected in the expected growth rate of total digital transaction volume which is expected to grow at a CAGR of 11.8% until 2027. Obviously, this will bode well for Visa which holds a very impressive market share in the digital payments industry and will be a primary beneficiary.

To maximize performance in this payment category, Visa focuses on three important factors which are growing credentials, acceptance, and engagement which means more buyers, sellers, and transactions. And Visa is doing great in all three of these as credentials were up 11% YoY and acceptance has grown to over 100 million merchants worldwide, which is incredible. Driving this is in part is the addition of new functionalities like tap-to-pay, which allows easier and faster payments, making it more appealing to consumers. Today, 74% of face-to-face transactions made with Visa use this functionality.

Latin America, in particular, has a very long runway of growth left in the consumer payments industry. This is highlighted by the fact that Visa has grown credentials by 1.5x and merchant locations by a whopping 2.5x in the period 2019-2022 in this region. Also, over this same period, the total volume that is point-of-sale payments versus getting cash out of an ATM has grown from 46% to 59% and perfectly illustrates the transition from cash to digital in the region. I believe Latin America could drive growth in payment volume for Visa in the next few years as this region is rapidly developing and adopting fintech solutions.

Furthermore, Visa keeps working on solidifying its payment network and active credit cards by signing new long-term partnerships with leading financial institutions worldwide. This is something Visa spends a lot of money on, as illustrated last quarter as 26.7% of gross revenues were spent on client incentives, all to ensure a strong user base that grows its payment volume YoY. This quarter was no different with Visa renewing a multiyear agreement with TD Bank, CIBC, and many more, which will therefore continue to issue Visa cards to clients. And Visa is not only focusing on renewing agreements but is also acquiring new agreements as it has done in Belgium with six issuers, resulting in 2.6 million debit cards being migrated to Visa over the next couple of years. In addition, Visa also highlighted new issuance deals with leading fintech companies like Adyen (OTCPK:ADYEY) and Stripe to increase Visa functionality within these platforms. Visa is doing incredibly well on this front, making it a winner in the payment industry and allowing it to show above-industry growth rates consistently. Visa now has a total of 4.2 billion active payment cards globally which illustrates the sheer size of the payment platform. This grew 7% YoY last quarter.

Another massive growth opportunity for Visa is new flows which refer to the new opportunities Visa gets to capture from new sources of money movement like, for example, peer-to-peer, business-to-consumer, and business-to-business, through a network in network strategy. Visa believes the potential payment volume here is 10x that of consumer payments. Visa reported excellent results in the latest quarter for this payment category as revenue increased by 20%, driven by Visa direct transactions which were up 32% YoY.

Regarding new flows, Visa introduced a fascinating new network two weeks ago named Visa+. This is how Visa explained this new network during the earnings call:

This new network allows users to send and receive payments among different P2P apps through a personalized payment address, a Visa+ Payname. This enables P2P payments from one app directly to another app, as well as gig creator and marketplace payouts.

This means Visa now targets to enable interoperability between multiple different payment sources like wallets, apps, banks, and many more. Visa has already launched a pilot with several partners which include Venmo, PayPal (PYPL), Tap-to-Pay, and Western Union. And potentially, this could make the Visa platform much more attractive to these payment processors than other competitors like Mastercard as it allows for many more payments to be processed through their wallets or apps. I believe this is a strong strategy from Visa and could very well increase the total payment volume for Visa in the future.

Visa is already going a long way in interoperability with Visa Direct which also continued to expand its number of partnerships. This is illustrated by the following quote from the earnings call which demonstrates the strength of the Visa network:

Visa Direct utilizes 66 ACH networks, 11 RTP networks, 16 card-based networks, and five gateways, with the potential to reach nearly 7 billion endpoints globally.

And Visa continues to expand on this to improve platform attractiveness and increase payment volume. During the latest quarter, Visa reached an agreement with PayPal to allow PayPal Xoom customers in the US to send money directly to an eligible Visa debit card in 25 countries by using the Visa Direct network. Visa Direct transactions grew 32% YoY.

Considering all this, I believe Visa might see even more impressive growth going forward than we have seen over the past decade. The company is doing everything it can to better position itself for the future and to ensure consistent payment volume and revenue growth. Especially its focus on partnerships with leading fintech companies and launching its own fintech solutions is a great move by management as it allows the company to maintain its market share and not fall behind.

The developments this quarter solidified my faith in Visa management once more. Therefore, I believe it is incredibly well-positioned to show an above-industry growth rate and continue to impress investors and analysts alike.

Outlook & Visa stock valuation

During the earnings call, management did indicate that it is seeing somewhat of a slowdown in payment volume growth as this ticked down in the last week of March and has remained at similar levels in the first three weeks of April. Driving this tick down in payment volume is primarily ticket size which decreased by 2% YoY in these last four weeks as inflation moderates and Visa starts lapping the high fuel prices from last year. Also contributing to this is discounting in particular retail goods channels to bring down inventory levels.

At the same time, total transaction growth does remain stable at 8%, largely offsetting the decline in ticket size. As a result, payments volume was up 6% in the first three weeks of April and Visa expects this trend to continue for the remainder of the second quarter. In addition, international growth is expected to remain strong, while growth in domestic payment volumes remains stable across the globe, indicating that Visa is not seeing much of a slowdown as a result of lower consumer spending.

Therefore, Visa guides for third-quarter net revenue growth of low-double-digits and a moderation of operating expense growth which could be good for EPS growth. Of course, management is aware of the economic instability resulting from higher interest rates and continued stubborn inflation and is prepared to act quickly if we were to enter a potential recession. This is what management said about this during the earnings call:

As we’ve said previously, should there be a recession or a geopolitical shock that impacts our business, slowing revenue growth below our presumptions, they will of course adjust our spending plans by reprioritizing investments, scaling back or delaying programs, and pulling back as appropriate in personnel expenses, marketing spend, travel, and other controllable categories.

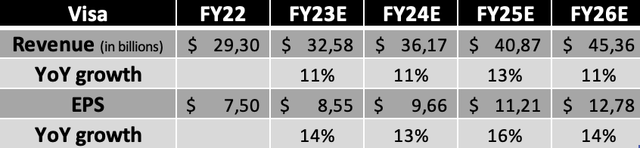

Following the solid quarterly results from Visa, the double-digit growth outlook for the third fiscal quarter, and continued positive company developments, I now arrive at the following expectations until FY26.

Shortly explaining these estimates, I have positively upgraded my revenue and EPS estimates (previous FY23 estimates were revenue of $32.32 billion and EPS of $$8.40) following the company’s earnings beat in 2Q23. I now expect Visa to report revenue growth of slightly above 11% for FY23, in addition to 14% EPS growth. Visa clearly has a strong position in the payment industry, allowing it to keep reporting strong growth rates. With the company seeing no signs of an immediate slowdown in total transactions worldwide, it is safe to assume Visa will report strong growth going forward. Second-half revenue and EPS growth may slow down ever so slightly compared to the first half of the year as client incentive growth is expected to be higher due to some delays in renewals. This will be a slight drag on growth but will not make a huge difference.

For the following years, I expect Visa to keep reporting very solid and consistent growth, driven by the strong increase in digital payments and new initiatives from Visa that have the potential to drive additional payment volume growth. Visa has a hugely impressive moat and is well-positioned to benefit from multiple secular trends that will help revenue and EPS growth.

Moving to the valuation, the unchallenged moat, consistent revenue growth, impressive shareholder returns, and business predictability result in this company rarely trading cheaply (5-year average valuation of a 32x P/E) and deserving a premium valuation.

Now, considering the growth outlook and stability of the business, in my previous article on Visa I claimed the company deserved to be valued at a P/E of at least 30x.

Today, I am lowering this slightly to 28x to take into account the risk of a potential recession and a slowdown in payment volume growth as a result. Therefore, based on my 2024 EPS estimate and a 28x P/E, I calculate a target price of $270 (up from $252), leaving investors with an upside of 18% (Please note, this target price is solely based on its forward P/E and is only for indicative purposes).

For comparison, Wall Street analysts currently maintain a target price of $260 combined with a buy rating.

Conclusion – Visa is a buy

Visa delivered another impressive quarterly report and outperformed the consensus by a fair margin. Visa is seeing no slowdown in global payment volume growth and is well-positioned for any growth in digital payments going forward. In addition, the company is looking for new revenue streams by introducing new products across other verticals of the payment industry. Still, overall, its incredible brand strength and a massive number of active cards across the globe give it a mighty moat already.

Visa is one of my top picks today and continues to be one of my largest holdings. Visa has a great growth outlook and I expect it to keep rewarding shareholders through dividend increases and share buybacks. Combined with double-digit growth and a consistent performance profile, I believe an investment in Visa is a no-brainer.

Based on a P/E of 28x and my EPS estimate for FY24, I calculate a target price of $270, leaving investors with an 18% upside potential from a current share price of $228. Therefore, I like the current risk-reward profile and believe shares are a buy today, following its earnings release.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.